Essential documents for commercial property leasing include a signed lease agreement outlining terms and conditions, proof of business registration, and financial statements to demonstrate the tenant's ability to pay rent. Landlords often require identification documents, insurance certificates, and sometimes a personal or corporate guarantee to secure the lease. Proper documentation ensures legal compliance and protects both parties throughout the leasing period.

What Documents are Necessary for Commercial Property Leasing?

| Number | Name | Description |

|---|---|---|

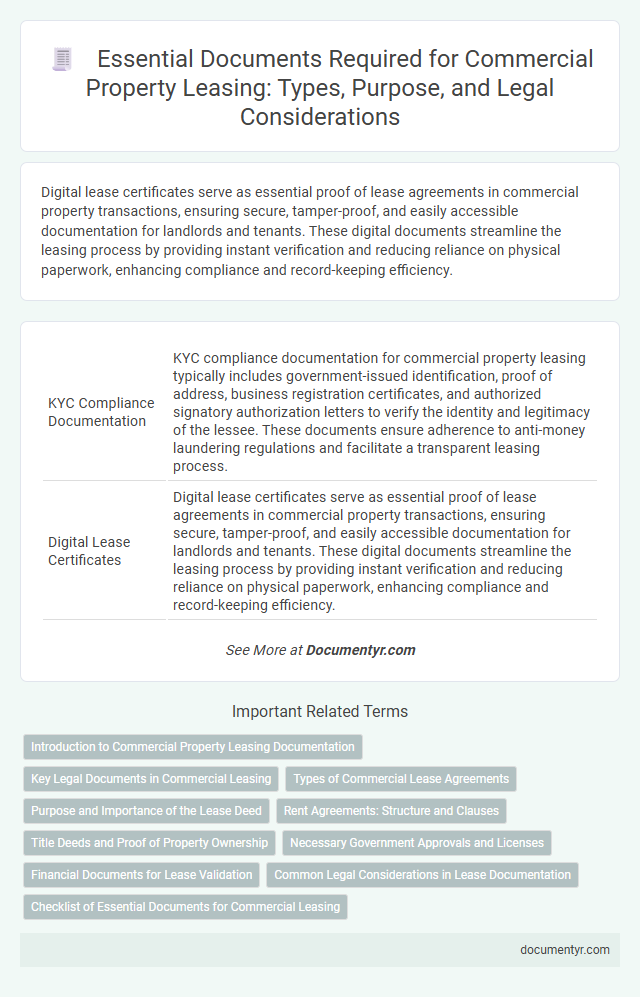

| 1 | KYC Compliance Documentation | KYC compliance documentation for commercial property leasing typically includes government-issued identification, proof of address, business registration certificates, and authorized signatory authorization letters to verify the identity and legitimacy of the lessee. These documents ensure adherence to anti-money laundering regulations and facilitate a transparent leasing process. |

| 2 | Digital Lease Certificates | Digital lease certificates serve as essential proof of lease agreements in commercial property transactions, ensuring secure, tamper-proof, and easily accessible documentation for landlords and tenants. These digital documents streamline the leasing process by providing instant verification and reducing reliance on physical paperwork, enhancing compliance and record-keeping efficiency. |

| 3 | ESG Disclosure Statements | ESG disclosure statements are essential documents in commercial property leasing, providing transparency on environmental, social, and governance practices that impact tenant and investor decisions. These statements typically include energy efficiency ratings, carbon footprint data, and compliance with local sustainability regulations, ensuring alignment with responsible investment standards. |

| 4 | Cybersecurity Clause Addendum | A Cybersecurity Clause Addendum in commercial property leasing outlines tenant and landlord responsibilities for protecting digital infrastructure and sensitive data within the premises. This document includes provisions for data breach notification protocols, cybersecurity measures, liability allocation, and compliance with applicable data protection regulations to mitigate cyber risks in leased commercial properties. |

| 5 | Tenant Financial Viability Report | A Tenant Financial Viability Report is essential for commercial property leasing, as it provides a comprehensive analysis of the tenant's financial stability, creditworthiness, and ability to meet lease obligations. This report typically includes financial statements, credit scores, cash flow analysis, and historical payment records to mitigate risks for landlords and ensure secure tenancy agreements. |

| 6 | Smart Building Access Agreements | Smart Building Access Agreements are essential documents in commercial property leasing that outline the terms of secure entry and technology integration for tenants. These agreements ensure compliance with building security protocols and manage access rights to advanced systems such as biometric scanners and digital keycards, facilitating efficient and controlled tenant access. |

| 7 | Sustainability Performance Notice | A Sustainability Performance Notice is a crucial document in commercial property leasing, detailing the building's environmental impact, energy efficiency, and compliance with local sustainability regulations. It ensures tenants are informed about the property's green credentials and helps promote environmentally responsible leasing decisions. |

| 8 | Green Lease Provisions | Essential documents for commercial property leasing with Green Lease Provisions include the lease agreement explicitly outlining sustainability obligations, energy performance certificates, and environmental compliance reports. Detailed addendums specifying tenant and landlord responsibilities for energy efficiency upgrades and waste reduction strategies ensure clear enforceability of green commitments. |

| 9 | Virtual Inspection Reports | Virtual inspection reports for commercial property leasing provide detailed digital assessments including high-resolution images, floor plans, and condition evaluations, ensuring transparent property conditions without physical visits. These reports are essential documents that streamline decision-making, reduce leasing time, and support legal compliance by verifying the property's status remotely. |

| 10 | Electronic Signature Audit Trails | Electronic signature audit trails are essential for commercial property leasing as they provide a detailed, tamper-proof record of the signing process, ensuring compliance and legal validity. These documents capture timestamps, IP addresses, and authentication methods, enhancing transparency and protecting both landlords and tenants in lease agreements. |

Introduction to Commercial Property Leasing Documentation

Leasing commercial property requires specific documentation to ensure legal compliance and clarity between parties. These documents outline the rights, responsibilities, and terms agreed upon by landlords and tenants.

Key documents include the lease agreement, proof of business registration, and identification credentials. Proper documentation protects both the property owner and the lessee throughout the lease term.

Key Legal Documents in Commercial Leasing

Securing a commercial property lease requires specific legal documents to ensure both parties' rights and responsibilities are clear. These documents protect your interests and establish the terms of the lease agreement.

- Lease Agreement - The primary contract outlining the terms, rent, duration, and obligations of both landlord and tenant.

- Property Title Documents - Proof of ownership and legal authority for leasing the commercial property.

- Compliance Certificates - Verification that the property meets local zoning laws, safety codes, and commercial regulations.

Types of Commercial Lease Agreements

| Types of Commercial Lease Agreements and Required Documents | |

|---|---|

| Gross Lease | In a gross lease, the tenant pays a fixed rent while the landlord covers expenses such as property taxes, insurance, and maintenance. Necessary documents include the lease agreement specifying rent and covered expenses, proof of business operation, and identification for lease signing. |

| Net Lease | A net lease requires the tenant to pay base rent plus some or all operating expenses. Types include single net, double net, and triple net leases. Essential documents comprise the detailed lease agreement outlining expense responsibilities, tenant financial statements, and business licenses. |

| Percentage Lease | This lease bases rent partially on a percentage of sales or revenue in addition to a base rent. Important documents are the lease contract with sales reporting requirements, financial records, and proof of tenant business legitimacy. |

| Ground Lease | The tenant leases the land only and may build on it. Documents required include the ground lease agreement, land use permits, and tenant's proof of financial capability to develop the property. |

| Lease Agreement Essentials | Your commercial property lease should include the signed lease contract, proof of insurance, tenant background checks, security deposit documentation, and any required government permits or zoning approvals. |

Purpose and Importance of the Lease Deed

The lease deed is a fundamental document in commercial property leasing that outlines the terms and conditions agreed upon by the landlord and tenant. It serves as a legal safeguard, ensuring clarity and protection for both parties involved in the transaction.

- Defines Lease Terms - The lease deed clearly specifies rental amount, lease duration, and renewal conditions to prevent disputes.

- Establishes Rights and Obligations - It details responsibilities such as maintenance, repairs, and usage restrictions for both landlord and tenant.

- Legal Evidence - Acts as proof of tenancy and enables enforcement of lease terms in case of disagreements or legal claims.

Rent Agreements: Structure and Clauses

What are the essential documents required for leasing commercial property? The primary document is the rent agreement, which outlines the terms and conditions between the landlord and tenant. This legally binding contract details the responsibilities and rights of both parties during the lease period.

How is a rent agreement for commercial property structured? The document typically includes parties' details, property description, lease duration, payment terms, and security deposit information. Clear clause definitions ensure protection and clarity for both landlord and tenant throughout the lease.

Which specific clauses should be included in a commercial rent agreement? Important clauses cover rent amount, mode of payment, maintenance responsibilities, renewal options, and termination conditions. Including dispute resolution and force majeure clauses helps mitigate potential conflicts and unforeseen circumstances.

Why is it important for you to thoroughly review the rent agreement clauses? Understanding each clause can prevent legal issues and financial losses during your tenancy. Careful examination ensures your rights are protected, and you comply with all obligations outlined in the lease.

Title Deeds and Proof of Property Ownership

Securing the right documents is crucial for commercial property leasing. Title deeds and proof of property ownership serve as primary evidence in the leasing process.

- Title Deeds - Legal documents that establish the ownership of the commercial property being leased.

- Proof of Property Ownership - Official records or certificates confirming the lessor's legal rights to lease the property.

- Verification Process - Ensures the authenticity of the documents, protecting your interests during the lease agreement.

Having clear and verified property documents expedites the leasing process and secures your commercial investment.

Necessary Government Approvals and Licenses

Leasing commercial property requires obtaining essential government approvals and licenses to ensure legal compliance. These documents typically include a valid trade license, occupancy certificate, and environmental clearances as mandated by local authorities. Securing these approvals protects both the landlord and tenant from legal disputes and operational interruptions.

Financial Documents for Lease Validation

Financial documents are essential for validating a commercial property lease, ensuring your ability to meet rental obligations. Key documents include bank statements, tax returns, and profit and loss statements to demonstrate consistent income and financial stability. Landlords often require these to assess risk and confirm the lessee's capacity to pay rent on time.

Common Legal Considerations in Lease Documentation

Commercial property leasing requires specific documents to protect both landlords and tenants. Essential paperwork typically includes the lease agreement, property title, and proof of compliance with zoning laws.

Common legal considerations in lease documentation involve clearly defining rental terms, maintenance responsibilities, and dispute resolution mechanisms. You must ensure the lease outlines permitted uses and subleasing rules to avoid future conflicts. Including clauses for rent escalation and termination conditions safeguards both parties' interests throughout the lease period.

What Documents are Necessary for Commercial Property Leasing? Infographic