To prove property inheritance, key documents include the original will or probate court order, the death certificate of the deceased, and the legal identification of the heir. A succession certificate or letter of administration may also be required if there is no will. Property tax receipts and title deeds help establish clear ownership and facilitate the transfer process.

What Documents are Needed to Prove Property Inheritance?

| Number | Name | Description |

|---|---|---|

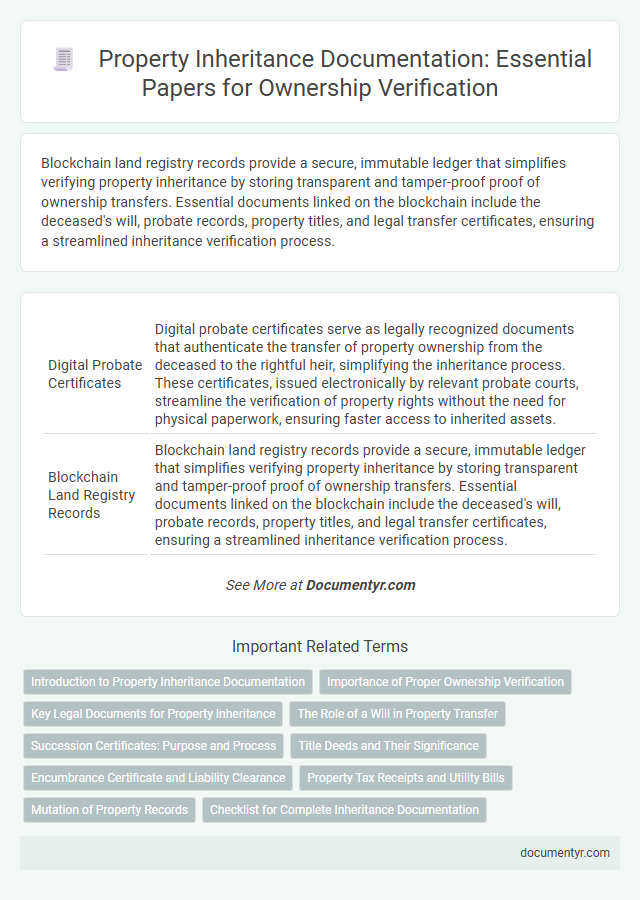

| 1 | Digital Probate Certificates | Digital probate certificates serve as legally recognized documents that authenticate the transfer of property ownership from the deceased to the rightful heir, simplifying the inheritance process. These certificates, issued electronically by relevant probate courts, streamline the verification of property rights without the need for physical paperwork, ensuring faster access to inherited assets. |

| 2 | Blockchain Land Registry Records | Blockchain land registry records provide a secure, immutable ledger that simplifies verifying property inheritance by storing transparent and tamper-proof proof of ownership transfers. Essential documents linked on the blockchain include the deceased's will, probate records, property titles, and legal transfer certificates, ensuring a streamlined inheritance verification process. |

| 3 | E-Will Authentication | E-Will authentication requires submitting the original electronic will, a digital signature certificate of the testator, and probate or succession certificate issued by the relevant court to legally prove property inheritance. These documents ensure the e-will's validity and confirm the rightful heir's claim to the inherited property under existing inheritance laws. |

| 4 | Succession Certificate QR Codes | Succession Certificate QR codes contain encrypted data that verifies the authenticity of inheritance claims, linking to official records that streamline the verification process during property transfer. These digital codes reduce the risk of fraud by providing instant access to the legal details of the heir's entitlement, ensuring faster and more secure property inheritance documentation. |

| 5 | Title Deed e-Verification | To prove property inheritance, essential documents include the original title deed, death certificate of the deceased, and legal succession certificate or will. Title deed e-verification enables secure online authentication of property ownership, ensuring accurate transfer records and reducing fraud risks in inheritance claims. |

| 6 | Inheritance Tax Clearance e-Forms | Inheritance Tax Clearance e-Forms, such as HMRC's IHT400, are essential documents to prove property inheritance as they confirm that all applicable taxes have been settled. These electronic forms streamline the process of validating legal ownership transfer and ensure compliance with inheritance tax regulations. |

| 7 | Blockchain-based Family Tree IDs | Blockchain-based family tree IDs provide a secure, immutable record linking heirs to the property through verified genealogical data, reducing disputes in inheritance claims. Essential documents include digital family tree records on the blockchain, certified probate certificates, and verified identity proofs matched with blockchain credentials. |

| 8 | e-Genealogy Tracing Reports | e-Genealogy Tracing Reports provide a comprehensive digital record of an individual's ancestry, linking legal heirs to the decedent's property through authenticated lineage data. These reports are essential in proving property inheritance by verifying rightful ownership and facilitating smooth title transfer in legal and cadastral systems. |

| 9 | Automated Legal Heir Certificates | Automated Legal Heir Certificates streamline the verification process by digitally validating documents such as the deceased's death certificate, property ownership records, and family lineage proof, ensuring swift and accurate inheritance claims. This technology reduces manual errors and accelerates legal proceedings, providing a secure platform for authenticating heirs in property succession cases. |

| 10 | AI-driven Inheritance Audit Trails | AI-driven inheritance audit trails require documents such as the decedent's will, death certificate, probate court orders, and property titles to verify rightful ownership transfer. Advanced algorithms analyze these records to ensure accuracy and detect discrepancies in the property inheritance process. |

Introduction to Property Inheritance Documentation

Property inheritance requires specific documentation to legally transfer ownership from the deceased to the heir. Understanding these essential documents can help you navigate the inheritance process smoothly.

- Death Certificate - Official proof of the property owner's passing needed to start the inheritance proceedings.

- Will or Testament - A legal document that outlines the deceased's wishes regarding property distribution.

- Probate Certificate - Certification from the court authorizing the executor to manage and distribute the inherited property.

Importance of Proper Ownership Verification

Proving property inheritance requires specific legal documents to establish rightful ownership. Proper ownership verification safeguards Your interest from future disputes and ensures a clear title transfer.

- Death Certificate - Official proof that confirms the passing of the property owner, essential for starting the inheritance process.

- Will or Testament - Legal document detailing the deceased's wishes regarding property distribution.

- Probate or Succession Certificate - Court-issued document validating the legitimacy of heirs and the transfer of property ownership.

Key Legal Documents for Property Inheritance

Proving property inheritance requires specific legal documents to establish rightful ownership. Key documents include the original will, probate court approval, and the grant of probate or letters of administration.

Your title deed must be updated to reflect the new ownership. Additional documents such as the death certificate of the deceased and an inheritance tax certificate may also be necessary for property transfer.

The Role of a Will in Property Transfer

Proving property inheritance requires specific legal documents to establish rightful ownership. A will plays a crucial role in the property transfer process by outlining the deceased's intentions and naming beneficiaries. Courts and authorities use the will as primary evidence to validate and execute property inheritance claims.

Succession Certificates: Purpose and Process

What documents are needed to prove property inheritance? Succession certificates play a crucial role in establishing your legal right to inherited property. These certificates serve as official proof that you are the rightful heir, enabling you to claim assets and transfer ownership smoothly.

What is the purpose of a succession certificate? The primary purpose is to simplify the transfer of movable property such as bank deposits, shares, and securities. It helps financial institutions and authorities release the deceased's assets to the rightful heirs without disputes.

What is the process to obtain a succession certificate? You must file a petition in the civil court of the deceased's last residence, submitting necessary documents like the death certificate and legal heir proof. The court verifies claims and may issue the succession certificate after a public notice period to prevent fraudulent claims.

Title Deeds and Their Significance

Title deeds serve as the primary legal documents needed to prove property inheritance. They provide proof of ownership and detail the property's history and boundaries.

Other essential documents include the deceased's will, grant of probate, and inheritance tax forms. Together, these papers establish clear legal rights to the inherited property and facilitate its transfer.

Encumbrance Certificate and Liability Clearance

To prove property inheritance, obtaining an Encumbrance Certificate is essential as it verifies the property is free from legal or financial liabilities. A Liability Clearance document further confirms that all outstanding dues, such as taxes or loans, have been settled by the previous owner. You must present these documents along with the will or succession certificate to establish clear ownership rights.

Property Tax Receipts and Utility Bills

| Document | Purpose | Details |

|---|---|---|

| Property Tax Receipts | Proof of ownership and tax compliance | Property tax receipts demonstrate that the property has been regularly assessed and taxed. They serve as official evidence of ownership history and ongoing financial responsibility, which is crucial when confirming inheritance rights. |

| Utility Bills | Proof of possession and maintenance | Utility bills, such as electricity, water, or gas statements, establish continuous use and possession of the property. These bills help verify that the inheritor or the deceased occupant maintained the property, supporting inheritance claims. |

Mutation of Property Records

Proving property inheritance requires specific legal documents to ensure a smooth transfer of ownership. Mutation of property records is a critical process that updates land ownership details in government records.

- Mutation Certificate - This document serves as official proof of ownership change in the municipal or local revenue records.

- Legal Heir Certificate - Confirms the rightful heirs of the deceased, essential for mutation approval.

- Death Certificate - Provides evidence of the original owner's death, initiating the inheritance and mutation process.

Mutation of property records legally recognizes inherited property ownership and is crucial for tax and legal purposes.

What Documents are Needed to Prove Property Inheritance? Infographic