Property tax appeal applications require essential documents such as the latest property tax assessment notice, recent property appraisal reports, and evidence supporting the claim like photographs or repair estimates. Including comparable property sales data and any relevant legal documents can strengthen the case. Submitting a detailed property tax appeal package improves the chances of a successful reconsideration.

What Documents are Needed for a Property Tax Appeal Application?

| Number | Name | Description |

|---|---|---|

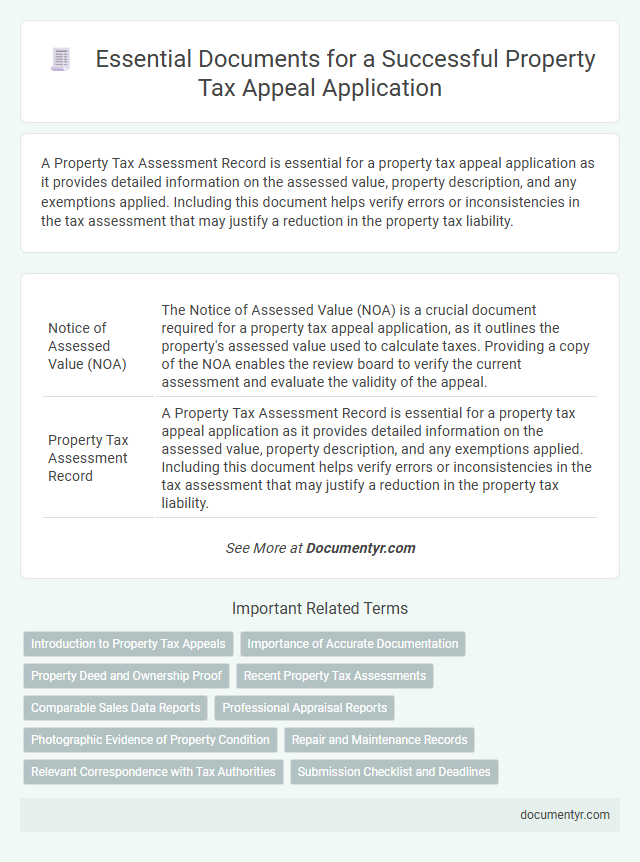

| 1 | Notice of Assessed Value (NOA) | The Notice of Assessed Value (NOA) is a crucial document required for a property tax appeal application, as it outlines the property's assessed value used to calculate taxes. Providing a copy of the NOA enables the review board to verify the current assessment and evaluate the validity of the appeal. |

| 2 | Property Tax Assessment Record | A Property Tax Assessment Record is essential for a property tax appeal application as it provides detailed information on the assessed value, property description, and any exemptions applied. Including this document helps verify errors or inconsistencies in the tax assessment that may justify a reduction in the property tax liability. |

| 3 | Comparable Sales Analysis Report | A Comparable Sales Analysis Report is essential for a property tax appeal application as it provides evidence of similar property values in the area, supporting a fair market value dispute. This report includes recent sales data, property characteristics, and adjustments, helping to validate claims for property tax reduction. |

| 4 | Assessment Reduction Worksheet | An Assessment Reduction Worksheet is a critical document in a property tax appeal application, providing detailed evidence to support the claim for lowering the assessed value. It includes property details, comparable sales data, and calculations that demonstrate discrepancies in the initial tax assessment, forming the foundation for a successful appeal. |

| 5 | Property Appraisal Report | A detailed Property Appraisal Report is crucial for a property tax appeal application, providing an expert evaluation of the property's market value based on recent sales, property condition, and comparable neighborhood data. This report substantiates the appeal by demonstrating discrepancies between the assessed value and the appraised value, supporting a reduction in property tax liability. |

| 6 | Signed Sworn Affidavit of Ownership | A Signed Sworn Affidavit of Ownership is crucial for a property tax appeal application as it legally verifies the appellant's ownership status, ensuring the appeal is filed by the rightful owner. This affidavit must be notarized and include accurate property details, ownership declaration, and signature to meet local tax assessor requirements. |

| 7 | Evidence of Physical Property Condition (e.g., Inspection Photos) | Inspection photos clearly documenting the current physical condition of the property serve as essential evidence in a property tax appeal application, helping to demonstrate issues such as structural damage, deferred maintenance, or discrepancies from assessor records. These visual records, combined with detailed inspection reports, provide compelling support to argue for a reassessment or reduction in the property's taxable value. |

| 8 | Prior Appeal Determination Letter | The Prior Appeal Determination Letter serves as crucial evidence in a property tax appeal application, documenting the outcome of a previous appeal and offering a reference point for current valuations or disputes. Including this letter strengthens the appeal by providing detailed insights into past assessments, supporting claims for reassessment or adjustments in property tax valuations. |

| 9 | Special Use or Exemption Certificates | Special Use or Exemption Certificates require submitting proof of eligibility documents, such as income statements, disability verification, or veteran status certificates, alongside the property tax appeal application. Supporting evidence like property deeds, prior tax assessments, and official exemption forms enhances the appeal's validity and increases the chance of a successful adjustment. |

| 10 | GIS Parcel Mapping Printout | A GIS parcel mapping printout is essential for a property tax appeal application as it provides a detailed visual representation of the property's boundaries, dimensions, and geographic location. This document helps verify property details and assess accurate valuation by local tax authorities. |

Introduction to Property Tax Appeals

Filing a property tax appeal requires understanding the necessary documentation to support Your case. Proper preparation increases the chances of a successful appeal outcome.

- Assessment Notice - This document shows the current assessed value of the property from the tax assessor's office.

- Property Deed - Provides legal proof of ownership and property details relevant to the appeal.

- Comparable Sales Data - Evidence of recent sales of similar properties to demonstrate valuation discrepancies.

Importance of Accurate Documentation

Accurate documentation is crucial for a successful property tax appeal application. Essential documents include the property tax assessment notice, recent appraisals, and comparable property sales data. These materials provide a clear and factual basis to challenge inaccurate property valuations effectively.

Property Deed and Ownership Proof

Submitting a property tax appeal requires specific documents to verify ownership and property details. Your application must include essential proof to ensure the appeal is accurately processed.

- Property Deed - This legal document proves your ownership and includes a detailed description of the property boundaries and rights.

- Ownership Proof - Official records such as a title report or tax bill confirm your status as the legal owner responsible for property taxes.

- Supporting Identification - A government-issued ID may be required to establish personal identity and connection to the property in question.

Recent Property Tax Assessments

Recent property tax assessments are crucial documents for a property tax appeal application. These assessments provide the current valuation of your property as determined by the tax authority.

To support your appeal, include a copy of the latest property tax assessment notice issued by the local tax assessor's office. This document shows the assessed value that is being contested and serves as primary evidence in the appeal process. Accurate and up-to-date assessments help establish a baseline for arguing a reduction in property taxes.

Comparable Sales Data Reports

Comparable sales data reports are essential documents for a property tax appeal application. These reports provide detailed information on recent sales of similar properties in your area, highlighting their sale prices and characteristics.

They serve as evidence to demonstrate that your property's assessed value is higher than comparable properties. Submitting accurate and up-to-date sales data strengthens your appeal by supporting a fair market value argument.

Professional Appraisal Reports

What documents are needed for a property tax appeal application?

Professional appraisal reports are essential documents that provide an unbiased valuation of the property. These reports help establish the accurate market value, strengthening the appeal case with credible evidence.

Photographic Evidence of Property Condition

| Document Type | Description | Importance in Tax Appeal |

|---|---|---|

| Photographic Evidence of Property Condition | High-resolution images showing current state of the property, highlighting damages, disrepair, or unique conditions that may affect valuation. | Provides visual proof supporting claims of depreciation or issues lowering property value; strengthens the appeal by offering tangible evidence. |

| Property Tax Assessment Notice | Official document indicating the assessed value and tax amount assigned by the local tax authority. | Serves as the base reference for the appeal; verifies assessment details to challenge. |

| Comparative Market Analysis (CMA) | Report comparing similar properties' sales prices and conditions within the neighborhood. | Supports argument that assessed value exceeds market value by showcasing relevant market data. |

| Repair Estimates or Contractor Reports | Written estimates for necessary repairs or expert evaluations of property condition. | Complements photographic evidence by quantifying the cost impact on property value. |

| Property Deed or Title | Legal proof of property ownership including boundaries and legal description. | Confirms ownership and delineates property specifics crucial to assessment. |

Repair and Maintenance Records

Repair and maintenance records play a crucial role in a property tax appeal application. These documents provide evidence of the property's condition that can impact its assessed value.

You should gather invoices, receipts, and detailed descriptions of all major repairs and maintenance performed. Submitting these records supports your claim that repair costs may reduce the property's taxable value.

Relevant Correspondence with Tax Authorities

Relevant correspondence with tax authorities is essential when filing a property tax appeal application. This documentation supports your case by providing official communication and evidence related to the tax assessment.

- Assessment Notice - Official document from the tax authority detailing the current property tax assessment and valuation.

- Previous Appeal Letters - Copies of any prior communications or appeal submissions sent to the tax office regarding the property.

- Response Letters from Tax Authorities - Written replies or decisions from tax officials addressing your appeal or inquiries.

Compiling these documents strengthens your property tax appeal by demonstrating a clear record of your interactions with tax authorities.

What Documents are Needed for a Property Tax Appeal Application? Infographic