To claim a charitable donation receipt, you need documents including a written acknowledgment from the charity that confirms the donation amount and date. This receipt should also contain the charity's name, registration number, and a description of the donated item if applicable. Maintaining these records is essential for tax deduction verification and compliance with donation claim regulations.

What Documents Are Necessary for Charitable Donation Receipt Claims?

| Number | Name | Description |

|---|---|---|

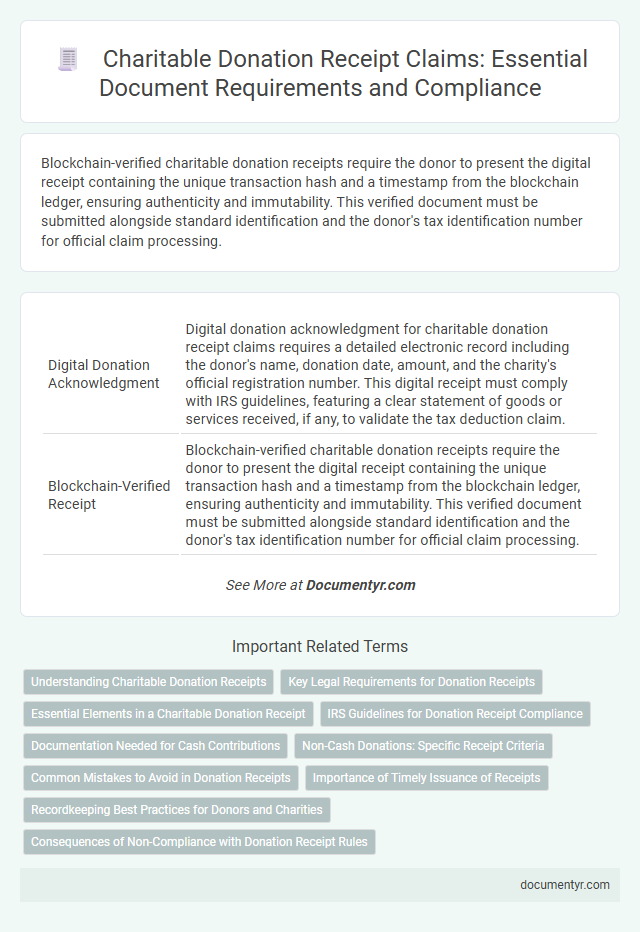

| 1 | Digital Donation Acknowledgment | Digital donation acknowledgment for charitable donation receipt claims requires a detailed electronic record including the donor's name, donation date, amount, and the charity's official registration number. This digital receipt must comply with IRS guidelines, featuring a clear statement of goods or services received, if any, to validate the tax deduction claim. |

| 2 | Blockchain-Verified Receipt | Blockchain-verified charitable donation receipts require the donor to present the digital receipt containing the unique transaction hash and a timestamp from the blockchain ledger, ensuring authenticity and immutability. This verified document must be submitted alongside standard identification and the donor's tax identification number for official claim processing. |

| 3 | e-Charity Validation Certificate | An e-Charity Validation Certificate is essential for claiming tax deductions on charitable donations, as it verifies the legitimacy of the charity organization in the official government database. Donors must present this digital certificate along with their receipt to ensure compliance with tax regulations and to facilitate accurate record-keeping for donation claims. |

| 4 | Donor-Advised Fund Statement | A Donor-Advised Fund (DAF) statement is essential for charitable donation receipt claims, providing official documentation of contributions made through the fund. This statement must include the donor's name, the contribution date, and the amount donated to qualify for tax deductions. |

| 5 | NFT-Based Donation Record | Charitable donation receipt claims for NFT-based donations require a blockchain-verified transfer record, a digital receipt from the receiving nonprofit, and proof of the NFT's fair market value at the time of donation. These documents ensure transparency, authenticity, and accurate tax deduction reporting in accordance with IRS guidelines for non-cash assets. |

| 6 | Automated Receipt Matching Report | Automated receipt matching reports streamline the verification process for charitable donation receipt claims by cross-referencing donation records with corresponding receipts, ensuring accuracy and compliance with tax regulations. Key documents required include official donation receipts containing donor details, donation amount, date, and charity registration number, which must match the automated system's records to validate tax deduction eligibility. |

| 7 | AI-Powered Compliance Audit Trail | Charitable donation receipt claims require official donation receipts containing donor information, donation amount, date, and the recipient organization's registration details. AI-powered compliance audit trail systems enhance accuracy by automatically verifying receipt authenticity, tracking transaction timestamps, and ensuring regulatory adherence in real-time. |

| 8 | QR-Coded Contribution Slip | QR-coded contribution slips serve as essential documents for charitable donation receipt claims, providing a secure and verifiable record of the transaction that includes the donor's information, donation amount, and date. These slips streamline the verification process for tax deductions by linking directly to the charity's database, ensuring accurate and fraud-resistant claim validation. |

| 9 | Crypto Donation Fair Market Value Report | To claim a charitable donation receipt for cryptocurrency, donors must provide a Crypto Donation Fair Market Value Report detailing the date of donation, type of cryptocurrency, and its market value at the time of transfer. This report serves as essential documentation for accurate tax reporting and compliance with IRS regulations on virtual currency donations. |

| 10 | Auto-Generated Impact Statement | A charitable donation receipt must include the donor's name, donation date, amount, and a detailed description of the donated item or funds to ensure proper claim validation; an auto-generated impact statement highlighting the donation's effect enhances transparency and donor engagement. This statement typically quantifies how the contribution supports specific programs or beneficiaries, facilitating accurate tax deductions and fostering donor trust. |

Understanding Charitable Donation Receipts

Charitable donation receipts are essential documents that verify your contributions to qualified organizations. These receipts include specific details such as the donor's name, donation amount, date, and the charity's official identification.

Understanding charitable donation receipts helps ensure your claims are valid for tax deductions. Proper documentation supports compliance with tax regulations and simplifies the donation claim process.

Key Legal Requirements for Donation Receipts

What documents are necessary for charitable donation receipt claims? Valid donation receipts must include the donor's name, the donation amount, and the date of the contribution. Receipts should also feature the charity's registration number and a clear statement confirming no goods or services were received in exchange.

What are the key legal requirements for donation receipts? Donation receipts must comply with tax authority regulations to qualify for tax deductions. Essential elements include the donor's identity, the donation value, the organization's official registration details, and a declaration of the donation's nature, either monetary or in-kind.

Essential Elements in a Charitable Donation Receipt

A charitable donation receipt must include the donor's name, the organization's name, and the donation date to be valid for tax claims. The receipt should clearly state the donation amount or describe non-cash contributions with an estimated value. Your receipt must also have the charity's registration number and a statement confirming no goods or services were received in exchange for the donation.

IRS Guidelines for Donation Receipt Compliance

To claim a charitable donation receipt for tax purposes, you must provide a written acknowledgment from the charity that includes the donor's name, the donation amount, and a description of any non-cash gifts. The IRS requires this documentation to validate your contribution and ensure compliance with tax laws. Your receipt must also state whether you received any goods or services in exchange for the donation, as outlined by IRS guidelines for donation receipt compliance.

Documentation Needed for Cash Contributions

Proper documentation is essential when claiming a charitable donation receipt for cash contributions. Your records must meet IRS requirements to validate the donation.

- Bank Records - Copies of cancelled checks, bank statements, or credit card statements showing the donation amount and date are required.

- Acknowledgment Letter - A written statement from the charity confirming the contribution and the amount donated must be obtained.

- Receipts for Contributions over $250 - For donations exceeding $250, a contemporaneous written acknowledgment from the organization is mandatory.

These documents ensure your cash contributions are eligible for tax deduction claims.

Non-Cash Donations: Specific Receipt Criteria

Non-cash donations require specific documentation to qualify for charitable donation receipt claims. Proper receipts ensure accurate reporting and compliance with tax regulations.

- Detailed Receipt Description - The receipt must include a detailed description of the donated items, specifying type, quantity, and condition.

- Donor and Organization Information - The receipt should contain full names, addresses, and contact details of both the donor and the charitable organization.

- Fair Market Value Statement - The estimated fair market value of the non-cash donation must be clearly stated to validate the claim amount.

Common Mistakes to Avoid in Donation Receipts

Accurate documentation is essential for a valid charitable donation receipt claim. Common mistakes include missing donor information and incomplete donation details.

Receipts must clearly state the charity's name, donation date, and amount or description of goods given. You should avoid vague or handwritten receipts that lack official signatures or tax identification numbers.

Importance of Timely Issuance of Receipts

Timely issuance of charitable donation receipts is crucial for ensuring your eligibility for tax deductions. These receipts serve as official proof of your donations and must be obtained promptly.

Required documents for claiming charitable donation receipts include the official donation receipt issued by the charity organization with details such as donor name, amount donated, date, and charity registration number. Submitting these receipts within the stipulated tax filing period is essential to avoid claim rejection. Prompt receipt issuance helps maintain accurate financial records and supports compliance with tax regulations.

Recordkeeping Best Practices for Donors and Charities

| Document Type | Description | Importance for Receipt Claims |

|---|---|---|

| Official Donation Receipt | Issued by the charity, includes donor name, donation date, amount, and charity registration number. | Essential proof for tax deduction claims and audit verification. |

| Bank Statements or Credit Card Records | Financial institution records showing the transaction details of the donation. | Supports confirmation of donation amount and date, strengthening claim credibility. |

| Written Acknowledgment from Charity | A letter or email from the charity acknowledging the donation, especially for non-cash gifts. | Required for non-cash contributions to substantiate the donation's nature and value. |

| Appraisal or Valuation Documents | Professional assessment documents for donated property or goods exceeding a certain value. | Necessary to determine accurate fair market value for substantial non-cash donations. |

| Donation Pledges or Agreements | Formal agreements outlining recurring or large donations. | Helps track commitment and fulfill recordkeeping for long-term donation plans. |

| Internal Recordkeeping Logs (For Charities) | Databases or spreadsheets maintained by charities to track donor information and transactions. | Facilitates accurate issuance of receipts and compliance with regulatory requirements. |

| Donor Contact Information | Complete donor details including name, address, and identification number. | Ensures proper acknowledgment and legal validation of donation claims. |

| Donation Receipt Number | Unique identifier printed on the official receipt for tracking purposes. | Supports audit trails and efficient record retrieval in case of inquiries. |

What Documents Are Necessary for Charitable Donation Receipt Claims? Infographic