An LLC needs several key documents to buy property, including the Articles of Organization to prove its legal formation and an Operating Agreement outlining member roles and decision-making processes. The LLC must also obtain an EIN (Employer Identification Number) from the IRS for tax purposes and provide a Resolution or Consent authorizing the purchase if required by its internal governance. Title documentation and a Purchase Agreement finalized under the LLC's name ensure the property transaction complies with legal and financial requirements.

What Documents Does an LLC Need to Buy Property?

| Number | Name | Description |

|---|---|---|

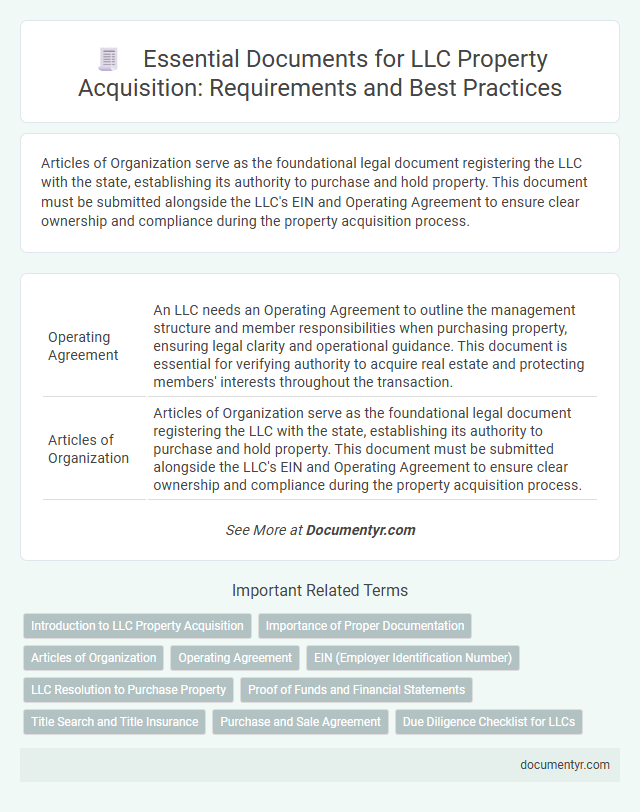

| 1 | Operating Agreement | An LLC needs an Operating Agreement to outline the management structure and member responsibilities when purchasing property, ensuring legal clarity and operational guidance. This document is essential for verifying authority to acquire real estate and protecting members' interests throughout the transaction. |

| 2 | Articles of Organization | Articles of Organization serve as the foundational legal document registering the LLC with the state, establishing its authority to purchase and hold property. This document must be submitted alongside the LLC's EIN and Operating Agreement to ensure clear ownership and compliance during the property acquisition process. |

| 3 | EIN Confirmation Letter (IRS CP 575) | An LLC needs the EIN Confirmation Letter (IRS CP 575) as a crucial document when purchasing property, serving as official proof of its Employer Identification Number issued by the IRS. This letter validates the LLC's tax identification, enabling it to open bank accounts, secure financing, and complete property title registration effectively. |

| 4 | LLC Resolution to Purchase Real Estate | An LLC Resolution to Purchase Real Estate is a formal document authorizing the company to acquire property, outlining the terms and approval from members or managers. This resolution is essential for legal compliance, providing clear evidence of the LLC's intent and authority to complete the real estate transaction. |

| 5 | Certificate of Good Standing | An LLC needs a Certificate of Good Standing to demonstrate its legal status and compliance when buying property, ensuring the entity is authorized to conduct business in the state. This document is often required by title companies and lenders during the property purchase process to verify the LLC's legitimacy and avoid potential legal issues. |

| 6 | LLC Membership Consent Form | An LLC must provide an LLC Membership Consent Form to demonstrate that all members have agreed to the purchase of property, ensuring legal authorization and compliance with internal governance. This document confirms member approval and protects against future disputes during real estate transactions. |

| 7 | Statement of Information | An LLC must provide a Statement of Information, detailing the company's key members, addresses, and management structure, to legally and transparently purchase property. This document is critical for verifying the LLC's legitimacy and is often required by state authorities and lenders during the property acquisition process. |

| 8 | Buyer’s Disclosure Authorization | A Buyer's Disclosure Authorization is essential for an LLC when purchasing property, granting permission to access the buyer's financial, legal, and credit information needed to verify qualifications and facilitate the transaction. This document ensures transparency and compliance with real estate regulations, protecting both the LLC and the seller throughout the property acquisition process. |

| 9 | Property Acquisition Authorization Letter | An LLC needs a Property Acquisition Authorization Letter to officially empower a designated member or manager to act on behalf of the company in purchasing real estate, ensuring legal compliance and transaction validity. This document typically includes the LLC's name, the authorized individual's details, specific property information, and signatures from authorized LLC members or managers. |

| 10 | LLC Beneficial Ownership Information Report | An LLC must provide a Beneficial Ownership Information Report containing details of individuals who directly or indirectly own 25% or more of the company or exercise significant control before purchasing property. This report ensures transparency and compliance with the Corporate Transparency Act, aiding in verification during the property acquisition process. |

Introduction to LLC Property Acquisition

| Document Type | Description |

|---|---|

| Articles of Organization | Official formation document filed with the state to legally create the LLC. |

| Operating Agreement | Internal document detailing ownership, management structure, and operational procedures of the LLC. |

| Employer Identification Number (EIN) | IRS-issued tax identification number required for tax reporting and opening bank accounts. |

| Resolution to Purchase Property | Formal written approval from LLC members authorizing the acquisition of the specific property. |

| Title Report | Detailed report confirming the legal ownership and any liens or encumbrances on the property. |

| Purchase Agreement | Legally binding contract between the LLC and the seller outlining terms and conditions of the sale. |

| Deed in the Name of the LLC | Official document transferring property ownership to the LLC after closing. |

Your LLC's successful property acquisition depends on obtaining and organizing these essential documents. Understanding their purpose ensures a smooth transaction and protects your investment.

Importance of Proper Documentation

What documents does an LLC need to buy property? Proper documentation is essential for an LLC to establish legal ownership and protect its interests in real estate transactions. Key documents include the LLC operating agreement, articles of organization, and a resolution authorizing the purchase.

Why is the importance of proper documentation critical in property purchases by an LLC? Accurate and complete paperwork ensures clear title transfer, minimizes legal risks, and facilitates smooth closing processes. Lenders and sellers often require proof of the LLC's formation and authority to avoid disputes and enforce contracts.

Articles of Organization

When an LLC intends to purchase property, having the Articles of Organization is essential. This document officially establishes the LLC's existence and outlines its purpose, including real estate transactions. Lenders and sellers often require a copy to verify the LLC's legal standing before completing the sale.

Operating Agreement

When your LLC plans to buy property, having a clear Operating Agreement is essential. This document outlines the management structure and decision-making processes of the LLC.

The Operating Agreement also specifies member roles and ownership percentages, which can impact property transactions. Lenders and sellers often require this document to verify the LLC's authority to purchase real estate.

EIN (Employer Identification Number)

When your LLC is buying property, securing the correct documents is essential to ensure legal compliance and smooth transactions. One of the most important documents required is the Employer Identification Number (EIN).

- EIN Identification - Your LLC must obtain an EIN from the IRS to establish its identity for tax purposes and property ownership documentation.

- Title and Ownership Records - The EIN is used to register the property title in the name of the LLC, linking ownership to the correct legal entity.

- Tax Reporting - The EIN enables the LLC to report property-related income, expenses, and taxes accurately to federal and state authorities.

LLC Resolution to Purchase Property

Purchasing property through an LLC requires specific legal documentation to ensure the transaction is valid and recognized. One critical document is the LLC resolution to purchase property, which formalizes the decision within the company.

- LLC Operating Agreement - Governs the internal management and outlines the authority for property purchases.

- LLC Resolution to Purchase Property - A formal written decision authorizing the purchase, signed by authorized members or managers.

- Property Purchase Agreement - The legal contract between the LLC and the property seller detailing terms and conditions.

Your LLC resolution to purchase property demonstrates proper authorization for the transaction, protecting the company's legal standing.

Proof of Funds and Financial Statements

When an LLC purchases property, it must provide specific documents to verify its financial capacity. Proof of funds and financial statements are essential to demonstrate the LLC's ability to complete the transaction.

Proof of funds typically includes bank statements or investment account balances showing available cash. Financial statements, such as balance sheets and income statements, offer a detailed overview of the LLC's financial health and liquidity.

Title Search and Title Insurance

When an LLC plans to buy property, securing the correct documents is essential for a smooth transaction. Two critical documents are the title search and title insurance, which protect your investment.

- Title Search - A thorough examination of public records to verify the property's legal ownership and uncover any liens or encumbrances.

- Title Insurance - A policy that safeguards the LLC against future claims or disputes related to the property's title, providing financial protection.

- LLC Operating Agreement - This document authorizes the LLC to purchase and hold real estate, clarifying member roles and ownership percentages.

Purchase and Sale Agreement

When an LLC buys property, a crucial document required is the Purchase and Sale Agreement. This contract outlines the terms, price, and conditions agreed upon by the buyer and seller. Ensure your LLC reviews this agreement carefully before signing to secure a smooth property transaction.

What Documents Does an LLC Need to Buy Property? Infographic