Essential documents for a real estate closing include the deed, which transfers ownership, and the title insurance policy to protect against ownership disputes. A closing disclosure outlining all costs and fees, along with the mortgage agreement detailing loan terms, must be reviewed and signed by both parties. Proof of homeowner's insurance and any required inspection reports are also necessary to finalize the transaction.

What Documents are Mandatory for a Real Estate Closing?

| Number | Name | Description |

|---|---|---|

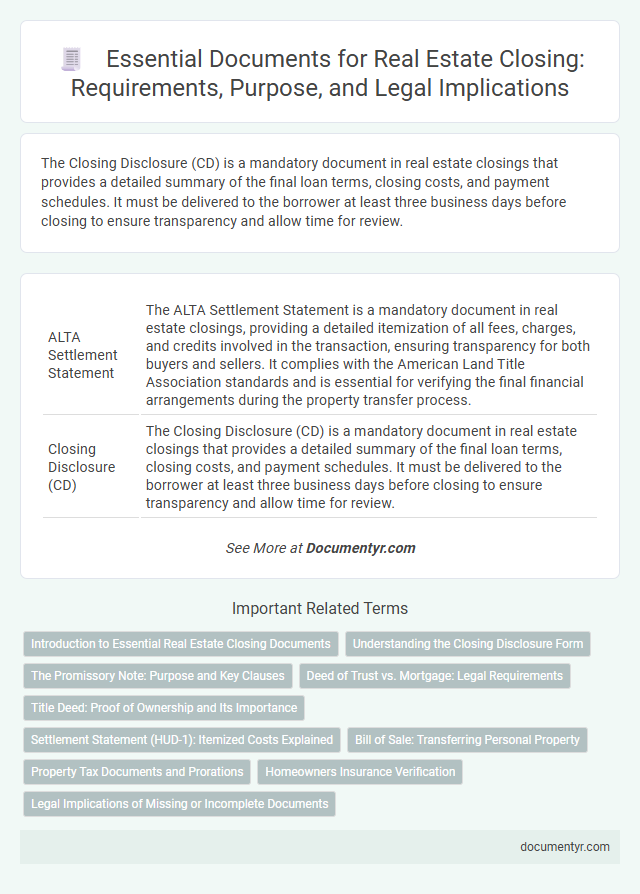

| 1 | ALTA Settlement Statement | The ALTA Settlement Statement is a mandatory document in real estate closings, providing a detailed itemization of all fees, charges, and credits involved in the transaction, ensuring transparency for both buyers and sellers. It complies with the American Land Title Association standards and is essential for verifying the final financial arrangements during the property transfer process. |

| 2 | Closing Disclosure (CD) | The Closing Disclosure (CD) is a mandatory document in real estate closings that provides a detailed summary of the final loan terms, closing costs, and payment schedules. It must be delivered to the borrower at least three business days before closing to ensure transparency and allow time for review. |

| 3 | Buyer’s Final Walk-Through Report | The buyer's final walk-through report is a mandatory document for real estate closings, confirming the property's condition aligns with the contract terms before transfer of ownership. This report ensures any agreed repairs are completed and no new damages have occurred, safeguarding the buyer's interests. |

| 4 | Loan Payoff Verification Statement | The Loan Payoff Verification Statement is a critical document in a real estate closing, confirming the exact amount required to satisfy the seller's outstanding mortgage balance. This statement ensures accurate allocation of funds, preventing any residual lien on the property and facilitating a clear transfer of ownership. |

| 5 | FIRPTA Affidavit (Foreign Investment in Real Property Tax Act) | The FIRPTA Affidavit is a mandatory document in real estate closings involving foreign sellers, ensuring compliance with the Foreign Investment in Real Property Tax Act by certifying the seller's non-foreign status or withholding the appropriate tax. Failure to provide a valid FIRPTA Affidavit can result in withholding of up to 15% of the sale price by the IRS, affecting the timely transfer of property ownership. |

| 6 | Wire Fraud Prevention Notice | A Wire Fraud Prevention Notice is a mandatory document in real estate closings that informs all parties about the risks of wire transfer fraud and provides instructions to verify wiring information through secure communication channels. This notice helps protect buyers and sellers by ensuring that funds are transferred safely and reduces the risk of financial loss due to cybercriminal interference. |

| 7 | Beneficial Ownership Declaration | The Beneficial Ownership Declaration is a mandatory document for real estate closing that identifies individuals who ultimately own or control the property transaction, ensuring compliance with anti-money laundering regulations. This declaration helps verify the legitimacy of the transaction and prevents fraudulent ownership claims during the closing process. |

| 8 | Remote Online Notarization (RON) Certificate | A Remote Online Notarization (RON) Certificate is a mandatory document for real estate closings involving digital transactions, ensuring the validity and legality of notarized signatures obtained through remote technology. This certificate verifies the notarization process complies with state laws and records vital details such as the notary's identity, the signer's remote presence, date, and time of notarization. |

| 9 | E-Signature Consent Authorization | E-Signature Consent Authorization is mandatory for real estate closings to ensure the electronic signing of documents complies with legal standards and facilitates a faster, secure transaction process. This authorization confirms that all parties agree to use electronic signatures, streamlining document execution and reducing paper-based delays during property transfer. |

| 10 | Environmental Hazard Disclosure Addendum | The Environmental Hazard Disclosure Addendum is mandatory for real estate closings in many states to inform buyers of potential environmental risks such as lead-based paint, asbestos, radon, or mold. This document ensures transparency about hazardous conditions on the property, helping protect both parties and complying with federal and state regulations. |

Introduction to Essential Real Estate Closing Documents

| Document Name | Description | Purpose |

|---|---|---|

| Purchase Agreement | A legally binding contract between the buyer and seller outlining the terms of the property sale. | Establishes the sale price, conditions, and timelines for the transaction. |

| Property Deed | Official document that transfers ownership of the property from the seller to the buyer. | Confirms legal ownership and is recorded with local government authorities. |

| Title Report or Title Insurance | Documents verifying the property's title status and protecting against ownership disputes. | Ensures clear ownership and guards your investment against title defects. |

| Loan Documents | Includes the mortgage note, deed of trust, or security deed detailing your loan terms. | Defines the commitment for financing the property purchase. |

| Closing Disclosure | A detailed statement of final loan terms, settlement costs, and fees. | Provides full transparency of financial obligations before closing. |

| Property Inspection Report | Assessment by a certified inspector outlining the condition of the home. | Highlights any structural or mechanical issues before purchase completion. |

| Seller's Property Disclosure | Document where the seller reveals known property defects or issues. | Ensures transparency about the property condition. |

| Proof of Homeowners Insurance | Evidence that insurance coverage is in place effective from the closing date. | Protects the property against damages and liabilities. |

| Settlement Statement (HUD-1) | Summary of all final costs for buyer and seller involved in the transaction. | Details financial exchanges and closing costs involved. |

Understanding the Closing Disclosure Form

What is the purpose of the Closing Disclosure Form in a real estate closing? This form outlines all final loan terms and closing costs, ensuring full transparency. It helps you verify that the financial details match the initial loan estimate.

The Promissory Note: Purpose and Key Clauses

The promissory note is a critical document in a real estate closing, serving as the borrower's written promise to repay the loan under specified terms. It legally binds the borrower to the lender, ensuring clarity and enforceability of the loan agreement.

This document details the loan amount, interest rate, payment schedule, and maturity date. Key clauses include late payment penalties, default conditions, and prepayment options. The promissory note protects both parties by clearly outlining repayment obligations and consequences for non-compliance.

Deed of Trust vs. Mortgage: Legal Requirements

A deed of trust and a mortgage both serve as security instruments for real estate loans, but their legal requirements vary by state. The deed of trust involves three parties: the borrower, lender, and trustee, whereas a mortgage only includes two parties: borrower and lender.

For a real estate closing, a deed of trust must be properly signed, notarized, and recorded to be legally binding. Mortgages require similar steps, including notarization and recording, but may have different state-specific filing procedures and rights of redemption timelines.

Title Deed: Proof of Ownership and Its Importance

The title deed serves as the primary proof of ownership in a real estate transaction. It is essential for confirming your legal right to transfer the property during closing.

- Legal Ownership Verification - The title deed verifies the seller's legal ownership, ensuring the property can be lawfully sold.

- Title Transfer Documentation - It facilitates the seamless transfer of ownership from seller to buyer.

- Prevents Future Disputes - Possession of a clear title deed minimizes the risk of ownership conflicts after closing.

Settlement Statement (HUD-1): Itemized Costs Explained

The Settlement Statement (HUD-1) is a crucial document in a real estate closing that outlines all itemized costs involved in the transaction. It provides a transparent record of fees paid by both the buyer and the seller.

- Loan Fees - Includes origination fees, points, and application charges associated with securing the mortgage.

- Title Charges - Covers costs for title search, title insurance, and document preparation to ensure clear property ownership.

- Escrow and Prepaid Items - Lists escrow deposits for taxes and insurance, as well as prepaid interest and homeowners insurance premiums.

The HUD-1 form enables buyers and sellers to verify all financial details before the transaction is finalized.

Bill of Sale: Transferring Personal Property

During a real estate closing, several documents are mandatory to ensure a smooth transfer of ownership. The Bill of Sale is essential for transferring personal property included in the sale, such as appliances or fixtures. You must review this document carefully to confirm all items are accurately listed and legally conveyed.

Property Tax Documents and Prorations

Property tax documents are essential for a real estate closing to ensure accurate financial obligations are met. Prorations account for the fair division of property taxes between the buyer and seller based on the closing date.

- Property Tax Statement - This document details the amount of property tax owed for the current tax year and is critical for closing calculations.

- Tax Proration Schedule - Outlines how property taxes will be divided between buyer and seller, reflecting the portion of the year each party owns the property.

- Receipt of Paid Taxes - Proof that property taxes have been paid up to a certain date, preventing disputes over unpaid taxes after closing.

Homeowners Insurance Verification

Homeowners insurance verification is a critical document required for a real estate closing. Lenders demand proof that your property is adequately insured before finalizing the transaction. This verification protects both you and the lender from potential financial losses due to damage or disasters.

What Documents are Mandatory for a Real Estate Closing? Infographic