To transfer property title to a family member, essential documents include the original title deed, a completed and signed deed of transfer or gift deed, and proof of identity for both parties involved. Supporting paperwork such as property tax receipts, a no-objection certificate (NOC) from the housing society, and an updated encumbrance certificate may also be required to verify clear ownership and legal compliance. Ensuring all documents are properly notarized and registered with the local land registry office finalizes the transfer process smoothly.

What Documents are Needed for Transferring Property Title to a Family Member?

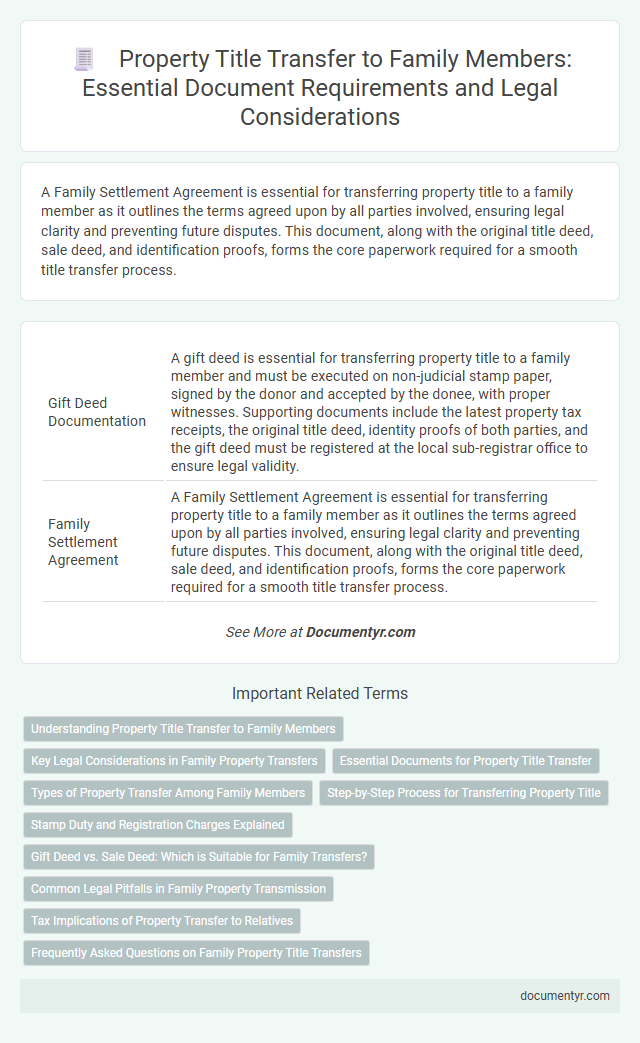

| Number | Name | Description |

|---|---|---|

| 1 | Gift Deed Documentation | A gift deed is essential for transferring property title to a family member and must be executed on non-judicial stamp paper, signed by the donor and accepted by the donee, with proper witnesses. Supporting documents include the latest property tax receipts, the original title deed, identity proofs of both parties, and the gift deed must be registered at the local sub-registrar office to ensure legal validity. |

| 2 | Family Settlement Agreement | A Family Settlement Agreement is essential for transferring property title to a family member as it outlines the terms agreed upon by all parties involved, ensuring legal clarity and preventing future disputes. This document, along with the original title deed, sale deed, and identification proofs, forms the core paperwork required for a smooth title transfer process. |

| 3 | No Objection Certificate (NOC) from Heirs | A No Objection Certificate (NOC) from heirs is essential for transferring property title to a family member, confirming that all rightful heirs consent to the transaction and waive any future claims. This document legally safeguards the transfer process by preventing disputes from other potential claimants and ensuring clear title ownership. |

| 4 | Digital Encumbrance Certificate | A Digital Encumbrance Certificate (EC) is essential for transferring property title to a family member, as it verifies that the property is free from legal dues or mortgages. This digitally issued document provides an updated and tamper-proof record of all transactions related to the property, ensuring a smooth and transparent transfer process. |

| 5 | E-Stamp Paper Verification | Transferring property title to a family member requires submitting the sale deed or gift deed on e-stamp paper, which must be verified for authenticity through the official state e-stamping portal. This verification ensures the document's legality and prevents fraudulent transactions during the title transfer process. |

| 6 | Aadhaar-Linked Title Transfer Form | The Aadhaar-linked title transfer form is essential for property title transfers to a family member, as it authenticates the identity of the involved parties through Aadhaar verification. Key documents include the original sale deed, the latest property tax receipts, the family member's Aadhaar card, and the duly filled Aadhaar-linked title transfer form submitted to the local land registry office. |

| 7 | Succession Certificate e-Processing | A Succession Certificate e-Processing system streamlines the transfer of property titles to family members by digitally verifying and issuing the certificate, which serves as legal proof of the rightful heirs. This electronic method reduces paperwork, expedites court approvals, and ensures secure documentation essential for smooth title succession. |

| 8 | Unified Property Mutation Request | The Unified Property Mutation Request is a crucial document required for transferring property title to a family member, streamlining the mutation process by consolidating ownership transfer details, identification proofs, and legal consent forms. Submission of this request, along with the original title deed, family affidavit, and latest property tax receipts, ensures a legally recognized mutation in government land records. |

| 9 | Online FRRO Clearance (for NRIs) | Transferring property title to a family member requires key documents such as the original sale deed, property tax receipts, and a No Objection Certificate (NOC), with Non-Resident Indians (NRIs) additionally needing an Online Foreigners Regional Registration Office (FRRO) clearance to comply with legal residency verification. The Online FRRO clearance ensures that the NRI applicant is authorized to undertake property transactions in India by confirming their current visa status and legal stay duration. |

| 10 | Blockchain-Based Property Ledger | Transferring property title to a family member via a blockchain-based property ledger requires a digital deed, notarized transaction records, a verified identity token for both parties, and the smart contract authorizing the transfer. This decentralized ledger ensures immutable proof of ownership change while streamlining the verification process and reducing reliance on traditional paper documents. |

Understanding Property Title Transfer to Family Members

Transferring property title to a family member requires key documents such as the original property deed, a valid identification of both parties, and a completed title transfer form. Understanding the process involves verifying that the deed is clear of liens and any existing mortgages, ensuring a smooth ownership transfer. Family transfers often require additional paperwork like gift deeds or affidavits to comply with local property laws and tax regulations.

Key Legal Considerations in Family Property Transfers

Transferring property title to a family member requires specific legal documents to ensure a clear and valid transfer. Key documents include the deed, which must be properly executed and notarized, and a completed title transfer form according to local regulations.

Proof of identity for both parties and any required tax clearance certificates are essential to avoid future disputes. You should also consider consulting legal counsel to understand implications such as gift taxes and inheritance laws during the transfer process.

Essential Documents for Property Title Transfer

Transferring property title to a family member requires essential documents such as the original title deed, which proves ownership of the property. A notarized gift deed or sale deed is necessary to legally transfer ownership and must be signed by both the transferor and the transferee. Additionally, identification proofs like government-issued IDs and the latest property tax receipts are required to complete the title transfer process smoothly.

Types of Property Transfer Among Family Members

Transferring property title to a family member requires specific legal documents to ensure a smooth and valid transfer. The types of property transfer commonly used among family members include gifts, inheritances, and quitclaim deeds.

Gift deeds must include a clear description of the property and the donor's intent to transfer ownership without payment. In inheritance cases, a will or probate court order is essential to authenticate the transfer to the rightful heir.

Step-by-Step Process for Transferring Property Title

Transferring a property title to a family member requires specific legal documents to ensure a smooth and valid process. Understanding each document's role is essential for avoiding complications during the ownership transfer.

The first step involves obtaining the original property deed, which proves current ownership. Next, a correctly filled and signed deed form, such as a quitclaim or warranty deed, must be prepared to transfer ownership rights. A notarized signature is vital to validate the transfer document legally.

Stamp Duty and Registration Charges Explained

| Document | Description | Relevance to Stamp Duty and Registration Charges |

|---|---|---|

| Title Deed | Original property ownership document showing current owner details. | Essential for verifying ownership; used to calculate stamp duty based on property value. |

| Gift Deed or Transfer Deed | Legal document establishing the transfer of property ownership to a family member. | Serves as the primary document for registration; stamp duty is applied on the transaction type. |

| Family Relationship Proof | Documents like birth certificates, marriage certificates, or affidavits proving relation. | May qualify the transfer for concessional or exempt stamp duty rates when transferring to a family member. |

| Identity Proofs | Aadhar card, Passport, or Driving License of both transferor and transferee. | Required for registration and to ensure proper record of parties involved in stamp duty assessment. |

| Encumbrance Certificate | Certificate showing the property is free from legal or monetary liabilities. | Mandatory for registration; ensures no dues affect stamp duty calculations or transfer validity. |

| Property Tax Receipts | Receipts proving all property taxes are paid up to date. | Necessary for smooth registration and accurate stamp duty assessment, reflecting clear property status. |

| No Objection Certificate (NOC) from Society or Authorities | Approval documents from relevant housing society or local authorities. | Required for legal transfer; indirectly affects registration and stamp duty process compliance. |

| Payment Proof for Stamp Duty | Receipt or certificate showing the stamp duty fee has been paid. | Proof of payment is needed to complete property registration, confirming stamp duty compliance. |

| Registration Fee Payment Receipt | Receipt confirming payment of registration charges to the government. | Required for the legal recording of the transfer at the sub-registrar office; confirms registration fee payment. |

Gift Deed vs. Sale Deed: Which is Suitable for Family Transfers?

Transferring property title to a family member requires specific legal documents tailored to the nature of the transfer. Choosing between a gift deed and a sale deed depends on the transaction's intent and tax implications.

- Gift Deed - A legal document used to transfer ownership without monetary consideration, suitable for gifting property to family members.

- Sale Deed - A contract evidencing the sale and purchase of property, requiring payment and formal registration.

- Tax Considerations - Gift deeds often attract gift tax exemptions within family transfers, while sale deeds involve capital gains tax based on the sale amount.

Proper registration of the chosen deed with the local sub-registrar office is essential to validate the property title transfer.

Common Legal Pitfalls in Family Property Transmission

What documents are required for transferring property title to a family member? The essential documents typically include the original property deed, a duly filled and signed deed transfer form, and proof of identity for both parties. Ensuring clear and updated titles helps prevent disputes during family property transmission.

How can common legal pitfalls in family property transfer be avoided? Failing to properly document the transfer or neglecting to record the deed can result in ownership challenges and potential litigation. Consulting a qualified real estate attorney and conducting a thorough title search reduces risks of errors and claims.

Is a gift deed necessary when transferring property to a family member? A gift deed legally documents the transfer without monetary consideration and must be registered according to local laws. Omitting registration may render the transaction invalid or open to legal challenges in the future.

What role do tax documents play in property title transfer within families? Properly filed gift tax returns or exemption certificates are often required to comply with tax regulations and avoid penalties. Overlooking tax implications can lead to unforeseen financial liabilities tied to the property transfer.

Why is a no-objection certificate (NOC) important in family property transfers? Certain jurisdictions mandate an NOC from local authorities or housing societies to confirm there are no pending financial or legal dues on the property. Skipping this document may delay registration or cause ownership disputes later on.

Tax Implications of Property Transfer to Relatives

Transferring a property title to a family member involves specific documentation and careful consideration of tax implications. Understanding these tax responsibilities helps in making informed decisions during the transfer process.

- Gift Tax Return Requirement - You must file IRS Form 709 if the property's value exceeds the annual gift tax exclusion when transferring to a relative.

- Capital Gains Tax Basis - The recipient inherits your property's original cost basis, affecting potential capital gains tax upon future sale.

- Property Tax Reassessment - Some states may reassess property taxes after transfer unless exemptions for family transfers apply, impacting ongoing tax costs.

What Documents are Needed for Transferring Property Title to a Family Member? Infographic