Condo association approval typically requires submitting several key documents, including a completed application form, proof of ownership, and a copy of the signed purchase agreement. Financial documents such as recent bank statements, credit reports, and proof of income are often necessary to verify the applicant's financial stability. Additionally, some associations require personal references, background checks, and interview attendance to ensure compliance with community standards.

What Documents are Necessary for Condo Association Approval?

| Number | Name | Description |

|---|---|---|

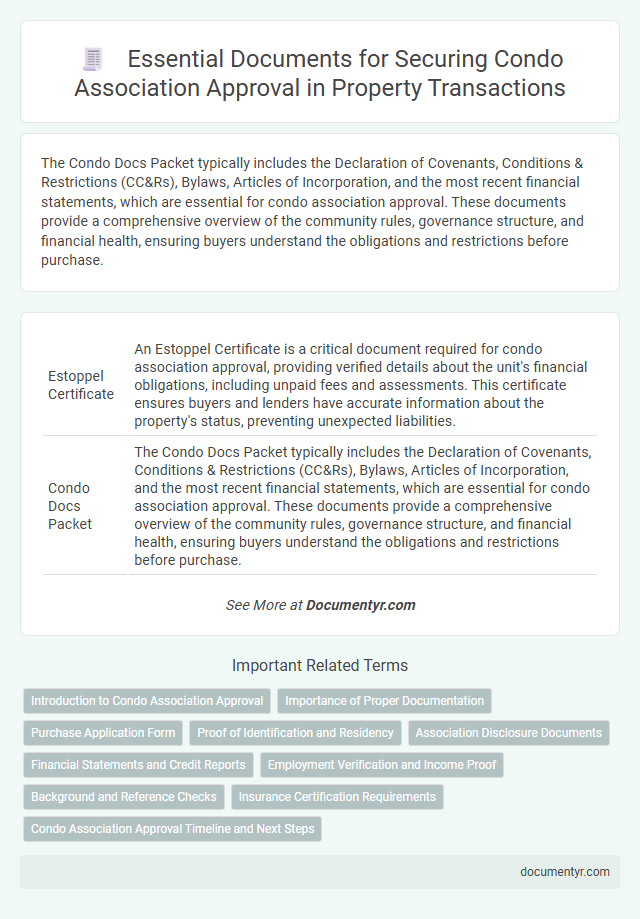

| 1 | Estoppel Certificate | An Estoppel Certificate is a critical document required for condo association approval, providing verified details about the unit's financial obligations, including unpaid fees and assessments. This certificate ensures buyers and lenders have accurate information about the property's status, preventing unexpected liabilities. |

| 2 | Condo Docs Packet | The Condo Docs Packet typically includes the Declaration of Covenants, Conditions & Restrictions (CC&Rs), Bylaws, Articles of Incorporation, and the most recent financial statements, which are essential for condo association approval. These documents provide a comprehensive overview of the community rules, governance structure, and financial health, ensuring buyers understand the obligations and restrictions before purchase. |

| 3 | HO-6 Insurance Declaration Page | The HO-6 insurance declaration page is crucial for condo association approval as it verifies the unit owner's coverage for personal property, interior walls, and liability within the condo. This document ensures compliance with the association's insurance requirements, protecting both the homeowner and the community from potential risks. |

| 4 | Budget Ratification Statement | A Budget Ratification Statement is essential for condo association approval as it confirms that members have reviewed and accepted the annual budget, ensuring transparent financial planning. This document must include detailed expense and income projections, reserve funds status, and member voting results to comply with state laws and association bylaws. |

| 5 | Lender Questionnaire (Condo Certificate) | The Lender Questionnaire, also known as the Condo Certificate, is a critical document required for condo association approval that verifies compliance with lender policies and financial stability of the condominium project. This form typically includes details on insurance coverage, legal status, and reserve funds, ensuring the condo meets criteria set by mortgage lenders for loan approval. |

| 6 | House Rules & Regulations Acknowledgement | House Rules & Regulations Acknowledgement is crucial for condo association approval, ensuring residents comply with community standards to maintain property value and harmony. This document typically includes agreements on noise control, pet policies, maintenance responsibilities, and use of common areas, reflecting the community's specific regulations. |

| 7 | Current Reserve Study Summary | A current reserve study summary is essential for condo association approval as it provides a detailed assessment of the association's long-term financial health, outlining the status of reserve funds allocated for major repairs and replacements. This document ensures transparency regarding future maintenance costs and demonstrates the association's preparedness for sustaining property value and infrastructure integrity. |

| 8 | Special Assessment Disclosure | Special Assessment Disclosure is a crucial document required for condo association approval, detailing any planned or ongoing special assessments that may impact owners financially. Accurate disclosure of special assessments ensures buyers are fully informed about potential additional costs beyond regular condo fees. |

| 9 | Proof of Funds for Association Dues | Proof of funds for association dues typically requires recent bank statements or a letter from a financial institution confirming the buyer's ability to cover monthly fees and any special assessments. This documentation ensures the condo association that the purchaser can meet all financial obligations associated with ownership, facilitating a smoother approval process. |

| 10 | Association Interview Form | The Association Interview Form is a critical document required for condo association approval, capturing detailed personal, financial, and employment information to assess the applicant's suitability. This form ensures the board evaluates the applicant's ability to meet financial obligations and adhere to community guidelines, facilitating informed decision-making. |

Introduction to Condo Association Approval

Condo association approval is a critical step in the property buying or renovation process within a condominium community. This approval ensures that proposed activities comply with the association's rules and maintain the property's value and harmony.

Necessary documents typically include the purchase agreement, financial statements, and detailed project plans. These materials help the condo board assess eligibility and potential impact on the community before granting approval.

Importance of Proper Documentation

What documents are necessary for condo association approval? Proper documentation ensures a smooth approval process and prevents delays. These include your purchase agreement, proof of insurance, and completed application forms.

Why is the importance of proper documentation critical in condo association approval? Accurate documents verify your eligibility and protect the association's interests. Missing or incorrect paperwork can lead to rejection or extended review times.

Purchase Application Form

| Document | Description | Importance |

|---|---|---|

| Purchase Application Form | This form contains essential details about the buyer, including financial background, personal references, and intended use of the condo. It is the primary document reviewed by the condo association to assess eligibility. | Submitting a completed and accurate Purchase Application Form is critical for timely approval. The association uses this to verify that the buyer meets community guidelines and financial criteria. |

| Financial Statements | Proof of income, credit reports, and bank statements that demonstrate the buyer's ability to meet monthly condo fees and other financial obligations. | Supports the information provided in the Purchase Application Form and confirms financial stability. |

| Background Check Authorization | Consent form allowing the association to conduct criminal and credit background checks on the buyer. | Ensures the safety and security of the condominium community. |

| References | Letters or contact information from previous landlords, employers, or personal references to verify character and reliability. | Validates the buyer's suitability as a community member. |

| Purchase Agreement | Contract detailing the terms of the sale between the buyer and seller. | Confirms the legal transfer of ownership subject to association approval. |

Proof of Identification and Residency

Condo association approval requires specific documentation to verify your identity and residency. These documents ensure you meet the community's eligibility standards.

- Government-Issued ID - A valid driver's license, passport, or state ID is necessary to confirm your identity.

- Utility Bills - Recent utility bills in your name serve as proof of residency within the condo unit.

- Lease Agreement or Deed - Official lease agreements or property deeds demonstrate your legal right to reside in the condominium.

Association Disclosure Documents

Association disclosure documents are essential for obtaining condo association approval. These documents provide detailed information about the financial status, rules, and regulations governing the condominium community.

Common disclosure documents include the association's bylaws, financial statements, meeting minutes, and the declaration of covenants, conditions, and restrictions (CC&Rs). Reviewing these documents ensures transparency and helps you understand your obligations before approval.

Financial Statements and Credit Reports

Condo association approval requires submitting essential financial documents for evaluation. These documents help assess your financial stability and reliability as a potential owner.

- Financial Statements - Detailed records of income, expenses, and assets showing the financial health of the individual or entity.

- Credit Reports - Comprehensive reports from credit bureaus indicating credit history, outstanding debts, and payment reliability.

- Background Checks - Verification processes that may include financial background to ensure responsible ownership and association trustworthiness.

Employment Verification and Income Proof

Condo associations require specific documents for approval, emphasizing Employment Verification and Income Proof to ensure financial stability. Employment Verification typically includes recent pay stubs, a letter from your employer, or tax returns confirming your job status and income consistency. Income Proof demonstrates your ability to meet condo fees and obligations, often requiring bank statements, W-2 forms, or profit and loss statements for self-employed applicants.

Background and Reference Checks

Condo association approval requires submitting specific documents to ensure compliance with community standards. Background and reference checks play a crucial role in verifying the applicant's financial stability and personal history. These checks help maintain a safe and well-managed living environment for all residents.

Insurance Certification Requirements

Condo association approval often requires submission of specific documents, with insurance certification being a critical component. This certification verifies that the property carries adequate liability, hazard, and flood insurance to protect the community and its assets.

Insurance certification requirements typically include proof of comprehensive general liability coverage, property damage insurance, and workers' compensation if applicable. The document must be current and issued by a licensed insurance provider. Meeting these insurance standards helps ensure financial protection and compliance with the association's risk management policies.

What Documents are Necessary for Condo Association Approval? Infographic