To transfer property ownership, essential documents include the sale deed, which serves as the primary legal proof of the transaction. The title deed verifies the seller's ownership, while the encumbrance certificate ensures the property is free from legal dues or mortgages. Other critical documents are the property tax receipts, no-objection certificate (NOC) from the relevant authorities, and identity proofs of both buyer and seller to complete the registration process.

What Documents are Required for Transferring Property Ownership?

| Number | Name | Description |

|---|---|---|

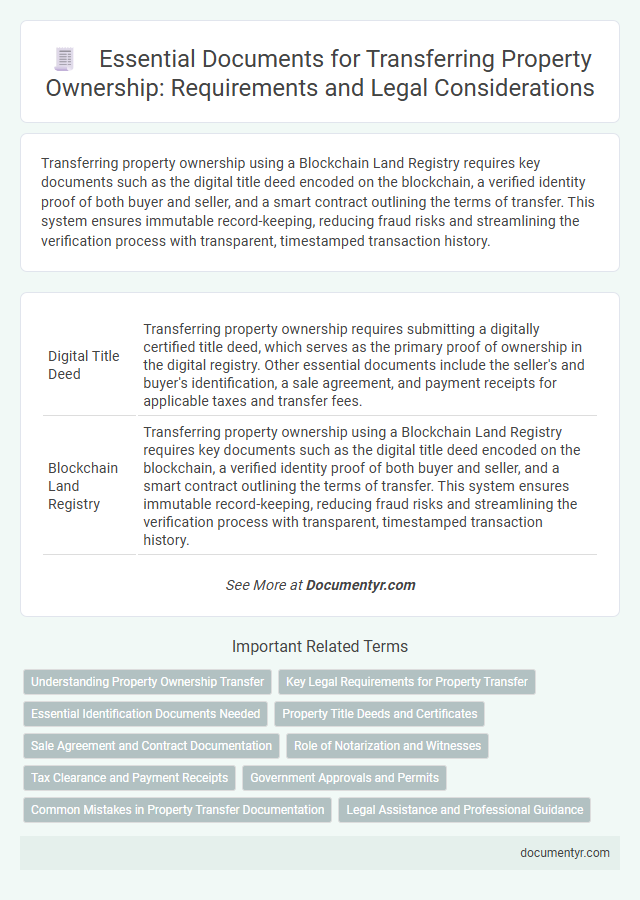

| 1 | Digital Title Deed | Transferring property ownership requires submitting a digitally certified title deed, which serves as the primary proof of ownership in the digital registry. Other essential documents include the seller's and buyer's identification, a sale agreement, and payment receipts for applicable taxes and transfer fees. |

| 2 | Blockchain Land Registry | Transferring property ownership using a Blockchain Land Registry requires key documents such as the digital title deed encoded on the blockchain, a verified identity proof of both buyer and seller, and a smart contract outlining the terms of transfer. This system ensures immutable record-keeping, reducing fraud risks and streamlining the verification process with transparent, timestamped transaction history. |

| 3 | Electronic Sale Deed | To transfer property ownership electronically, a valid electronic sale deed must be registered through the state's online property registration portal, accompanied by digital copies of the buyer's and seller's identity proofs, encumbrance certificate, and approved property layout plan. The electronic sale deed should be digitally signed by both parties and the registering authority, ensuring authenticity and legal validity in compliance with the Indian Registration Act and Information Technology Act. |

| 4 | e-Encumbrance Certificate | An e-Encumbrance Certificate is essential for transferring property ownership as it verifies the property is free from legal liabilities or loans, ensuring a clear title for the buyer. This digitally issued document from the sub-registrar's office records all registered transactions, providing crucial proof of ownership and aiding in smooth property transfer processes. |

| 5 | No Objection Certificate (NOC) Blockchain-Verified | The No Objection Certificate (NOC) is a crucial document required for transferring property ownership, serving as formal consent from relevant authorities or stakeholders that there are no objections to the transaction. Blockchain-verified NOCs enhance security and transparency by providing tamper-proof, easily verifiable records, reducing fraud risks and expediting the property transfer process. |

| 6 | Aadhaar-Linked Power of Attorney | Aadhaar-linked Power of Attorney (PoA) is an essential document for transferring property ownership, enabling a trusted individual to act on behalf of the owner in registration processes. This PoA, authenticated via Aadhaar biometric verification, ensures secure and efficient property transfer while complying with legal requirements and preventing fraud. |

| 7 | e-KYC Compliance Documentation | Transferring property ownership requires key e-KYC compliance documents such as a valid government-issued ID (Aadhaar card, PAN card, or passport), proof of address, and the latest utility bills to verify the seller and buyer identity. Additionally, digitally signed application forms and consent declarations ensure secure and authenticated ownership transfer within the official property registry systems. |

| 8 | Virtual Mutation Application | The virtual mutation application for transferring property ownership requires key documents such as the original sale deed, property tax receipts, identity proof of the buyer, and the latest mutation or revenue record. Submission through the online portal expedites verification and approval by the municipal or revenue department, ensuring seamless ownership transfer without physical visits. |

| 9 | Online Property Tax Clearance Certificate | The Online Property Tax Clearance Certificate is a crucial document required for transferring property ownership, verifying that all outstanding property taxes have been paid. This digital certificate streamlines the transfer process by providing official proof of tax compliance, ensuring a smooth and legally valid transaction. |

| 10 | CERSAI Lien Release Document | The CERSAI Lien Release Document is a crucial legal paper required to transfer property ownership, confirming that all loans secured against the property have been fully repaid and no liens remain. This document, issued by the Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI), must be submitted to ensure clear title and avoid disputes during the ownership transfer process. |

Understanding Property Ownership Transfer

Transferring property ownership requires essential documents to validate the transaction and ensure legal compliance. Key documents include the original title deed, a sale agreement, and proof of identity for both parties involved. Understanding these requirements helps streamline the transfer process and protects the rights of the new owner.

Key Legal Requirements for Property Transfer

| Document | Description | Importance in Property Transfer |

|---|---|---|

| Sale Deed | Legal document that proves the sale and transfer of property ownership from the seller to the buyer. | Essential for validating the ownership change; must be registered with relevant authorities. |

| Title Deed | Proof of the seller's ownership and authority to transfer the property. | Verifies that the property is free from legal disputes and liens. |

| Encumbrance Certificate (EC) | Certificate showing that the property is free from any monetary or legal liabilities. | Confirms there are no outstanding loans or mortgages affecting the property. |

| Property Tax Receipts | Proof that property taxes have been paid up to date by the current owner. | Ensures no pending dues which could complicate the ownership transfer. |

| No Objection Certificate (NOC) | Authorization from relevant authorities (e.g., housing society, municipal corporation) allowing the sale. | Required to avoid future objections during or after the transfer process. |

| Identity and Address Proofs | Valid government-issued IDs such as passport, Aadhaar, or driver's license of both buyer and seller. | Verifies identities and legal status of parties involved in the transaction. |

| Registered Agreement to Sale | Preliminary agreement outlining terms and conditions agreed by both parties before final sale deed. | Helps to secure transaction details and avoid disputes. |

| Occupancy Certificate (OC) / Completion Certificate (CC) | Documents indicating that the property complies with building regulations and is ready for occupation. | Important for verifying legality and safety of the property. |

Meeting these key legal requirements ensures Your property ownership transfer is valid, secure, and legally recognized.

Essential Identification Documents Needed

What essential identification documents are required for transferring property ownership? Proper identification is crucial to authenticate the identity of both the buyer and seller. Documents such as government-issued photo ID, proof of address, and the original title deed are typically mandatory for the transfer process.

Property Title Deeds and Certificates

Transferring property ownership requires specific legal documents to ensure a valid and secure transaction. Property title deeds and certificates are essential to establish and verify ownership rights.

- Property Title Deed - This document serves as the primary proof of ownership, detailing the current owner's name and the property's legal description.

- Title Certificate - It confirms that the property's title is free from encumbrances or claims, providing assurance to the buyer and authorities.

- Encumbrance Certificate - This certificate records all transactions related to the property, verifying its clear and marketable status at the time of transfer.

Having these documents verified and authenticated is crucial for a smooth property ownership transfer process.

Sale Agreement and Contract Documentation

Transferring property ownership requires several essential documents to ensure legal validity. The Sale Agreement is a critical document that outlines the terms and conditions agreed upon by the buyer and seller.

This agreement serves as proof of the intent to transfer ownership and includes details such as property description, sale price, and payment terms. Contract documentation formalizes the transaction and may include additional agreements like indemnity clauses or warranties.

Role of Notarization and Witnesses

Transferring property ownership requires specific legal documents to ensure a valid and binding transaction. The role of notarization and witnesses is crucial to authenticate these documents and protect your interests.

- Deed of Transfer - This document legally transfers ownership from the seller to the buyer and must be notarized to confirm its authenticity.

- Title Certificate - Proves current ownership and is essential for verifying clear title before transfer.

- Witnesses' Signatures - Witnesses confirm the identities of the parties involved and validate their voluntary consent to the transfer.

Tax Clearance and Payment Receipts

Transferring property ownership requires specific legal and financial documents to ensure a smooth transaction. Tax clearance certificates and payment receipts play a crucial role in validating that all dues are settled before the transfer.

- Tax Clearance Certificate - This document certifies that the property owner has paid all applicable taxes, confirming no outstanding liabilities exist.

- Payment Receipts - Receipts for property tax payments serve as proof of timely payments and prevent disputes during ownership transfer.

- Importance of Compliance - Submitting these documents is mandatory for legal property registration and to avoid penalties or transaction delays.

Government Approvals and Permits

Transferring property ownership requires several government approvals and permits to ensure legal compliance. Essential documents include the sale deed, no-objection certificate (NOC) from local authorities, and property tax clearance certificates. You must also obtain approval from municipal or revenue departments to validate the transfer process and avoid future disputes.

Common Mistakes in Property Transfer Documentation

Transferring property ownership requires precise documentation to ensure a smooth legal process. Missing or incorrect documents can lead to significant delays and potential disputes.

Common mistakes include incomplete property titles, incorrect identification details, and failure to notarize key documents. Ensuring all paperwork such as the deed, sale agreement, and tax receipts are accurate is crucial for a valid transfer.

What Documents are Required for Transferring Property Ownership? Infographic