Small businesses require key documents such as purchase invoices, sales receipts, and payment confirmations for effective digital receipt management. These documents must be clearly scanned or digitally generated to ensure accuracy and compliance with bookkeeping standards. Maintaining organized digital records facilitates easy retrieval, audit readiness, and streamlined expense tracking.

What Documents Are Required for Digital Receipt Management in Small Businesses?

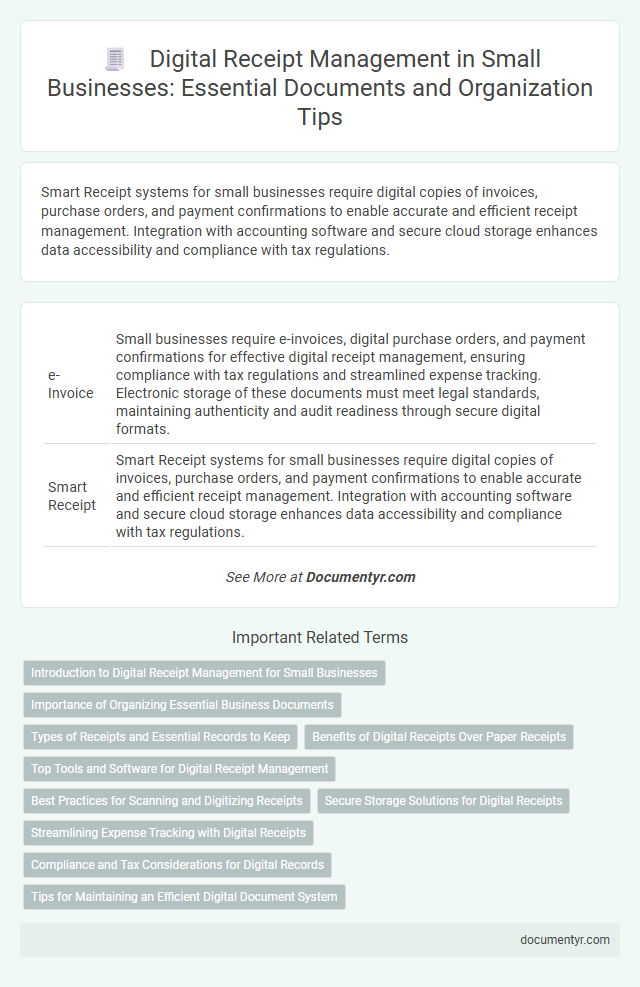

| Number | Name | Description |

|---|---|---|

| 1 | e-Invoice | Small businesses require e-invoices, digital purchase orders, and payment confirmations for effective digital receipt management, ensuring compliance with tax regulations and streamlined expense tracking. Electronic storage of these documents must meet legal standards, maintaining authenticity and audit readiness through secure digital formats. |

| 2 | Smart Receipt | Smart Receipt systems for small businesses require digital copies of invoices, purchase orders, and payment confirmations to enable accurate and efficient receipt management. Integration with accounting software and secure cloud storage enhances data accessibility and compliance with tax regulations. |

| 3 | PDF/A Compliance | Digital receipt management in small businesses requires documents to be stored in PDF/A format to ensure long-term archiving and regulatory compliance. PDF/A compliance guarantees that receipts maintain their visual integrity and data accessibility without reliance on external resources, facilitating efficient retrieval during audits. |

| 4 | OCR-Tagged Invoice | OCR-tagged invoices are essential for digital receipt management in small businesses as they enable automated data extraction, reducing manual entry errors and streamlining bookkeeping processes. Key documents required include scanned invoices with clear OCR-readable text, purchase orders, and payment confirmations to ensure accurate matching and verification. |

| 5 | Blockchain Receipt | Blockchain receipt management in small businesses requires digital documents such as encrypted transaction records, authenticated smart contracts, and tamper-proof timestamped invoices to ensure security and traceability. Integration with blockchain platforms demands verifiable digital signatures and real-time synchronization of receipts within distributed ledger systems to maintain transparency and reduce fraud. |

| 6 | Digital Audit Trail | Small businesses require invoices, payment confirmations, and delivery notes to establish a comprehensive digital audit trail for receipt management. Secure storage of tamper-proof digital records and timestamped transaction logs ensures transparency and compliance during audits. |

| 7 | Receipt Parser Output | Receipt parser output for digital receipt management in small businesses typically requires itemized purchase details, merchant information, transaction date and time, total amount, tax breakdown, and payment method. Accurate extraction of these data points from scanned or digital receipts ensures streamlined bookkeeping, expense tracking, and compliance with tax regulations. |

| 8 | Machine-Readable Expense Report | Small businesses require machine-readable expense reports formatted in XML, JSON, or CSV for effective digital receipt management, enabling automated data extraction and seamless integration with accounting software. These reports must include detailed transaction data such as date, vendor, amount, tax information, and payment method to ensure accuracy and compliance. |

| 9 | API-Generated Receipt | API-generated receipts require key documents such as transaction data files, digital signatures, and authentication tokens to ensure accuracy and compliance with financial regulations. Integration protocols and encryption certificates are essential to secure data transmission and validate the authenticity of digital receipts in small business systems. |

| 10 | E-Tax Certificate | Small businesses require an E-Tax Certificate to ensure compliance and secure digital receipt management by verifying tax registration and authorization for electronic invoicing. This certificate enables seamless integration with accounting software, authenticates transactions, and supports accurate tax reporting. |

Introduction to Digital Receipt Management for Small Businesses

Digital receipt management revolutionizes how small businesses handle transaction records by replacing traditional paper receipts with electronic formats. This system enhances organization, reduces clutter, and improves accessibility to financial data for better decision-making. Implementing digital receipt management requires gathering essential documents to ensure accuracy and compliance with business and tax regulations.

Importance of Organizing Essential Business Documents

Efficient digital receipt management requires organizing essential business documents such as purchase invoices, vendor receipts, and payment confirmations. Maintaining these records digitally ensures accuracy and quick access during audits or financial reviews.

Small businesses benefit from systematic document organization to track expenses, manage cash flow, and comply with tax regulations. Properly stored digital receipts also improve transparency, reduce paper clutter, and streamline bookkeeping processes.

Types of Receipts and Essential Records to Keep

Small businesses require various documents for effective digital receipt management. Key documents include sales receipts, purchase invoices, and expense reports.

Types of receipts essential for digital record-keeping are customer receipts, vendor receipts, and payment confirmations. Keeping copies of delivery notes and return receipts ensures accurate transaction tracking. Essential records to maintain include tax documents, warranty information, and employee expense claims.

Benefits of Digital Receipts Over Paper Receipts

Digital receipt management requires key documents like transaction records and vendor invoices to streamline small business operations. Embracing digital receipts offers numerous advantages over traditional paper copies for efficient bookkeeping and customer service.

- Reduced Paper Waste - Digital receipts eliminate the need for physical paper, helping your business minimize environmental impact and clutter.

- Easier Accessibility - Stored digitally, receipts can be quickly retrieved from any device, enhancing convenience and time savings.

- Improved Accuracy - Automated digital systems reduce errors common in manual receipt handling, boosting data reliability for your business.

Top Tools and Software for Digital Receipt Management

Effective digital receipt management in small businesses requires key documents such as invoices, purchase orders, and payment confirmations. Organizing these documents using specialized tools simplifies tracking and enhances financial accuracy.

- Receipt Bank (Dext) - Automates data extraction from receipts and integrates with accounting software for seamless expense management.

- Expensify - Offers receipt scanning, expense reporting, and real-time tracking to streamline business expense workflows.

- Hubdoc - Collects and organizes digital receipts and bills while syncing data directly with cloud accounting platforms.

Utilizing these top tools allows small businesses to maintain organized records, improve audit readiness, and save valuable time on financial administration.

Best Practices for Scanning and Digitizing Receipts

Small businesses require key documents like original receipts, invoices, and purchase orders for effective digital receipt management. Best practices for scanning include using high-resolution scanners to ensure clarity and accuracy of digitized copies. Organize receipts by date and category, and store them in secure cloud-based platforms to enhance accessibility and compliance.

Secure Storage Solutions for Digital Receipts

What documents are required for digital receipt management in small businesses? Small businesses need to store digital receipts, invoices, and payment confirmations to maintain accurate financial records. Secure storage solutions protect these documents from loss, unauthorized access, and data breaches.

Streamlining Expense Tracking with Digital Receipts

| Document Type | Description | Purpose in Digital Receipt Management |

|---|---|---|

| Invoice Copies | Digital or scanned invoices from suppliers or service providers | Serve as proof of purchase and facilitate accurate expense categorization |

| Purchase Receipts | Receipts generated at point of sale, often emailed or stored via apps | Help verify transaction details for bookkeeping and tax compliance |

| Expense Reports | Summaries created by employees listing business-related expenses | Support consolidation of multiple expenses and streamline reimbursement processing |

| Bank Statements | Monthly statements showing transactions linked to business accounts | Assist in cross-referencing receipts and detecting discrepancies |

| Credit Card Statements | Statements detailing purchases made with business cards | Provide an additional layer of verification for expense tracking |

| Digital Receipt Templates | Standardized electronic formats designed for capturing receipt data | Ensure consistency across records and improve data retrieval efficiency |

Compliance and Tax Considerations for Digital Records

Small businesses must maintain accurate digital receipts to comply with tax regulations and ensure proper financial reporting. Proper document management reduces audit risks and streamlines tax filing processes.

- Proof of Purchase - Digital receipts serve as primary evidence of transactions and must include date, amount, and vendor details.

- Retention Period Compliance - Records must be stored securely for a minimum of 5 to 7 years according to most tax authorities' requirements.

- Data Integrity and Accessibility - Digital records should be tamper-proof and easily accessible for audits and tax reviews to meet regulatory standards.

What Documents Are Required for Digital Receipt Management in Small Businesses? Infographic