To file a property tax appeal, essential documents include the property's current tax assessment notice, recent property tax bills, and evidence supporting a lower valuation such as recent appraisal reports or sales data of comparable properties. Photographs illustrating property defects or discrepancies in size and condition can also strengthen the appeal. Supporting financial records, like repair estimates or income statements for rental properties, may further validate the claim for reduced tax assessment.

What Documents are Necessary for a Property Tax Appeal?

| Number | Name | Description |

|---|---|---|

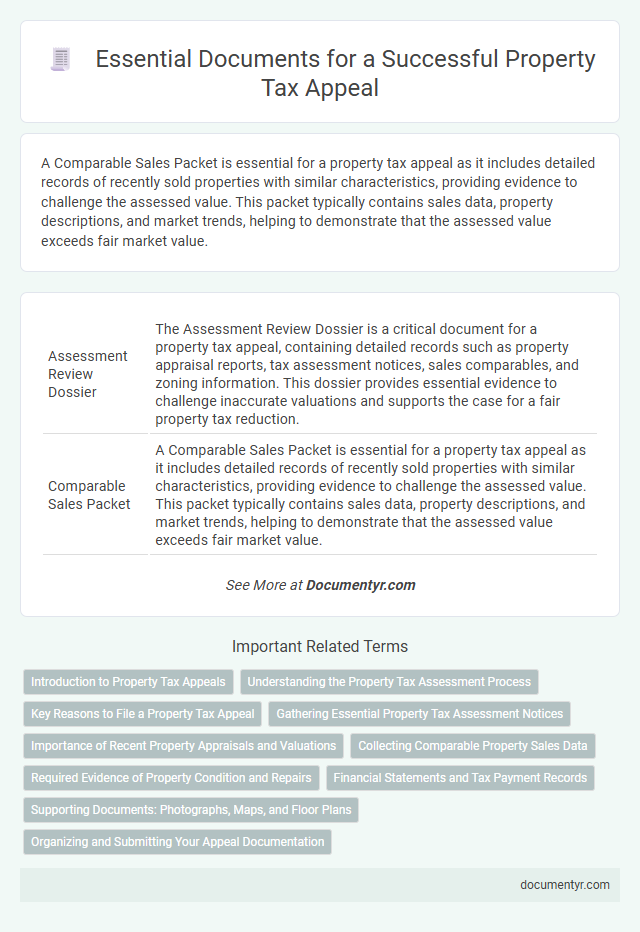

| 1 | Assessment Review Dossier | The Assessment Review Dossier is a critical document for a property tax appeal, containing detailed records such as property appraisal reports, tax assessment notices, sales comparables, and zoning information. This dossier provides essential evidence to challenge inaccurate valuations and supports the case for a fair property tax reduction. |

| 2 | Comparable Sales Packet | A Comparable Sales Packet is essential for a property tax appeal as it includes detailed records of recently sold properties with similar characteristics, providing evidence to challenge the assessed value. This packet typically contains sales data, property descriptions, and market trends, helping to demonstrate that the assessed value exceeds fair market value. |

| 3 | Property Valuation Adjustment Report | A Property Valuation Adjustment Report is essential for a property tax appeal as it provides a detailed and professional assessment of the property's market value, highlighting discrepancies with the tax assessor's valuation. This report typically includes comparable sales data, property condition analysis, and adjustment explanations, which strengthen the appeal case by demonstrating an accurate and justified property value. |

| 4 | Income Capitalization Worksheet | An Income Capitalization Worksheet is essential for a property tax appeal as it provides a detailed analysis of the property's income, expenses, and net operating income, helping to establish the accurate market value. Supporting documents such as rent rolls, lease agreements, and expense statements should be included to validate the income data presented on the worksheet. |

| 5 | Digital GIS Parcel Overlay | Digital GIS parcel overlay maps serve as essential documents in a property tax appeal by providing accurate, geospatially referenced property boundaries and land use data. Integrating these digital maps with tax assessment records strengthens evidence for disputes over property size, zoning, or land classification, enhancing the appeal's credibility. |

| 6 | Tax Lot Boundary Dispute File | The Tax Lot Boundary Dispute File must include detailed property maps, a certified survey, and historical tax records to accurately identify discrepancies in lot lines affecting tax assessments. Supporting documents such as neighbor affidavits, zoning certificates, and prior appraisal reports strengthen the appeal by verifying correct property boundaries. |

| 7 | Market Rent Survey Statement | A Market Rent Survey Statement is essential for a property tax appeal as it provides documented evidence of current rental rates in the local market, demonstrating the property's fair market value. This statement helps assessors compare the subject property's income potential against similar properties, supporting a potentially lower tax assessment. |

| 8 | Energy-Efficiency Appraisal Addendum | The Energy-Efficiency Appraisal Addendum is essential for a property tax appeal involving energy-efficient upgrades, providing an official assessment of the property's energy-saving features and their impact on market value. This document supports the appeal by demonstrating reductions in operating costs and increased property desirability due to sustainable improvements. |

| 9 | Automated Valuation Model (AVM) Output | Property tax appeals require the Automated Valuation Model (AVM) output, which includes detailed data on property value estimations generated through algorithms analyzing market trends, comparable sales, and property characteristics. Presenting the AVM report alongside official tax assessments strengthens the appeal by providing an objective, data-driven valuation to challenge inaccurate tax assessments. |

| 10 | Remote Inspection Photographic Log | A Remote Inspection Photographic Log is essential for a property tax appeal as it provides time-stamped visual evidence of the property's condition, supporting claims of discrepancies or damages that affect valuation. This log must be detailed, including high-resolution images with clear annotations, to effectively demonstrate the property's true state during the inspection period. |

Introduction to Property Tax Appeals

Property tax appeals enable property owners to challenge the assessed value of their property to potentially reduce their tax burden. Understanding the necessary documents is crucial for a successful appeal, as they provide evidence supporting the claim. Key documents typically include the property tax assessment notice, recent property appraisals, and comparable property sales data.

Understanding the Property Tax Assessment Process

Understanding the property tax assessment process is essential when preparing for a property tax appeal. The assessment determines the property's taxable value based on market data, which directly impacts the amount owed.

Key documents necessary for a property tax appeal include the official property tax assessment notice, recent property tax bills, and evidence of the property's fair market value. Supporting documents such as recent appraisals, comparable sales data, and photographs of the property condition can strengthen the case. Gathering these materials helps ensure a well-supported appeal process, potentially leading to a reduced tax liability.

Key Reasons to File a Property Tax Appeal

Filing a property tax appeal requires specific documents to support your case effectively. Essential documents include the original property tax assessment, recent property appraisals, and evidence of comparable property values in your area.

Key reasons to file a property tax appeal involve correcting assessment errors, such as overvaluation or misclassification. These appeals help ensure you are not overpaying taxes due to inaccurate property information or market changes.

Gathering Essential Property Tax Assessment Notices

Gathering essential property tax assessment notices is critical when preparing for a property tax appeal. These documents provide key evidence needed to challenge the assessed value effectively.

- Assessment Notice - This document shows the current valuation of your property as determined by the tax assessor.

- Tax Bill - The detailed bill lists the amount of tax owed based on the assessed value, highlighting how the charges are calculated.

- Previous Appeal Records - Any prior appeal submissions and decisions offer insight into past valuation disputes and their outcomes.

Importance of Recent Property Appraisals and Valuations

What documents are necessary for a property tax appeal? Recent property appraisals and valuations play a crucial role in supporting the appeal process. These documents provide updated market data that help establish the accurate value of the property, which is essential for contesting incorrect tax assessments.

Collecting Comparable Property Sales Data

Collecting comparable property sales data is essential for supporting a property tax appeal. This data provides evidence that similar properties have been valued differently, highlighting potential discrepancies in your property's assessment.

Key documents include recent sales records of nearby properties with similar features, size, and location. Official sales reports or listings from county records or real estate databases ensure accuracy and credibility in your appeal.

Required Evidence of Property Condition and Repairs

| Document Type | Description | Purpose in Tax Appeal | Examples |

|---|---|---|---|

| Property Condition Reports | Detailed assessment reports that describe the physical state of the property | Demonstrates current condition affecting property value | Home inspection reports, structural integrity evaluations |

| Repair Estimates and Invoices | Documents showing costs for repairs needed or completed on the property | Shows impact of repairs on property value and supports appeal for lower tax assessment | Contractor estimates, paid invoices, receipts for materials |

| Photographic Evidence | Images documenting property condition, damage, or repairs | Visual proof supporting claims of deterioration or completed repairs | Photos of foundation cracks, roof damage, water damage, or renovation progress |

| Municipal or Code Violation Notices | Official notices related to property condition violations or required repairs | Confirms recognized issues lowering property value and justifying appeal | Building code violation letters, notices from local authorities |

| Appraisal Reports | Professional appraisals reflecting current market value factoring in condition and repairs | Provides expert valuation evidence supporting tax appeal | Licensed appraiser's written report, comparative market analyses |

Financial Statements and Tax Payment Records

When filing a property tax appeal, accurate documentation is essential to support your case. Key financial records demonstrate your property's value and payment history to the tax assessor.

- Financial Statements - Detailed income and expense reports verify your property's income potential and operational costs.

- Tax Payment Records - Proof of previous tax payments shows compliance and highlights any discrepancies in assessed taxes.

- Appraisal Reports - Professional valuations provide an independent assessment of your property's market value.

Supporting Documents: Photographs, Maps, and Floor Plans

Supporting documents play a crucial role in strengthening a property tax appeal by providing visual and factual evidence. Accurate photographs, detailed maps, and precise floor plans help validate claims about property value and condition.

- Photographs - Clear images showcase the current state and any damages or discrepancies in the property that may affect its valuation.

- Maps - Geographic maps illustrate the property's location relative to neighboring properties and community features impacting its value.

- Floor Plans - Detailed layouts reveal the exact dimensions and structural characteristics of the property, supporting claims of size or design inaccuracies.

Gathering these supporting documents enhances the accuracy and credibility of your property tax appeal.

What Documents are Necessary for a Property Tax Appeal? Infographic