A residential lease agreement requires key documents such as a valid government-issued ID, proof of income or employment, and references from previous landlords to verify tenant reliability. The lease contract itself outlines terms, rent amount, and duration while including property details and resident responsibilities. Security deposit receipts and any disclosures about property conditions or rules must also be documented to protect both landlord and tenant rights.

What Documents are Needed for a Residential Lease Agreement?

| Number | Name | Description |

|---|---|---|

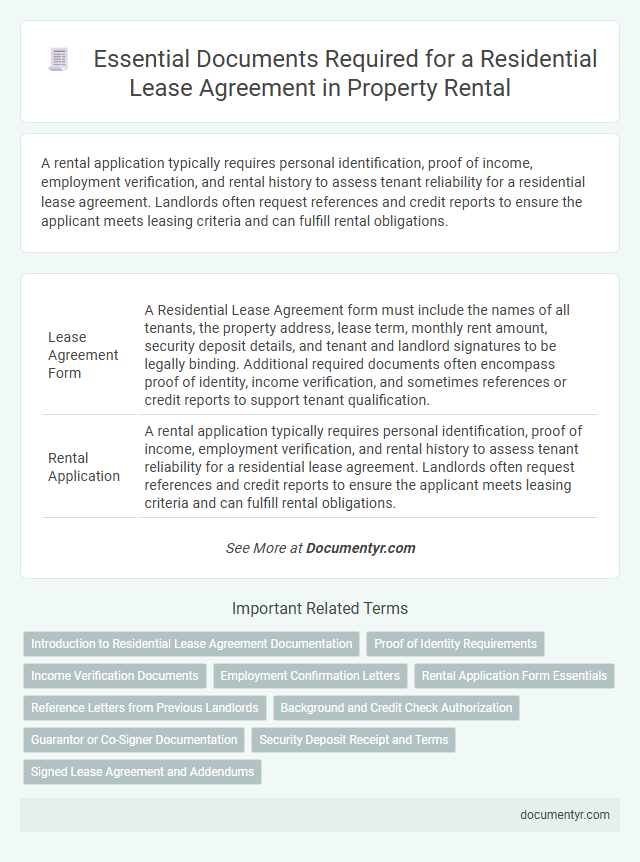

| 1 | Lease Agreement Form | A Residential Lease Agreement form must include the names of all tenants, the property address, lease term, monthly rent amount, security deposit details, and tenant and landlord signatures to be legally binding. Additional required documents often encompass proof of identity, income verification, and sometimes references or credit reports to support tenant qualification. |

| 2 | Rental Application | A rental application typically requires personal identification, proof of income, employment verification, and rental history to assess tenant reliability for a residential lease agreement. Landlords often request references and credit reports to ensure the applicant meets leasing criteria and can fulfill rental obligations. |

| 3 | Proof of Income | Proof of income for a residential lease agreement typically includes recent pay stubs, bank statements, or tax returns to verify the tenant's financial stability. Landlords may also require employer letters or social security income documentation to confirm consistent earnings. |

| 4 | Credit Report | A credit report is essential for a residential lease agreement as it provides landlords with detailed insights into a tenant's creditworthiness, payment history, and financial responsibility, helping to assess the risk of non-payment or late rent. This document typically includes credit scores, outstanding debts, past delinquencies, and public records, which are crucial for making informed leasing decisions. |

| 5 | Photo Identification | Photo identification, such as a government-issued driver's license or passport, is essential for verifying the identity of both landlords and tenants in a residential lease agreement. This ensures the legality of the contract and helps prevent fraud by confirming the parties involved. |

| 6 | Employment Verification | Employment verification documents for a residential lease agreement typically include recent pay stubs, employer contact information, and an employment verification letter confirming job status and income. These documents ensure the tenant has a stable income source to meet rent obligations, protecting landlords from potential financial risks. |

| 7 | References | References for a residential lease agreement typically include previous landlord contact information, employment verification letters, and character references to demonstrate reliability and financial stability. Providing accurate and verifiable references helps landlords assess the tenant's rental history and trustworthiness. |

| 8 | Security Deposit Receipt | A Security Deposit Receipt is essential in a residential lease agreement, providing proof that the tenant has paid the security deposit, which is often required by law to be documented. This receipt typically includes the amount paid, the date of payment, the property address, and signatures of both landlord and tenant to ensure transparency and protect both parties' rights. |

| 9 | Move-In/Move-Out Checklist | A Move-In/Move-Out Checklist is essential for documenting property conditions and ensuring both landlord and tenant agree on the state of the residence at the beginning and end of the lease term. This checklist typically includes inventory of appliances, wall conditions, flooring, and fixtures, serving as a key reference to address security deposit disputes and maintenance responsibilities. |

| 10 | Pet Agreement (if applicable) | A Pet Agreement is essential when a tenant plans to keep pets in a residential rental, outlining specific rules, pet types allowed, and any pet-related fees or deposits. This document protects both landlord and tenant by clearly defining responsibilities and ensuring compliance with housing policies. |

| 11 | Guarantor/Co-Signer Agreement (if applicable) | A Guarantor/Co-Signer Agreement is essential when the tenant requires an additional party to guarantee lease obligations, ensuring rent payment and property maintenance. This document must include the guarantor's full legal name, contact information, financial details, and a clear statement of their responsibilities under the lease terms. |

| 12 | Lead-Based Paint Disclosure (if applicable) | Residential lease agreements require a Lead-Based Paint Disclosure form when the property was built before 1978, ensuring tenants are informed about potential lead hazards. This federal requirement aims to protect occupants from lead poisoning by providing detailed information on known paint hazards and any available reports. |

| 13 | Renters Insurance Proof (if required) | Renters insurance proof is often required as part of a residential lease agreement to protect both the tenant and landlord from potential property damage or liability claims. This document must clearly show the tenant's name, coverage limits, and effective dates to ensure compliance with lease terms and provide adequate financial protection. |

| 14 | HOA Rules and Regulations (if applicable) | HOA rules and regulations must be reviewed and included as part of the residential lease agreement documents to ensure tenant compliance with community standards and restrictions. Providing these documents upfront helps prevent violations related to property use, noise, and maintenance, thereby protecting both landlord and tenant interests. |

| 15 | Utility Responsibility Agreement | A Utility Responsibility Agreement is essential in a residential lease to clearly outline which utilities the tenant is responsible for, such as electricity, water, gas, and trash services. This document prevents disputes by specifying payment obligations and service management between landlord and tenant. |

Introduction to Residential Lease Agreement Documentation

A residential lease agreement outlines the terms and conditions between a landlord and tenant for renting a property. Proper documentation ensures legal protection and clarity for both parties.

- Identification Documents - Valid government-issued IDs verify the identity of tenants and landlords involved in the lease.

- Proof of Income - Documents such as pay stubs or bank statements confirm the tenant's ability to pay rent.

- Property Details - Including the property deed or previous lease agreements clarifies the specifics of the rental unit.

Completing these documents accurately is essential for a binding and transparent residential lease agreement.

Proof of Identity Requirements

What documents are needed to prove identity for a residential lease agreement? Proof of identity typically includes a government-issued photo ID such as a passport or driver's license. These documents verify the tenant's identity and help protect both parties in the rental process.

Income Verification Documents

Income verification documents are crucial for securing a residential lease agreement. These documents help landlords assess a tenant's ability to pay rent consistently.

Common income verification documents include recent pay stubs, bank statements, and tax returns. Self-employed applicants may provide profit and loss statements or 1099 forms. These documents ensure landlords can verify stable and sufficient income to meet lease obligations.

Employment Confirmation Letters

Employment confirmation letters are essential documents in a residential lease agreement process. They provide landlords with proof of steady income and job stability.

These letters typically include details such as the tenant's position, length of employment, and salary. Verifying employment helps landlords assess the tenant's ability to pay rent consistently.

Rental Application Form Essentials

Preparing a residential lease agreement requires specific documents to ensure a smooth rental process. One of the most important documents is the rental application form, which collects vital information about prospective tenants.

- Personal Information - The form must include full name, date of birth, and contact details to verify the tenant's identity.

- Employment and Income Details - This section confirms the tenant's ability to pay rent by providing employer information and proof of income.

- Rental History - Previous landlord references and rental payment records help assess the tenant's reliability and rental behavior.

Reference Letters from Previous Landlords

Reference letters from previous landlords provide essential insights into a tenant's rental history and reliability. These documents help landlords assess the applicant's behavior, payment punctuality, and property care. Including well-documented reference letters strengthens a residential lease agreement application.

Background and Credit Check Authorization

| Document | Description | Purpose |

|---|---|---|

| Background Check Authorization | Written consent form allowing the landlord or property manager to conduct a background check on the prospective tenant. | Verifies criminal history, eviction records, and other legal issues to ensure tenant suitability and protect property safety. |

| Credit Check Authorization | Permission document granting access to the applicant's credit report from authorized credit bureaus. | Assesses financial reliability by reviewing credit score, payment history, and existing debts to evaluate the tenant's ability to pay rent on time. |

Guarantor or Co-Signer Documentation

For a residential lease agreement, guarantor or co-signer documentation typically includes proof of identity such as a government-issued ID. Financial documents like recent pay stubs, bank statements, or tax returns are required to verify income and creditworthiness. Some landlords may also request a credit report and a signed guarantor agreement outlining responsibilities.

Security Deposit Receipt and Terms

When entering a residential lease agreement, a Security Deposit Receipt is essential to document the payment and protect both tenant and landlord. This receipt serves as proof of the security deposit amount, payment date, and conditions under which the deposit may be retained or refunded.

Terms related to the security deposit must be clearly outlined in the lease agreement, including the amount required, permissible uses, and the timeline for returning the deposit after tenancy ends. This ensures transparency and helps You understand your rights regarding your security deposit during and after the lease period.

What Documents are Needed for a Residential Lease Agreement? Infographic