Refinancing a rental property requires specific documents to verify ownership, income, and property value. Key documents include recent mortgage statements, proof of rental income such as lease agreements or tax returns, and property tax assessments. Lenders also typically request credit reports, bank statements, and a current property appraisal to evaluate the financial risk and asset condition.

What Documents are Required for Refinancing a Rental Property?

| Number | Name | Description |

|---|---|---|

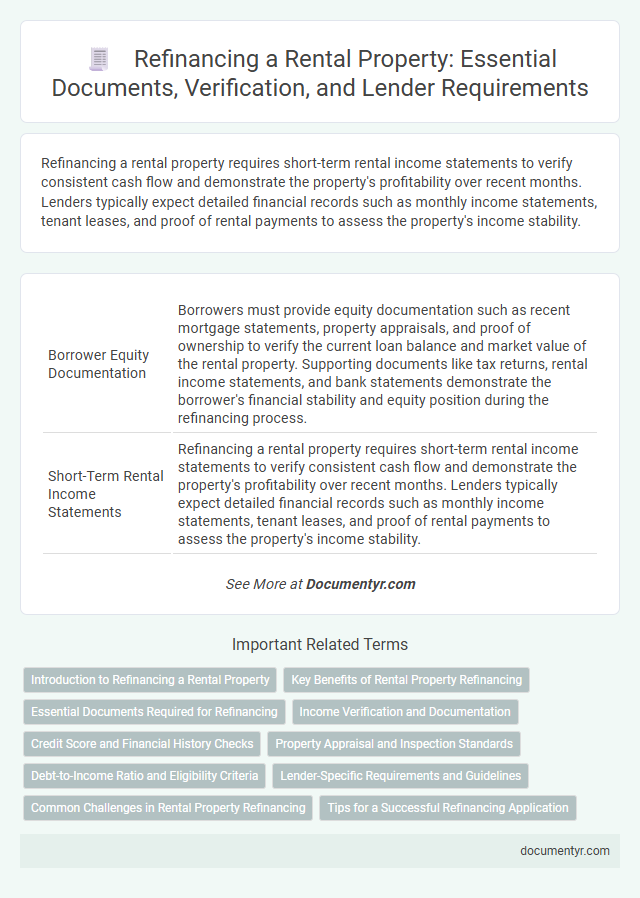

| 1 | Borrower Equity Documentation | Borrowers must provide equity documentation such as recent mortgage statements, property appraisals, and proof of ownership to verify the current loan balance and market value of the rental property. Supporting documents like tax returns, rental income statements, and bank statements demonstrate the borrower's financial stability and equity position during the refinancing process. |

| 2 | Short-Term Rental Income Statements | Refinancing a rental property requires short-term rental income statements to verify consistent cash flow and demonstrate the property's profitability over recent months. Lenders typically expect detailed financial records such as monthly income statements, tenant leases, and proof of rental payments to assess the property's income stability. |

| 3 | Digital Lease Validation | Digital lease validation requires electronic copies of the original lease agreement, tenant payment history, and consent forms to verify rental income and tenancy terms. Lenders also demand digital proof of property ownership, current mortgage statements, and recent property tax assessments to complete the refinancing application. |

| 4 | Automated Rental Payment Histories | Automated rental payment histories provide an accurate, verifiable record of on-time tenant payments, crucial for refinancing a rental property as they demonstrate consistent cash flow to lenders. These digital histories streamline the approval process by supplying detailed transaction dates, amounts, and tenant information directly from payment platforms. |

| 5 | Landlord LLC Operating Agreements | Refinancing a rental property requires submitting the Landlord LLC Operating Agreement to verify ownership structure and management responsibilities. This document is essential for lenders to assess the LLC's legal authority and confirm decision-making protocols. |

| 6 | Property Management Contract Proofs | Refinancing a rental property requires submitting a property management contract to verify professional oversight and income stability, alongside proof of rental income such as recent lease agreements and bank statements. Lenders also demand documentation of tax returns and property appraisal reports to assess the property's value and financial viability. |

| 7 | DSCR (Debt Service Coverage Ratio) Reports | DSCR reports are critical documents required for refinancing a rental property, providing lenders with detailed analysis of the property's net operating income versus debt obligations to assess repayment capability. Alongside DSCR reports, borrowers typically must submit proof of income, rental property tax returns, current mortgage statements, and property appraisal reports to complete the refinancing application. |

| 8 | e-Signature Authorization Forms | Refinancing a rental property requires submitting e-Signature Authorization Forms to streamline the mortgage application process, allowing secure and legal electronic signing of loan documents. These forms verify your consent to use digital signatures for all related paperwork, expediting approvals and reducing paperwork delays. |

| 9 | Fannie Mae Form 1007 (Single-Family Comparable Rent Schedule) | Fannie Mae Form 1007 (Single-Family Comparable Rent Schedule) is essential for refinancing a rental property, providing detailed rental market analysis to verify the property's income potential. This document supports accurate underwriting by comparing similar rental units in the area, ensuring the investor's income projections align with market standards. |

| 10 | Non-Occupancy Certification | Non-Occupancy Certification is a critical document for refinancing rental properties, proving that the property is not the borrower's primary residence and is instead leased to tenants. Lenders require this certification alongside the mortgage statement, current lease agreements, and proof of rental income to assess risk and verify the property's rental status during the refinancing process. |

Introduction to Refinancing a Rental Property

Refinancing a rental property involves replacing an existing mortgage with a new loan, often to secure better terms or lower interest rates. This process requires specific documentation to verify the property's value and the borrower's financial status.

- Proof of Income - Documents like tax returns and pay stubs demonstrate the borrower's ability to repay the loan.

- Property Appraisal - An appraisal report provides an updated market value of the rental property.

- Current Mortgage Statement - This shows the existing loan balance and payment history on the rental property.

Gathering these documents streamlines the refinancing process, ensuring lenders have accurate information to assess the loan application.

Key Benefits of Rental Property Refinancing

Refinancing a rental property requires specific documents to ensure a smooth approval process. Understanding these requirements helps maximize key benefits like lower interest rates and improved cash flow.

- Proof of Income - Recent tax returns and rental income statements verify your ability to repay the loan.

- Credit Report - Lenders assess your creditworthiness through an updated credit report for better loan terms.

- Property Appraisal - An official appraisal determines the current market value of the rental property to secure appropriate refinancing amounts.

- Loan Application - A completed and accurate loan application provides essential information for refinancing approval.

- Current Mortgage Statements - These documents help lenders understand existing loan terms and balances on the rental property.

Essential Documents Required for Refinancing

Refinancing a rental property requires specific documentation to ensure a smooth approval process. Essential documents verify your financial stability and property details.

Loan applications typically require proof of income, such as tax returns and pay stubs, to demonstrate your ability to repay. You must provide rental property income statements and current lease agreements to confirm rental revenue. Also, submit property tax records, insurance policies, and a recent appraisal report to validate the property's value and condition.

Income Verification and Documentation

Income verification is a critical component when refinancing a rental property, requiring recent pay stubs, tax returns, and bank statements to demonstrate consistent cash flow. Lenders often request Schedule E from tax returns to confirm rental income and operating expenses. Providing thorough documentation ensures a smoother approval process and establishes the property's income reliability.

Credit Score and Financial History Checks

| Document Type | Description |

|---|---|

| Credit Report | Shows credit score and detailed credit history, essential for lenders to assess borrower's creditworthiness. A strong credit score can secure better refinancing terms. |

| Proof of Income | Includes pay stubs, tax returns, or rental income statements. Verifies the borrower's ability to make loan payments, impacting loan approval. |

| Rental Property Financial Statements | Includes profit and loss statements, rent rolls, and expense reports. Demonstrates the cash flow and financial management of the rental property. |

| Bank Statements | Reflects current financial stability and availability of funds. Lenders use this to confirm income deposits and evaluate liquidity. |

Property Appraisal and Inspection Standards

Refinancing a rental property requires specific documents to verify its value and condition. A detailed property appraisal report is essential to establish the current market value accurately.

The appraisal must follow industry standards, ensuring an unbiased assessment based on comparable market data. A thorough property inspection report is also necessary to confirm the property's physical condition and identify any needed repairs.

Debt-to-Income Ratio and Eligibility Criteria

Refinancing a rental property requires specific documents to verify your financial status and property details. Key documents include recent pay stubs, tax returns, rental income statements, and the current mortgage statement.

Lenders emphasize the debt-to-income (DTI) ratio to assess your eligibility for refinancing, focusing on your ability to manage additional loan payments. Providing accurate documentation helps ensure your DTI meets lender criteria, improving the chances of approval.

Lender-Specific Requirements and Guidelines

Refinancing a rental property involves submitting various documents that differ based on lender-specific requirements and guidelines. Understanding these requirements helps streamline the approval process and ensures compliance with lender policies.

- Proof of Income - Lenders typically require tax returns, pay stubs, or profit and loss statements to verify the borrower's income stability and ability to repay.

- Property Documentation - Rental property appraisal reports, lease agreements, and current property tax statements are essential for lenders to assess property value and rental income.

- Credit and Financial Records - Detailed credit reports, bank statements, and debt information help lenders evaluate financial health and risk factors specific to the borrower.

Common Challenges in Rental Property Refinancing

Refinancing a rental property requires essential documents such as the current mortgage statement, proof of rental income, and comprehensive tax returns. Lenders often request detailed property information and credit reports to assess eligibility accurately. Common challenges include compiling consistent rental income records and addressing discrepancies in credit history.

What Documents are Required for Refinancing a Rental Property? Infographic