To gift real estate property, essential documents include the deed of gift, which legally transfers ownership from the donor to the recipient, and a properly executed and notarized gift deed. The deed must clearly describe the property, identify the parties involved, and be registered with the local land registry or recorder's office to validate the transfer. Additional documents such as the donor's identification, proof of ownership, and tax clearance certificates may also be required depending on jurisdiction.

What Documents are Needed for Gifting Real Estate Property?

| Number | Name | Description |

|---|---|---|

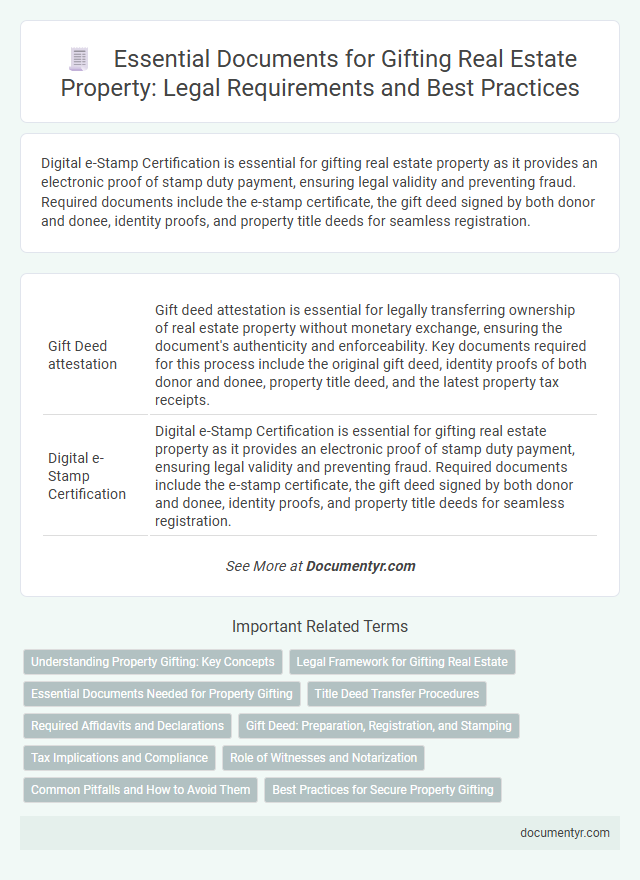

| 1 | Gift Deed attestation | Gift deed attestation is essential for legally transferring ownership of real estate property without monetary exchange, ensuring the document's authenticity and enforceability. Key documents required for this process include the original gift deed, identity proofs of both donor and donee, property title deed, and the latest property tax receipts. |

| 2 | Digital e-Stamp Certification | Digital e-Stamp Certification is essential for gifting real estate property as it provides an electronic proof of stamp duty payment, ensuring legal validity and preventing fraud. Required documents include the e-stamp certificate, the gift deed signed by both donor and donee, identity proofs, and property title deeds for seamless registration. |

| 3 | Encumbrance Certificate (latest) | An Encumbrance Certificate (latest) is essential for gifting real estate property as it verifies the property is free of legal dues or mortgages, ensuring a clear title transfer. This document, obtained from the sub-registrar's office, provides a history of all transactions related to the property, which protects both donor and recipient from future disputes. |

| 4 | PAN-Aadhaar Linking Proof | For gifting real estate property, essential documents include the registered gift deed, proof of identity, proof of ownership, and PAN card linked with Aadhaar as mandatory for verifying the donor's and donee's tax compliance. The PAN-Aadhaar linking proof ensures that capital gains tax and stamp duty are accurately assessed, preventing legal complications in property transfer. |

| 5 | No Objection Certificate (NOC) from development authority | A No Objection Certificate (NOC) from the development authority is essential when gifting real estate property to ensure the transfer complies with local regulations and there are no legal encumbrances on the property. This document verifies that the property is free from disputes, outstanding dues, and that the authority permits the transaction, safeguarding the interests of both the donor and the recipient. |

| 6 | Mutation Application Slip | The mutation application slip is essential for transferring property ownership in real estate gifting, serving as official proof that the mutation process has been initiated with the local land revenue office. This document ensures the property's title is updated in government records, facilitating legal recognition of the new owner post-gift transfer. |

| 7 | Donor and Donee Relationship Affidavit | The Donor and Donee Relationship Affidavit is a critical document in gifting real estate property, verifying the personal relationship between the parties involved to ensure the transaction's legitimacy. This affidavit helps prevent fraud and supports the transfer process by confirming the donor's intent and the donee's acceptance, making it essential for legal and tax purposes. |

| 8 | Property Title Chain Document | The property title chain document is essential for gifting real estate as it verifies legal ownership and ensures a clear transfer without disputes. This document traces the history of ownership, confirming that the current owner has the right to gift the property and that no encumbrances or liens exist. |

| 9 | Sub-Registrar Digital Token | The Sub-Registrar Digital Token is essential for gifting real estate property, serving as proof of appointment for property registration at the Sub-Registrar's office. Alongside the token, critical documents include the gift deed, identification proofs of the donor and donee, property title deed, and the latest property tax receipt, all required to complete the legal transfer process electronically. |

| 10 | KYC Verification Receipt | KYC verification receipt is essential for gifting real estate property as it authenticates the identity of both the donor and the recipient, ensuring compliance with legal regulations and preventing fraud. This document, along with the gift deed, property title, and encumbrance certificate, forms the core paperwork required for a valid property gift transaction. |

Understanding Property Gifting: Key Concepts

Gifting real estate property requires specific legal documents to ensure a smooth and valid transfer of ownership. Understanding the key documents helps both the donor and recipient comply with legal and tax obligations.

The primary document needed is the gift deed, which legally transfers ownership from the donor to the recipient without monetary exchange. Additional documents may include the title deed, property tax receipts, and no-objection certificates from relevant authorities.

Legal Framework for Gifting Real Estate

Gifting real estate property requires a clear understanding of the legal framework and necessary documentation to ensure a valid transfer. Proper documentation protects the rights of both the donor and the recipient under property laws.

- Gift Deed - A legally binding document that explicitly states the transfer of ownership without consideration.

- Title Deed - Proof of the donor's ownership and the subject property being gifted.

- Encumbrance Certificate - Evidence that the property is free from any legal liabilities or mortgages.

Registration of the gift deed with the local land registry is mandatory to formalize the transaction according to the legal framework.

Essential Documents Needed for Property Gifting

Gifting real estate property requires essential documents such as the gift deed, which legally transfers ownership without monetary exchange. You must also provide the property title deed to establish clear ownership and ensure the property is free from encumbrances. Additional documents include identification proofs of both donor and recipient, and a no-objection certificate if applicable to comply with local regulations.

Title Deed Transfer Procedures

Gifting real estate property requires careful attention to the Title Deed transfer procedures to ensure a legally valid transaction. You must gather specific documents before initiating the transfer process.

- Original Title Deed - This document proves ownership and is essential for transferring the property to the recipient.

- Gift Deed - A legally drafted and notarized gift deed outlining the transfer without consideration must be prepared and signed.

- Identification Proofs - Both the donor and the recipient need to provide valid ID proofs such as government-issued identification for verification purposes.

Required Affidavits and Declarations

Gifting real estate property requires specific documents to ensure a legal transfer. Among these, affidavits and declarations play a crucial role in validating the gift.

Required affidavits typically include a gift affidavit stating that the property is being transferred without monetary consideration. Declarations often confirm the donor's intent and the donee's acceptance of the gift. These documents help prevent disputes and provide clear evidence of the gift's nature.

Gift Deed: Preparation, Registration, and Stamping

| Document | Description | Importance in Gifting Real Estate |

|---|---|---|

| Gift Deed | A legal document transferring ownership of the property without any exchange of money. | Essential for formalizing the gift; clearly states the donor and recipient details, property description, and declaration of gift. |

| Preparation of Gift Deed | Drafted carefully with accurate details, including the donor's consent and explicit transfer of ownership. | Ensures the deed is legally valid, avoids future disputes, and complies with property laws. |

| Registration of Gift Deed | Mandatory process where the Gift Deed is submitted and registered at the local Sub-Registrar Office. | Provides legal sanctity and makes the transfer official and public, protecting the rights of the donee. |

| Stamping of Gift Deed | Payment of Stamp Duty as per state regulations, which is affixed to the Gift Deed document. | Validates the deed; low stamp duty rates often apply to gifts between close relatives, benefiting Your transaction. |

| Supporting Documents | Includes property title deed, identity proof of donor and donee, and no-objection certificate if applicable. | Necessary for verification and ensuring clear ownership transfer without legal hindrances. |

Tax Implications and Compliance

Gifting real estate property requires essential documents such as the deed, gift tax return (IRS Form 709), and a property appraisal to establish fair market value. Understanding tax implications like gift tax exemptions and potential capital gains taxes is crucial for compliance with IRS regulations. Ensuring these documents are accurately prepared helps protect your interests and avoid legal issues during the transfer process.

Role of Witnesses and Notarization

When gifting real estate property, certain documents are essential to ensure the transfer is legally valid. These typically include the deed of gift, a title deed, and proof of identification for both the donor and recipient.

The role of witnesses is crucial as they verify the authenticity of the signatures on the deed of gift. Witnesses provide an added layer of security, confirming that the transaction was voluntary and free from coercion.

Notarization is another vital step in the gifting process, as it involves a notary public who certifies the identity of the parties involved. This certification helps prevent fraud and ensures that the document is legally binding and recognized by courts and government agencies.

Your signed deed of gift, witnessed and notarized, must then be filed with the local land registry or recorder's office. This final step officially records the change of ownership and protects the rights of the recipient.

Common Pitfalls and How to Avoid Them

Gifting real estate property requires specific legal documentation to ensure a smooth transfer and avoid future disputes. Understanding common pitfalls can help streamline the gifting process and protect both parties involved.

- Gift Deed - This legal document formally transfers ownership and must be properly drafted and registered to be valid.

- Title Deed Verification - Ensuring the property's title is clear prevents disputes about ownership during or after the gifting process.

- Tax Implications Documentation - Properly addressing gift tax and capital gains tax obligations avoids unexpected financial liabilities for the donor and recipient.

What Documents are Needed for Gifting Real Estate Property? Infographic