Accurate commercial property appraisal requires essential documents such as the property deed, recent tax assessments, and detailed floor plans. Financial records including lease agreements, income statements, and expense reports provide insight into the property's revenue potential. Environmental reports and zoning certifications are also necessary to ensure compliance and evaluate any restrictions affecting the property's value.

What Documents are Necessary for Commercial Property Appraisal?

| Number | Name | Description |

|---|---|---|

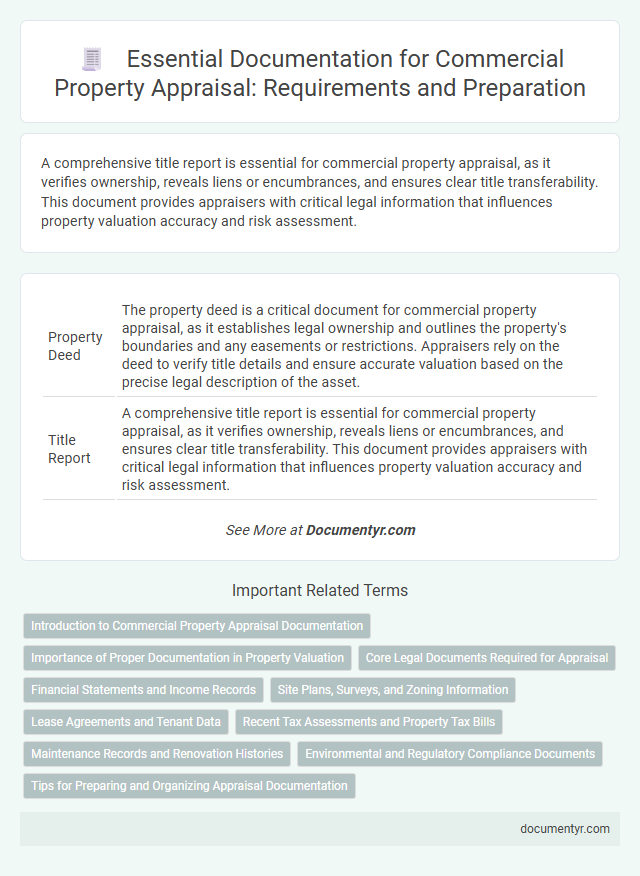

| 1 | Property Deed | The property deed is a critical document for commercial property appraisal, as it establishes legal ownership and outlines the property's boundaries and any easements or restrictions. Appraisers rely on the deed to verify title details and ensure accurate valuation based on the precise legal description of the asset. |

| 2 | Title Report | A comprehensive title report is essential for commercial property appraisal, as it verifies ownership, reveals liens or encumbrances, and ensures clear title transferability. This document provides appraisers with critical legal information that influences property valuation accuracy and risk assessment. |

| 3 | Recent Appraisal Reports | Recent appraisal reports for commercial property typically require documents such as the property deed, lease agreements, recent tax assessments, and financial statements reflecting income and expenses. Accurate and up-to-date appraisal reports rely heavily on these documents to analyze market value and investment potential effectively. |

| 4 | Lease Agreements | Lease agreements are essential documents for commercial property appraisal as they provide critical information on rental income, lease terms, tenant obligations, and occupancy rates. These agreements help appraisers assess the property's value by analyzing cash flow stability, lease duration, and market rent comparability. |

| 5 | Rent Roll | A comprehensive rent roll is essential for commercial property appraisal, detailing current tenants, lease terms, rental rates, and payment histories to accurately assess income potential. This document provides critical insights into property's revenue stability and future cash flow, aiding appraisers in determining market value. |

| 6 | Survey/Plat Map | A detailed survey or plat map is essential for commercial property appraisal as it outlines the precise boundaries, dimensions, and easements of the land, providing critical data to assess the property's value accurately. Survey documents also reveal any encroachments or zoning restrictions that may impact the commercial development potential and overall appraisal outcome. |

| 7 | Property Tax Statements | Property tax statements are crucial for commercial property appraisal as they provide verified information on assessed property value and tax liabilities, directly influencing the appraisal's accuracy. These documents help appraisers compare tax assessments with market values to determine a realistic valuation of the commercial property. |

| 8 | Income and Expense Statements | Income and expense statements are essential documents for commercial property appraisal, providing detailed records of revenue streams and operating costs that influence valuation accuracy. These statements help appraisers assess the property's net operating income (NOI), a critical factor in determining market value and investment potential. |

| 9 | Purchase Agreement | The Purchase Agreement is essential for commercial property appraisal as it outlines the transaction terms, including sale price, contingencies, and conditions that impact the property's market value. Appraisers analyze this document alongside financial records and zoning permits to determine an accurate and legally compliant valuation. |

| 10 | Building Plans and Specifications | Building plans and specifications provide critical details such as layout, dimensions, materials, and construction quality, essential for accurately assessing the value of commercial property. These documents enable appraisers to evaluate structural integrity and compliance with zoning regulations, impacting the overall appraisal outcome. |

| 11 | Zoning Documents | Zoning documents are crucial for commercial property appraisal as they define land use regulations, permissible building types, and development restrictions, directly impacting property value and potential. Detailed zoning maps, ordinances, and certificates of compliance ensure the property conforms to local government requirements, providing appraisers with essential data to assess legality and highest and best use. |

| 12 | Environmental Reports (Phase I/II ESA) | Environmental reports such as Phase I and Phase II Environmental Site Assessments (ESA) are essential documents in commercial property appraisal, providing critical data on potential contamination and environmental risks. These reports help appraisers determine the property's market value by identifying liabilities linked to soil, groundwater, and hazardous materials that could affect future use or redevelopment. |

| 13 | Permits and Licenses | Permits and licenses essential for commercial property appraisal include zoning permits, building permits, occupancy certificates, and business licenses that verify legal compliance and operational legitimacy. Accurate documentation of these permits ensures the appraisal reflects the property's true market value and adherence to local regulations. |

| 14 | Mortgage Statements | Mortgage statements are critical documents in commercial property appraisal as they provide detailed information about existing loan balances, interest rates, and payment histories, which directly influence property valuation. Appraisers use these statements to assess the property's financial obligations, ensuring accurate estimates of market value and potential investment risks. |

| 15 | Utility Bills | Utility bills such as electricity, water, and gas statements provide essential data on the operational expenses and energy consumption of a commercial property, directly influencing its valuation. These documents help appraisers assess ongoing costs, which affect the property's net operating income and overall market value. |

| 16 | Insurance Policies | Insurance policies play a critical role in commercial property appraisal by providing detailed information on coverage limits, risk factors, and historical claims that affect the property's market value. Appraisers require these documents to assess potential liabilities and ensure accurate valuation based on the property's insured status and risk exposure. |

| 17 | Maintenance Records | Maintenance records are crucial for commercial property appraisal as they provide comprehensive evidence of the property's condition and upkeep history, directly influencing its market value and longevity. Detailed logs of repairs, inspections, and routine maintenance demonstrate responsible asset management, affecting appraisers' assessment of functional and economic utility. |

| 18 | Capital Improvement Records | Capital improvement records are essential for commercial property appraisal as they provide detailed documentation of all enhancements and renovations that increase the property's value. These records help appraisers accurately assess the current condition and potential market worth by showcasing investments made in structural upgrades, system modernizations, and overall property improvements. |

| 19 | Tenant Estoppel Certificates | Tenant Estoppel Certificates are crucial documents in commercial property appraisals as they verify the terms, rent amounts, and lease obligations directly from tenants, providing lenders and appraisers with accurate information on income stability. These certificates help assess the property's financial viability by confirming there are no undisclosed disputes or lease modifications that could affect valuation. |

| 20 | Easement Agreements | Easement agreements are critical documents in commercial property appraisal as they define the legal rights for use or access to portions of the property by third parties, directly impacting property value and utility. Accurate appraisal requires reviewing recorded easements, access rights, and any restrictions they impose to assess potential limitations or benefits affecting marketability and functional use. |

Introduction to Commercial Property Appraisal Documentation

Commercial property appraisal requires a detailed collection of specific documents to accurately determine market value. Understanding the necessary documentation ensures a thorough and compliant appraisal process.

- Property Deed - Confirms legal ownership and property boundaries essential for appraisal accuracy.

- Lease Agreements - Provides insight into rental income and terms impacting property valuation.

- Financial Statements - Shows operating expenses and revenue, critical for assessing investment potential.

Importance of Proper Documentation in Property Valuation

What documents are necessary for a commercial property appraisal? Proper documentation ensures an accurate and reliable property valuation. Key documents include the deed, property tax records, lease agreements, and recent sales data.

Why is proper documentation important in commercial property valuation? Accurate documents provide a clear understanding of the property's legal status and financial performance. This helps appraisers determine the true market value and avoid valuation errors.

Core Legal Documents Required for Appraisal

Commercial property appraisal requires a set of core legal documents to ensure accurate valuation. These documents provide critical information about ownership, property rights, and legal boundaries.

Key documents include the property's title deed, which verifies ownership and any encumbrances or liens. A recent property tax statement is essential to confirm taxes paid and assess fiscal obligations. Additionally, any existing lease agreements help appraisers understand income potential and tenant obligations.

Financial Statements and Income Records

Financial statements are essential documents for commercial property appraisal, providing a clear picture of the property's income and expenses. Accurate records showcase the property's profitability and financial health to appraisers.

Income records, including rent rolls and lease agreements, demonstrate consistent revenue streams and tenant stability. You must ensure these documents are up-to-date and organized to facilitate a thorough appraisal process.

Site Plans, Surveys, and Zoning Information

Accurate commercial property appraisal requires specific documents to assess the property's value comprehensively. Site plans, surveys, and zoning information are critical for understanding property boundaries, land use, and legal restrictions.

- Site Plans - Detailed drawings that show the layout of buildings, utilities, and infrastructure on the property.

- Surveys - Professional measurements that define property boundaries and identify any encroachments or easements.

- Zoning Information - Legal documentation that specifies permitted land uses, zoning classifications, and development regulations.

These documents ensure a thorough and legally compliant commercial property appraisal process.

Lease Agreements and Tenant Data

Accurate commercial property appraisal requires essential documentation to evaluate the asset's income potential and legal standing. Lease agreements and tenant data are critical components for determining rental income and occupancy stability.

- Lease Agreements - These documents provide detailed terms of tenancy, including rent amounts, lease duration, and renewal options crucial for income analysis.

- Tenant Data - Information on tenant creditworthiness, payment history, and business operations helps assess the reliability of rental income streams.

- Rent Roll - A comprehensive rent roll lists all tenants, lease dates, and rent schedules, offering a snapshot of current cash flow and occupancy rates.

Recent Tax Assessments and Property Tax Bills

Recent tax assessments provide a current market value estimate used by appraisers to determine the worth of commercial properties. Property tax bills offer detailed information on annual tax expenses, reflecting the financial obligations tied to the property. These documents are essential in benchmarking the appraisal and ensuring accurate valuation for commercial property transactions.

Maintenance Records and Renovation Histories

| Document Type | Importance in Commercial Property Appraisal | Details |

|---|---|---|

| Maintenance Records | Essential for assessing property condition and longevity | Records showing routine upkeep such as HVAC servicing, plumbing checks, electrical inspections, and structural repairs. These documents highlight the property's current state and potential future expenses. Well-maintained properties often appraise at higher values due to reduced risk of immediate repairs. |

| Renovation Histories | Crucial for understanding improvements and compliance | Detailed reports of past renovations including dates, contractors, permits, and scope of work. Renovation histories demonstrate upgrades like modernization of interiors, facade improvements, or expansion projects. These factors influence market value by showcasing enhancements in functionality and property appeal. |

Environmental and Regulatory Compliance Documents

Environmental and regulatory compliance documents are crucial for an accurate commercial property appraisal. These documents verify that the property meets all local, state, and federal environmental standards.

Key documents include Phase I and Phase II Environmental Site Assessments, which identify potential contamination risks. You should also provide permits, zoning certificates, and records of any past environmental remediation efforts.

What Documents are Necessary for Commercial Property Appraisal? Infographic