Transferring a property title requires key documents such as the original title deed, a valid sale agreement, and proof of identity of both buyer and seller. Additional paperwork may include property tax receipts, no-objection certificates from housing societies, and encumbrance certificates to verify the property's legal status. Ensuring all these documents are accurately prepared helps facilitate a smooth and legally compliant title transfer process.

What Documents are Needed for Property Title Transfer?

| Number | Name | Description |

|---|---|---|

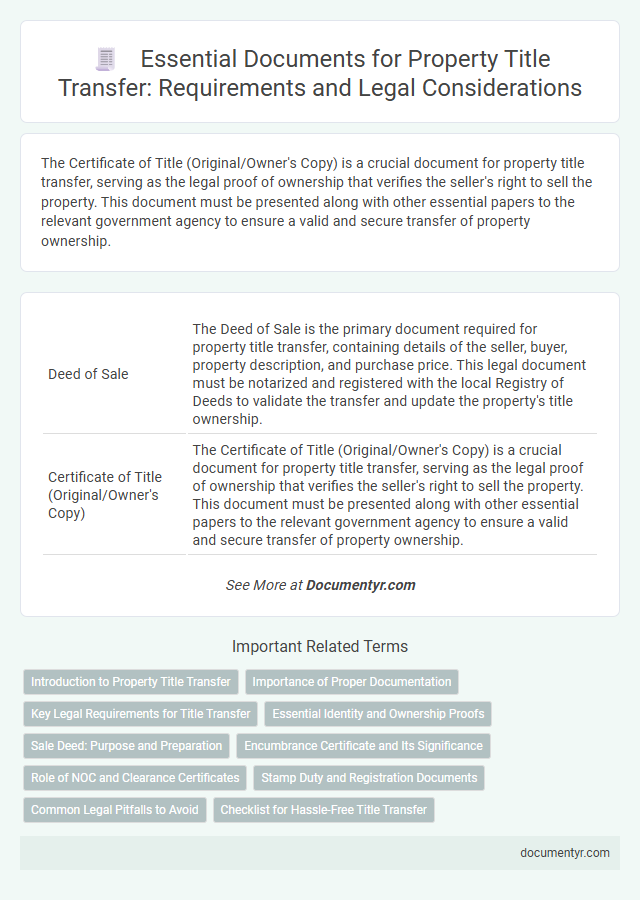

| 1 | Deed of Sale | The Deed of Sale is the primary document required for property title transfer, containing details of the seller, buyer, property description, and purchase price. This legal document must be notarized and registered with the local Registry of Deeds to validate the transfer and update the property's title ownership. |

| 2 | Certificate of Title (Original/Owner's Copy) | The Certificate of Title (Original/Owner's Copy) is a crucial document for property title transfer, serving as the legal proof of ownership that verifies the seller's right to sell the property. This document must be presented along with other essential papers to the relevant government agency to ensure a valid and secure transfer of property ownership. |

| 3 | Tax Declaration | Tax declaration documents are essential for property title transfer as they verify the property's assessed value and ownership history. These documents, including the latest tax receipt and tax clearance certificate, ensure that all tax obligations are settled before the transfer is completed. |

| 4 | Transfer Tax Receipt | The Transfer Tax Receipt is a crucial document required for property title transfer, serving as proof that the transfer tax has been fully paid. This receipt must be presented along with the Deed of Sale and other necessary legal documents to ensure a smooth and legally valid title transfer process. |

| 5 | Real Property Tax Clearance | Real Property Tax Clearance is a crucial document for property title transfer, certifying that all real estate taxes have been fully paid and no tax liabilities exist on the property. This clearance is typically issued by the local Treasurer's Office and must be submitted along with the deed of sale and other requirements to ensure a smooth transfer of ownership. |

| 6 | Certificate Authorizing Registration (CAR) from BIR | The Certificate Authorizing Registration (CAR) from the Bureau of Internal Revenue (BIR) is a crucial document required in the property title transfer process, serving as proof that the applicable taxes on the sale have been paid. This certification ensures compliance with tax regulations and must be presented before the Register of Deeds to proceed with the transfer of ownership. |

| 7 | Documentary Stamp Tax Receipt | The Documentary Stamp Tax Receipt is a crucial document required for property title transfer, serving as proof that the necessary tax on the property sale or transfer has been paid. This receipt must be presented along with the original title and other legal documents to the Registry of Deeds to complete the ownership transfer process. |

| 8 | Capital Gains Tax Receipt | A Capital Gains Tax Receipt is a crucial document required for property title transfer, confirming that the seller has paid the applicable taxes on the profit made from the sale. This receipt ensures compliance with tax regulations and facilitates a smooth transaction process between buyer and seller. |

| 9 | Notarized Deed of Absolute Sale | A notarized Deed of Absolute Sale is essential for property title transfer as it serves as the primary legal document proving the seller's consent and transfer of ownership to the buyer. This document must be duly signed by both parties and notarized to ensure its authenticity and acceptance by the local Registry of Deeds. |

| 10 | Valid Government-issued IDs of Buyer and Seller | Valid government-issued IDs for both buyer and seller, such as passports, driver's licenses, or national identity cards, are essential documents required for a property title transfer to verify identities and prevent fraud. These IDs must be current and officially recognized to ensure compliance with legal and regulatory standards during the transaction process. |

| 11 | Marriage Certificate (if applicable) | A Marriage Certificate is essential for property title transfer when the property is jointly owned by spouses or if spousal consent is required by law, serving as proof of marital status and legal rights to the property. This document validates the relationship between parties and ensures that all legal obligations and benefits related to marital property distribution are properly addressed during the transfer process. |

| 12 | Special Power of Attorney (if transacted by representative) | A Special Power of Attorney (SPA) is crucial for property title transfer when a representative acts on behalf of the owner, granting legal authority to sign documents and complete the transaction. This document must be notarized and explicitly state the scope of authority related to the property transfer to ensure validity and prevent future disputes. |

| 13 | Updated Tax Receipts | Updated tax receipts are essential documents for property title transfer as they verify that all property taxes have been paid up to the date of transfer, ensuring no outstanding liabilities hinder the transaction. These receipts must be obtained from the local tax authority and presented alongside the title deed, sale agreement, proof of identity, and other required documents to complete the transfer process legally. |

| 14 | Homeowners Association Clearance (if applicable) | Homeowners Association Clearance is a critical document required for property title transfer, confirming that the seller has settled all association dues and complies with community rules. This clearance certificate prevents any legal disputes related to unpaid fees or violations, ensuring a smooth and legally compliant ownership transfer. |

| 15 | Sworn Statement of No Improvements (if needed) | The Sworn Statement of No Improvements is required during a property title transfer to confirm that no unauthorized constructions or modifications have been made since the last official survey or title issuance. This document helps ensure clear title ownership by verifying the property's compliance with local zoning and building regulations. |

| 16 | Affidavit of Non-Tenancy (if applicable) | The Affidavit of Non-Tenancy is a crucial document for property title transfer when the property is not occupied by tenants, certifying that no rental agreements exist and helping to prevent disputes regarding tenancy rights. Other essential documents include the original Transfer Certificate of Title, Deed of Sale, tax declaration, and tax clearance. |

| 17 | Secretary’s Certificate or Board Resolution (for corporations) | A Secretary's Certificate or Board Resolution is essential for property title transfers involving corporations, as it verifies the corporate authorization to sell or transfer the property. This document must be signed by the corporate secretary and affirms that the transaction complies with the corporation's bylaws and shareholder approvals. |

| 18 | Barangay Clearance (if required by local government) | Barangay Clearance serves as a crucial local government requirement for property title transfer, verifying no legal impediments or disputes exist regarding the property within the barangay. This document ensures compliance with community regulations and is often mandated alongside other essential documents like the deed of sale, tax declaration, and transfer tax receipt. |

| 19 | Birth Certificate (if property is inherited) | A birth certificate is essential for property title transfer when the property is inherited, serving as proof of identity and legal heirship. This document establishes the claimant's relationship to the deceased owner, facilitating validation in the transfer process by land registry authorities. |

| 20 | Extrajudicial Settlement of Estate (if applicable) | Required documents for property title transfer via Extrajudicial Settlement of Estate include the deceased's original title, a notarized Extrajudicial Settlement Agreement among heirs, the death certificate, tax clearance certificates, and the latest real estate tax receipts. Supporting documents such as valid identification of heirs and a Special Power of Attorney (if applicable) must also be submitted to the Register of Deeds for processing the transfer. |

Introduction to Property Title Transfer

Transferring a property title is a critical step in real estate ownership changes. Understanding the necessary documents ensures a smooth legal process.

- Title Deed - This document proves ownership and is essential for transferring property rights.

- Sale Agreement - A legal contract outlining the terms and conditions of the property sale between parties.

- Identification Proof - Valid personal identification verifies the identities of the buyer and seller involved in the transfer.

Importance of Proper Documentation

Proper documentation is essential for a smooth property title transfer, ensuring legal ownership is clearly established. Without the correct paperwork, the transfer process can face delays or legal complications.

Your title transfer requires key documents such as the original sale deed, property tax receipts, and no-objection certificates from relevant authorities. These documents confirm the legitimacy of the transaction and protect against future disputes.

Key Legal Requirements for Title Transfer

Transferring a property title requires specific legal documents to ensure the transaction's validity. Understanding key legal requirements helps streamline the process and avoid future disputes.

- Original Title Deed - The document proving current ownership must be presented for verification during the transfer.

- Sale Agreement - A legally binding contract between the buyer and seller outlining terms and conditions of the property sale.

- No Objection Certificate (NOC) - Required from relevant authorities to confirm there are no pending liabilities or objections on the property.

Proper submission of these documents is essential for a smooth and legally compliant property title transfer.

Essential Identity and Ownership Proofs

Transferring a property title requires essential documents to establish identity and ownership. Primary identity proofs include government-issued IDs such as a passport, driver's license, or Aadhaar card. Ownership proofs typically consist of the original sale deed, previous property tax receipts, and the latest title deed or mutation certificate.

Sale Deed: Purpose and Preparation

What is the role of the Sale Deed in property title transfer? The Sale Deed serves as the primary legal document evidencing the transfer of ownership from the seller to the buyer. Proper preparation of the Sale Deed ensures clear title and protects your rights in the transaction.

Encumbrance Certificate and Its Significance

Transferring a property title requires essential documents such as the sale deed, previous title deed, and encumbrance certificate. The encumbrance certificate is significant as it verifies that the property is free from any legal dues or mortgages, ensuring a clear title. Obtaining this certificate protects your investment by confirming the property's lawful status before completing the transfer process.

Role of NOC and Clearance Certificates

Transferring a property title requires several key documents to ensure a smooth legal process. Among these, the No Objection Certificate (NOC) and various clearance certificates play a crucial role in verifying the property's legal and financial status.

The NOC is issued by relevant authorities or housing societies confirming there are no pending dues or disputes on the property. Clearance certificates, including tax and encumbrance certificates, validate that the property is free from legal liabilities and financial encumbrances, facilitating a hassle-free transfer.

Stamp Duty and Registration Documents

Transferring the title of a property requires careful submission of specific documents to ensure legal ownership is properly recorded. Stamp duty and registration documents play a crucial role in validating and completing the transfer process.

- Stamp Duty Receipt - Proof of payment of the stamp duty tax, mandatory for legally recognizing the property transfer.

- Sale Deed - The signed legal document between buyer and seller outlining the terms of the property sale.

- Registration Proof - Official certificate obtained after registering the property transfer with the local authority to confirm ownership.

Common Legal Pitfalls to Avoid

| Document | Purpose | Common Legal Pitfalls to Avoid |

|---|---|---|

| Original Title Deed | Proves ownership and is essential for transferring the property title. | Ensure the deed is original and properly executed; beware of forged or altered documents that can invalidate the transfer. |

| Sale Agreement | Details terms and conditions of the sale between buyer and seller. | Avoid vague terms and incomplete signatures; clearly specify payment schedule and property details to prevent disputes. |

| Encumbrance Certificate | Confirms the property is free from legal liabilities or mortgages. | Verify the certificate covers the complete timeline; missing or outdated certificates may hide outstanding loans or liens. |

| Property Tax Receipts | Shows all taxes have been paid on the property. | Check for delayed or unpaid taxes; unpaid dues can result in legal claims on the property. |

| No Objection Certificate (NOC) | Provides approval from relevant authorities or housing societies for the transfer. | Confirm that the NOC is specific to the property and transfer type; lack of proper NOC can stall or nullify the transfer process. |

| Identity Proof and Address Proof | Confirms the identity of buyer and seller for legal records. | Use government-issued valid documents to avoid identity disputes and fraud. |

| Possession Certificate | Confirms the physical handover of the property to the buyer. | Ensure it is signed by authorized personnel; lack of documentation can cause future possession conflicts. |

Familiarizing yourself with these key documents and pitfalls ensures a smooth property title transfer and protects your legal interests.

What Documents are Needed for Property Title Transfer? Infographic