Buyers need several key documents for a real estate closing, including a government-issued ID, proof of homeowners insurance, and the closing disclosure detailing all transaction costs. They must also bring the mortgage payoff statement if applicable, the purchase agreement, and any required inspection reports. Having these documents organized ensures a smooth and timely closing process.

What Documents Does a Buyer Need for a Real Estate Closing?

| Number | Name | Description |

|---|---|---|

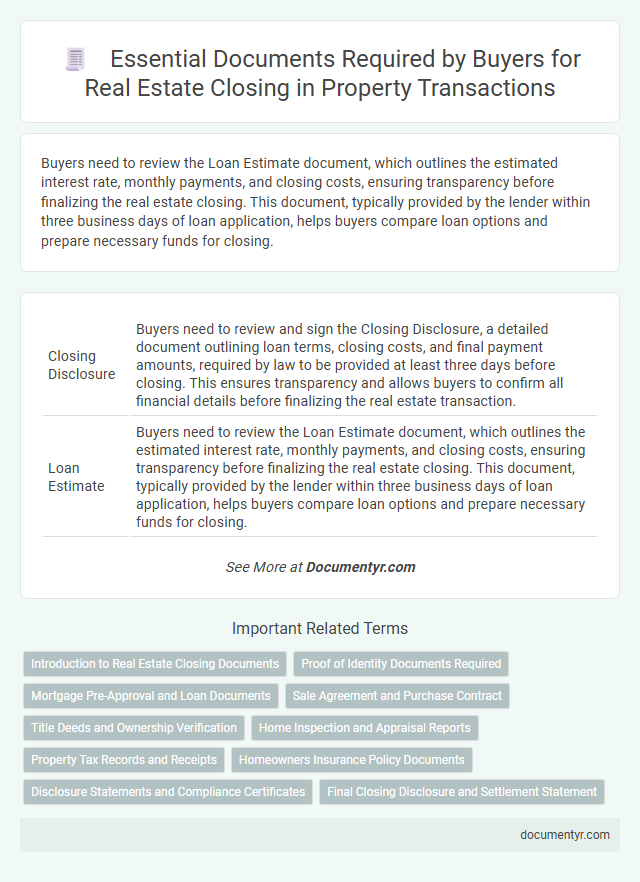

| 1 | Closing Disclosure | Buyers need to review and sign the Closing Disclosure, a detailed document outlining loan terms, closing costs, and final payment amounts, required by law to be provided at least three days before closing. This ensures transparency and allows buyers to confirm all financial details before finalizing the real estate transaction. |

| 2 | Loan Estimate | Buyers need to review the Loan Estimate document, which outlines the estimated interest rate, monthly payments, and closing costs, ensuring transparency before finalizing the real estate closing. This document, typically provided by the lender within three business days of loan application, helps buyers compare loan options and prepare necessary funds for closing. |

| 3 | Promissory Note | A buyer needs a promissory note at real estate closing, which serves as a legally binding document outlining the loan terms agreed upon with the lender. This note details the principal amount, interest rate, payment schedule, and repayment conditions essential for finalizing the property purchase. |

| 4 | Deed of Trust (or Mortgage) | Buyers need to provide the Deed of Trust or Mortgage document during a real estate closing to secure the loan and establish the lender's interest in the property. This legal instrument outlines the terms of the loan and serves as a lien, ensuring the lender can claim the property if the borrower defaults. |

| 5 | Proof of Homeowner’s Insurance | Proof of homeowner's insurance is a critical document buyers must provide at a real estate closing to confirm that the property is adequately insured against potential risks. This policy ensures lenders that the home is protected, satisfying mortgage requirements and protecting the buyer's investment. |

| 6 | Title Commitment | The buyer needs the title commitment document to verify the property's legal ownership status and confirm there are no liens or encumbrances affecting the title before closing. This document ensures the title company will provide clear ownership insurance, safeguarding the buyer's investment in the real estate transaction. |

| 7 | Seller’s Disclosure Statement | The Seller's Disclosure Statement is a crucial document in real estate closing, providing essential information about the property's condition, known defects, and any past repairs or issues. Buyers rely on this disclosure to make informed decisions and verify the property's status before finalizing the purchase agreement. |

| 8 | Wire Fraud Disclosure | Buyers need to provide a signed Wire Fraud Disclosure to acknowledge the risks of electronic transfer scams during real estate transactions, ensuring they are informed about secure payment procedures. This document is critical for verifying the buyer's understanding of potential cyber threats and protecting all parties from fraudulent wire transfers. |

| 9 | Settlement Statement (ALTA Statement) | The Settlement Statement, also known as the ALTA Statement, is a critical document detailing all financial transactions between the buyer, seller, and lender during a real estate closing, ensuring transparency of costs and credits. Buyers must review this statement carefully to confirm accuracy of closing costs, loan fees, prepaid items, and prorations before signing final paperwork. |

| 10 | Remote Online Notarization Certificate | Buyers must provide a Remote Online Notarization Certificate during a real estate closing to verify the authenticity of electronic signatures and ensure compliance with state laws. This certificate facilitates secure and legally binding online notarizations, streamlining the closing process for remote transactions. |

Introduction to Real Estate Closing Documents

Understanding the essential documents for a real estate closing is crucial for buyers to ensure a smooth property transfer. These documents protect both parties and finalize the terms of the sale.

- Purchase Agreement - This contract outlines the terms and conditions agreed upon by the buyer and seller.

- Title Report - Confirms the property's legal ownership and any existing liens or encumbrances.

- Closing Disclosure - Details all financial transactions, fees, and costs associated with the closing process.

Proof of Identity Documents Required

For a real estate closing, proof of identity documents are essential to verify the buyer's authenticity. Common documents include a valid government-issued photo ID such as a driver's license, passport, or state identification card. You must bring these original forms of identification to ensure a smooth and legally compliant closing process.

Mortgage Pre-Approval and Loan Documents

Preparing for a real estate closing requires specific documents to ensure a smooth transaction. Mortgage pre-approval and loan documents are essential components of this process.

- Mortgage Pre-Approval Letter - This document verifies that a lender has conditionally approved your loan based on your financial information.

- Loan Application Forms - These forms detail your financial history and property information, serving as the foundation for your mortgage approval.

- Loan Estimate and Closing Disclosure - These documents outline the loan terms, expected costs, and final payment details for your review before closing.

Sale Agreement and Purchase Contract

For a real estate closing, a buyer must have essential documents to ensure a smooth transaction. The sale agreement and purchase contract are among the most critical papers required at this stage.

The sale agreement outlines the terms and conditions mutually agreed upon by the buyer and seller. The purchase contract legally binds both parties to the transaction, specifying the property's details, sale price, and closing date. Make sure your copies of these documents are complete and signed to avoid delays during closing.

Title Deeds and Ownership Verification

Buyers need to provide title deeds during a real estate closing to confirm the legal ownership of the property. Title deeds serve as official documents proving the seller's right to transfer the property to the buyer.

Ownership verification is essential to avoid disputes or fraud during the transaction. Buyers often obtain a title report or title insurance to ensure the property's ownership history is clear and unencumbered.

Home Inspection and Appraisal Reports

Home inspection and appraisal reports play a crucial role in the real estate closing process. These documents verify the property's condition and market value, ensuring transparency for all parties involved.

Your home inspection report details any existing issues or repairs needed, helping you assess the property's true state. The appraisal report confirms the property's worth, which lenders use to approve your mortgage and finalize the sale.

Property Tax Records and Receipts

Property tax records and receipts are essential documents a buyer needs for a real estate closing. These documents verify the payment history and outstanding tax obligations related to the property.

- Property Tax Records - Provide detailed information on the assessed value and tax amounts levied on the property.

- Tax Receipts - Confirm that previous property taxes have been paid and there are no liens against the property.

- Tax Payment History - Helps buyers understand any unpaid taxes that could affect the closing process.

Having accurate property tax documents ensures a smooth real estate transaction and protects buyers from inheriting unexpected tax debts.

Homeowners Insurance Policy Documents

| Document | Description | Importance in Real Estate Closing |

|---|---|---|

| Homeowners Insurance Policy | A contract between the buyer and insurance company that provides coverage for the property against damages and liabilities. | Required by lenders to protect the investment; proof of an active policy must be submitted before or at closing. |

| Declarations Page | A summary page from the homeowners insurance policy listing coverage limits, policy number, insured property address, and effective dates. | Verifies the existence of insurance, confirms coverage amount, and ensures the policy aligns with lender requirements. |

| Receipt of Payment | Proof that the initial premium payment for the homeowners insurance has been made. | Demonstrates active coverage and satisfies lender and closing agent requirements before finalizing the transaction. |

| Additional Endorsements or Riders | Documents that extend or modify coverage (e.g., flood insurance, earthquake coverage). | May be required for properties in special risk zones to ensure comprehensive protection as mandated by lenders or law. |

Disclosure Statements and Compliance Certificates

What documents are essential for a real estate closing? Disclosure statements provide critical information about the property's condition and history. Compliance certificates verify that the property meets local regulations and safety standards, ensuring a smooth transaction for you.

What Documents Does a Buyer Need for a Real Estate Closing? Infographic