Condominium association applications require essential documents such as the association's bylaws, declaration of condominium, and articles of incorporation. Financial statements and budgets are necessary to demonstrate fiscal responsibility and operational transparency. Proof of insurance and any pending litigation disclosures must also be included to ensure compliance and risk management.

What Documents are Necessary for Condominium Association Applications?

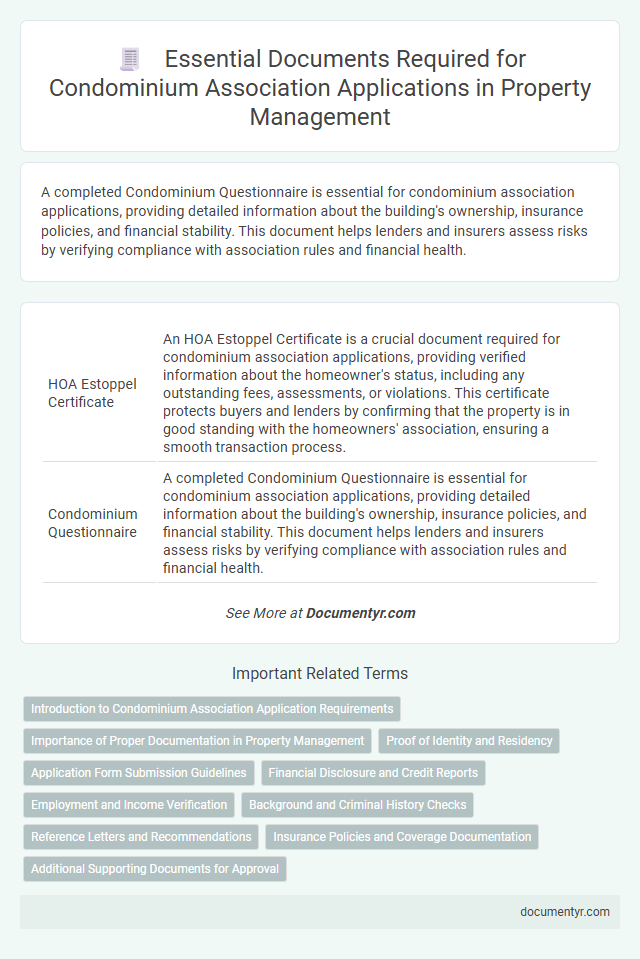

| Number | Name | Description |

|---|---|---|

| 1 | HOA Estoppel Certificate | An HOA Estoppel Certificate is a crucial document required for condominium association applications, providing verified information about the homeowner's status, including any outstanding fees, assessments, or violations. This certificate protects buyers and lenders by confirming that the property is in good standing with the homeowners' association, ensuring a smooth transaction process. |

| 2 | Condominium Questionnaire | A completed Condominium Questionnaire is essential for condominium association applications, providing detailed information about the building's ownership, insurance policies, and financial stability. This document helps lenders and insurers assess risks by verifying compliance with association rules and financial health. |

| 3 | FIRPTA Affidavit | Condominium association applications often require a FIRPTA affidavit to ensure compliance with the Foreign Investment in Real Property Tax Act, which certifies whether the seller is a foreign person subject to withholding tax. This document is essential to avoid IRS withholding penalties and must be accurately completed and submitted during the property transfer process. |

| 4 | Bulk Buyer Disclosure | Bulk Buyer Disclosure is a critical document in condominium association applications, detailing the buyer's intent to purchase multiple units and ensuring transparency in ownership structure. This disclosure protects existing owners by outlining potential impacts on association governance, resale restrictions, and compliance with state laws. |

| 5 | Association Insurance Binder | An Association Insurance Binder is a crucial document required for condominium association applications, serving as temporary proof of insurance coverage until the formal policy is issued. This binder must detail liability, property, and casualty coverage amounts, ensuring the association meets regulatory and lender requirements. |

| 6 | Budget Reserve Schedule | A comprehensive Budget Reserve Schedule is essential for condominium association applications, detailing projected maintenance expenses and capital improvement funds to ensure financial stability. This document must include itemized reserve contributions, expected repair timelines, and funding strategies to demonstrate the association's preparedness for future repairs and replacements. |

| 7 | 6D Certificate | A 6D Certificate, also known as a Certificate of Incorporation for a Condominium Association, is essential for confirming the legal formation and registration of the association with state authorities. This document ensures compliance with property laws and is required for submitting condominium association applications, securing permits, and validating the association's authority to operate. |

| 8 | Owner-Occupancy Affidavit | An Owner-Occupancy Affidavit is a crucial document required in condominium association applications to verify that the applicant occupies the unit as their primary residence. This affidavit helps associations enforce owner-occupancy rules and maintain compliance with community regulations. |

| 9 | Conflict of Interest Disclosure | Conflict of Interest Disclosure forms are essential for condominium association applications to ensure transparency and prevent any potential bias or unethical influence in decision-making processes. These documents typically require board members and applicants to disclose any personal, financial, or professional relationships that might affect their impartiality within the association. |

| 10 | PUD Rider (Planned Unit Development Rider) | The PUD Rider (Planned Unit Development Rider) is a crucial document in condominium association applications, outlining specific covenants, conditions, and restrictions tailored to the planned unit development's unique characteristics. This rider must be submitted along with the master declaration, bylaws, and articles of incorporation to ensure comprehensive legal compliance and accurate representation of property governance. |

Introduction to Condominium Association Application Requirements

| Introduction to Condominium Association Application Requirements | |

|---|---|

| Purpose of Documents | Documents verify ownership, ensure compliance with association rules, and protect all parties involved in the condominium community. |

| Common Required Documents | Completed application form, proof of property ownership, identification (government-issued ID), financial statements, and background checks. |

| Legal Agreements | Declaration of condominium ownership, bylaws, and rules and regulations governing the association. |

| Financial Requirements | Payment of application fees, proof of financial stability, and sometimes credit reports. |

| Additional Documentation | References, pet registration forms, architectural approval requests, and insurance certificates if applicable. |

| Importance for Application Approval | Complete and accurate document submission expedites the review process and reduces delays in application approval. |

Importance of Proper Documentation in Property Management

Proper documentation is essential for condominium association applications to ensure legal compliance and smooth processing. Key documents include the association's bylaws, financial statements, and proof of insurance.

Accurate records protect the association from disputes and support effective property management. Your thorough preparation of these documents helps maintain transparency and fosters trust among residents and stakeholders.

Proof of Identity and Residency

Applying for a condominium association requires submitting key documents that verify your identity and residency. These papers ensure the association maintains accurate records and complies with legal requirements.

- Proof of Identity - Valid government-issued identification such as a driver's license or passport confirms your legal identity.

- Proof of Residency - Utility bills, lease agreements, or official correspondence showing your current address establish residency within the condominium.

- Additional Verification - Supplemental documents like voter registration or bank statements may be requested to further validate your residency status.

Application Form Submission Guidelines

Condominium association applications require a completed application form that must be submitted accurately to avoid processing delays. Essential attachments include proof of ownership, identification documents, and any required consent forms specified by the association. Ensure all sections of the application are filled, signed, and submitted within the designated deadlines to meet compliance standards.

Financial Disclosure and Credit Reports

When applying to a condominium association, submitting financial disclosure documents is essential. These documents provide a clear picture of the applicant's fiscal responsibility and ability to meet association fees.

Credit reports are equally important for the application process, as they reveal credit history and financial behavior. Associations use credit reports to assess risk and ensure applicants can maintain timely payments. Together, financial disclosures and credit reports form the foundation for approving or denying condominium association applications.

Employment and Income Verification

Employment and income verification are critical documents for condominium association applications. You must provide recent pay stubs, bank statements, or tax returns to prove financial stability. These documents help the association assess your ability to meet monthly fees and maintain the property.

Background and Criminal History Checks

Condominium association applications often require thorough background and criminal history checks to ensure the safety and integrity of the community. These checks help verify applicant information and identify any potential risks.

- Completed Application Form - Provides personal details necessary for background verification.

- Authorization for Background Check - Legal consent allowing the association to conduct criminal history screenings.

- Identification Documents - Government-issued IDs confirm identity and support accurate record searches.

Submitting these documents helps condominium associations maintain a secure and trustworthy environment for all residents.

Reference Letters and Recommendations

What documents are necessary for condominium association applications regarding reference letters and recommendations? Reference letters provide insight into your character and reliability, often required to support your application. Recommendations from previous landlords or community members help demonstrate your trustworthiness and suitability as a resident.

Insurance Policies and Coverage Documentation

Condominium association applications require comprehensive insurance policies to ensure adequate protection of the property and common areas. These documents typically include liability insurance, property damage coverage, and workers' compensation policies.

Coverage documentation must detail the policy limits, endorsements, and the duration of coverage to meet association standards. Providing these records helps verify that the association is financially prepared to handle potential risks and liabilities.

What Documents are Necessary for Condominium Association Applications? Infographic