Foreigners looking to buy property in the US need a valid passport, proof of income or financial stability, and a taxpayer identification number (TIN) such as an Individual Taxpayer Identification Number (ITIN). Lenders may also require credit reports, and non-residents often need to provide additional documentation like a visa or residency status. It is essential to have all legal documents verified by a real estate attorney to ensure compliance with federal and state regulations.

What Documents Does a Foreigner Need to Buy Property in the US?

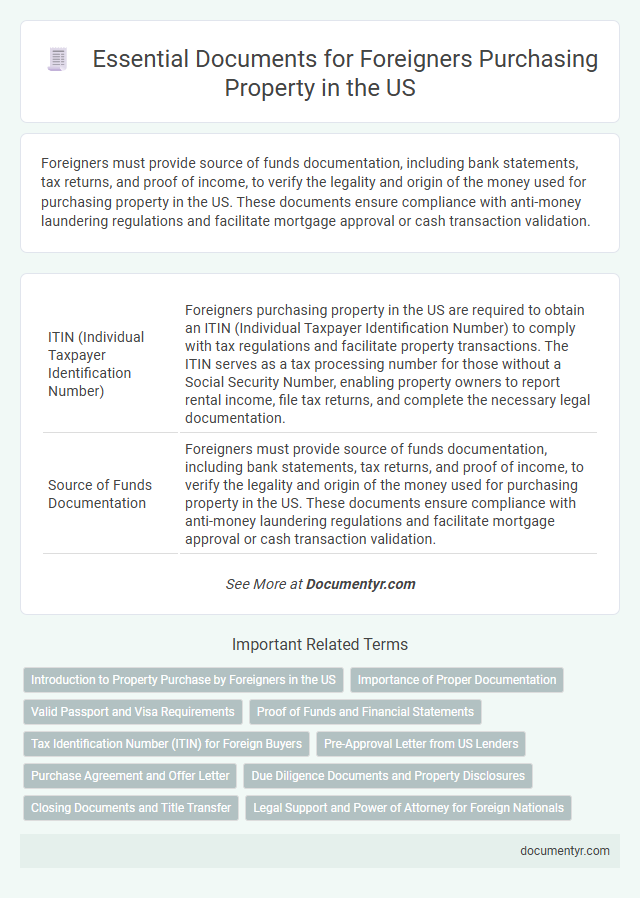

| Number | Name | Description |

|---|---|---|

| 1 | ITIN (Individual Taxpayer Identification Number) | Foreigners purchasing property in the US are required to obtain an ITIN (Individual Taxpayer Identification Number) to comply with tax regulations and facilitate property transactions. The ITIN serves as a tax processing number for those without a Social Security Number, enabling property owners to report rental income, file tax returns, and complete the necessary legal documentation. |

| 2 | Source of Funds Documentation | Foreigners must provide source of funds documentation, including bank statements, tax returns, and proof of income, to verify the legality and origin of the money used for purchasing property in the US. These documents ensure compliance with anti-money laundering regulations and facilitate mortgage approval or cash transaction validation. |

| 3 | FIRPTA Compliance Certificate | Foreign buyers purchasing property in the US must obtain a FIRPTA Compliance Certificate, which verifies that the foreign seller has met withholding tax requirements under the Foreign Investment in Real Property Tax Act. This certificate is essential to ensure the transaction adheres to IRS regulations and prevents potential legal or financial penalties. |

| 4 | OFAC Screening Clearance | Foreigners seeking to buy property in the US must complete OFAC screening clearance to ensure compliance with the Office of Foreign Assets Control and avoid transactions involving sanctioned individuals or entities. Essential documents include a valid passport, proof of address, a tax identification number, and the OFAC clearance certificate verifying the buyer is not on restricted lists. |

| 5 | Proof of Legal Entry (I-94 or Visa Stamp) | Foreigners buying property in the US must provide proof of legal entry, such as a valid I-94 arrival/departure record or a visa stamp in their passport, to comply with federal regulations. These documents verify the individual's lawful status and entry date, which are critical for property transactions and tax reporting. |

| 6 | Foreign Investment Due Diligence Report | Foreign buyers must obtain a Foreign Investment Due Diligence Report, which includes verification of identity, proof of lawful presence, and detailed property title searches to ensure compliance with U.S. regulations. This report also covers tax identification requirements such as obtaining an Individual Taxpayer Identification Number (ITIN) and reviews any restrictions under the Foreign Investment in Real Property Tax Act (FIRPTA). |

| 7 | Cross-Border Wire Authorization | Foreigners buying property in the US must provide a valid passport, visa, and Individual Taxpayer Identification Number (ITIN), along with cross-border wire authorization forms required by banks to transfer funds internationally. These documents ensure compliance with anti-money laundering regulations and facilitate secure, traceable transactions during the property acquisition process. |

| 8 | Letter of No Criminal Record (International Background Check) | Foreigners seeking to buy property in the US must often provide a Letter of No Criminal Record, an international background check verifying the absence of criminal history in their home country. This document is crucial to comply with US regulations and ensure eligibility for property ownership, enhancing the legitimacy of the transaction. |

| 9 | FinCEN Geographic Targeting Order (GTO) Disclosure | Foreign buyers purchasing property in the US must comply with the FinCEN Geographic Targeting Order (GTO) Disclosure, which requires revealing the identity of individuals behind shell companies used in transactions exceeding $300,000 in specified metropolitan areas. This documentation ensures transparency by mandating the collection and reporting of beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN). |

| 10 | Anti-Money Laundering (AML) Questionnaire | Foreign buyers must complete an Anti-Money Laundering (AML) questionnaire to verify the source of funds and comply with U.S. Treasury regulations, ensuring transparency in property transactions. This document is crucial for identifying potential risks and preventing illicit financial activities in real estate purchases. |

Introduction to Property Purchase by Foreigners in the US

Buying property in the US as a foreigner requires specific documentation to ensure a smooth transaction. Understanding these requirements helps you prepare efficiently for your investment.

- Valid Passport - A government-issued passport serves as your primary identification throughout the purchase process.

- Tax Identification Number (TIN or ITIN) - Necessary for tax reporting and financial transactions related to the property.

- Proof of Funds - Documents verifying your financial capability to complete the purchase, such as bank statements or letters from financial institutions.

Having these documents ready streamlines your property acquisition in the US.

Importance of Proper Documentation

What documents does a foreigner need to buy property in the US? Proper documentation is essential to ensure a smooth transaction and legal ownership. You must prepare identification, proof of funds, and tax identification numbers to complete the purchase.

Valid Passport and Visa Requirements

Foreigners interested in purchasing property in the US must have a valid passport to verify their identity. This essential document serves as the primary form of identification throughout the buying process.

Visa requirements vary based on the buyer's nationality and the intended duration of stay. While some visas like the B-2 tourist visa allow property visits, others may be necessary for longer-term investment purposes. It is crucial to check visa eligibility and ensure compliance with US immigration laws before proceeding with a property purchase.

Proof of Funds and Financial Statements

Foreign buyers must provide specific documents to prove their financial capability when purchasing property in the US. Proof of Funds and Financial Statements are crucial to verify the source and availability of funds.

- Proof of Funds - A document showing the buyer's available liquid assets, such as bank statements or investment accounts, to confirm the ability to cover the purchase price.

- Financial Statements - Comprehensive records including income statements and balance sheets that detail the buyer's overall financial health and asset legitimacy.

- Verification Process - Lenders or sellers often require authenticated documents to prevent fraud and ensure compliance with US real estate regulations for foreign nationals.

Tax Identification Number (ITIN) for Foreign Buyers

```html| Document | Description | Purpose | Additional Notes |

|---|---|---|---|

| Tax Identification Number (ITIN) | A unique nine-digit number issued by the Internal Revenue Service (IRS) to non-U.S. residents and foreigners who are not eligible for a Social Security Number (SSN). | Required for tax reporting when purchasing and owning property in the U.S., including rental income reporting and filing tax returns. | Essential for foreigners to comply with U.S. tax laws; can be obtained by submitting IRS Form W-7 with proof of identity and foreign status. |

| Valid Passport | Government-issued travel document that verifies identity and citizenship. | Used as primary identification during property purchase and ITIN application. | Must be current and valid throughout the transaction process. |

| Visa or Immigration Documents | Documents proving legal presence in the United States such as tourist, investor, or other visa types. | Needed to confirm legal entry status for both property purchase and ITIN application procedures. | Visa requirements vary depending on nationality and length of stay. |

| Property Purchase Agreement | Legal contract between buyer and seller outlining terms of sale. | Necessary to complete the transaction and support ITIN application with proof of U.S. property ownership. | Should be reviewed by a qualified real estate attorney. |

| Proof of Address | Documents such as utility bills or bank statements confirming current foreign or U.S. address. | Required to satisfy identification and verification rules for property and tax purposes. | Must be recent, typically within the last 3 months. |

Pre-Approval Letter from US Lenders

Foreigners looking to buy property in the US must gather specific documents to complete the purchase smoothly. One essential document is the Pre-Approval Letter from US lenders, which confirms your ability to secure financing.

A Pre-Approval Letter demonstrates financial credibility and speeds up the buying process. US lenders require proof of income, credit history, and identification to issue this crucial document.

Purchase Agreement and Offer Letter

Foreigners buying property in the US must prepare essential documents to complete the purchase. A Purchase Agreement is a legally binding contract outlining the terms and conditions of the sale, including price, contingencies, and closing date. An Offer Letter serves as the initial proposal to the seller, expressing the buyer's intent and proposed purchase price.

Due Diligence Documents and Property Disclosures

Foreigners looking to buy property in the US must gather key due diligence documents, including the title report, property survey, and proof of funds. Property disclosures, such as lead-based paint warnings and any known structural issues, are critical to assess the property's condition and legal status. Ensuring you have these documents safeguards your investment and facilitates a smooth transaction process.

Closing Documents and Title Transfer

When purchasing property in the US, foreigners must prepare essential closing documents to finalize the transaction securely. These include the Purchase Agreement, Closing Disclosure, and the Title Insurance Policy.

Title transfer documents are critical to legally establish ownership and protect against future claims. You'll need to review and sign the Deed, which officially transfers property ownership to you, and ensure it is recorded with the local county office.

What Documents Does a Foreigner Need to Buy Property in the US? Infographic