When filing a property tax assessment appeal, essential documents include the original property tax assessment notice, recent property tax bills, and a completed appeal form. Supporting evidence such as recent property appraisals, sales data of comparable properties, and photographs of the property's condition can strengthen the case. Providing proof of any errors in the assessor's report or documentation of improvements can also be crucial in achieving a successful appeal.

What Documents are Needed for Property Tax Assessment Appeals?

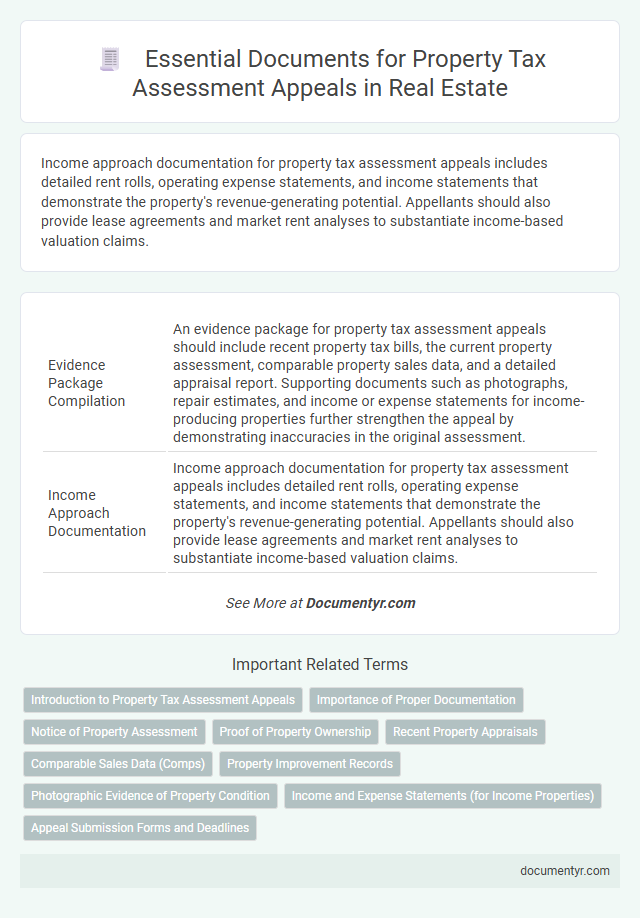

| Number | Name | Description |

|---|---|---|

| 1 | Evidence Package Compilation | An evidence package for property tax assessment appeals should include recent property tax bills, the current property assessment, comparable property sales data, and a detailed appraisal report. Supporting documents such as photographs, repair estimates, and income or expense statements for income-producing properties further strengthen the appeal by demonstrating inaccuracies in the original assessment. |

| 2 | Income Approach Documentation | Income approach documentation for property tax assessment appeals includes detailed rent rolls, operating expense statements, and income statements that demonstrate the property's revenue-generating potential. Appellants should also provide lease agreements and market rent analyses to substantiate income-based valuation claims. |

| 3 | Comparable Sales Analysis Report | A Comparable Sales Analysis Report is essential for property tax assessment appeals as it provides detailed data on recent sales of similar properties, helping to establish a fair market value. This report includes sales prices, property features, and location details, allowing for a precise comparison to support your appeal. |

| 4 | Valuation Protest Statement | A Valuation Protest Statement is a crucial document for property tax assessment appeals, detailing specific reasons for disputing the assessed value and providing evidence such as recent appraisals, property condition reports, and comparable sales data. This statement must be precise and supported by relevant documentation to effectively challenge the assessor's valuation and achieve a fair property tax adjustment. |

| 5 | Appraisal Gap Support | Appraisal gap support documents for property tax assessment appeals include a current independent appraisal report demonstrating the market value discrepancy and recent comparable sales data that justify the assessed value adjustment. Property owners should also provide evidence of prior tax bills and assessment notices to establish a clear basis for the appeal and highlight the financial impact of the appraisal gap. |

| 6 | Property Condition Disclosure | Property condition disclosure statements are crucial documents for property tax assessment appeals, providing detailed information on the current state and any defects of the property. These disclosures help assessors accurately evaluate the property's value by highlighting issues such as structural damage, needed repairs, or environmental hazards. |

| 7 | Rent Roll Verification | Rent roll verification requires detailed lease agreements, tenant payment histories, and occupancy schedules to accurately support property income claims during tax assessment appeals. Providing comprehensive rent rolls helps establish the property's fair market rental value and challenges inflated assessments effectively. |

| 8 | Cost Segregation Study | Cost segregation study reports, including detailed engineering analyses and asset reclassifications, are essential documents for property tax assessment appeals to demonstrate accelerated depreciation and reduce property tax liability. These studies provide specific schedules identifying personal property components, helping assessors accurately assess the value and support a lower tax assessment. |

| 9 | GIS Mapping Exhibit | A GIS Mapping Exhibit is crucial for property tax appeals as it visually defines the exact boundaries and characteristics of the property, supporting accurate valuation claims. This exhibit, combined with tax assessment records and property deeds, provides compelling evidence to dispute incorrect assessments. |

| 10 | Market Adjustment Worksheet | The Market Adjustment Worksheet is essential for property tax assessment appeals as it provides detailed comparative market data demonstrating discrepancies in valuation. This document supports accurate reassessment by highlighting recent sales and adjustments, reinforcing the appeal with tangible market evidence. |

Introduction to Property Tax Assessment Appeals

Property tax assessment appeals allow you to challenge the assessed value of your property if you believe it is incorrect. This process can lead to a reduction in your property tax liability if successful.

- Property Tax Assessment Notice - Official document showing the current assessed value used for tax calculations.

- Evidence of Property Value - Includes recent appraisals, sales data of comparable properties, or market analysis reports.

- Supporting Documents - May consist of photographs, repair estimates, or documentation of property condition affecting value.

Importance of Proper Documentation

Proper documentation is crucial for a successful property tax assessment appeal, as it provides clear evidence supporting your case. Accurate and thorough records help ensure that the appeal is reviewed fairly and accurately.

- Property Tax Assessment Notice - This official document outlines the assessed value and is essential for contesting the valuation.

- Comparable Property Data - Records of similar properties' assessments demonstrate discrepancies and support a lower valuation.

- Property Appraisal Report - A professional appraisal provides an independent evaluation of the property's market value.

Notice of Property Assessment

The Notice of Property Assessment is a crucial document for property tax assessment appeals. It details the assessed value assigned to the property by the local tax authority. This notice serves as the primary evidence needed to initiate and support your appeal process effectively.

Proof of Property Ownership

Proof of property ownership is a crucial document for property tax assessment appeals. It establishes the legal right to dispute the assessed value with the tax authority.

Common proofs include a recorded deed, a property tax bill showing the owner's name, or a title insurance policy. These documents demonstrate clear ownership and support the legitimacy of the appeal. Providing accurate ownership evidence helps ensure the appeal is processed efficiently.

Recent Property Appraisals

Recent property appraisals are essential documents for property tax assessment appeals, providing an updated market value of the property. These appraisals help demonstrate discrepancies between the assessed value and the actual market value.

Supporting evidence like detailed appraisal reports, including property condition and comparable sales data, strengthens the appeal case. Accurate and current appraisal documents improve the likelihood of a successful reassessment.

Comparable Sales Data (Comps)

What documents are needed to support a property tax assessment appeal? Comparable sales data (comps) is crucial for demonstrating that a property's assessed value is inaccurate. These documents include recent sales records of similar properties in the same area to provide a benchmark for fair market value.

Property Improvement Records

Property improvement records play a crucial role in supporting your property tax assessment appeal. These documents provide evidence of any changes or enhancements made to the property that may affect its assessed value.

- Building Permits - Official records that verify authorized renovations and additions to the property.

- Receipts and Invoices - Proof of expenses incurred for property improvements, including materials and labor costs.

- Inspection Reports - Professional assessments that detail the scope and quality of completed property improvements.

Compiling thorough property improvement records increases the chances of a successful property tax assessment appeal.

Photographic Evidence of Property Condition

Photographic evidence plays a crucial role in property tax assessment appeals by visually documenting the current condition of the property. Clear, dated images can highlight issues such as structural damage, deferred maintenance, or discrepancies from the assessor's records.

Submitting high-quality photos supports your case by providing tangible proof that may justify a lower tax assessment. Ensure the images are organized and referenced in your appeal documentation to strengthen your argument effectively.

Income and Expense Statements (for Income Properties)

| Document Type | Description | Importance for Appeal |

|---|---|---|

| Income and Expense Statements | Detailed records of rental income, operational costs, maintenance expenses, and other financial data related to income-producing properties. | Critical for demonstrating the actual income generated by income properties, helping to establish a fair property value during tax assessment appeals. |

| Lease Agreements | Contracts outlining rental terms and tenant obligations. | Supports income claims and validity of income figures presented. |

| Property Tax Assessment Notice | Official document stating the current assessment and tax amount. | Foundation for the appeal process, showing the assessment being challenged. |

| Comparable Property Data | Market analysis reports of similar income properties in the area. | Shows discrepancies in assessed values based on market conditions. |

What Documents are Needed for Property Tax Assessment Appeals? Infographic