To complete a property title transfer, essential documents include the original title deed, a copy of the buyer and seller's identification, and a signed sale agreement. Proof of payment of property taxes, a no-objection certificate from the relevant authorities, and a clearance certificate may also be required. Verification of encumbrance certificates ensures the property is free of legal dues before the transfer is finalized.

What Documents are Required for Property Title Transfer?

| Number | Name | Description |

|---|---|---|

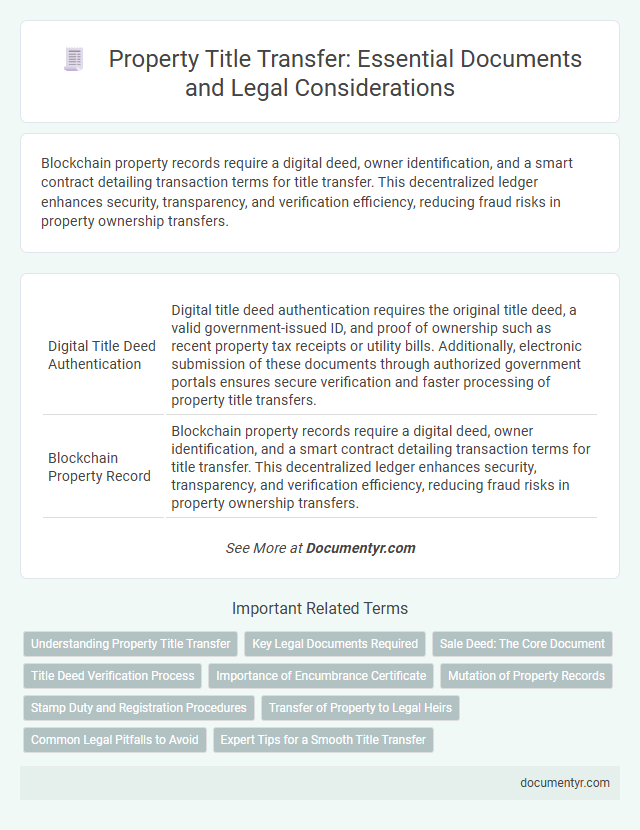

| 1 | Digital Title Deed Authentication | Digital title deed authentication requires the original title deed, a valid government-issued ID, and proof of ownership such as recent property tax receipts or utility bills. Additionally, electronic submission of these documents through authorized government portals ensures secure verification and faster processing of property title transfers. |

| 2 | Blockchain Property Record | Blockchain property records require a digital deed, owner identification, and a smart contract detailing transaction terms for title transfer. This decentralized ledger enhances security, transparency, and verification efficiency, reducing fraud risks in property ownership transfers. |

| 3 | e-KYC (Electronic Know Your Customer) | For property title transfer, submitting e-KYC documents such as a valid government-issued ID, PAN card, and proof of address is essential to verify the identities of both buyer and seller electronically. Utilizing e-KYC streamlines the verification process, reduces paperwork, and enhances the security and authenticity of the title transfer transaction. |

| 4 | Mutation Certificate | The Mutation Certificate is a crucial document required for property title transfer, serving as official proof that the property's ownership details have been updated in government records. This certificate ensures the new owner's name is recorded in the land revenue department, facilitating legal recognition and preventing future title disputes. |

| 5 | Encumbrance Certificate API | The Encumbrance Certificate (EC) API provides verified records of all transactions linked to a property, ensuring it is free from legal dues or mortgages during title transfer. Integrating the EC API streamlines the verification process by offering real-time, authenticated encumbrance data essential for secure and transparent property ownership transfer. |

| 6 | Adhaar-linked Ownership Proof | For property title transfer, an Aadhaar-linked ownership proof is essential to verify the identity and ownership authenticity of the seller, ensuring seamless verification during the transaction. Key documents include the Aadhaar card, sale deed, original title deed, and a no-objection certificate (NOC) if applicable, all linked with the Aadhaar number to prevent fraud and streamline the registration process. |

| 7 | Property Tax Clearance e-Receipt | A Property Tax Clearance e-Receipt is a crucial document required for property title transfer as it certifies that the current owner has paid all outstanding property taxes. This electronic receipt serves as official proof to local government units, facilitating a smooth and legal transfer of ownership. |

| 8 | GIS-based Property Mapping | Key documents required for property title transfer include the original title deed, sale agreement, and no-objection certificates, with GIS-based property mapping documents becoming essential for accurate boundary identification and legal verification. GIS maps provide precise geospatial data that helps resolve disputes and ensures compliance with urban planning regulations during the title transfer process. |

| 9 | RERA Registration Extract | The RERA Registration Extract is a crucial document for property title transfer, providing verified details about the property's ownership, legal status, and development approvals. This extract, issued by the Real Estate Regulatory Authority, ensures transparency and helps validate the legitimacy of the property transaction. |

| 10 | Benami Transaction Compliance Form | The Benami Transaction Compliance Form is a crucial document required for property title transfer to ensure the transaction adheres to the Benami Transactions (Prohibition) Act, 1988, preventing illegal ownership concealment. Alongside the form, valid identity proofs, the original title deed, and a sale deed signed by both parties are essential for completing the legal transfer process. |

Understanding Property Title Transfer

Understanding property title transfer is essential when buying or selling real estate. This process legally changes ownership, ensuring the new owner has clear rights to the property.

Key documents required include the original title deed, a sale deed, and an encumbrance certificate. You must also provide identity proof, property tax receipts, and any necessary no-objection certificates.

Key Legal Documents Required

| Document Name | Description | Purpose |

|---|---|---|

| Sale Deed | Legally binding contract between buyer and seller detailing the transfer of property ownership. | Establishes and validates the transfer of property title from seller to buyer. |

| Title Extract | Official record confirming the current ownership and any encumbrances on the property. | Ensures clear and marketable title without legal disputes or liens. |

| Property Tax Receipts | Proof of payment of property taxes up to date by the current owner. | Confirms that the property is free from unpaid taxes, avoiding legal issues during transfer. |

| Encumbrance Certificate | Document that certifies the property is free from monetary or legal liabilities. | Guarantees that the property does not have any mortgage, loan, or other encumbrances. |

| No Objection Certificate (NOC) | Certificate issued by relevant authorities or housing societies permitting the property title transfer. | Verifies that there are no objections or restrictions on transferring the property title. |

| Identity Proof | Government-issued documents such as passport, Aadhaar card, or driving license of buyer and seller. | Validates identities of parties involved in the transaction to comply with legal requirements. |

| Address Proof | Documents like utility bills or ration cards verifying the residential address of buyer and seller. | Supports verification of parties' addresses for official transfer records. |

| Mutation Register Extract | Record showing the change in ownership details in the land revenue records after transfer. | Confirms official update of ownership in government records post-transfer. |

| Power of Attorney (if applicable) | Legal document authorizing a representative to perform the title transfer on behalf of buyer or seller. | Facilitates transfer process in cases where parties cannot be physically present. |

Sale Deed: The Core Document

The sale deed is the core document required for property title transfer, serving as legal proof of ownership change from the seller to the buyer. It contains detailed information about the property, the buyer and seller, sale consideration, and terms agreed upon. Your property title transfer process is incomplete without a properly registered sale deed at the local sub-registrar office.

Title Deed Verification Process

Transferring a property title requires thorough verification of the title deed to ensure legal ownership and clear property rights. The title deed verification process involves checking multiple documents to confirm authenticity and prevent disputes.

- Title Deed Original - The original title deed must be inspected to confirm the current owner's legal possession of the property.

- Encumbrance Certificate - This document verifies that the property is free from any monetary or legal liabilities.

- Property Tax Receipts - Recent property tax receipts are checked to ensure all dues are paid and the property is under regular taxation.

Importance of Encumbrance Certificate

Property title transfer requires specific documents to ensure clear ownership and legal validity. One of the most crucial documents is the Encumbrance Certificate, which verifies that the property is free from any monetary or legal liabilities.

The Encumbrance Certificate is essential as it provides proof that the property has no outstanding loans, mortgages, or legal disputes. This certificate protects the buyer from future financial risks and ensures a smooth transaction. Without an Encumbrance Certificate, the title transfer process can face significant delays or complications.

Mutation of Property Records

Mutation of property records is a crucial process for transferring the title of a property in official government records. It ensures that your ownership details are updated in municipal or local revenue offices.

Essential documents for property title transfer during mutation include the original sale deed, property tax receipts, and the latest mutation certificate if available. You must also provide identification proof and a no-objection certificate (NOC) from the relevant authorities.

Stamp Duty and Registration Procedures

What documents are required for property title transfer to complete the stamp duty and registration procedures? You need the sale deed, previous title deed, and identity proofs to initiate the transfer. Stamp duty payment receipts and registration forms must also be submitted to the local registrar's office for official recording.

Transfer of Property to Legal Heirs

Transferring property title to legal heirs requires specific documents to ensure a smooth and legally valid process. Proper documentation protects your rights and helps avoid disputes during inheritance.

- Succession Certificate or Legal Heir Certificate - Official proof of the legal heirs entitled to inherit the property.

- Death Certificate of the Deceased Owner - Government-issued certificate confirming the death of the property owner.

- Original Sale Deed or Property Title Deed - The primary document proving ownership of the property before transfer.

Submitting these documents to the local registration office is essential for completing the property title transfer to legal heirs.

Common Legal Pitfalls to Avoid

Transferring a property title requires essential documents such as the original title deed, sale agreement, property tax receipts, and identity proofs of both buyer and seller. Common legal pitfalls to avoid include incomplete documentation, unresolved encumbrances, and failure to verify the property's legal status beforehand. Ensuring these documents are accurate and current protects your investment and facilitates a smooth title transfer process.

What Documents are Required for Property Title Transfer? Infographic