An executor must gather important documents to sell inherited property, including the original death certificate, the will of the deceased, and the court-issued letters testamentary or letters of administration. Proof of property ownership, such as the title deed, and a recent property appraisal are also essential for the transaction. Tax clearance certificates and any required release forms ensure legal compliance and a smooth transfer of ownership.

What Documents Does an Executor Need to Sell Inherited Property?

| Number | Name | Description |

|---|---|---|

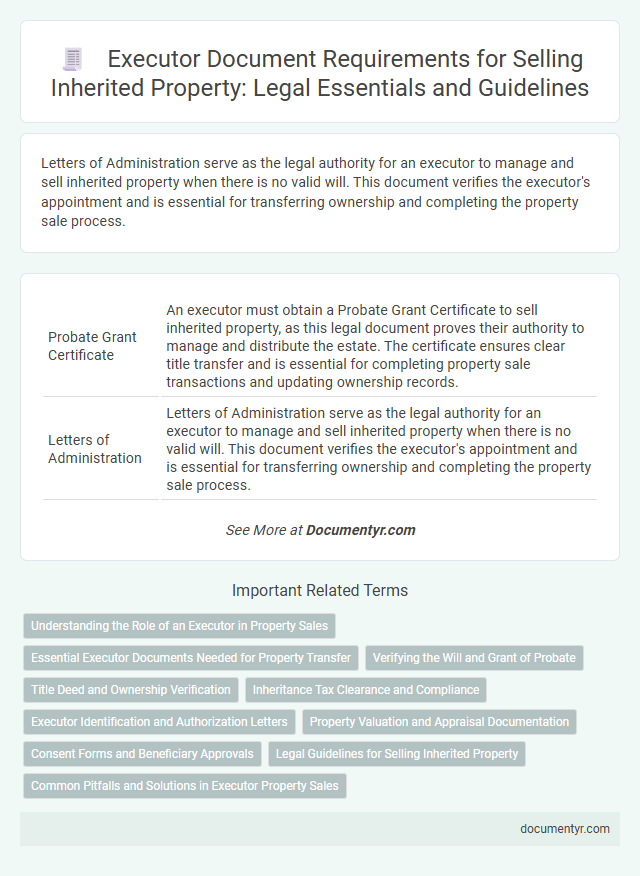

| 1 | Probate Grant Certificate | An executor must obtain a Probate Grant Certificate to sell inherited property, as this legal document proves their authority to manage and distribute the estate. The certificate ensures clear title transfer and is essential for completing property sale transactions and updating ownership records. |

| 2 | Letters of Administration | Letters of Administration serve as the legal authority for an executor to manage and sell inherited property when there is no valid will. This document verifies the executor's appointment and is essential for transferring ownership and completing the property sale process. |

| 3 | Executor's Identification Affidavit | The Executor's Identification Affidavit is a crucial document required to verify the executor's legal authority to manage and sell inherited property, ensuring the transfer complies with probate laws. This affidavit typically includes the executor's personal details, proof of appointment by the court, and affirmation of their fiduciary responsibilities. |

| 4 | Estate Asset Inventory Report | An Estate Asset Inventory Report is essential for an executor to provide a comprehensive list of all inherited property, ensuring accurate valuation and legal compliance during the sale process. This document supports the transfer of ownership and satisfies court requirements by detailing each asset within the estate. |

| 5 | Inheritance Tax Clearance Certificate | An Executor must obtain the Inheritance Tax Clearance Certificate to legally sell inherited property, ensuring all inheritance taxes are settled with HM Revenue & Customs (HMRC). This certificate confirms that the estate's tax liabilities have been paid, allowing the transfer of ownership and completion of the property sale without legal complications. |

| 6 | Testamentary Deed Attribution | An executor must obtain the testamentary deed attribution, a legal document proving their authority to manage and sell the inherited property according to the will. This deed, often issued by the probate court, ensures the executor can transfer title and handle all necessary transactions during the estate settlement process. |

| 7 | Estate Property Disclosure Statement | An executor must provide an Estate Property Disclosure Statement detailing the condition and known issues of the inherited property to comply with legal requirements during the sale process. This document helps ensure transparency, protects the executor from future liability, and facilitates a smoother real estate transaction. |

| 8 | Executor’s Indemnity Bond | An Executor's Indemnity Bond is a crucial legal document that protects the executor from personal liability when managing and selling inherited property, ensuring financial security for beneficiaries. This bond is often required by courts to guarantee the executor fulfills their fiduciary duties honestly and responsibly during the property sale process. |

| 9 | Beneficiary Waiver of Interest | An executor needs a Beneficiary Waiver of Interest to proceed with selling inherited property, as it legally confirms the beneficiary's consent to transfer their rights. This document, along with the death certificate and the will, ensures clear title and prevents future disputes during the property sale process. |

| 10 | Digital Estate Authentication Notice | The executor must present a Digital Estate Authentication Notice to verify their authority over the inherited property, ensuring compliance with digital asset laws and estate regulations. This document is crucial for accessing and managing digital accounts related to the property before completing the sale. |

Understanding the Role of an Executor in Property Sales

An executor plays a crucial role in managing and selling inherited property. They must gather essential documents such as the will, death certificate, and property title to facilitate the sale. Understanding these responsibilities ensures your ability to efficiently transfer ownership and settle the estate.

Essential Executor Documents Needed for Property Transfer

An executor must gather specific legal documents to sell inherited property efficiently. Proper documentation ensures a smooth transfer of ownership and compliance with estate laws.

- Death Certificate - Official proof of the decedent's passing, required to initiate the estate administration.

- Will or Probate Documents - Legal authorization proving the executor's right to manage and sell the estate property.

- Property Title Deed - Document confirming ownership of the inherited property to facilitate the transfer to the buyer.

Verifying the Will and Grant of Probate

Verifying the will is a crucial step when selling inherited property. This process confirms your legal right as the executor to manage and dispose of the estate.

The grant of probate is the official document issued by the court that authorizes you to handle the deceased's assets. You must present the original will along with the grant of probate to prove your executor status. These documents are essential to transfer property ownership and complete the sale legally.

Title Deed and Ownership Verification

What documents are essential for an executor to sell inherited property? The Title Deed is the primary document proving ownership and must be updated to reflect the executor's authority. Ownership verification through a certified copy of the will and death certificate is also required to confirm legal rights.

Inheritance Tax Clearance and Compliance

Executors must secure specific documents to sell inherited property, with a key focus on Inheritance Tax clearance and compliance. Proper documentation ensures legal sale and tax obligations are fully met.

- Inheritance Tax Clearance Certificate - This document proves all inheritance tax liabilities have been settled or approvals obtained from HM Revenue & Customs (HMRC).

- Probate or Confirmation - Legal authorization confirming your executor status, allowing the sale of the deceased's property.

- Property Title Deeds - Evidence of ownership transfer and essential for registering the sale with the Land Registry after tax clearance.

Executor Identification and Authorization Letters

| Document Type | Description | Importance for Selling Inherited Property |

|---|---|---|

| Executor Identification | Official documents that verify the identity and legal status of the executor, such as a government-issued ID and a copy of the death certificate of the deceased. | Confirms the executor's authority to manage and sell the inherited property, preventing unauthorized transactions. |

| Letters Testamentary or Letters of Administration | Legal documents issued by the probate court granting the executor the power to administer the estate, including the sale of property. | Provides formal authorization for the executor to act on behalf of the estate, ensuring the transfer of title is legitimate and recognized by buyers and financial institutions. |

| Authorization Letters | Specific letters granting permission from the probate court or co-executors to the executor, if applicable, allowing the sale of the inherited property. | Clarifies any limitations or shared authority, facilitating smooth transactions when multiple parties are involved in managing the estate. |

Property Valuation and Appraisal Documentation

An executor must obtain a professional property valuation to establish the accurate market value of the inherited property. This valuation is essential for tax reporting and equitable distribution among beneficiaries.

Appraisal documentation from a certified appraiser provides an unbiased estimate of the property's worth at the time of inheritance. These documents support legal and financial processes during the sale of the estate.

Consent Forms and Beneficiary Approvals

An executor must obtain consent forms signed by all beneficiaries to proceed with selling inherited property, ensuring legal authorization. These consent forms serve as official proof that beneficiaries agree to the sale and the distribution of proceeds. Without beneficiary approvals, the executor may face legal challenges or delays in the property sale process.

Legal Guidelines for Selling Inherited Property

Selling inherited property requires specific legal documents to ensure a smooth transfer. Understanding these requirements helps you comply with probate laws and sell the property correctly.

- Death Certificate - Official proof of the deceased person's passing necessary to initiate property transfer.

- Will or Probate Documents - Legal papers that identify you as the executor and authorize you to handle the property.

- Property Title or Deed - Legal ownership document that must be updated to reflect the transfer after sale.

Reviewing local estate and probate laws is essential for complying with all legal guidelines related to selling inherited property.

What Documents Does an Executor Need to Sell Inherited Property? Infographic