A home loan application requires essential documents such as proof of identity, income verification, and property-related paperwork. Commonly requested items include government-issued ID, salary slips or tax returns, bank statements, and the property's sale agreement or title deed. These documents help lenders assess the applicant's creditworthiness and the legality of the property transaction.

What Documents are Necessary for a Home Loan Application?

| Number | Name | Description |

|---|---|---|

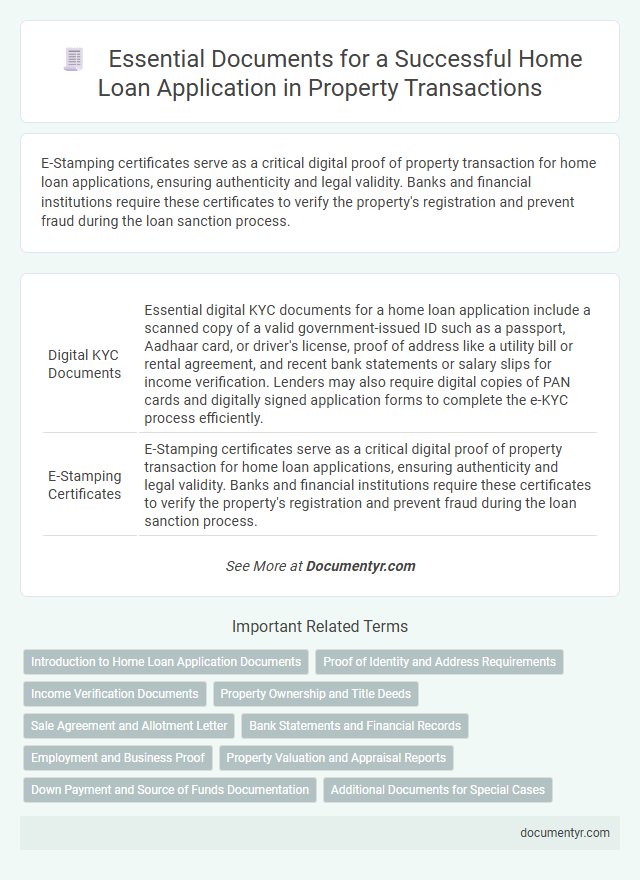

| 1 | Digital KYC Documents | Essential digital KYC documents for a home loan application include a scanned copy of a valid government-issued ID such as a passport, Aadhaar card, or driver's license, proof of address like a utility bill or rental agreement, and recent bank statements or salary slips for income verification. Lenders may also require digital copies of PAN cards and digitally signed application forms to complete the e-KYC process efficiently. |

| 2 | E-Stamping Certificates | E-Stamping certificates serve as a critical digital proof of property transaction for home loan applications, ensuring authenticity and legal validity. Banks and financial institutions require these certificates to verify the property's registration and prevent fraud during the loan sanction process. |

| 3 | Income Tax e-Filing Acknowledgment | Income Tax e-Filing Acknowledgment is a critical document in a home loan application as it verifies the applicant's declared income and tax compliance, providing lenders with proof of financial credibility. Lenders typically require the latest ITR acknowledgment along with Form 16 or salary slips to accurately assess the borrower's repayment capacity and reduce loan approval risks. |

| 4 | Updated CIBIL Credit Report | An updated CIBIL credit report is essential for a home loan application as it provides lenders with a detailed overview of the applicant's credit history and repayment behavior, directly impacting loan approval and interest rates. Ensuring the report is recent and error-free enhances the credibility of the applicant and streamlines the loan processing timeline. |

| 5 | Encumbrance Certificate | An Encumbrance Certificate is essential in a home loan application as it verifies that the property is free from any legal or monetary liabilities, ensuring a clear title. This document helps lenders assess the property's legal status and protects buyers from future ownership disputes or financial claims. |

| 6 | Online Property Valuation Reports | Online property valuation reports are essential documents in a home loan application as they provide lenders with an accurate assessment of the property's market value, aiding in risk evaluation and loan eligibility. These digital reports typically include detailed property information, recent sales data, and automated valuation models, streamlining the approval process and ensuring compliance with lending criteria. |

| 7 | e-Agreement to Sell | An e-Agreement to Sell is a crucial document in a home loan application, serving as a legally binding contract between the buyer and seller that outlines property details, sale price, and payment terms electronically. Lenders require this digital agreement to verify ownership rights and ensure the transaction's legitimacy before approving the loan. |

| 8 | Utility Bill Geo-Location Proof | Utility bill geo-location proof serves as a critical document in a home loan application, verifying the applicant's current residential address through recent utility statements such as electricity, water, or gas bills. Lenders use this documentation to ensure accuracy in applicant identification and to assess the risk based on the property's location. |

| 9 | Aadhaar-Linked Bank Statements | Aadhaar-linked bank statements serve as crucial financial documents in a home loan application, verifying income consistency and linking the applicant's financial transactions to their official identity. Lenders require these statements to assess creditworthiness and ensure transparency in the borrower's monetary history. |

| 10 | RERA Registration Certificate | A RERA Registration Certificate is a crucial document required for a home loan application as it verifies the property's compliance with the Real Estate (Regulation and Development) Act, ensuring legal legitimacy and protection for buyers. Lenders prioritize properties with RERA registration to minimize risk and facilitate a smoother loan approval process. |

Introduction to Home Loan Application Documents

What documents are necessary for a home loan application? A clear understanding of required documents streamlines the loan process and ensures timely approval. Essential paperwork typically includes identity proof, income statements, and property documents.

Proof of Identity and Address Requirements

Proof of identity is essential for a home loan application, typically requiring documents such as a government-issued passport, driver's license, or national ID card. Address verification must include recent utility bills, rental agreements, or bank statements that clearly show the applicant's current residential address. These documents help lenders verify the applicant's identity and residence, ensuring eligibility and reducing fraud risk.

Income Verification Documents

Income verification documents are essential for validating a borrower's financial stability during a home loan application. These documents provide lenders with proof of consistent earnings and the ability to repay the loan.

- Salary Slips - Recent pay stubs from the past 3 to 6 months demonstrate regular income from employment.

- Income Tax Returns (ITR) - Filed ITRs for the last 2 to 3 years establish declared annual income and tax compliance.

- Bank Statements - Statements for 6 to 12 months reflect salary credits and overall financial transactions.

Property Ownership and Title Deeds

Proof of property ownership is a crucial document for a home loan application. Title deeds serve as the primary evidence confirming the legal ownership of the property.

These documents must be clear, valid, and free of disputes to ensure smooth loan processing. Your loan approval depends significantly on the authenticity of property ownership and title deeds.

Sale Agreement and Allotment Letter

When applying for a home loan, providing the correct property documents is crucial to verify ownership and transaction details. The Sale Agreement and Allotment Letter are among the key documents required by lenders to process your application efficiently.

- Sale Agreement - This document outlines the terms and conditions agreed upon by the buyer and seller, serving as proof of property purchase commitment.

- Sale Agreement - Lenders use it to confirm the sale price, payment schedule, and possession timeline relevant to the home loan approval.

- Allotment Letter - Issued by the builder or developer, this letter confirms the allocation of the specific property unit to the buyer.

- Allotment Letter - It is essential for verifying the legitimacy of the property and forms a legal basis for availing the home loan.

Bank Statements and Financial Records

| Document Type | Purpose | Details to Include |

|---|---|---|

| Bank Statements | Proof of Income and Financial Stability | Recent 3 to 6 months of bank statements showing salary deposits, monthly expenses, and overall financial activity |

| Pay Slips or Salary Certificates | Verification of Steady Income | Last 3 months' pay slips or a certificate from your employer confirming income |

| Income Tax Returns (ITR) | Verification of Annual Income | ITR documents for the past 2 to 3 years, including Form 16 for salaried individuals |

| Financial Records | Assessment of Financial Health | Statements for any investments, fixed deposits, mutual funds, and details of assets and liabilities |

| Credit Report | Creditworthiness Evaluation | Recent credit report from recognized credit bureaus showing credit score and history of repayments |

Bank statements and financial records play a critical role in the home loan application process. They provide detailed proof of your income sources, financial discipline, and ability to repay the loan. Maintaining accurate and updated documents enhances the chances of loan approval and often leads to better loan terms.

Employment and Business Proof

Submitting a home loan application requires comprehensive employment and business proof to verify income stability. Lenders use these documents to assess the borrower's financial reliability and repayment capacity.

- Salary Slips - Typically, the last three to six months of salary slips are required to confirm steady employment income.

- Income Tax Returns (ITR) - Copies of filed ITRs for the past two to three years validate declared income for salaried and self-employed applicants.

- Business Registration and Financial Statements - For business owners, proof of registration and recent profit & loss statements demonstrate business legitimacy and profitability.

Providing accurate and complete employment or business documents expedites loan processing and improves approval chances.

Property Valuation and Appraisal Reports

Property valuation reports are essential documents in a home loan application as they provide an objective estimate of the property's market value. Lenders use these reports to assess the loan amount relative to the property's worth, minimizing financial risk.

Appraisal reports include detailed analysis of the property's condition, location, and comparable sales data. These reports help lenders verify that the property serves as adequate collateral for the loan requested by the borrower.

Down Payment and Source of Funds Documentation

When applying for a home loan, providing proof of your down payment is essential to verify your financial commitment. Documentation such as bank statements, gift letters, or sale proceeds serves as evidence of the down payment amount. Lenders also require source of funds documentation to ensure the legitimacy and origin of the money used in the transaction.

What Documents are Necessary for a Home Loan Application? Infographic