When selling inherited property, key documents include the death certificate, which proves the owner's passing, and the will or trust documents that establish inheritance rights. A probate court order may be necessary to confirm legal ownership if the estate is under probate. Additionally, the property's title deed and tax records are essential to ensure clear transfer and compliance with legal and financial requirements.

What Documents are Needed When Selling Inherited Property?

| Number | Name | Description |

|---|---|---|

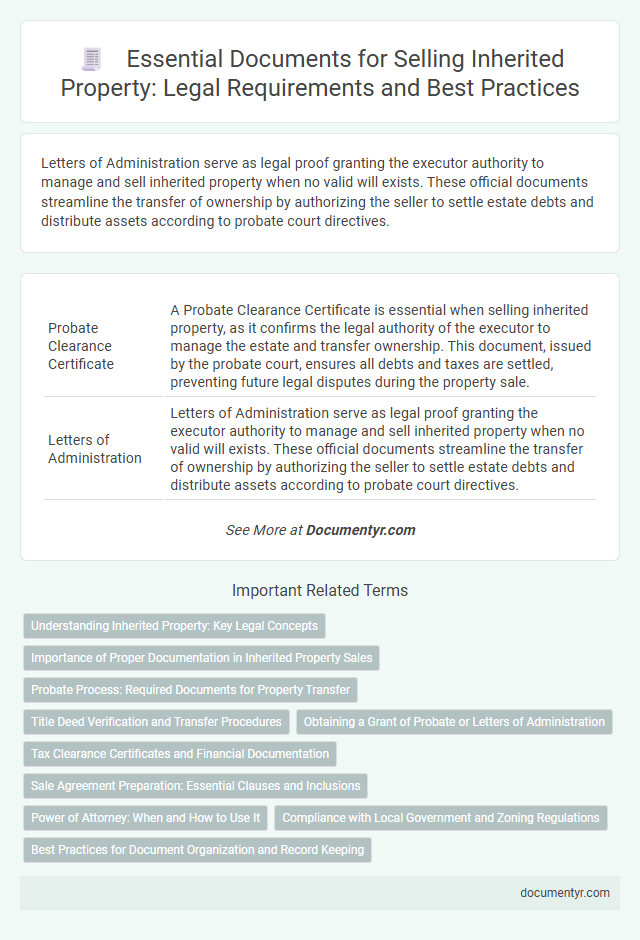

| 1 | Probate Clearance Certificate | A Probate Clearance Certificate is essential when selling inherited property, as it confirms the legal authority of the executor to manage the estate and transfer ownership. This document, issued by the probate court, ensures all debts and taxes are settled, preventing future legal disputes during the property sale. |

| 2 | Letters of Administration | Letters of Administration serve as legal proof granting the executor authority to manage and sell inherited property when no valid will exists. These official documents streamline the transfer of ownership by authorizing the seller to settle estate debts and distribute assets according to probate court directives. |

| 3 | Small Estate Affidavit | A Small Estate Affidavit is a crucial document required when selling inherited property, allowing heirs to bypass formal probate if the estate's value falls below a state-specific threshold. This affidavit must include proof of death, heirship, and a detailed inventory of assets, ensuring a legally smooth transfer of the inherited property title. |

| 4 | Transfer-on-Death Deed (TOD Deed) | When selling inherited property with a Transfer-on-Death Deed (TOD Deed), key documents include the original TOD Deed, the death certificate of the property owner, and the beneficiary's identification. The TOD Deed allows the property to transfer directly to the beneficiary without probate, streamlining ownership transfer and facilitating a smoother sale process. |

| 5 | Surviving Spouse Affidavit | A Surviving Spouse Affidavit is a critical document when selling inherited property, certifying the identity of the surviving spouse and their legal right to sell the asset without probate. This affidavit typically includes details such as the decedent's date of death, marriage information, and confirmation that no other heirs have a claim, streamlining the transfer and sale process. |

| 6 | Heirship Affidavit | An Heirship Affidavit is a vital document proving legal ownership and heirship when selling inherited property, especially if no probate was filed. This affidavit typically includes details about the decedent's death, heirs' identities, and their shares, ensuring clear title transfer and preventing future disputes. |

| 7 | Estate Tax Waiver | An Estate Tax Waiver is a crucial document required when selling inherited property, confirming that any applicable estate taxes imposed on the decedent's estate have been settled or waived by tax authorities. This waiver ensures a clear title transfer by proving no outstanding tax liabilities exist, enabling a smoother and legally compliant property sale. |

| 8 | Release of Inheritance Lien | A Release of Inheritance Lien is a critical document required when selling inherited property, confirming that any claims or liens by heirs or creditors on the estate have been legally resolved. This release ensures a clear title transfer, protecting the buyer and facilitating a smooth transaction process. |

| 9 | Executor’s Sale Authorization | The Executor's Sale Authorization is a crucial document required when selling inherited property, granting the executor legal permission to sell on behalf of the estate. This authorization often comes in the form of a court-issued order or letters testamentary, ensuring the transaction complies with probate laws. |

| 10 | Digital Asset Disclosure Statement | When selling inherited property, a Digital Asset Disclosure Statement is essential to provide a comprehensive inventory of any digital accounts, cryptocurrencies, or online investments associated with the estate. This document ensures transparency and aids in the accurate valuation and transfer of digital assets alongside traditional property records. |

Understanding Inherited Property: Key Legal Concepts

Understanding inherited property involves recognizing its unique legal status, which differs from purchasing or selling property acquired through other means. Key legal concepts include the probate process, which validates the deceased's will, and the transfer of title to the heir. Familiarity with inheritance tax laws and any outstanding liens or debts is essential before selling inherited property.

Importance of Proper Documentation in Inherited Property Sales

Selling inherited property requires specific legal documents to ensure a smooth and valid transaction. Proper documentation eliminates disputes, verifies ownership, and accelerates the sale process.

Essential documents include the death certificate, will or trust, grant of probate or letters of administration, and the property title deed. You must also provide proof of tax clearance and any necessary appraisal reports to support the property's value.

Probate Process: Required Documents for Property Transfer

Selling inherited property requires specific documents to complete the probate process smoothly. These documents verify your legal right to transfer ownership and help avoid delays in the sale.

- Death Certificate - Official proof of the deceased person's passing, necessary to initiate probate.

- Will or Trust Document - Legal paperwork outlining the deceased's wishes for property distribution.

- Letters Testamentary or Letters of Administration - Court-issued documents granting you authority to manage and sell the inherited property.

Title Deed Verification and Transfer Procedures

| Document | Description | Importance in Selling Inherited Property |

|---|---|---|

| Original Title Deed | The official document proving ownership of the property. | Essential for verifying the legal ownership before any sale can proceed. |

| Death Certificate of the Deceased | Legal proof of the previous owner's death. | Used to initiate the transfer of ownership from the deceased to the heir. |

| Probate or Letters of Administration | Legal documents issued by the court authorizing inheritance transfer. | Required to establish the rightful heir and authorize property sale. |

| Will or Testament (if applicable) | Document specifying how the deceased wanted their property distributed. | Facilitates clearer transfer procedure in accordance with the deceased's wishes. |

| Affidavit of Heirship | A sworn statement identifying rightful heirs, often used when no will exists. | Supports transfer of title when probate has not been filed. |

| Title Deed Verification Report | Official search report from land registry verifying the authenticity and status of the title deed. | Prevents disputes by ensuring the property is free of encumbrances or liens. |

| Transfer of Ownership Form | Standardized form required by the land registry office to transfer the title to the heir or buyer. | Critical for legal transfer and to update ownership records. |

| ID Proofs of Heirs and Buyer | Government-issued identification documents of all parties involved. | Used to verify identity and avoid fraud during transaction and title transfer. |

| Tax Clearance Certificates | Proof that all relevant property taxes and inheritance taxes have been paid. | Necessary to avoid legal issues and delays in title transfer. |

| Sale Deed/Agreement | The contract documenting the terms and conditions agreed upon between seller and buyer. | Legally binds the parties and forms the basis for ownership transfer registration. |

Obtaining a Grant of Probate or Letters of Administration

When selling inherited property, obtaining the correct legal documents is essential to transfer ownership. A Grant of Probate or Letters of Administration authorize you to manage and sell the estate legally.

- Grant of Probate - This document is issued when the deceased left a valid will, confirming the executor's authority.

- Letters of Administration - Provided when there is no will, appointing an administrator to handle the estate.

- Proof of Identity - Identification documents for the executor or administrator are required to complete the sale process.

Tax Clearance Certificates and Financial Documentation

When selling inherited property, securing tax clearance certificates is essential to prove all estate taxes have been paid. These certificates prevent legal complications and ensure a smooth transaction process.

Financial documentation, including the original will, death certificate, and proof of property ownership, must be compiled. You should also gather records of outstanding debts and liens to provide a clear financial standing to potential buyers.

Sale Agreement Preparation: Essential Clauses and Inclusions

When selling inherited property, preparing a well-drafted sale agreement is crucial to ensure a smooth transaction. This document must clearly outline the terms agreed upon by both the seller and the buyer to avoid future disputes.

The sale agreement should include essential clauses such as the description of the inherited property, the sale price, and payment terms. It must also specify any disclosures related to the property's condition and legal status. Including a clause on possession date and conditions for default protects both parties involved in the sale.

Power of Attorney: When and How to Use It

Selling inherited property requires specific legal documents to ensure a smooth transaction. One crucial document is the Power of Attorney, which grants someone the authority to act on behalf of the owner.

- Power of Attorney Definition - A legal document that authorizes an individual to manage property transactions on behalf of the inherited property's owner.

- When to Use Power of Attorney - Use it when the property owner is unable to sell due to absence, health issues, or other limitations.

- How to Draft Power of Attorney - It must be a legally binding document, often notarized, clearly specifying the powers granted for selling the inherited property.

You should consult a legal professional to ensure the Power of Attorney is valid and tailored for your property sale needs.

Compliance with Local Government and Zoning Regulations

What documents are needed to ensure compliance with local government and zoning regulations when selling inherited property? Proper documentation typically includes a title deed, probate or legal heir certificate, and zoning clearance certificates. These documents confirm legal ownership and verify that the property conforms to local zoning laws.

What Documents are Needed When Selling Inherited Property? Infographic