First-time home buyers must provide essential documents including proof of income such as pay stubs, tax returns, and W-2 forms, along with bank statements to verify savings and assets. Lenders also require identification documents like a valid driver's license or passport and a completed loan application form. Credit reports and employment verification letters help assess financial stability, making these documents vital for a smooth mortgage approval process.

What Documents are Necessary for First-Time Home Buyer Mortgage Application?

| Number | Name | Description |

|---|---|---|

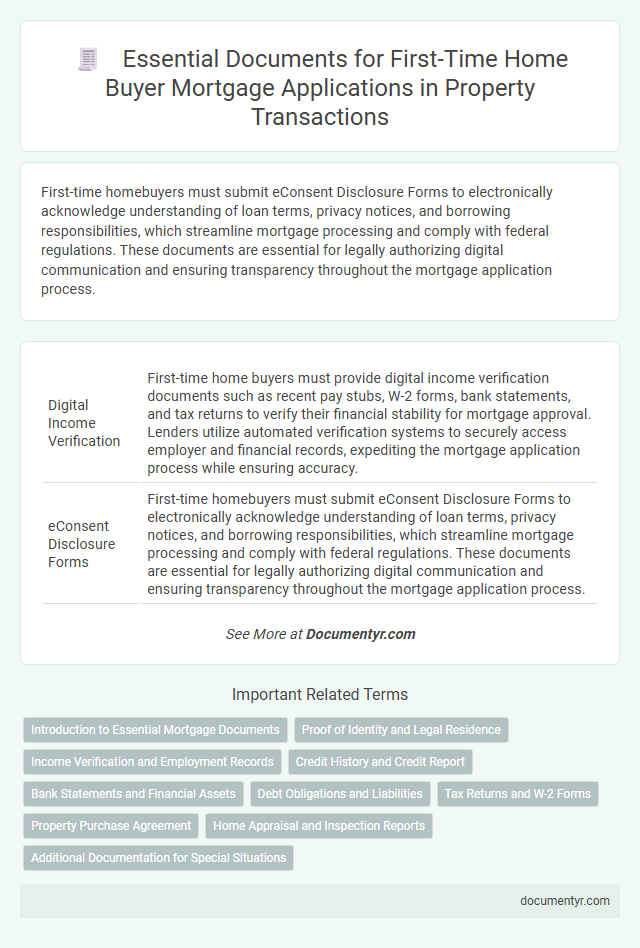

| 1 | Digital Income Verification | First-time home buyers must provide digital income verification documents such as recent pay stubs, W-2 forms, bank statements, and tax returns to verify their financial stability for mortgage approval. Lenders utilize automated verification systems to securely access employer and financial records, expediting the mortgage application process while ensuring accuracy. |

| 2 | eConsent Disclosure Forms | First-time homebuyers must submit eConsent Disclosure Forms to electronically acknowledge understanding of loan terms, privacy notices, and borrowing responsibilities, which streamline mortgage processing and comply with federal regulations. These documents are essential for legally authorizing digital communication and ensuring transparency throughout the mortgage application process. |

| 3 | Automated Asset Statements | Automated asset statements streamline the mortgage application process for first-time home buyers by providing verified bank transaction histories directly from financial institutions, reducing the need for manual document submissions. Lenders require these statements to assess financial stability, verify income sources, and ensure sufficient funds for down payments and closing costs. |

| 4 | Electronic W-2 Import | First-time homebuyers must submit essential documents such as income verification, with Electronic W-2 Import streamlining the mortgage application by directly uploading W-2 forms from employers or IRS databases, ensuring accurate and efficient income verification. This digital method reduces errors, accelerates processing times, and provides lenders with reliable data to assess borrower eligibility. |

| 5 | Remote Online Notarization (RON) | First-time home buyers must provide key documents such as government-issued ID, proof of income, credit reports, and property details for mortgage applications, with Remote Online Notarization (RON) enabling secure, electronic notarization of these documents to streamline the process. RON ensures legal compliance and reduces delays by allowing buyers to notarize mortgage documents remotely through encrypted video conferencing platforms. |

| 6 | eClosing Disclosure Acknowledgement | First-time home buyers must submit a signed eClosing Disclosure Acknowledgement to confirm receipt and review of key loan terms and closing costs, ensuring compliance with the Truth in Lending Act and Real Estate Settlement Procedures Act. This document is crucial for transparent communication between lenders and buyers, preventing last-minute surprises at closing and facilitating a smoother mortgage approval process. |

| 7 | Blockchain Property Title | First-time home buyers applying for a mortgage must provide a blockchain property title, which offers a secure and tamper-proof digital record of ownership that simplifies title verification and reduces fraud risks. Essential documents also include proof of identity, income statements, credit reports, and the purchase agreement, all integrated with the blockchain title to ensure seamless verification by lenders. |

| 8 | E-signature Borrower Certification | First-time home buyers must provide an E-signature Borrower Certification during the mortgage application to verify identity and agreement to loan terms electronically, ensuring compliance with the Electronic Signatures in Global and National Commerce Act (ESIGN). This digital certification streamlines the approval process by legally binding the borrower's consent without physical paperwork. |

| 9 | Digital Identity Verification (KYC) | Digital identity verification streamlines the mortgage application process for first-time home buyers by enabling secure and instant Know Your Customer (KYC) compliance through government-issued ID authentication, facial recognition, and biometric data matching. Essential documents include a valid government ID, proof of address, Social Security Number, and financial statements, all digitally submitted to expedite verification and reduce fraud risk. |

| 10 | Verification of Rent (VOR) API | Verification of Rent (VOR) API streamlines the mortgage application process for first-time home buyers by providing instant access to verified rental payment histories, reducing the need for traditional documentation like bank statements or landlord letters. This real-time rental verification enhances accuracy and accelerates lender decision-making, ensuring a smoother path to mortgage approval. |

Introduction to Essential Mortgage Documents

Applying for a mortgage as a first-time home buyer requires gathering specific documents to verify financial and personal information. These documents help lenders assess creditworthiness and ability to repay the loan.

- Proof of Income - Documents such as pay stubs, tax returns, and W-2 forms demonstrate the applicant's earning stability and capacity to afford mortgage payments.

- Credit History - Credit reports and scores provide lenders with insight into the borrower's financial responsibility and past debt management.

- Identification and Residency - Valid government-issued ID and proof of residence confirm the borrower's identity and legal ability to enter into a mortgage agreement.

Proof of Identity and Legal Residence

Proof of identity is a crucial document for a first-time home buyer mortgage application. Valid government-issued identification such as a passport or driver's license verifies your identity.

Legal residence status must also be established through documents like a permanent resident card or visa. These papers confirm your eligibility to apply for a mortgage within the property's jurisdiction.

Income Verification and Employment Records

| Document Type | Purpose | Details Required |

|---|---|---|

| Income Verification | Confirm your financial stability and ability to repay the mortgage | Recent pay stubs (last 30 days), W-2 forms (past two years), tax returns (past two years), and proof of additional income such as bonuses or alimony |

| Employment Records | Verify continuous employment and job stability | Employment verification letter from employer, contact information of HR or manager, details of position and length of employment, and if self-employed, profit and loss statements or business tax returns |

Credit History and Credit Report

Securing a mortgage as a first-time home buyer requires detailed documentation, with a strong focus on your credit history and credit report. These documents demonstrate your financial responsibility and ability to repay the loan.

- Credit Report - A comprehensive report detailing your credit accounts, payments, and outstanding debts.

- Credit Score - A numerical representation of your creditworthiness, influencing mortgage approval and interest rates.

- Credit History Verification - Documentation from credit bureaus confirming your payment history and financial behavior.

Lenders use these credit documents to assess risk and determine the best mortgage terms for first-time buyers.

Bank Statements and Financial Assets

First-time home buyers must provide recent bank statements to verify their financial stability during the mortgage application process. These documents demonstrate consistent income and help lenders assess the ability to repay the loan.

Financial assets, such as savings accounts, retirement funds, and investment portfolios, must also be documented to support the buyer's financial profile. Lenders use this information to evaluate reserves available for down payment and closing costs. Accurate and up-to-date records increase the chances of mortgage approval and favorable loan terms.

Debt Obligations and Liabilities

First-time home buyers must provide detailed documentation of their current debt obligations and liabilities to secure a mortgage. Essential documents include credit card statements, student loan records, and any outstanding personal loans, which help lenders assess the borrower's financial stability. Accurate disclosure of these liabilities ensures the lender can properly evaluate the applicant's debt-to-income ratio and mortgage eligibility.

Tax Returns and W-2 Forms

First-time home buyers must provide specific documents to complete their mortgage application effectively. Tax returns and W-2 forms are crucial for verifying income and ensuring loan eligibility.

Mortgage lenders require copies of tax returns, typically for the past two years, to assess financial stability and income consistency. W-2 forms supplement tax returns by confirming annual earnings from employers, enhancing the accuracy of income verification.

Property Purchase Agreement

The Property Purchase Agreement is a crucial document for first-time home buyers applying for a mortgage. It outlines the terms and conditions of the property sale, including the agreed price, property details, and contingencies. Lenders require this agreement to verify the transaction and ensure the loan aligns with the property's purchase terms.

Home Appraisal and Inspection Reports

What documents are necessary for a first-time home buyer mortgage application? Lenders require a thorough home appraisal report to ensure the property's value justifies the loan amount. Inspection reports are essential to verify the home's condition and identify any potential issues that could affect your mortgage approval.

What Documents are Necessary for First-Time Home Buyer Mortgage Application? Infographic