Essential documents for property tax assessment include the property title deed, which proves ownership, and the latest property tax receipt to verify current tax status. Accurate land survey maps and property valuation reports provide necessary details about property dimensions and market value. Additionally, identification documents of the owner and any legal agreements related to the property might be required for a complete assessment.

What Documents are Essential for Property Tax Assessment?

| Number | Name | Description |

|---|---|---|

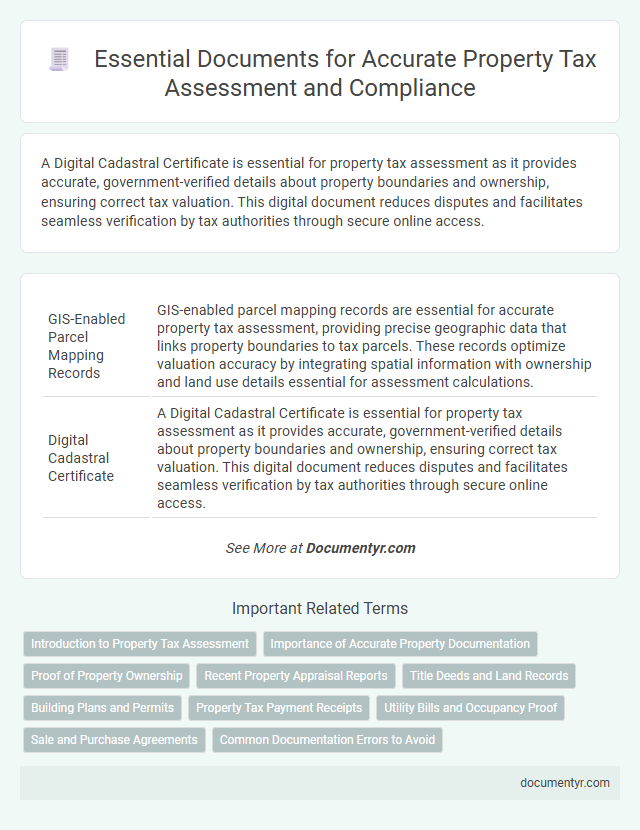

| 1 | GIS-Enabled Parcel Mapping Records | GIS-enabled parcel mapping records are essential for accurate property tax assessment, providing precise geographic data that links property boundaries to tax parcels. These records optimize valuation accuracy by integrating spatial information with ownership and land use details essential for assessment calculations. |

| 2 | Digital Cadastral Certificate | A Digital Cadastral Certificate is essential for property tax assessment as it provides accurate, government-verified details about property boundaries and ownership, ensuring correct tax valuation. This digital document reduces disputes and facilitates seamless verification by tax authorities through secure online access. |

| 3 | Blockchain-Based Title Deed | Blockchain-based title deeds provide a secure and tamper-proof record essential for accurate property tax assessment, ensuring transparent ownership verification and reducing fraud risks. These digital documents streamline the assessment process by offering real-time access to immutable property ownership data, enabling precise valuation and timely tax calculations. |

| 4 | e-Encumbrance Certificate | The e-Encumbrance Certificate is a crucial document for property tax assessment, as it verifies that the property is free from legal or financial liabilities such as mortgages or liens. This digital certificate ensures clear title ownership, streamlines the assessment process, and helps avoid disputes related to encumbrances during property transactions. |

| 5 | Automated Valuation Model (AVM) Report | An Automated Valuation Model (AVM) report is essential for property tax assessment as it provides an accurate, data-driven estimate of a property's market value based on recent sales, property characteristics, and neighborhood trends. This report enhances the precision of tax calculations, ensuring equitable property tax liabilities by integrating advanced algorithms and comprehensive real estate data. |

| 6 | Smart Utility Bill Statement | A smart utility bill statement provides accurate usage data and verifies occupancy, essential for precise property tax assessments. This document enhances the assessment's reliability by offering real-time consumption patterns linked to the property's address. |

| 7 | AI-Powered Property Inspection Report | AI-powered property inspection reports streamline property tax assessments by providing accurate, real-time data on property conditions and valuations. These reports integrate high-resolution imagery, sensor data, and automated analysis to ensure comprehensive documentation essential for precise tax calculation and dispute resolution. |

| 8 | Land Use Zoning GIS Layer | The Land Use Zoning GIS layer is essential for property tax assessment as it provides detailed spatial data on land classification, helping authorities determine accurate tax rates based on zoning regulations. This geospatial information integrates property boundaries, land use categories, and local zoning ordinances to ensure precise valuation and compliance with municipal tax codes. |

| 9 | Environmental Impact Compliance Certificate | An Environmental Impact Compliance Certificate is crucial for property tax assessment as it verifies the property's adherence to environmental regulations and potential liabilities. This document influences tax rates by ensuring the property meets sustainability standards and mitigates risks related to environmental impact. |

| 10 | Non-Fungible Token (NFT) Property Ownership Proof | Non-Fungible Token (NFT) property ownership proof serves as a digital certificate verifying unique asset possession, increasingly accepted for property tax assessment documentation. Essential documents include the NFT smart contract details, blockchain transaction records, and ownership metadata to establish authenticity and legal ownership in tax evaluations. |

Introduction to Property Tax Assessment

Property tax assessment determines the value of your property for taxation purposes. Accurate documentation is crucial in ensuring a fair and precise assessment.

Essential documents include the property deed, tax identification number, and recent appraisal reports. These records help assessors verify ownership, location, and property value effectively.

Importance of Accurate Property Documentation

Accurate property documentation is crucial for proper tax assessment and avoiding legal complications. Ensuring your documents are complete helps verify property ownership and value.

- Title Deed - This document establishes legal ownership and is necessary for property tax records.

- Property Tax Receipts - Previous tax payment records confirm your payment history and assist in accurate assessment.

- Property Survey Plan - A detailed survey supports the correct measurement and valuation of your property for taxation.

Proof of Property Ownership

| Document Type | Description | Importance for Property Tax Assessment |

|---|---|---|

| Title Deed | Official document proving legal ownership of the property. | Serves as the primary proof of ownership, confirming the taxpayer's right to the property. |

| Property Tax Receipt | Receipt from previous tax payments on the property. | Validates ongoing ownership and previous compliance with tax requirements. |

| Sale Deed | Legal agreement of sale recording the transfer of ownership. | Establishes the date and legitimacy of ownership transfer. |

| Encumbrance Certificate | Document showing the property is free from legal liabilities. | Confirms clear ownership without financial burdens affecting tax assessment. |

| Property Tax Assessment Notice | Official notice detailing assessed tax value of the property. | Used to cross-verify property details and ownership status for taxation. |

Recent Property Appraisal Reports

Recent property appraisal reports are critical documents for accurate property tax assessment. These reports provide updated valuations based on current market conditions and property improvements. You should ensure that these appraisal reports are submitted to the tax assessor to reflect the true value of your property.

Title Deeds and Land Records

Property tax assessment requires accurate documentation to determine ownership and property details. Title deeds and land records are critical for proving legal ownership and property boundaries.

- Title Deeds - Serve as legal proof of property ownership and establish the rightful owner.

- Land Records - Contain detailed information about property boundaries, dimensions, and historical ownership.

- Updated Records - Ensure the documents reflect current ownership and any recent changes affecting the property.

Accurate title deeds and land records streamline the property tax assessment process and prevent disputes.

Building Plans and Permits

Building plans and permits are crucial documents for an accurate property tax assessment. They provide detailed information about the construction and legal approvals of your property.

- Building Plans - Detailed architectural drawings that outline the structure and dimensions of the property for assessment purposes.

- Construction Permits - Official approvals granted by local authorities ensuring the building complies with zoning and safety regulations.

- Permit Completion Certificates - Documentation confirming that the construction was completed according to the approved plans and regulations.

Property Tax Payment Receipts

What documents are essential for property tax assessment? Property tax payment receipts serve as critical proof of payment and help verify the accuracy of assessed taxes. These receipts provide a transparent record of payments made to local tax authorities, ensuring compliance and preventing disputes.

Utility Bills and Occupancy Proof

Utility bills such as electricity, water, and gas statements are essential for property tax assessment as they verify ongoing usage and support ownership claims. Occupancy proof documents, including lease agreements or voter ID cards, establish the resident's identity and residency status at the property. These documents help tax authorities accurately assess property taxes based on verified habitation and consumption patterns.

Sale and Purchase Agreements

The Sale and Purchase Agreement is a crucial document for property tax assessment. It provides legally binding evidence of the transaction details between the buyer and seller.

This agreement outlines key information such as the sale price, property description, and transaction date. Tax authorities rely on these details to accurately calculate property tax liabilities. Ensuring the agreement is precise and complete helps prevent discrepancies during the assessment process.

What Documents are Essential for Property Tax Assessment? Infographic