Foreigners need a valid passport, proof of legal presence such as a visa or ESTA, and a Tax Identification Number (TIN) to buy a house in the US. They must also provide proof of funds, a signed purchase agreement, and may require a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for tax purposes. Lenders often request financial documents like bank statements and credit history, while title insurance and property disclosures are essential for completing the transaction.

What Documents Does a Foreigner Need to Buy a House in the US?

| Number | Name | Description |

|---|---|---|

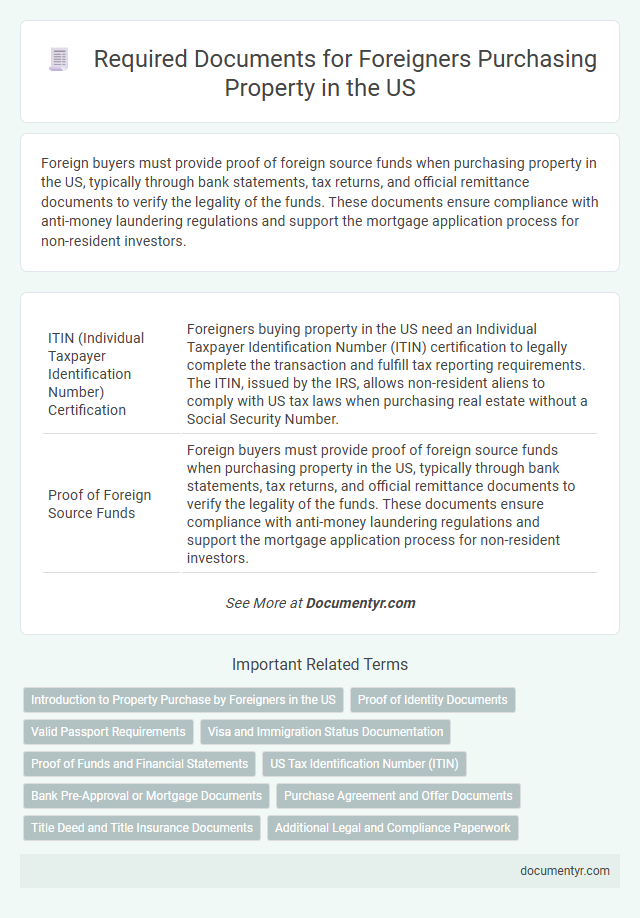

| 1 | ITIN (Individual Taxpayer Identification Number) Certification | Foreigners buying property in the US need an Individual Taxpayer Identification Number (ITIN) certification to legally complete the transaction and fulfill tax reporting requirements. The ITIN, issued by the IRS, allows non-resident aliens to comply with US tax laws when purchasing real estate without a Social Security Number. |

| 2 | Proof of Foreign Source Funds | Foreign buyers must provide proof of foreign source funds when purchasing property in the US, typically through bank statements, tax returns, and official remittance documents to verify the legality of the funds. These documents ensure compliance with anti-money laundering regulations and support the mortgage application process for non-resident investors. |

| 3 | FIRPTA Compliance Documentation | Foreign buyers must provide a completed FIRPTA Certificate of Compliance, along with IRS Form 8288 and Form 8288-A, to ensure adherence to tax withholding requirements on the sale of U.S. real property interests. Proper documentation ensures withholding tax is correctly reported and remitted, safeguarding compliance with the Foreign Investment in Real Property Tax Act regulations. |

| 4 | Cross-Border Bank Statements | Foreign buyers must provide cross-border bank statements to verify financial stability and ensure compliance with U.S. anti-money laundering regulations when purchasing a house. These documents typically include detailed transaction histories from both domestic and international accounts, demonstrating the lawful origin of funds. |

| 5 | International Credit Report | Foreigners buying property in the US often need to provide an international credit report to demonstrate financial reliability, which helps lenders assess creditworthiness for mortgage approval. This report typically includes credit history, outstanding debts, and payment behavior from the buyer's home country, ensuring a comprehensive evaluation of their financial status. |

| 6 | Enhanced Due Diligence (EDD) Forms | Foreigners purchasing property in the US must complete Enhanced Due Diligence (EDD) forms, which include proof of identity, source of funds, and compliance with anti-money laundering regulations to ensure lawful transactions. These documents help verify the buyer's legitimacy and prevent fraud, making them essential for all foreign property buyers. |

| 7 | OFAC (Office of Foreign Assets Control) Clearance | Foreign buyers must obtain OFAC (Office of Foreign Assets Control) clearance to ensure they are not prohibited from conducting property transactions in the US due to sanctions or restrictions. This clearance involves verifying identities against OFAC's Specially Designated Nationals list before finalizing the house purchase. |

| 8 | Biometric Identification Records | Foreigners buying property in the US must provide biometric identification records, including fingerprints and photo identification, as part of the verification process to comply with federal regulations and prevent identity fraud. These biometric records are typically collected during the application for a tax identification number (ITIN) or through other government-mandated identification procedures. |

| 9 | Global KYC (Know Your Customer) Profile | Foreign buyers need to provide a valid passport, visa, tax identification number (ITIN or SSN), proof of address, and a global KYC profile including detailed personal identification, financial statements, and source of funds documentation to comply with US anti-money laundering regulations. Lenders and real estate agents will require these documents to verify identity, assess risk, and facilitate the home purchase process under the Foreign Investment in Real Property Tax Act (FIRPTA) guidelines. |

| 10 | Apostilled Power of Attorney | Foreign buyers in the US typically need an Apostilled Power of Attorney to authorize a trusted representative to handle property transactions on their behalf, ensuring legal compliance and smooth processing. This document must be notarized and apostilled in the buyer's home country to be valid and recognized by US authorities during the property purchase. |

| 11 | Valid Passport | A valid passport is essential for foreigners to establish identity and legal status when purchasing property in the US. It serves as the primary identification document required by real estate agents, lenders, and government authorities throughout the buying process. |

| 12 | Visa or ESTA Authorization | Foreign buyers must present valid visa or ESTA authorization to legally enter the US and complete real estate transactions; these documents verify lawful presence but do not grant property ownership rights. Essential paperwork includes a passport, approved visa (such as B-2 tourist or investor visas like E-2), or ESTA under the Visa Waiver Program, ensuring compliance with US immigration and property purchase regulations. |

| 13 | Individual Taxpayer Identification Number (ITIN) | Foreigners need an Individual Taxpayer Identification Number (ITIN) to legally purchase property in the US, as it allows them to comply with tax reporting requirements. Obtaining an ITIN from the IRS is essential for non-resident aliens who do not qualify for a Social Security Number but want to engage in real estate transactions. |

| 14 | Proof of Funds | Foreigners need to provide proof of funds when buying a house in the US, which typically includes bank statements, investment account summaries, or a letter from a financial institution confirming available funds. These documents demonstrate the buyer's ability to complete the transaction and are critical for mortgage approval and closing procedures. |

| 15 | Bank Statements | Foreigners looking to buy a house in the US typically need to provide bank statements as proof of financial stability and source of funds, demonstrating sufficient liquidity to complete the transaction. Lenders and sellers often require several months of bank statements to verify income, savings, and the ability to cover down payment and closing costs. |

| 16 | Credit Report (international or US-based) | Foreigners looking to buy a house in the US typically need to provide a credit report, which can be either an international credit report or a US-based credit history, to demonstrate financial reliability. Lenders often require these documents to assess creditworthiness and determine mortgage eligibility for non-resident buyers. |

| 17 | Letter of Employment or Income Verification | Foreigners need a Letter of Employment or Income Verification to demonstrate stable income sources when buying a house in the US, which helps lenders assess their creditworthiness. This document typically includes employer details, job title, salary, and length of employment, ensuring the buyer meets mortgage qualification criteria. |

| 18 | Purchase Agreement (Offer to Purchase Contract) | A foreigner needs a signed Purchase Agreement, also known as an Offer to Purchase Contract, which outlines the terms and conditions of the home sale, including price, contingencies, and closing date. This legally binding document is essential for securing the property and initiating the transaction process in the US real estate market. |

| 19 | Earnest Money Deposit Receipt | Foreign buyers in the US must provide an Earnest Money Deposit Receipt, which serves as proof of their initial good faith payment during the property purchase process. This document is essential to demonstrate commitment and secure the contract while complying with local real estate transaction requirements. |

| 20 | Title Deed (for transfer) | Foreign buyers must present a valid passport and complete the transfer of the Title Deed to secure legal ownership of a US property. The Title Deed serves as the primary document proving property ownership and must be properly recorded with the county recorder's office after the transaction. |

| 21 | Closing Disclosure Statement | Foreign buyers need a Closing Disclosure Statement outlining loan terms, closing costs, and final payment details to complete a US property purchase. This document ensures transparency and compliance with federal regulations, protecting foreign investors in the real estate transaction. |

| 22 | Property Appraisal Report | A Property Appraisal Report is essential for foreigners buying a house in the US as it provides an accurate market value assessment required by lenders and legal authorities. This document ensures the property's price aligns with current market trends, protecting the buyer from overpaying and facilitating mortgage approval. |

| 23 | Home Inspection Report | A home inspection report is a critical document for foreigners buying property in the US, providing a detailed assessment of the home's condition and identifying potential issues that may affect its value or safety. This report helps buyers make informed decisions and negotiate repairs or price adjustments before finalizing the purchase. |

| 24 | Homeowners Insurance Proof | Foreigners purchasing property in the US must provide proof of homeowners insurance as a critical document to secure financing and finalize the transaction. This insurance protects both the buyer and lender from potential property damage, serving as a mandatory requirement in most mortgage agreements. |

| 25 | U.S. Mailing Address Proof | Foreigners purchasing property in the U.S. typically need to provide proof of a U.S. mailing address, which can include utility bills, lease agreements, or a letter from a U.S.-based employer confirming residence. This document serves to verify the buyer's local address for official correspondence during the property transaction process. |

| 26 | Power of Attorney (if applicable) | Foreigners purchasing property in the US may need a notarized Power of Attorney (POA) to authorize a trusted representative to handle transactions, especially if they cannot be physically present. This document ensures legal authority for signing contracts, managing closing procedures, and handling title transfers on behalf of the buyer. |

| 27 | Real Estate Agent Agreement | A foreigner buying a house in the US must carefully review and sign a Real Estate Agent Agreement, which outlines the terms of representation, commission fees, and duties of the agent during the transaction. This agreement ensures clear communication and legal protection while navigating property purchase requirements such as identification documents, tax identification numbers, and financing arrangements. |

| 28 | Escrow Agreement | Foreign buyers in the US must provide a valid passport, proof of funds, and a signed Escrow Agreement to securely hold deposits and ensure transaction compliance. The Escrow Agreement outlines the terms for the third-party escrow agent, safeguarding both buyer and seller interests during the property purchase process. |

| 29 | FIRPTA Affidavit (Foreign Investment in Real Property Tax Act) | Foreign buyers in the US must provide a FIRPTA affidavit to certify the transaction for withholding purposes under the Foreign Investment in Real Property Tax Act, ensuring compliance with IRS regulations on foreign investment in real estate. This affidavit is critical to avoid automatic withholding of 15% of the sales price during property transactions involving non-resident aliens. |

| 30 | Tax Declaration Form (e.g., W-8BEN) | Foreigners buying property in the US must submit a Tax Declaration Form such as the W-8BEN to certify foreign status and claim tax treaty benefits, reducing withholding tax on rental income or capital gains. The W-8BEN form is essential for compliance with the IRS and must be updated periodically to avoid default withholding rates. |

Introduction to Property Purchase by Foreigners in the US

Foreigners interested in purchasing property in the United States must navigate specific documentation requirements. Understanding these documents is essential to ensure a smooth transaction and comply with US regulations. This guide provides an introduction to the key paperwork necessary for foreign buyers entering the US real estate market.

Proof of Identity Documents

Foreigners looking to buy a house in the US must provide valid proof of identity documents to complete the transaction. Primary documents include a valid passport and, in some cases, a government-issued identification card from their home country.

Additional identity verification may involve submitting a visa or residency permit to confirm legal status in the United States. These documents help streamline the property purchase process and comply with federal and state regulations.

Valid Passport Requirements

Foreign buyers must present a valid passport to purchase property in the US. This document verifies identity and citizenship status during the transaction.

- Proof of Identity - A valid passport confirms your identity and is the primary form of identification required by sellers and lenders.

- Government-Issued Document - Your passport must be current and issued by a recognized government agency to be accepted.

- Supports Legal Transactions - A valid passport ensures compliance with US regulations for property purchases by non-citizens.

Visa and Immigration Status Documentation

Foreign nationals looking to purchase property in the US must provide specific visa and immigration status documents. These documents verify your legal presence and eligibility to complete the transaction.

Key visa documents include a valid passport with the appropriate US visa, such as a tourist, investor, or work visa. Proof of immigration status, like a Green Card or Employment Authorization Document (EAD), is often required by sellers or financial institutions. These documents ensure compliance with US laws and facilitate a smooth property purchase process.

Proof of Funds and Financial Statements

Foreigners looking to buy a house in the US must provide specific financial documents to prove their ability to complete the transaction. Proof of funds and financial statements are critical in establishing financial credibility during the property purchase process.

- Proof of Funds - A document such as bank statements or a letter from a financial institution showing available funds for the property purchase.

- Financial Statements - Comprehensive records including income statements, tax returns, and asset reports to demonstrate financial stability.

- Importance for Mortgage Approval - Lenders require these documents to assess the buyer's creditworthiness and loan eligibility if financing is needed.

Providing accurate proof of funds and detailed financial statements ensures a smoother home buying experience for foreigners in the US.

US Tax Identification Number (ITIN)

What documents does a foreigner need to buy a house in the US? A crucial document is the US Tax Identification Number (ITIN), which allows non-residents to comply with US tax laws. Other necessary documents include a valid passport, proof of income, and sometimes a visa or immigration status documentation.

Bank Pre-Approval or Mortgage Documents

| Document Type | Description | Importance for Foreign Buyers |

|---|---|---|

| Bank Pre-Approval Letter | A formal document from a financial institution stating the amount the buyer is qualified to borrow based on creditworthiness and financial status. | Demonstrates financial capability to sellers and shows serious intent, enhancing bargaining power in the US real estate market. |

| Mortgage Application | Form submitted to banks or mortgage lenders providing detailed personal, financial, and property information to initiate the loan process. | Essential for securing financing; helps determine eligibility and loan terms tailored to foreign nationals. |

| Proof of Income | Documents such as pay stubs, tax returns, or employment verification that confirm steady income streams. | Supports mortgage approval by validating the buyer's ability to repay the loan. |

| Credit Report | Credit history obtained from credit bureaus detailing past loans, debts, and payment records. | Used by lenders to assess risk; foreign buyers may need to provide international credit reports or alternative documentation. |

| Identification Documents | Passports, visas, or other government-issued identification confirming identity and legal status in the US. | Required for verification and compliance with federal regulations during mortgage processing. |

| Proof of Funds | Bank statements or financial statements showing available funds for down payment and closing costs. | Confirms the buyer has sufficient capital to cover initial purchase expenses. |

Purchase Agreement and Offer Documents

Foreigners looking to buy a house in the US must provide a Purchase Agreement and Offer Documents as part of the property transaction. These documents outline the terms, price, and conditions agreed upon by both the buyer and the seller.

The Purchase Agreement serves as a legally binding contract that details the buyer's commitment to purchase the property. Offer Documents include the initial offer letter and any counteroffers, helping to establish the negotiation framework.

Title Deed and Title Insurance Documents

Foreigners looking to buy a house in the US must secure essential documents such as the Title Deed, which proves ownership of the property. Title Insurance protects against potential legal disputes or claims on the property's ownership history. Ensuring these documents are in order safeguards your investment and provides peace of mind throughout the purchase process.

What Documents Does a Foreigner Need to Buy a House in the US? Infographic