First-time home buyers need several essential documents, including proof of income such as pay stubs or tax returns, credit reports, and a valid identification card. Lenders also require documentation of assets, like bank statements and proof of any existing debts or liabilities. Additionally, a pre-approval letter from a mortgage lender and purchase agreement are critical for a smooth home buying process.

What Documents are Needed for First-Time Home Buyers?

| Number | Name | Description |

|---|---|---|

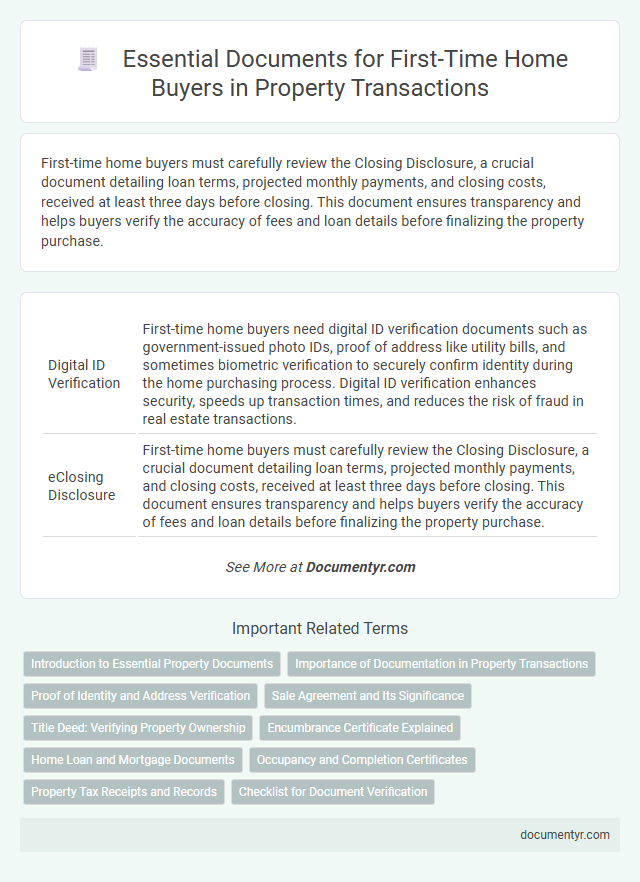

| 1 | Digital ID Verification | First-time home buyers need digital ID verification documents such as government-issued photo IDs, proof of address like utility bills, and sometimes biometric verification to securely confirm identity during the home purchasing process. Digital ID verification enhances security, speeds up transaction times, and reduces the risk of fraud in real estate transactions. |

| 2 | eClosing Disclosure | First-time home buyers must carefully review the Closing Disclosure, a crucial document detailing loan terms, projected monthly payments, and closing costs, received at least three days before closing. This document ensures transparency and helps buyers verify the accuracy of fees and loan details before finalizing the property purchase. |

| 3 | Automated Underwriting Findings | First-time home buyers must provide automated underwriting findings, including credit reports, income verification, and asset statements, to streamline loan approval. These documents help lenders assess risk accurately and expedite the mortgage process. |

| 4 | Remote Online Notarization (RON) Documents | First-time home buyers must prepare essential documents such as the purchase agreement, mortgage application, government-issued ID, and proof of income, all of which can be efficiently authenticated through Remote Online Notarization (RON) services. RON enables secure electronic notarization of key documents via video conferencing, streamlining the home buying process and ensuring compliance with state-specific legal requirements. |

| 5 | Non-Traditional Income Documentation | First-time home buyers with non-traditional income such as freelance, commission-based, or gig economy earnings typically need to provide additional documentation like bank statements, 1099 forms, profit and loss statements, and signed contracts to verify their income. Lenders may also require detailed financial records, tax returns for the past two years, and letters from clients or employers to substantiate the stability and reliability of this income source. |

| 6 | Down Payment Assistance Program Letters | First-time home buyers typically need Down Payment Assistance Program Letters to verify eligibility and secure financial aid for their purchase, including approval letters from housing agencies or lenders specifying the assistance amount. These documents are essential to demonstrate the source of funds and support loan application requirements in the property buying process. |

| 7 | Alternative Credit Data Reports | First-time home buyers should obtain Alternative Credit Data Reports, which include utility payments, rent history, and other non-traditional credit sources to supplement standard credit reports. Lenders increasingly consider these reports to assess creditworthiness for applicants with limited or no conventional credit history. |

| 8 | Self-Employed Profit & Loss eStatements | First-time home buyers who are self-employed must provide detailed Profit & Loss statements, typically covering the past two years, to verify income stability and financial health for mortgage approval. Lenders require these eStatements along with tax returns, bank statements, and business licenses to accurately assess the borrower's ability to repay the loan. |

| 9 | Climate Risk Assessment Addendum | First-time home buyers need to review the Climate Risk Assessment Addendum, which evaluates potential environmental hazards like flooding, wildfires, and earthquakes that could affect the property's safety and insurance requirements. This document is essential for understanding long-term risks and ensuring compliance with local regulations on climate resilience. |

| 10 | Blockchain Property Title Records | First-time home buyers should gather essential documents such as government-issued identification, proof of income, and pre-approval letters while also verifying property title records through blockchain technology to ensure transparency and reduce the risk of fraud. Blockchain property title records provide a secure, immutable ledger that streamlines the title verification process, enhancing trust and efficiency in real estate transactions. |

Introduction to Essential Property Documents

First-time home buyers must gather several key documents to navigate the property purchase process smoothly. Understanding these essential property documents helps ensure a successful transaction and avoids delays.

Documents typically include proof of income, credit reports, and identification. These papers verify financial stability and legal eligibility to purchase a home.

Importance of Documentation in Property Transactions

First-time home buyers must gather essential documents such as proof of identity, income verification, and credit reports to ensure a smooth property transaction. These documents verify the buyer's eligibility for loans and confirm the legal ownership status of the property. Proper documentation minimizes risks, prevents fraud, and facilitates faster approvals in real estate deals.

Proof of Identity and Address Verification

First-time home buyers must provide specific documents to verify their identity and address during the property purchasing process. These documents ensure legal compliance and smooth transaction flow.

- Proof of Identity - Accepted forms include government-issued photo IDs such as a passport, driver's license, or state ID card.

- Address Verification - Utility bills, bank statements, or rental agreements dated within the last three months serve as valid proof of current residence.

- Additional Identification - Social Security cards or birth certificates may be required to confirm eligibility and residency status.

Your preparation with these documents accelerates mortgage approval and final property acquisition.

Sale Agreement and Its Significance

For first-time home buyers, having the right documents is essential to ensure a smooth transaction. One of the most important documents you will need is the Sale Agreement, which outlines the terms and conditions of the property purchase.

The Sale Agreement serves as a legal contract between the buyer and the seller, detailing the price, payment schedule, and responsibilities of both parties. Understanding this document is crucial, as it protects your interests and sets clear expectations throughout the buying process.

Title Deed: Verifying Property Ownership

First-time home buyers must verify property ownership to ensure a secure transaction. The title deed is the primary document that confirms legal ownership and any encumbrances on the property.

- Title Deed Verification - The title deed provides proof of ownership and outlines the property's legal boundaries.

- Check for Encumbrances - Verify the title deed to identify any liens, mortgages, or claims against the property.

- Title Search Report - A professional title search confirms the legitimacy of the title deed and reveals any ownership disputes or restrictions.

Encumbrance Certificate Explained

First-time home buyers need several important documents to ensure a smooth property purchase. One key document is the Encumbrance Certificate, which verifies the property's free status from legal dues and claims.

- Encumbrance Certificate Definition - This certificate confirms that the property is free from monetary or legal liabilities over a specified period.

- Purpose of the Certificate - It helps buyers verify clear ownership and ensures no pending loans or mortgages affect the property.

- How to Obtain - Buyers can request the Encumbrance Certificate from the local sub-registrar's office or through online government portals.

Home Loan and Mortgage Documents

What documents are required for first-time home buyers to secure a home loan? Lenders typically ask for proof of income, credit history, and employment verification. These documents help assess your ability to repay the mortgage.

Which mortgage-related papers must you prepare before closing? Key documents include the loan estimate, mortgage application, and the closing disclosure. These forms provide transparency on loan terms, interest rates, and final costs.

Occupancy and Completion Certificates

| Document | Description | Importance for First-Time Home Buyers |

|---|---|---|

| Occupancy Certificate (OC) | Issued by local municipal authorities, this certificate confirms that the property complies with all building codes and is safe to inhabit. | Essential for ensuring your new home is legally habitable and meets safety standards before moving in. |

| Completion Certificate (CC) | Provided by the local development authority after verifying that the construction is complete as per approved plans and regulations. | Proof that the building construction is finished and authorized, necessary for legally ownership transfer and property registration. |

Property Tax Receipts and Records

First-time home buyers must gather essential documents, including property tax receipts and records, to complete the purchase process smoothly. Property tax receipts provide proof that previous owners have paid local taxes, which helps avoid future liens or disputes. Your accurate and up-to-date tax records ensure transparency and confirm the property's financial standing during the transaction.

What Documents are Needed for First-Time Home Buyers? Infographic