When buying a foreclosed property, essential documents include the Notice of Default, Trustee's Deed, and the Title Report to verify ownership and any existing liens. The Sale Agreement and Mortgage Statement provide details on the transaction and outstanding debts. It is crucial to review the Property Inspection Report to assess the condition before finalizing the purchase.

What Documents are Required for Buying a Foreclosed Property?

| Number | Name | Description |

|---|---|---|

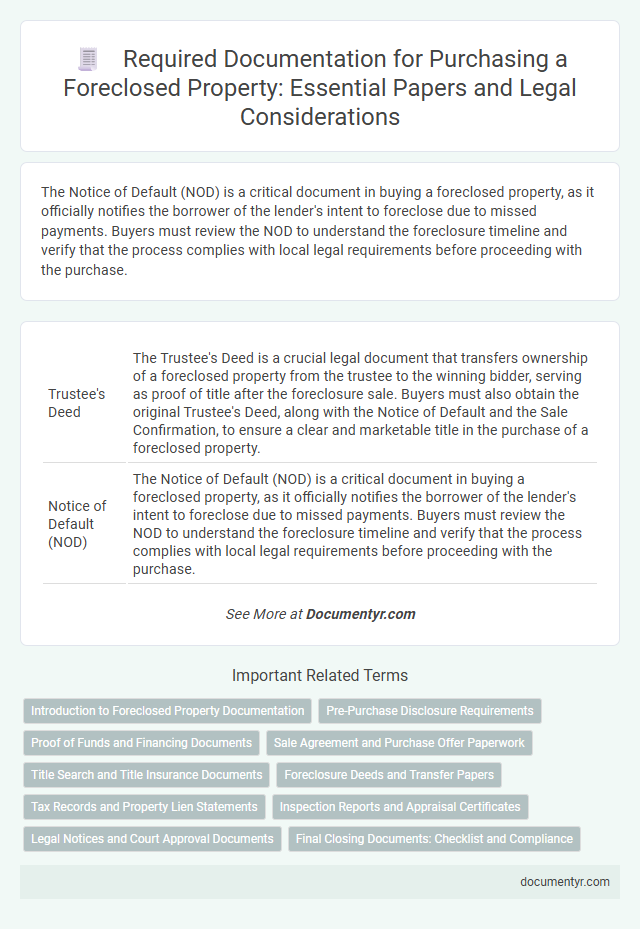

| 1 | Trustee's Deed | The Trustee's Deed is a crucial legal document that transfers ownership of a foreclosed property from the trustee to the winning bidder, serving as proof of title after the foreclosure sale. Buyers must also obtain the original Trustee's Deed, along with the Notice of Default and the Sale Confirmation, to ensure a clear and marketable title in the purchase of a foreclosed property. |

| 2 | Notice of Default (NOD) | The Notice of Default (NOD) is a critical document in buying a foreclosed property, as it officially notifies the borrower of the lender's intent to foreclose due to missed payments. Buyers must review the NOD to understand the foreclosure timeline and verify that the process complies with local legal requirements before proceeding with the purchase. |

| 3 | Real Estate Owned (REO) Addendum | The Real Estate Owned (REO) Addendum is a crucial document in the foreclosure property purchase process, outlining the specific terms and conditions set by the bank or lender selling the REO property. Buyers must review this addendum carefully alongside the purchase agreement, title report, and disclosures to ensure compliance with lender requirements and confirm clear title transfer. |

| 4 | Certified Bidding Confirmation Letter | A Certified Bidding Confirmation Letter is essential for buyers of foreclosed properties as it verifies the legitimacy of their bid during the auction process and outlines the terms agreed upon. This document ensures transparency and is often required by lenders and title companies to proceed with the ownership transfer and final sale. |

| 5 | Auction Sale Receipt | An Auction Sale Receipt is a critical document in buying a foreclosed property, serving as proof of the bidder's successful purchase and payment at the auction. This receipt must be retained to complete the property transfer process and is often required to secure the official title deed from the foreclosure agency or court. |

| 6 | Redemption Period Statement | A Redemption Period Statement is a critical document when buying a foreclosed property, outlining the timeframe during which the original owner can reclaim the property by paying off the debt. This statement ensures buyers understand the potential risk of losing the property if the redemption period has not yet expired. |

| 7 | Final Payoff Demand Letter | The Final Payoff Demand Letter is a critical document in buying a foreclosed property, detailing the exact amount needed to satisfy the outstanding mortgage and related fees. This letter ensures clear understanding of the financial obligations before closing, preventing unexpected costs or liens. |

| 8 | Estoppel Certificate | An Estoppel Certificate is a crucial document when buying a foreclosed property as it verifies outstanding debts, lease agreements, and tenant obligations associated with the property. This certificate protects buyers by confirming the accuracy of financial and contractual information to avoid future disputes or liabilities. |

| 9 | Foreclosure Sale Disposition Certificate | The Foreclosure Sale Disposition Certificate is a crucial document required when buying a foreclosed property, as it verifies the legal transfer of ownership from the lender to the buyer after the auction. This certificate ensures the buyer's title is clear of prior liens and confirms that the foreclosure sale complied with all regulatory procedures. |

| 10 | Title Vesting Instructions | Title vesting instructions are essential documents that specify how the ownership of a foreclosed property will be transferred and recorded in the buyer's name, ensuring clear legal rights. These instructions typically include the vesting type, party names, and any special conditions required by the lender or trustee to complete the title transfer process. |

Introduction to Foreclosed Property Documentation

Buying a foreclosed property involves specific documentation that protects both the buyer and the seller. Understanding these documents ensures a smooth transaction and avoids future legal complications. You must be familiar with titles, auction notices, and lender paperwork to complete the purchase successfully.

Pre-Purchase Disclosure Requirements

When buying a foreclosed property, understanding pre-purchase disclosure requirements is crucial. These disclosures provide essential information about the property's condition and any existing liens or legal issues.

You must obtain the seller's title report, property tax information, and any notices related to foreclosure proceedings. Inspecting these documents helps protect your investment and ensures transparency before finalizing the purchase.

Proof of Funds and Financing Documents

What documents are required for buying a foreclosed property? Proof of funds is essential to demonstrate your ability to complete the purchase without financing contingencies. Financing documents, such as pre-approval letters or mortgage statements, provide evidence of secured loans for the transaction.

Sale Agreement and Purchase Offer Paperwork

Buying a foreclosed property requires specific documents to ensure a smooth transaction. Key among these are the Sale Agreement and the Purchase Offer paperwork.

The Sale Agreement outlines the terms and conditions of the property transfer, including pricing, deadlines, and legal obligations. The Purchase Offer paperwork serves as your initial proposal to buy the property and must detail your offer price, contingencies, and financing methods. These documents are essential to protect your interests and facilitate the closing process.

Title Search and Title Insurance Documents

When buying a foreclosed property, conducting a thorough title search is essential to verify the property's ownership history and identify any liens or encumbrances. This document helps ensure that the title is clear and transferable without legal complications.

Title insurance documents provide protection against potential defects or disputes related to the property's title after purchase. These documents safeguard the buyer from financial loss due to undiscovered claims or issues not found during the title search.

Foreclosure Deeds and Transfer Papers

| Document | Description | Importance |

|---|---|---|

| Foreclosure Deed | This legal document confirms the transfer of ownership from the lender or bank to the new buyer after the foreclosure process is complete. | Essential for proving legal ownership and ensuring clear title to the foreclosed property. |

| Transfer Papers | Includes all necessary paperwork such as the deed of sale, title transfer forms, and any court orders related to the property's transfer. | Required for officially recording the change of ownership with the local land registry or government authority. |

Tax Records and Property Lien Statements

When buying a foreclosed property, obtaining accurate tax records and property lien statements is essential for verifying financial obligations. These documents help buyers understand any outstanding debts or claims against the property before completing the purchase.

- Tax Records - Provide detailed information on property tax history, including any unpaid property taxes that the buyer may need to settle.

- Property Lien Statements - Show all existing liens or claims by creditors against the property, ensuring buyers are aware of any legal encumbrances.

- Verification of Clearance - Confirm that all tax liens and other encumbrances are cleared or accounted for to avoid future legal or financial complications.

Inspection Reports and Appraisal Certificates

When buying a foreclosed property, having the right documents is crucial for a smooth transaction. Inspection reports and appraisal certificates provide essential information about the property's condition and value.

- Inspection Reports - Detailed assessments of the property's physical condition highlighting any structural issues or repairs needed.

- Appraisal Certificates - Professional evaluations that establish the current market value, ensuring you do not overpay for the foreclosure.

- Mortgage and Title Documents - Confirm legal ownership and identify any liens or encumbrances attached to the property.

Reviewing these documents thoroughly helps protect your investment and prevents unexpected costs after purchase.

Legal Notices and Court Approval Documents

When buying a foreclosed property, obtaining Legal Notices is essential to verify the property's foreclosure status and ensure all parties have been properly informed. Court Approval Documents confirm that the sale has been authorized by the court, protecting your purchase from future legal disputes. These documents work together to provide a clear legal framework, helping you complete the transaction with confidence.

What Documents are Required for Buying a Foreclosed Property? Infographic