First-time homebuyers need essential documents such as their government-issued ID, proof of income like pay stubs or tax returns, and bank statements to verify funds for closing costs. The purchase agreement, home inspection report, and loan estimate are also crucial to finalize the transaction. Additionally, buyers must provide homeowner's insurance proof and any required disclosures to complete the closing process smoothly.

What Documents Does a First-Time Homebuyer Need for Closing?

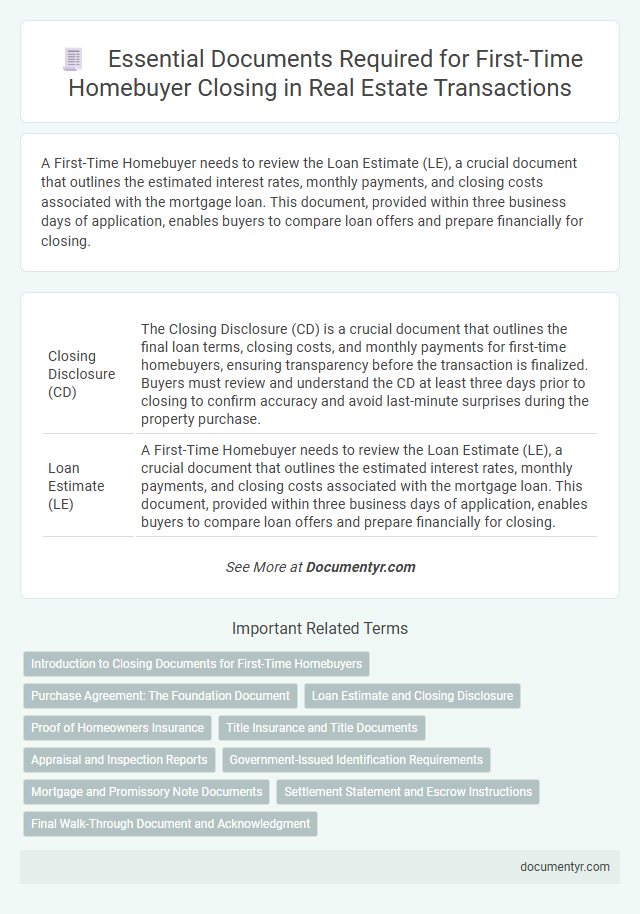

| Number | Name | Description |

|---|---|---|

| 1 | Closing Disclosure (CD) | The Closing Disclosure (CD) is a crucial document that outlines the final loan terms, closing costs, and monthly payments for first-time homebuyers, ensuring transparency before the transaction is finalized. Buyers must review and understand the CD at least three days prior to closing to confirm accuracy and avoid last-minute surprises during the property purchase. |

| 2 | Loan Estimate (LE) | A First-Time Homebuyer needs to review the Loan Estimate (LE), a crucial document that outlines the estimated interest rates, monthly payments, and closing costs associated with the mortgage loan. This document, provided within three business days of application, enables buyers to compare loan offers and prepare financially for closing. |

| 3 | Proof of Earnest Money Deposit | A first-time homebuyer must provide proof of earnest money deposit, typically in the form of a bank statement or a canceled check, to demonstrate their commitment and secure the property during closing. This document is essential to confirm the transfer of funds into an escrow or trust account, ensuring the seller that the buyer is serious about proceeding with the transaction. |

| 4 | Gift Letter (with source verification) | A Gift Letter is a crucial document for first-time homebuyers who receive financial assistance from family or friends, verifying that the funds provided are a gift and not a loan, which must be clearly stated to satisfy lender requirements (HUD, 2023). This letter typically includes the donor's name, relationship to the buyer, gift amount, and a statement confirming no repayment is expected, ensuring compliance with mortgage underwriting guidelines. |

| 5 | Mortgage Commitment Letter | A Mortgage Commitment Letter is a critical document for first-time homebuyers, serving as the lender's formal approval of the loan based on the buyer's financial qualifications and property appraisal. This letter not only confirms the loan terms but also assures the seller of the buyer's ability to fund the purchase, making it essential for closing procedures. |

| 6 | Seller’s Property Disclosure Statement | A first-time homebuyer needs the Seller's Property Disclosure Statement to review detailed information about the property's condition, including known defects and past repairs. This document ensures transparency and helps buyers make informed decisions before closing on the home. |

| 7 | Payoff Statement (for seller or prior loans) | A payoff statement is a crucial document that details the exact amount required to fully satisfy an existing mortgage or loan on the property, ensuring all prior liens are cleared before closing. First-time homebuyers must verify this statement to confirm that sellers have settled any outstanding debts, securing a clean title transfer. |

| 8 | Homeowners Association (HOA) Estoppel | First-time homebuyers need to obtain a Homeowners Association (HOA) estoppel letter during closing, which verifies outstanding fees, rules, and financial status of the HOA. This document ensures buyers are aware of any pending dues or restrictions imposed by the HOA that could affect property ownership. |

| 9 | Down Payment Source Documentation (e.g., seasoned funds) | First-time homebuyers must provide down payment source documentation, including bank statements showing seasoned funds--funds held in an account for a minimum of 60 to 90 days without large, unexplained deposits--to verify the legitimacy and source of their payment. Lenders require these documents to ensure the down payment is not borrowed and complies with mortgage underwriting guidelines. |

| 10 | Identity Verification Compliance Form (e.g., Patriot Act form) | First-time homebuyers must provide an Identity Verification Compliance Form, such as the Patriot Act form, to satisfy federal regulations aimed at preventing money laundering and terrorism financing. This document requires government-issued photo identification and proof of address to verify the buyer's identity before closing. |

Introduction to Closing Documents for First-Time Homebuyers

Closing on your first home involves a set of important documents that finalize the purchase and transfer ownership. These documents include the purchase agreement, title insurance policy, and closing disclosure statement. Understanding these key papers helps ensure a smooth transition from buyer to homeowner.

Purchase Agreement: The Foundation Document

The purchase agreement serves as the foundation document in the home buying process. It outlines the terms and conditions agreed upon by the buyer and seller, including price, contingencies, and closing date.

This document is essential for closing, ensuring all parties understand their responsibilities and the transaction details. You will need a fully executed purchase agreement to proceed with title searches, inspections, and finalizing financing.

Loan Estimate and Closing Disclosure

| Document | Description | Importance at Closing |

|---|---|---|

| Loan Estimate | This document provides an outline of the estimated loan terms, monthly payments, and closing costs based on the initial loan application. It is delivered within three business days after applying for a mortgage. | The Loan Estimate helps you understand loan costs upfront and allows comparison between different lenders. It ensures transparency and prepares you for the financial commitment ahead. |

| Closing Disclosure | The Closing Disclosure details the final loan terms, exact closing costs, and payment schedule. It is provided at least three business days before the closing date. | This document confirms the final financial obligations and protects against unexpected charges at closing. It gives a clear view of all fees, ensuring that you are fully informed before signing. |

Proof of Homeowners Insurance

What proof of homeowners insurance is required for closing on your first home? Lenders need official documentation to confirm your property is protected against potential damages. This proof ensures your investment is secure and meets mortgage requirements.

Title Insurance and Title Documents

Title insurance protects your investment by ensuring the property title is free from liens or disputes. It provides peace of mind during the closing process by safeguarding against potential ownership issues.

Title documents include the deed, title report, and lender's title insurance policy. The deed verifies ownership transfer, while the title report reveals any encumbrances on the property. Your title insurance policy confirms coverage against possible title defects discovered after closing.

Appraisal and Inspection Reports

Appraisal and inspection reports are critical documents required for closing a property purchase, ensuring the home's value and condition meet purchase terms. These reports protect both the buyer and lender by providing detailed evaluations of the property.

- Appraisal Report - This document estimates the home's fair market value based on recent sales of comparable properties and the property's unique features.

- Home Inspection Report - A licensed inspector assesses the property's structural integrity, systems, and potential repairs, highlighting any issues that could affect safety or value.

- Condition Verification - Both reports combined verify the property's condition aligns with your expectations and lender requirements before finalizing the sale.

Government-Issued Identification Requirements

Government-issued identification is essential for first-time homebuyers during the closing process. Commonly accepted forms include a valid driver's license, passport, or state ID card. Your identification must be current and unexpired to verify your identity and complete the transaction smoothly.

Mortgage and Promissory Note Documents

First-time homebuyers must prepare crucial mortgage documents to complete the closing process. These documents verify loan approval and outline the terms and conditions agreed upon with the lender.

The promissory note is a key document that details the borrower's promise to repay the mortgage loan. It includes the loan amount, interest rate, payment schedule, and consequences of default.

Settlement Statement and Escrow Instructions

First-time homebuyers must prepare several key documents for closing to ensure a smooth transaction. Two essential documents are the Settlement Statement and Escrow Instructions, which outline financial details and property handling instructions.

- Settlement Statement - This detailed document itemizes all costs and fees involved in the property purchase.

- Escrow Instructions - These are written directions guiding the escrow agent on managing funds and documents during closing.

- Settlement Statement - It ensures transparency by providing buyers and sellers with a clear breakdown of who pays what.

Having these documents accurately prepared helps first-time buyers avoid delays and misunderstandings at closing.

What Documents Does a First-Time Homebuyer Need for Closing? Infographic