Renting commercial property requires essential documents such as a valid business license, proof of identity, and financial statements including bank statements or tax returns to demonstrate the tenant's ability to pay rent. A signed lease agreement outlining the terms and conditions is mandatory, along with references from previous landlords or business partners to establish credibility. Additional paperwork may include insurance certificates, zoning permits, and a security deposit receipt to ensure compliance and protect both parties.

What Documents are Needed for Renting Commercial Property?

| Number | Name | Description |

|---|---|---|

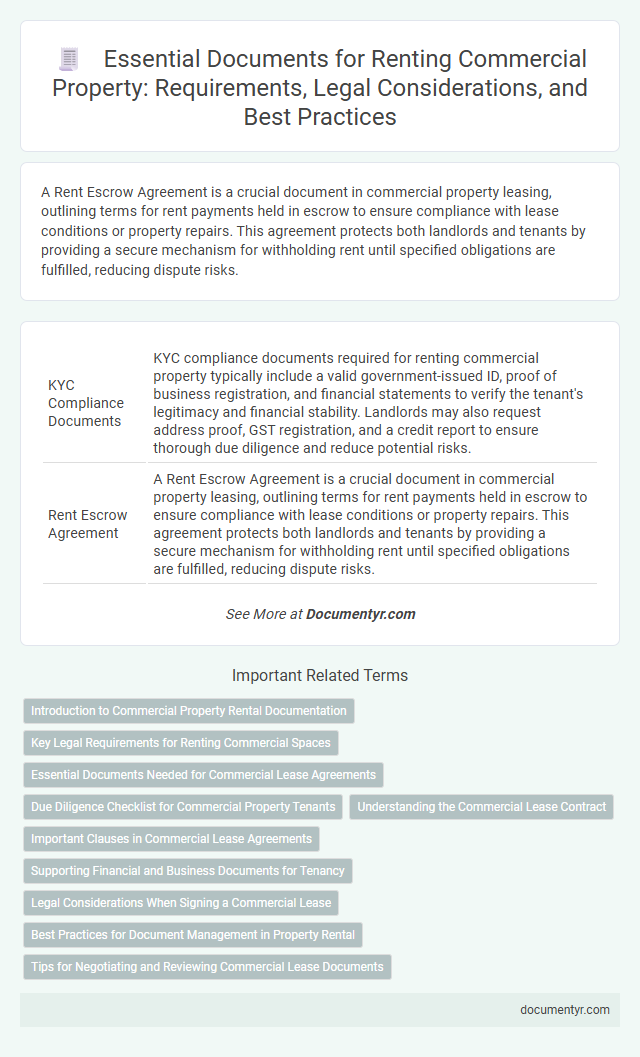

| 1 | KYC Compliance Documents | KYC compliance documents required for renting commercial property typically include a valid government-issued ID, proof of business registration, and financial statements to verify the tenant's legitimacy and financial stability. Landlords may also request address proof, GST registration, and a credit report to ensure thorough due diligence and reduce potential risks. |

| 2 | Rent Escrow Agreement | A Rent Escrow Agreement is a crucial document in commercial property leasing, outlining terms for rent payments held in escrow to ensure compliance with lease conditions or property repairs. This agreement protects both landlords and tenants by providing a secure mechanism for withholding rent until specified obligations are fulfilled, reducing dispute risks. |

| 3 | Digital Lease Certificate | A Digital Lease Certificate is essential for renting commercial property as it legally verifies lease agreements electronically, streamlining the documentation process and ensuring authenticity. Key documents required alongside include digital identity proofs, previous tenancy records, and proof of business registration to support the lease certificate's validity. |

| 4 | GST Registration Proof | GST registration proof is essential for renting commercial property as it validates the tenant's eligibility to conduct business under the Goods and Services Tax regime. Landlords typically require a copy of the GST certificate to ensure compliance with tax regulations and facilitate seamless leasing agreements. |

| 5 | Udyam Registration (for MSMEs) | For renting commercial property, Udyam Registration is essential for Micro, Small, and Medium Enterprises (MSMEs) as it verifies the business's legal identity and eligibility for benefits under government schemes. Key documents include the Udyam Registration certificate, proof of business address, identity proof of the applicant, and a valid lease agreement to ensure compliance with regulatory requirements. |

| 6 | Personal Guarantee Statement | A Personal Guarantee Statement is crucial for renting commercial property as it provides the landlord with a legally binding promise from an individual to cover lease obligations if the business fails to meet them. This document typically includes the guarantor's financial information, credit history, and a clear agreement outlining the extent of liability. |

| 7 | Municipal Trade License | A Municipal Trade License is a mandatory document for renting commercial property, verifying the tenant's legal authorization to conduct business within the municipality. This license ensures compliance with local zoning and business regulations, protecting both landlords and tenants during the lease agreement. |

| 8 | Title Due Diligence Report | A Title Due Diligence Report is essential for renting commercial property as it verifies the legal ownership, identifies any encumbrances, liens, or disputes, and ensures the property has clear title for a secure lease agreement. This document helps tenants avoid potential legal risks and confirms the landlord's authority to rent the property. |

| 9 | Virtual Office Agreement | A Virtual Office Agreement requires valid identification documents, proof of business registration, and a signed agreement outlining the terms of use and services provided by the virtual office provider. Essential documents also include a utility bill or bank statement for address verification and any necessary permits specific to the commercial activity conducted under the virtual office. |

| 10 | E-signature Authorization Letter | An E-signature Authorization Letter is essential for renting commercial property as it grants legal permission to use electronic signatures on rental agreements, ensuring faster and secure contract execution. This document verifies the signer's identity and consent, streamlining the leasing process while maintaining compliance with digital transaction laws. |

Introduction to Commercial Property Rental Documentation

What documents are essential for renting commercial property? Understanding the required documentation is key to a smooth commercial lease process. Proper paperwork protects both the landlord and tenant throughout the rental agreement.

Key Legal Requirements for Renting Commercial Spaces

Renting commercial property requires specific legal documents to protect both the landlord and tenant. Understanding key requirements helps ensure a smooth leasing process.

- Commercial Lease Agreement - This contract outlines the terms, conditions, and obligations of your tenancy, including rent, duration, and usage.

- Proof of Business Registration - Verification of your business's legal status is essential to confirm your eligibility to lease the commercial space.

- Financial Statements - Landlords often require financial documentation to assess your ability to pay rent and maintain the property.

Ensuring you have these documents prepared will facilitate a legally compliant and successful commercial rental experience.

Essential Documents Needed for Commercial Lease Agreements

Essential documents for renting commercial property include the commercial lease agreement, which outlines the terms and conditions of the tenancy. Proof of business registration and financial statements are often required to verify the tenant's legitimacy and financial stability. Additionally, identification documents for the business owner or authorized signatories must be submitted to complete the leasing process.

Due Diligence Checklist for Commercial Property Tenants

| Document Type | Description | Purpose in Due Diligence |

|---|---|---|

| Proof of Identity | Government-issued identification such as passport or driver's license | Verifies the tenant's legal identity to prevent fraud |

| Business License | Official documentation proving the business is registered and authorized to operate | Confirms legitimacy of the tenant's business activities |

| Financial Statements | Recent balance sheets, income statements, and cash flow reports | Assesses financial stability and ability to pay rent consistently |

| Credit Report | A detailed record of credit history from recognized bureaus | Evaluates creditworthiness and risk of default |

| References from Previous Landlords | Contact details and testimonials from past commercial property landlords | Provides insight into tenant's rental history and reliability |

| Proof of Insurance | Certificates for liability, property, and workers' compensation insurance | Ensures tenant has adequate coverage to mitigate potential risks |

| Business Plan or Use of Premises | Outline of intended operations and any modifications planned on the property | Helps verify the property's suitability and compliance with zoning laws |

| Security Deposit Documentation | Details on deposit amount and payment proof | Confirms financial commitment and secures interest against damages |

This due diligence checklist ensures thorough vetting of potential tenants before signing a commercial lease. Collecting these documents protects your interests and facilitates a smooth renting process.

Understanding the Commercial Lease Contract

Understanding the commercial lease contract is crucial when renting a commercial property. This contract outlines the terms, rights, and obligations between the landlord and tenant.

- Identification Documents - Valid ID proofs such as a driver's license or passport are required to verify the tenant's identity.

- Financial Statements - Recent bank statements or financial reports demonstrate the tenant's ability to meet rental obligations.

- Business Licenses - Relevant permits and business licenses confirm the tenant's legal ability to operate the intended commercial activity on the premises.

Important Clauses in Commercial Lease Agreements

Renting commercial property requires specific documents to ensure legal clarity and protection for both landlord and tenant. Essential documents include the commercial lease agreement, proof of business registration, and financial statements.

The commercial lease agreement contains important clauses such as rent amount, lease term, maintenance responsibilities, and renewal options. Carefully reviewing these clauses helps prevent disputes and secures tenant rights throughout the lease period.

Supporting Financial and Business Documents for Tenancy

When renting commercial property, submitting supporting financial and business documents is essential to secure tenancy. These documents demonstrate your financial stability and business credibility to the landlord or property manager.

Commonly required financial documents include bank statements, tax returns, and profit and loss statements. Business documents such as a business license, incorporation papers, and a detailed business plan further support your application.

Legal Considerations When Signing a Commercial Lease

When renting commercial property, it is crucial to gather all necessary legal documents to ensure a smooth leasing process. Understanding the legal considerations involved in signing a commercial lease protects both the tenant and the landlord from future disputes.

- Commercial Lease Agreement - This legally binding document outlines the terms, rights, and obligations of both parties during the lease period.

- Proof of Business Registration - Validates the tenant's legal status to operate a business within the commercial property.

- Insurance Certificates - Provides evidence of liability and property insurance required to mitigate risks associated with leasing premises.

Best Practices for Document Management in Property Rental

Renting commercial property requires essential documents such as a valid business license, proof of financial stability, and a signed lease agreement to ensure a smooth transaction. Proper document management involves organizing all contracts, payment records, and correspondence in secure digital or physical formats for easy access and legal compliance. Maintaining a clear and thorough documentation system protects your interests and fosters trust between landlords and tenants.

What Documents are Needed for Renting Commercial Property? Infographic