First-time home buyers need essential documents including proof of income, such as pay stubs or tax returns, to verify financial stability. Lenders require a valid government-issued ID and credit reports to assess eligibility and creditworthiness for mortgage approval. Additionally, documents like bank statements, proof of funds for the down payment, and a purchase agreement are crucial to complete the home buying process smoothly.

What Documents are Necessary for First-Time Home Buyers?

| Number | Name | Description |

|---|---|---|

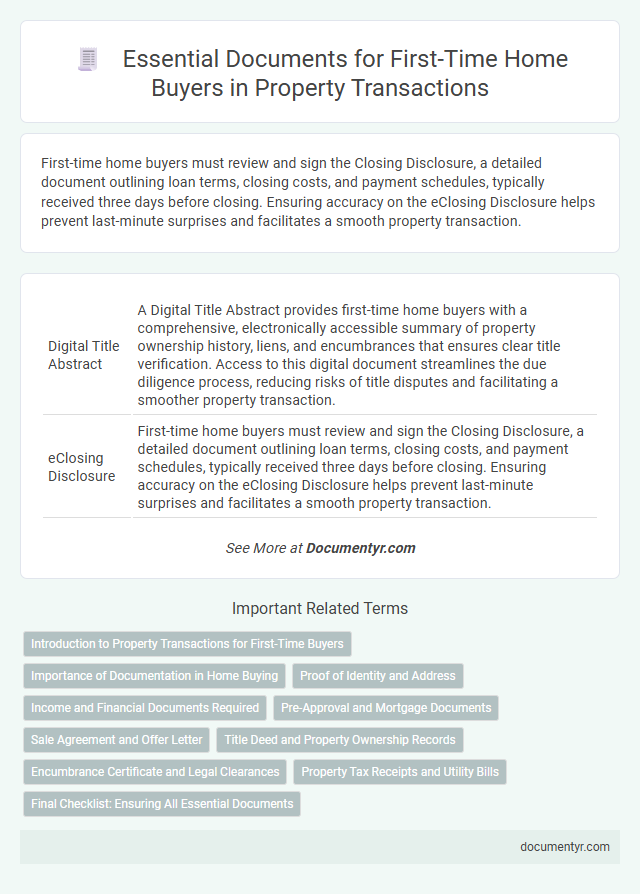

| 1 | Digital Title Abstract | A Digital Title Abstract provides first-time home buyers with a comprehensive, electronically accessible summary of property ownership history, liens, and encumbrances that ensures clear title verification. Access to this digital document streamlines the due diligence process, reducing risks of title disputes and facilitating a smoother property transaction. |

| 2 | eClosing Disclosure | First-time home buyers must review and sign the Closing Disclosure, a detailed document outlining loan terms, closing costs, and payment schedules, typically received three days before closing. Ensuring accuracy on the eClosing Disclosure helps prevent last-minute surprises and facilitates a smooth property transaction. |

| 3 | Remote Online Notarization (RON) Certificate | First-time home buyers must obtain a Remote Online Notarization (RON) certificate to authenticate documents digitally during the property purchase process, streamlining transactions remotely. This certificate ensures legal compliance by verifying identities and notarizing key documents such as purchase agreements and loan paperwork electronically. |

| 4 | Mortgage Pre-approval Letter PDF | Mortgage pre-approval letter PDF is essential for first-time home buyers as it verifies their loan eligibility and strengthens their offer by demonstrating serious intent to sellers. This document typically includes the buyer's credit score, loan amount, interest rate estimate, and lender information, streamlining the home buying process and enhancing negotiation power. |

| 5 | Homebuyer Education Certificate | A Homebuyer Education Certificate is essential for first-time home buyers as it demonstrates completion of a HUD-approved counseling course covering crucial topics like budgeting, mortgage options, and the buying process. Lenders often require this certificate to qualify for special loan programs and down payment assistance. |

| 6 | Lender’s Digital Assets Statement | First-time home buyers must provide a Lender's Digital Assets Statement to verify ownership and value of cryptocurrencies, digital investments, and online financial accounts as part of their mortgage application. This document helps lenders assess the buyer's overall financial stability and liquidity in the evolving digital asset landscape. |

| 7 | Down Payment Assistance Documentation | First-time home buyers seeking down payment assistance must provide proof of income, such as pay stubs or tax returns, and documentation verifying their eligibility, including identification and residency status. Lenders typically require bank statements, credit reports, and a formal application for the assistance program to ensure compliance with funding requirements. |

| 8 | Automated Underwriting Findings Report | The Automated Underwriting Findings Report is a crucial document for first-time home buyers, providing lenders with an evaluation of the borrower's creditworthiness based on automated analysis of credit, income, and asset information. This report helps streamline loan approval by identifying potential risks and eligibility for various mortgage products, ensuring a faster and more accurate decision-making process. |

| 9 | Earnest Money Wire Receipt | First-time home buyers must provide an earnest money wire receipt as proof of good faith payment, which secures the property during contract negotiations. This document confirms that the earnest deposit has been successfully transferred, ensuring the transaction's legitimacy and commitment level to sellers and agents. |

| 10 | Blockchain Property Deed | First-time home buyers must obtain a blockchain property deed to ensure secure, tamper-proof ownership records stored on a decentralized ledger, enhancing transparency and reducing fraud risks. Essential documents also include proof of identity, mortgage approval, and a signed sales agreement to complete the property transaction. |

Introduction to Property Transactions for First-Time Buyers

Purchasing your first home involves several essential documents that ensure a smooth property transaction. Understanding these documents helps you prepare and avoid delays in the buying process.

- Purchase Agreement - This legally binding contract outlines the terms and conditions between the buyer and seller.

- Proof of Financing - Mortgage pre-approval or loan documents verify your financial ability to complete the purchase.

- Property Title - This document confirms the seller's legal ownership and ensures the property is free from liens or claims.

Importance of Documentation in Home Buying

Essential documents play a crucial role in the home buying process, ensuring transparency and legal protection. They verify ownership, confirm financial status, and outline the terms of sale.

Property deeds, mortgage agreements, and proof of income are among the key documents required. Proper documentation safeguards your investment and facilitates a smooth transaction.

Proof of Identity and Address

First-time home buyers must provide essential documents to verify their identity and address. Proof of identity typically includes a government-issued photo ID such as a passport or driver's license.

Proof of address can be demonstrated through utility bills, bank statements, or lease agreements dated within the last three months. These documents help lenders and sellers confirm the buyer's residence and eligibility. Ensuring that your identity and address proofs are current and valid streamlines the home buying process.

Income and Financial Documents Required

First-time home buyers must provide specific income and financial documents to verify their ability to afford a mortgage. These documents streamline the loan approval process and ensure accurate financial assessment.

- Proof of Income - Recent pay stubs, W-2 forms, and tax returns from the past two years demonstrate stable earnings.

- Bank Statements - Statements from checking and savings accounts verify available funds for down payment and closing costs.

- Credit Report - A detailed credit report helps lenders evaluate creditworthiness and financial responsibility.

Pre-Approval and Mortgage Documents

First-time home buyers must prepare several essential documents to streamline the mortgage approval process. Pre-approval and mortgage documents play a critical role in securing financing for a new home.

- Pre-Approval Letter - A document from a lender indicating the loan amount a buyer qualifies for based on financial evaluation.

- Proof of Income - Recent pay stubs, tax returns, and employment verification to confirm the buyer's ability to repay the mortgage.

- Credit Report - A comprehensive report detailing the buyer's credit history and score, influencing loan approval and interest rates.

Having all necessary documentation ready accelerates the mortgage process and increases the chances of approval for first-time buyers.

Sale Agreement and Offer Letter

What documents are necessary for first-time home buyers to secure a property? Sale Agreement and Offer Letter are crucial in the home buying process. The Offer Letter initiates the buying proposal, while the Sale Agreement finalizes the terms and conditions between buyer and seller.

Title Deed and Property Ownership Records

First-time home buyers must obtain the title deed to verify the legal ownership of the property. The title deed serves as proof that the seller has the right to transfer ownership to the buyer. Property ownership records should be reviewed to ensure there are no liens or disputes affecting the title before completing the purchase.

Encumbrance Certificate and Legal Clearances

| Document | Importance | Details |

|---|---|---|

| Encumbrance Certificate | Proof of Clear Title | This certificate verifies that the property is free from any monetary or legal liabilities. It is essential for confirming that no loans, mortgages, or legal disputes exist against the property. It provides You with confidence about the property's ownership history and ensures a secure transaction. |

| Legal Clearances | Verification of Compliance | Legal clearances include approvals from local municipal authorities, building permits, zoning permissions, and environmental clearances. These documents confirm that the property adheres to applicable laws and regulations, preventing future legal complications. Confirming legal clearances is critical before finalizing Your purchase. |

Property Tax Receipts and Utility Bills

First-time home buyers must gather essential documents to ensure a smooth purchase process. Property tax receipts confirm the current owner's tax payment status, preventing future liabilities.

Utility bills, such as electricity and water statements, verify the property's ongoing service status. These documents help buyers assess maintenance and avoid unexpected utility debts after moving in.

What Documents are Necessary for First-Time Home Buyers? Infographic