First-time homebuyer's program applications typically require proof of income, such as pay stubs, tax returns, and W-2 forms, to verify financial eligibility. Applicants must provide identification documents including a government-issued ID and Social Security number. Additional paperwork may include a purchase agreement, credit report authorization, and evidence of any required homebuyer education courses.

What Documents are Needed for a First-Time Homebuyer’s Program Application?

| Number | Name | Description |

|---|---|---|

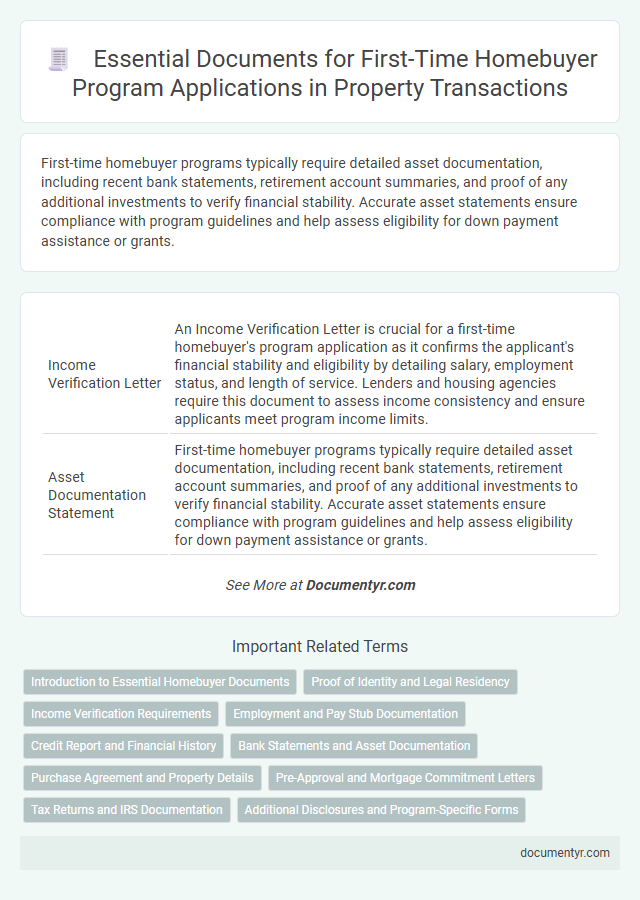

| 1 | Income Verification Letter | An Income Verification Letter is crucial for a first-time homebuyer's program application as it confirms the applicant's financial stability and eligibility by detailing salary, employment status, and length of service. Lenders and housing agencies require this document to assess income consistency and ensure applicants meet program income limits. |

| 2 | Asset Documentation Statement | First-time homebuyer programs typically require detailed asset documentation, including recent bank statements, retirement account summaries, and proof of any additional investments to verify financial stability. Accurate asset statements ensure compliance with program guidelines and help assess eligibility for down payment assistance or grants. |

| 3 | Gift Letter for Down Payment | A Gift Letter for a down payment confirms the funds given by a family member or friend as a non-repayable gift, ensuring the lender that the money is not a loan. This letter typically includes the donor's name, relationship to the buyer, gift amount, and a statement that repayment is not expected, playing a crucial role in first-time homebuyer program applications. |

| 4 | Employment Verification Form | An Employment Verification Form is essential for a first-time homebuyer's program application as it confirms the applicant's current employment status, income stability, and job tenure, which lenders use to assess financial reliability. This document often requires employer details, job position, salary information, and verification of continuous employment to support the buyer's ability to repay the mortgage. |

| 5 | Mortgage Pre-Approval Certificate | A Mortgage Pre-Approval Certificate is a crucial document for first-time homebuyer program applications, demonstrating financial readiness and strengthening your offer credibility. This certificate typically requires proof of income, credit reports, employment verification, and identification to validate your borrowing capacity. |

| 6 | First-Time Homebuyer Affidavit | A First-Time Homebuyer Affidavit, a crucial document for validating eligibility, must be signed to confirm that the applicant has not owned a home in the past three years. This affidavit is often accompanied by proof of income, identification, and a purchase agreement to complete the application for most first-time homebuyer programs. |

| 7 | Rental History Report | A Rental History Report is a crucial document for first-time homebuyer program applications, providing detailed records of previous leases, payment consistency, and landlord references. This report helps lenders assess the applicant's creditworthiness and financial responsibility by verifying rental payment history and tenancy stability. |

| 8 | Debt-to-Income Calculation Sheet | A Debt-to-Income (DTI) Calculation Sheet is essential for a first-time homebuyer's program application, as it provides a detailed summary of monthly debts compared to gross monthly income to assess borrowing capacity. This document typically includes proof of income, outstanding loan statements, and monthly debt obligations, ensuring accurate evaluation of financial stability and loan eligibility. |

| 9 | Homeownership Education Certificate | A Homeownership Education Certificate is essential for first-time homebuyer program applications, demonstrating the completion of an approved homebuyer education course. This certificate verifies that applicants have received critical guidance on budgeting, mortgage options, and home maintenance, increasing their readiness for responsible homeownership. |

| 10 | Non-Occupant Co-Borrower Agreement | A Non-Occupant Co-Borrower Agreement is a crucial document in first-time homebuyer program applications, allowing a co-borrower who does not live in the property to share loan responsibility. This agreement typically requires identification, income verification, and a signed consent form to ensure qualification and financial backing for the mortgage. |

Introduction to Essential Homebuyer Documents

Applying for a first-time homebuyer's program requires specific documentation to verify eligibility and financial status. Understanding these essential documents can streamline your application process.

- Proof of Income - Documents such as pay stubs, tax returns, or W-2 forms confirm your financial capacity to support mortgage payments.

- Credit Report - A credit report shows your credit history and score, which lenders use to evaluate your borrowing risk.

- Identification Documents - Government-issued IDs like a driver's license or passport verify your identity and residency status.

Proof of Identity and Legal Residency

Proof of identity is essential when applying for a first-time homebuyer's program. Government-issued identification, such as a driver's license or passport, verifies your identity during the application process.

Legal residency documentation confirms eligibility for the program. Acceptable documents include a permanent resident card, visa, or naturalization certificate. These papers ensure compliance with residency requirements and facilitate smooth application approval.

Income Verification Requirements

Income verification is a critical component of a first-time homebuyer's program application. You must provide recent pay stubs, W-2 forms, and federal tax returns to confirm your earnings. Additional documents like bank statements or proof of other income sources may also be required to complete the process.

Employment and Pay Stub Documentation

| Document Type | Description | Purpose | Additional Notes |

|---|---|---|---|

| Recent Pay Stubs | Copies of pay stubs from the last 30 to 60 days | Verify current income and employment stability | Include all sources of income if employed at multiple jobs |

| Employment Verification Letter | Official letter from employer confirming job status | Confirm length of employment and job position | Should be on company letterhead with contact information |

| W-2 Forms or Tax Returns | Previous two years of W-2 forms or tax returns if self-employed | Provide proof of consistent income over time | Self-employed applicants must include tax returns with Schedule C or equivalent |

| Bank Statements | Statements showing consistent deposits of payroll | Verify income deposits matching pay stubs | Typically required for the last two to three months |

Credit Report and Financial History

A credit report is essential for a first-time homebuyer's program application as it provides a detailed overview of your creditworthiness and payment history. Lenders use this report to assess risk and determine eligibility for loan programs. Financial history, including income statements and debt records, supports the credit report by verifying your ability to repay the mortgage.

Bank Statements and Asset Documentation

First-time homebuyer programs require thorough financial documentation to verify your eligibility and financial stability. Key documents include bank statements and proof of assets to demonstrate your ability to cover down payments and closing costs.

- Bank Statements - Provide at least the last two to three months of bank statements to show consistent income and account activity.

- Asset Documentation - Submit statements for savings, retirement accounts, or other investments to verify available funds for the property's purchase.

- Verification of Funds - Ensure all submitted documents clearly display account holder names, balances, and transaction histories to support your financial profile.

Accurate bank and asset documentation significantly strengthen your first-time homebuyer program application.

Purchase Agreement and Property Details

What documents are required from the purchase agreement for a first-time homebuyer's program application?

The purchase agreement must include the buyer's and seller's information, property address, and agreed purchase price. This document verifies the transaction terms and ensures eligibility for the program.

Why are detailed property documents essential when applying for a first-time homebuyer's program?

Property details such as the legal description, property type, and condition report confirm the asset being purchased. Accurate documentation supports the application review process and loan approval.

Pre-Approval and Mortgage Commitment Letters

First-time homebuyer programs require specific documentation to verify financial eligibility. Pre-approval letters demonstrate your creditworthiness and the loan amount you qualify for from a lender.

Mortgage commitment letters confirm that the lender has approved financing based on submitted documents and underwriting. These letters are crucial for securing your application and moving forward in the home buying process.

Tax Returns and IRS Documentation

First-time homebuyer programs often require applicants to submit recent tax returns as proof of income and financial stability. These documents verify earnings and help determine eligibility for assistance or loan programs.

IRS documentation such as wage transcripts or tax transcripts may also be necessary to confirm income reported on tax returns. Providing accurate IRS documents ensures the application process is thorough and compliant with program requirements.

What Documents are Needed for a First-Time Homebuyer’s Program Application? Infographic