Investors engaging in 1031 exchange transactions must prepare key documents such as the original property deed, the sales contract, and a qualified intermediary agreement to facilitate the exchange. They also need a detailed exchange identification form listing potential replacement properties within the specified timelines. Proper documentation ensures compliance with IRS regulations and helps secure the tax-deferred benefits of the 1031 exchange.

What Documents Does an Investor Need for 1031 Exchange Transactions?

| Number | Name | Description |

|---|---|---|

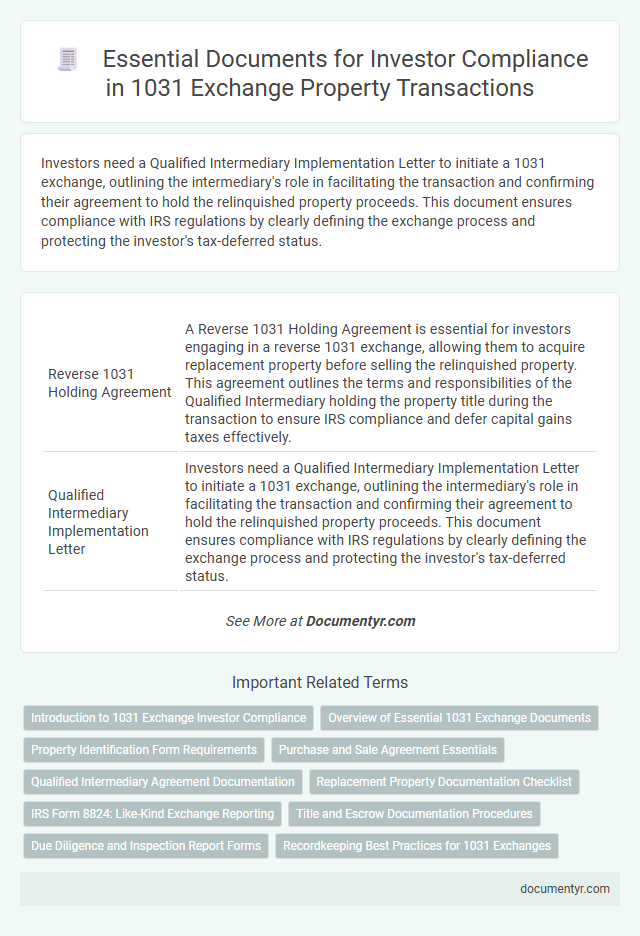

| 1 | Reverse 1031 Holding Agreement | A Reverse 1031 Holding Agreement is essential for investors engaging in a reverse 1031 exchange, allowing them to acquire replacement property before selling the relinquished property. This agreement outlines the terms and responsibilities of the Qualified Intermediary holding the property title during the transaction to ensure IRS compliance and defer capital gains taxes effectively. |

| 2 | Qualified Intermediary Implementation Letter | Investors need a Qualified Intermediary Implementation Letter to initiate a 1031 exchange, outlining the intermediary's role in facilitating the transaction and confirming their agreement to hold the relinquished property proceeds. This document ensures compliance with IRS regulations by clearly defining the exchange process and protecting the investor's tax-deferred status. |

| 3 | Delaware Statutory Trust (DST) Subscription Documents | Investors engaging in 1031 exchange transactions must secure Delaware Statutory Trust (DST) subscription documents, which include the private placement memorandum, operating agreement, and subscription agreement to ensure compliance and validate ownership interests. These documents establish the investor's rights, outline the terms of the investment, and fulfill IRS requirements for like-kind exchange qualification. |

| 4 | TIC (Tenancy-in-Common) Beneficial Interest Assignment | Investors involved in 1031 exchange transactions using TIC (Tenancy-in-Common) beneficial interest assignments must have a signed TIC agreement, assignment documents transferring beneficial interests, and relevant property title records to ensure proper legal transfer and IRS compliance. Additionally, obtaining a qualified intermediary agreement and proof of timely exchange identification and completion is critical for maintaining tax-deferred status. |

| 5 | Identification Notice Compliance Form | Investors engaging in 1031 exchange transactions must submit an Identification Notice Compliance Form within 45 days of the property sale to meet IRS requirements. This form precisely lists the replacement properties, ensuring the transaction qualifies for tax deferral under Section 1031 of the Internal Revenue Code. |

| 6 | Exchange Accommodation Titleholder (EAT) Contract | An Exchange Accommodation Titleholder (EAT) Contract is crucial in 1031 exchange transactions to hold title to replacement property temporarily, ensuring compliance with IRS regulations. This contract facilitates the deferred exchange by allowing the EAT to acquire and transfer property without the investor taking constructive receipt of funds. |

| 7 | IRS Form 8824: Like-Kind Exchange Supplemental | IRS Form 8824: Like-Kind Exchange Supplemental is essential for investors to report the details of their 1031 exchange transactions, ensuring compliance with tax regulations by documenting the relinquished and replacement properties involved. Accurate completion of this form, including the description, dates, and values of exchanged properties, is critical to defer capital gains taxes under the Internal Revenue Code Section 1031. |

| 8 | Deferred Exchange Replacement Property Addendum | Investors conducting 1031 exchange transactions require the Deferred Exchange Replacement Property Addendum, which outlines essential details about the replacement property to ensure compliance with IRS regulations. This document specifies identification deadlines, outlines the property's characteristics, and confirms the investor's intent to complete the exchange within stipulated timeframes. |

| 9 | Qualified Escrow Account Verification | Investors must provide Qualified Escrow Account Verification to ensure funds from the sale are securely held by a third party compliant with IRS 1031 exchange rules. This document verifies the escrow account's status, protecting the transaction's tax-deferred nature by confirming proper handling of proceeds. |

| 10 | 1031 Exchange Timeline Compliance Checklist | Investors must maintain strict adherence to the 1031 Exchange timeline by securing critical documents such as the Notice of Intent to Exchange, identification of replacement property within 45 days, and the closing statement of the relinquished property within 180 days. Timely submission of the Qualified Intermediary agreement, purchase contract for the replacement property, and IRS Form 8824 is essential to ensure compliance and successful tax deferral under Section 1031 of the Internal Revenue Code. |

Introduction to 1031 Exchange Investor Compliance

Investors engaging in 1031 exchange transactions must adhere to specific document requirements to ensure compliance with IRS regulations. Proper documentation facilitates the deferral of capital gains taxes during the exchange of like-kind properties.

- Qualified Intermediary Agreement - This document appoints a third party to hold funds during the exchange, preventing the investor from taking constructive receipt.

- Purchase and Sale Agreements - Contracts for both the relinquished and replacement properties must clearly outline terms to meet exchange criteria.

- Identification of Replacement Property - Investors are required to provide written identification of potential replacement properties within 45 days of selling the initial property.

Maintaining accurate and timely documentation is critical to successfully completing a 1031 exchange and achieving tax deferral benefits.

Overview of Essential 1031 Exchange Documents

Completing a 1031 exchange requires specific documentation to ensure compliance with IRS regulations. Essential documents include the exchange agreement, identification of replacement property, and closing statements.

You must also maintain detailed records such as the assignment of rights, the Qualified Intermediary agreement, and proof of timelines for property identification and acquisition. Proper documentation supports your tax deferral and protects you from potential audits. Keeping these documents organized is crucial for a successful 1031 exchange transaction.

Property Identification Form Requirements

Investors undertaking a 1031 Exchange must submit a Property Identification Form that clearly lists the potential replacement properties within 45 days of selling the relinquished property. The form must include specific details such as the property address, legal description, and unique identifiers to ensure compliance with IRS regulations. Accurate and timely submission of this form is crucial to maintain the tax-deferred status of the exchange transaction.

Purchase and Sale Agreement Essentials

Understanding the Purchase and Sale Agreement essentials is critical for a successful 1031 Exchange transaction. Your agreement must clearly outline the terms to meet IRS requirements for tax deferral.

- Identification of Relinquished and Replacement Properties - Specifies the exact properties involved, ensuring compliance with exchange rules.

- Exchange Accommodation Clause - Allows use of a qualified intermediary to facilitate the transaction without triggering taxable events.

- Contingency Provisions - Protects the investor by addressing potential issues like financing or inspection results during the exchange process.

Qualified Intermediary Agreement Documentation

In 1031 exchange transactions, an investor must secure a Qualified Intermediary Agreement to ensure compliance with IRS regulations. This document outlines the intermediary's role in facilitating the exchange without the investor taking constructive receipt of the funds. Proper execution of the Qualified Intermediary Agreement is essential to maintain the tax-deferred status of the exchange.

Replacement Property Documentation Checklist

What documents are essential for the replacement property in a 1031 exchange? A detailed replacement property documentation checklist ensures compliance with IRS rules. Proper documentation supports a successful tax-deferred exchange.

Which forms should you gather for the replacement property? You need the purchase agreement, title report, and proof of funds for the new property. These documents verify ownership transfer and financial readiness.

What role does the identification of replacement property play? The identification notice must be precise and submitted within 45 days after selling the relinquished property. Accurate identification is critical to meet IRS timeframes.

Why is the title report important in 1031 exchange transactions? It confirms clear ownership and absence of liens on the replacement property. Title insurance may also be required to protect your investment.

How does the closing statement impact the exchange process? The HUD-1 or closing disclosure details financial transactions at closing. This document evidences the exchange and purchase price for IRS records.

IRS Form 8824: Like-Kind Exchange Reporting

Investors engaging in 1031 exchange transactions must file IRS Form 8824 to report like-kind exchanges accurately. This form details the properties exchanged, ensuring compliance with tax regulations and deferring capital gains taxes.

- Identification of Properties - IRS Form 8824 requires listing both relinquished and replacement properties involved in the exchange.

- Calculation of Gain or Loss - The form calculates realized and recognized gains or losses from the transaction for accurate tax reporting.

- Exchange Timelines and Values - Form 8824 captures critical dates and property values to verify adherence to 1031 exchange rules.

Title and Escrow Documentation Procedures

Title and escrow documentation are critical components in 1031 exchange transactions to ensure a smooth transfer of property ownership. These documents verify the legal ownership and confirm that the title is free of liens or encumbrances.

You will need to provide the original title deed and a current title report prepared by a reputable title company. Escrow instructions must be carefully reviewed and signed to outline the terms of the transaction and the disbursement of funds during the exchange process.

Due Diligence and Inspection Report Forms

| Document Type | Description | Importance in 1031 Exchange |

|---|---|---|

| Due Diligence Reports | Comprehensive assessments covering property title, liens, zoning compliance, environmental concerns, and financial viability. | Essential for verifying that the replacement property meets IRS requirements and avoids future legal or financial issues. |

| Inspection Report Forms | Detailed evaluations of the physical condition of the property, including structural integrity, pest presence, and systems functionality. | Critical to identify potential repairs or hazards before completing the exchange, ensuring informed investment decisions. |

| 1031 Exchange Agreement Document | Formal contract outlining the terms and timeline of the exchange transaction between involved parties. | Required to establish the legal framework for your 1031 exchange, protecting tax-deferred status. |

| Qualified Intermediary Agreement | Agreement appointing a third party to hold funds during the exchange transaction period. | Necessary to comply with IRS rules prohibiting direct receipt of proceeds, maintaining the 1031 exchange validity. |

What Documents Does an Investor Need for 1031 Exchange Transactions? Infographic