To apply for a property tax exemption, essential documents typically include proof of property ownership such as the deed or title, a completed exemption application form, and valid identification of the property owner. Additional supporting documents may be required depending on the exemption type, such as proof of residency, income statements, or eligibility certificates for seniors, veterans, or disabled individuals. Submitting accurate and complete documentation ensures a smooth and timely review process by the tax authorities.

What Documents are Required for Property Tax Exemption Application?

| Number | Name | Description |

|---|---|---|

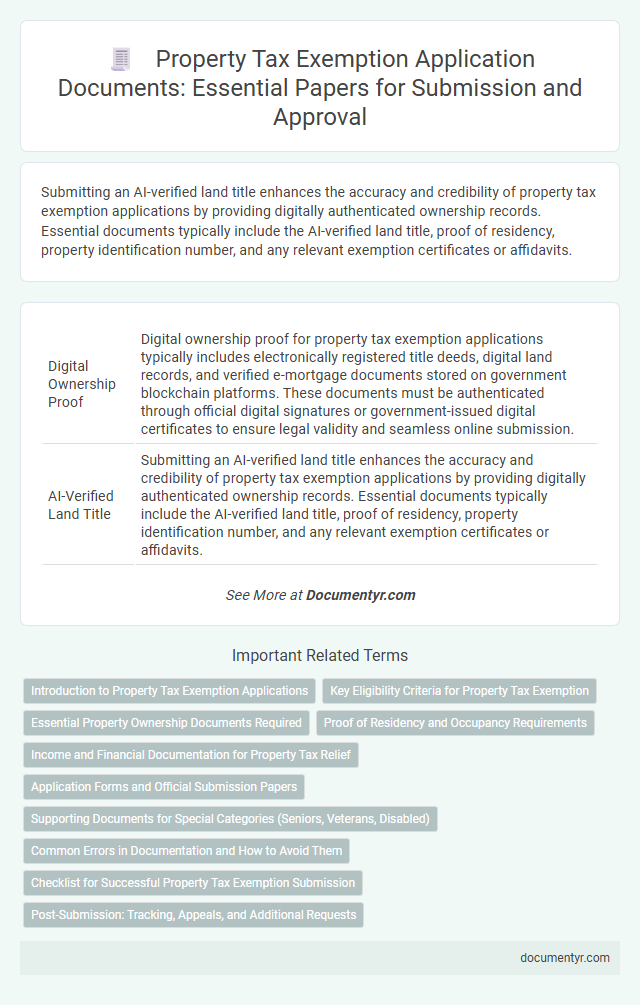

| 1 | Digital Ownership Proof | Digital ownership proof for property tax exemption applications typically includes electronically registered title deeds, digital land records, and verified e-mortgage documents stored on government blockchain platforms. These documents must be authenticated through official digital signatures or government-issued digital certificates to ensure legal validity and seamless online submission. |

| 2 | AI-Verified Land Title | Submitting an AI-verified land title enhances the accuracy and credibility of property tax exemption applications by providing digitally authenticated ownership records. Essential documents typically include the AI-verified land title, proof of residency, property identification number, and any relevant exemption certificates or affidavits. |

| 3 | Blockchain Property Deed | A Blockchain Property Deed requires submission of the smart contract record, notarized digital ownership proof, and valid government-issued identification to validate ownership for property tax exemption applications. Supporting documents may include prior tax receipts, property valuation reports, and exemption eligibility certificates aligned with blockchain verification protocols. |

| 4 | Green Building Certification | Property tax exemption applications for green buildings require submission of a certified Green Building Certification issued by recognized authorities such as LEED, BREEAM, or IGBC, along with property ownership documents, proof of occupancy, and relevant tax identification details. These documents verify the building's sustainability credentials and eligibility for tax benefits under environmental incentive programs. |

| 5 | E-KYC Compliance Document | Property tax exemption applications require an E-KYC compliance document to verify the applicant's identity and ownership details electronically. This document typically includes a government-issued ID, proof of residence, and a digitally authenticated property ownership certificate to streamline the verification process. |

| 6 | Ancestral Property Digitization Record | Ancestral Property Digitization Records are essential for property tax exemption applications, providing authenticated proof of ownership and historical lineage. These records must include scanned copies of original title deeds, inheritance documents, and government-issued property certificates to validate the ancestral nature of the asset. |

| 7 | Smart Utility Bill Statement | A Smart Utility Bill Statement, displaying accurate and up-to-date property usage data, is essential for a property tax exemption application as it verifies residency and utility consumption. This document, often accompanied by proof of ownership and identification, substantiates the applicant's eligibility for tax relief programs. |

| 8 | Geotagged Site Photographs | Geotagged site photographs documenting the property's exact location and current condition are essential for a property tax exemption application, ensuring accurate verification by tax authorities. These photographs must clearly display identifiable landmarks and boundaries to support the property's eligibility for exemption. |

| 9 | Urban Redevelopment Clearance | For an Urban Redevelopment Clearance in a property tax exemption application, essential documents include the certified copy of the clearance issued by the redevelopment authority, proof of property ownership such as the title deed or tax declaration, and a valid government-issued ID of the applicant. Submission of the latest tax declaration, a recent property tax payment receipt, and any redevelopment agreement or certificate confirming compliance with redevelopment plans further supports eligibility for exemption. |

| 10 | ESG (Environmental, Social, Governance) Compliance Report | Property tax exemption applications require submission of an ESG Compliance Report detailing adherence to environmental regulations, social responsibility initiatives, and governance standards. Supporting documents include recent property tax bills, proof of ownership, and certifications verifying the property's compliance with sustainability and corporate governance criteria. |

Introduction to Property Tax Exemption Applications

Property tax exemption applications require specific documents to verify eligibility and ownership details. These documents ensure accurate processing and compliance with local tax regulations.

Commonly required documents include proof of ownership, identification, and any relevant exemption certificates. Proper documentation is crucial for a successful property tax exemption approval.

Key Eligibility Criteria for Property Tax Exemption

Applying for a property tax exemption requires submitting specific documents that verify eligibility criteria. Understanding these key documents ensures a smooth and successful application process.

- Proof of Ownership - Official property deed or title showing the applicant's legal ownership of the property.

- Residency Verification - Documents such as utility bills or driver's license that confirm the applicant resides at the property address.

- Income or Age Documentation - Tax returns, Social Security statements, or birth certificates to verify income limits or age requirements for exemption eligibility.

Essential Property Ownership Documents Required

What documents are required for a property tax exemption application? Essential property ownership documents include the deed or title proving ownership and recent property tax statements. Proof of identification and any exemption-specific forms may also be necessary for successful application processing.

Proof of Residency and Occupancy Requirements

Proof of residency is a fundamental requirement for a property tax exemption application. Acceptable documents typically include a government-issued ID, utility bills, or lease agreements that verify the applicant's address.

Occupancy requirements must demonstrate that the applicant resides in the property as their primary residence. Documents such as a sworn affidavit or evidence of continuous habitation help satisfy this criterion for tax exemption eligibility.

Income and Financial Documentation for Property Tax Relief

Income and financial documentation is essential for property tax exemption applications to verify eligibility for tax relief programs. Commonly required documents include recent pay stubs, tax returns, Social Security benefit statements, and bank statements to demonstrate financial status. Providing accurate and up-to-date financial records helps assessors determine the appropriate exemption amount based on household income and assets.

Application Forms and Official Submission Papers

Submitting a property tax exemption application requires specific forms and official documents to ensure eligibility. Proper completion and official submission are essential for processing your request.

- Property Tax Exemption Application Form - This form collects essential details about the property and applicant for exemption consideration.

- Proof of Ownership - Official documents such as the property deed or title demonstrate legal ownership required for exemption eligibility.

- Government-Issued Identification - Valid identification like a driver's license or passport verifies the identity of the applicant submitting the exemption request.

Supporting Documents for Special Categories (Seniors, Veterans, Disabled)

Applying for a property tax exemption requires submitting specific supporting documents, especially for special categories such as seniors, veterans, and disabled individuals. These documents verify eligibility and ensure the application is processed correctly.

- Proof of Age for Seniors - A government-issued ID or birth certificate confirms that you meet the age requirement for senior exemptions.

- Military Service Documentation for Veterans - Valid discharge papers such as a DD-214 or veteran ID card demonstrate eligibility for veteran tax benefits.

- Disability Certification - A recent medical evaluation or Social Security disability award letter substantiates the applicant's disability status.

Submitting these supporting documents along with your application helps secure timely approval of your property tax exemption request.

Common Errors in Documentation and How to Avoid Them

| Required Documents for Property Tax Exemption Application | Description |

|---|---|

| Proof of Ownership | Deed, title, or other legal documents verifying ownership of the property. |

| Property Tax Receipt | Most recent property tax bill or receipt showing payment history. |

| Exemption Claim Form | Official form provided by the tax authority, completed and signed. |

| Income Verification | Documents such as pay stubs, tax returns, or social security statements to verify eligibility based on income. |

| Identification Proof | Government-issued ID such as a driver's license or passport. |

| Common Errors in Documentation | How to Avoid Them |

| Incomplete or Missing Documents | Ensure all required documents are gathered and double-checked for completeness before submission. |

| Incorrect or Outdated Information | Verify all personal and property details match official records and update them if necessary. |

| Unclear or Illegible Copies | Submit clear, readable photocopies or scans. Avoid damaged or faded documents. |

| Unsigned Forms | Sign all forms and confirm that signatures are placed where required to avoid delays. |

| Missing Deadlines | Mark the submission deadline prominently and send applications well in advance to prevent rejection. |

| Failure to Provide Supporting Evidence | Include all supporting evidence relevant to your exemption claim, such as income proof and identification. |

Checklist for Successful Property Tax Exemption Submission

To successfully apply for a property tax exemption, gather essential documents including proof of property ownership, identification, and any relevant eligibility certificates such as disability or veteran status. Submit property tax statements, income proofs, and supporting affidavits as per local jurisdiction requirements. Ensure all forms are accurately completed and signed to avoid delays in the exemption approval process.

What Documents are Required for Property Tax Exemption Application? Infographic