Property tax assessment requires key documents such as the property deed, which proves ownership, and the latest property tax receipts to confirm prior payments. Additionally, the assessor typically needs a recent property survey or blueprint to verify land boundaries and structure details. Proof of identification and any previous assessment notices may also be requested for accurate evaluation.

What Documents are Required for Property Tax Assessment?

| Number | Name | Description |

|---|---|---|

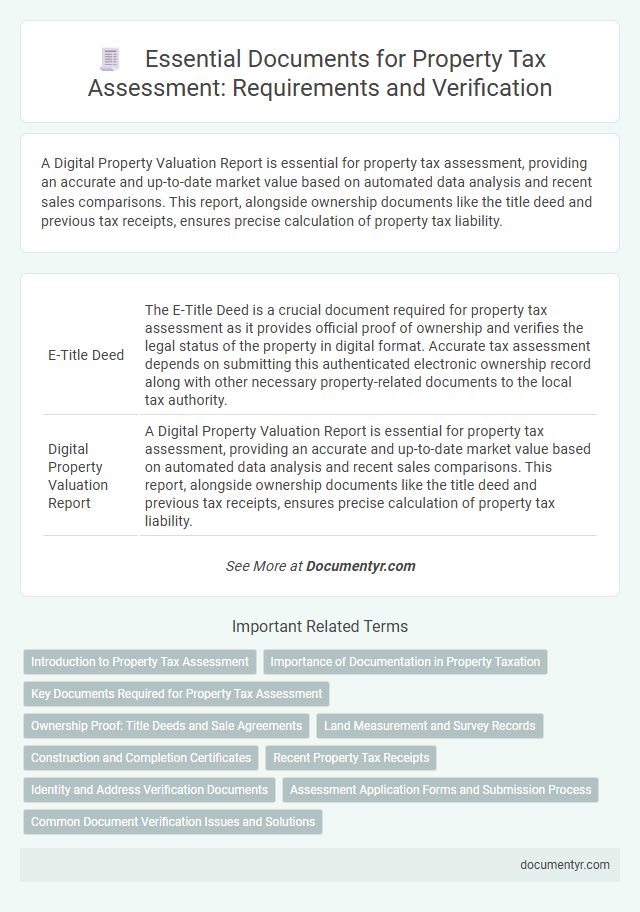

| 1 | E-Title Deed | The E-Title Deed is a crucial document required for property tax assessment as it provides official proof of ownership and verifies the legal status of the property in digital format. Accurate tax assessment depends on submitting this authenticated electronic ownership record along with other necessary property-related documents to the local tax authority. |

| 2 | Digital Property Valuation Report | A Digital Property Valuation Report is essential for property tax assessment, providing an accurate and up-to-date market value based on automated data analysis and recent sales comparisons. This report, alongside ownership documents like the title deed and previous tax receipts, ensures precise calculation of property tax liability. |

| 3 | GIS-Based Land Mapping Certificate | A GIS-Based Land Mapping Certificate is essential for property tax assessment as it provides accurate, geospatial data verifying property boundaries and land dimensions. This certificate helps local authorities in precisely calculating property taxes by integrating satellite imagery and digital mapping technologies. |

| 4 | Smart Registry Extract | The Smart Registry Extract is a vital document for property tax assessment, providing comprehensive data on ownership, property boundaries, and legal status essential for accurate valuation. This digitally authenticated extract ensures transparency and expedites the verification process, reducing discrepancies in property tax calculations. |

| 5 | UPI-Linked Ownership Proof | Property tax assessment requires submission of ownership proof documents linked to the Unique Property Identifier (UPI) to ensure accurate identification and valuation. Critical documents include the sale deed, property tax receipts, and the UPI registration certificate, which collectively validate legal ownership and facilitate seamless tax processing. |

| 6 | Blockchain Property Ledger | Property tax assessment requires verified ownership documents, proof of identity, and comprehensive property details; blockchain property ledger enhances this process by providing immutable, transparent records that streamline verification and reduce fraud risks. Utilizing blockchain technology ensures accurate, tamper-proof data, improving the efficiency and reliability of property tax assessments. |

| 7 | Occupancy Blockchain Record | Occupancy Blockchain Records provide a secure and immutable digital proof of property usage, streamlining the property tax assessment process by verifying real-time occupancy status. These records, combined with traditional documents such as title deeds and identification proofs, enable accurate and transparent tax evaluations. |

| 8 | Automated Sale Agreement e-Copy | An automated sale agreement e-copy is a crucial document for property tax assessment, providing a verified digital record of the transaction that simplifies verification processes. This e-copy includes key details such as property description, sale price, buyer and seller information, and transaction date, ensuring accurate and efficient tax calculation. |

| 9 | Virtual Mutation Order | Virtual Mutation Order (VMO) is a crucial document required for property tax assessment, serving as official proof of ownership transfer in government records. It helps ensure accurate property valuation and tax calculations by verifying the mutation of property title in land revenue records. |

| 10 | Drone Survey Documentation | Drone survey documentation provides high-resolution aerial imagery and precise property boundaries essential for accurate property tax assessments. These documents typically include georeferenced maps, 3D models, and detailed site analysis reports that enhance verification and valuation processes. |

Introduction to Property Tax Assessment

Property tax assessment is a process used by local governments to determine the value of a property for taxation purposes. Understanding the required documents is essential for accurate and timely property tax evaluation.

- Proof of Ownership - Documents such as the title deed or sale deed verify legal ownership of the property.

- Property Identification Details - Survey numbers, plot numbers, or property registration certificates are needed to identify the exact property.

- Previous Tax Receipts - Records of past property tax payments help assess the continuity and history of tax assessment.

Importance of Documentation in Property Taxation

Accurate property tax assessment relies heavily on the submission of specific documents that verify ownership, property details, and valuation. Essential documents include the title deed, property tax receipt, and land survey report, which help establish the legal and physical attributes of the property.

Proper documentation ensures transparency and prevents discrepancies in tax calculation, protecting property owners from overvaluation or legal disputes. Maintaining updated records facilitates efficient government revenue collection and supports fair municipal development planning.

Key Documents Required for Property Tax Assessment

Property tax assessment requires specific documents to verify ownership, property details, and valuation. Submitting accurate paperwork ensures proper tax calculation and avoids disputes.

- Proof of Ownership - Documents such as the sale deed or title deed confirm legal possession of the property.

- Property Tax Payment Receipts - Previous tax receipts help establish the property's tax history and current status.

- Property Layout or Survey Plan - Detailed drawings or maps provide essential information about the property's size and boundaries.

Presenting these key documents streamlines the property tax assessment process and secures compliance with local tax authorities.

Ownership Proof: Title Deeds and Sale Agreements

Ownership proof is a crucial element in property tax assessment, serving as evidence of the rightful holder of the property. Title deeds and sale agreements are the primary documents required to establish ownership.

The title deed provides legal confirmation of property ownership and includes detailed information such as the owner's name, property boundaries, and registration details. Sale agreements act as supporting evidence during the transaction process, outlining the terms of sale between buyer and seller. These documents must be submitted to the local tax authority to ensure accurate property tax calculation and assessment.

Land Measurement and Survey Records

Land measurement and survey records are essential documents required for property tax assessment. These records provide accurate details about the size, boundaries, and location of your property, ensuring correct tax evaluation. Proper documentation helps avoid disputes and ensures compliance with local tax authorities.

Construction and Completion Certificates

What documents are required for property tax assessment related to construction and completion?

Construction and completion certificates are essential documents for property tax assessment. These certificates verify that the building complies with local regulations and has been constructed according to approved plans.

Recent Property Tax Receipts

Recent property tax receipts are essential documents for property tax assessment. They serve as proof of payment and help verify your tax history.

These receipts must be submitted along with other required documents, such as the property deed and identification proof. Ensuring you have the latest tax receipts can streamline the assessment process.

Identity and Address Verification Documents

Property tax assessment requires precise documentation to verify the identity and address of the property owner. These documents ensure accurate tax calculation and legal compliance.

- Government-issued Photo ID - Documents such as a passport, driver's license, or voter ID card confirm the property owner's identity with an official photo and personal details.

- Proof of Address - Utility bills, bank statements, or rental agreements matching the property location establish the owner's current residential address.

- Property Ownership Documents - Title deed or sale agreement corroborates ownership and connects the identity and address to the specific property under assessment.

Assessment Application Forms and Submission Process

Property tax assessment requires submitting the official Assessment Application Form, which can be obtained from the local tax authority's office or website. This form must include detailed property information such as ownership details, property size, and location for accurate evaluation. The submission process typically involves presenting the completed form along with proof of ownership and identification at the designated municipal tax office or through an authorized online portal.

What Documents are Required for Property Tax Assessment? Infographic