To submit a charitable donation receipt, donors typically need to provide a completed donation receipt form including the charity's official name, tax identification number, and the date of the donation. Proof of donation such as bank statements, credit card slips, or canceled checks should accompany the receipt for verification purposes. Detailed records of non-cash donations may require an appraisal or valuation report to confirm the donation's estimated worth.

What Documents Are Required for Charitable Donation Receipt Submissions?

| Number | Name | Description |

|---|---|---|

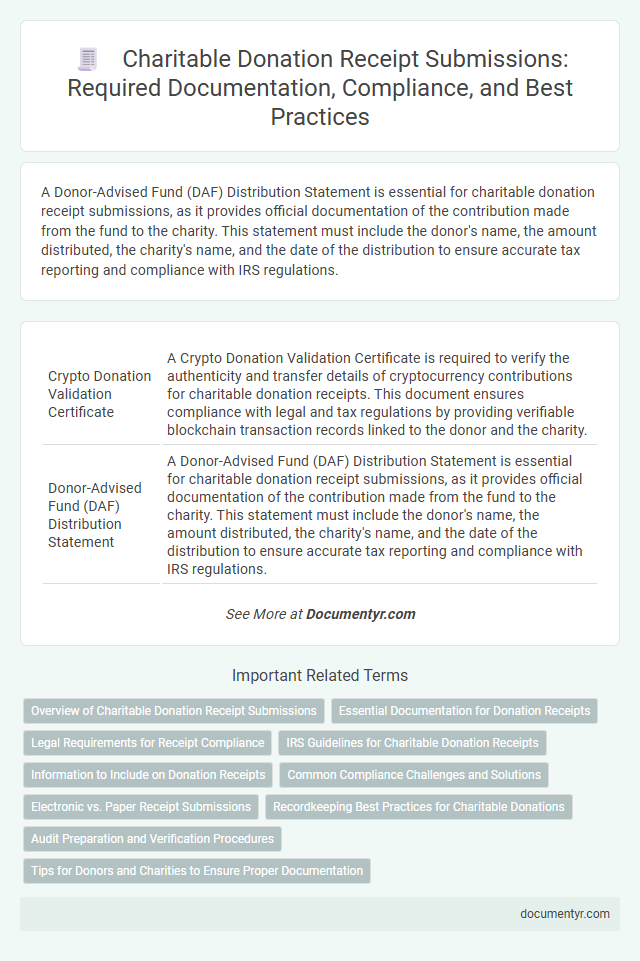

| 1 | Crypto Donation Validation Certificate | A Crypto Donation Validation Certificate is required to verify the authenticity and transfer details of cryptocurrency contributions for charitable donation receipts. This document ensures compliance with legal and tax regulations by providing verifiable blockchain transaction records linked to the donor and the charity. |

| 2 | Donor-Advised Fund (DAF) Distribution Statement | A Donor-Advised Fund (DAF) Distribution Statement is essential for charitable donation receipt submissions, as it provides official documentation of the contribution made from the fund to the charity. This statement must include the donor's name, the amount distributed, the charity's name, and the date of the distribution to ensure accurate tax reporting and compliance with IRS regulations. |

| 3 | NFT Gift Transfer Record | A detailed NFT gift transfer record including blockchain transaction ID, wallet addresses of donor and recipient, and timestamp is essential for validating charitable donation receipts involving digital assets. This document ensures accurate tracking and legal compliance for tax deductions linked to NFT contributions. |

| 4 | Environmental Social Governance (ESG) Impact Report | Documents required for charitable donation receipt submissions include the official donation receipt, donor identification, and detailed Environmental Social Governance (ESG) Impact Reports that demonstrate the social and environmental outcomes of the contribution. ESG Impact Reports should outline measurable metrics, such as carbon footprint reduction, community development initiatives, and governance practices to validate the donation's effectiveness and compliance with sustainability standards. |

| 5 | Micro-Donation Aggregation Log | A Micro-Donation Aggregation Log must include detailed records such as donor names, donation amounts, dates, and transaction references to ensure accurate charitable donation receipt submissions. This log serves as a crucial document for verifying cumulative micro-donations and complying with tax regulations and audit requirements. |

| 6 | Peer-to-Peer Fundraiser Verification Sheet | The Peer-to-Peer Fundraiser Verification Sheet is essential for validating charitable donation receipts, ensuring all donor details and transaction records are accurately documented. This sheet streamlines the audit process by confirming compliance with regulatory requirements and maintaining transparency in peer-to-peer fundraising activities. |

| 7 | Social Media Fundraising Documentation | Social media fundraising documentation for charitable donation receipt submissions typically includes screenshots of campaign pages, transaction records, donor information, and acknowledgments of funds received. Maintaining clear, verifiable records ensures compliance with tax regulations and validates the authenticity of donations processed through platforms like Facebook Fundraisers or GoFundMe. |

| 8 | In-Kind Service Valuation Statement | An In-Kind Service Valuation Statement requires detailed documentation of donated services, including date, description, hours contributed, and fair market value per hour, supported by official receipts or timesheets. Accurate valuation ensures compliance with IRS guidelines for charitable donation receipt submissions and maximizing eligible tax deductions. |

| 9 | Carbon Offset Donation Receipt | Carbon offset donation receipts require documentation such as proof of payment, a detailed description of the carbon offset project, and verification from a recognized carbon offset provider. These documents ensure compliance with tax regulations and validate the environmental impact of the donation. |

| 10 | Digital Wallet Transaction Ledger | A digital wallet transaction ledger must include timestamped donation details, donor identification information, and transaction amounts to validate charitable donation receipts. Accurate records from digital wallets streamline submission processes and ensure compliance with tax regulations for charitable contributions. |

Overview of Charitable Donation Receipt Submissions

| Document Type | Description | Purpose |

|---|---|---|

| Official Donation Receipt | Receipt issued by the charitable organization confirming the donation. | Proof of contribution required for tax deductions and record keeping. |

| Proof of Payment | Bank statements, credit card slips, or canceled checks showing the transaction. | Verifies that the donation was successfully processed. |

| Donor Identification | Government-issued identification or donor registration details. | Confirms donor identity for compliance and documentation accuracy. |

| Donation Details Form | Form capturing the donation date, amount, and beneficiary organization details. | Ensures the donation is recorded correctly and supports receipt issuance. |

| Organizational Registration Certificate | Certification proving the charity is registered and authorized to issue receipts. | Validates the legitimacy of the charitable organization. |

You should prepare these documents carefully to ensure smooth submission and recognition of your charitable donations.

Essential Documentation for Donation Receipts

Essential documentation for charitable donation receipt submissions includes a formal receipt issued by the organization confirming the donation. This receipt should detail the donor's name, the date of donation, and the exact amount or description of the donated item.

The donor must also provide proof of payment, such as a bank statement, credit card slip, or canceled check. For non-cash donations, an appraisal or valuation report may be necessary to establish the fair market value. Maintaining these documents ensures compliance with tax regulations and facilitates accurate record-keeping for both donors and charities.

Legal Requirements for Receipt Compliance

Legal requirements for charitable donation receipt submissions ensure the validity of your claims and compliance with tax authorities. Essential documents typically include the official donation receipt issued by the registered charity, a detailed description of the donated item or amount, and proof of the charity's registration status. Submitting these documents accurately protects your tax benefits and supports transparent donation practices.

IRS Guidelines for Charitable Donation Receipts

The IRS requires donors to obtain a written acknowledgment from the charity for any single donation of $250 or more. This receipt must include the donor's name, the date, the amount of cash or a description of donated property, and a statement confirming whether any goods or services were provided in exchange. Your documentation must meet these guidelines to ensure eligibility for tax deductions.

Information to Include on Donation Receipts

Charitable donation receipts must include specific information to validate the contribution. Essential details include the donor's name, donation date, and the exact amount or description of the donated items.

Receipts should also feature the charity's name, registration number, and a statement confirming that no goods or services were provided in exchange for the donation. Your accurate donation receipt ensures compliance with tax regulations and facilitates proper record-keeping.

Common Compliance Challenges and Solutions

Submitting charitable donation receipts requires specific documentation to meet legal and tax regulations. Understanding common compliance challenges helps ensure your submissions are accepted without issues.

- Accurate Receipt Details - Receipts must include the donor's name, donation amount, date, and organization details to comply with tax authority requirements.

- Valid Proof of Donation - Supporting documents like bank statements or acknowledgment letters confirm the legitimacy of the donation and prevent fraud allegations.

- Timely Submission Deadlines - Meeting IRS or local tax deadlines avoids penalties and ensures the donations are deductible for the donor.

Electronic vs. Paper Receipt Submissions

Submitting a charitable donation receipt requires specific documents depending on whether the receipt is electronic or paper. Understanding these requirements ensures your donation is properly recorded for tax deductions.

- Electronic Receipt Submission - You must provide a digital copy of the receipt, typically in PDF or image format, accompanied by an email confirmation or upload through the charity's official portal.

- Paper Receipt Submission - A physical copy of the receipt, including the charity's official stamp or signature, is necessary for verification during manual processing.

- Proof of Donation Payment - Whether electronic or paper, include proof of payment such as bank statements, credit card slips, or transaction confirmations to validate the donation amount.

Recordkeeping Best Practices for Charitable Donations

Accurate recordkeeping is essential for submitting charitable donation receipts. Proper documentation ensures compliance with tax regulations and substantiates donation claims.

- Donation Receipt - A detailed receipt from the charity including donor name, date, and amount is required for tax deduction purposes.

- Bank Statements - Proof of payment through bank or credit card statements validates the monetary donation.

- Non-Cash Donation Records - Appraisals, condition reports, and receipts are necessary for donated goods or property to establish fair market value.

Maintaining organized records with supporting documents reduces audit risks and facilitates accurate tax reporting for charitable contributions.

Audit Preparation and Verification Procedures

What documents are required for charitable donation receipt submissions during audit preparation? You need to gather donation receipts, acknowledgment letters, and relevant bank statements. These documents ensure accurate verification of your charitable contributions.

What Documents Are Required for Charitable Donation Receipt Submissions? Infographic