A commercial lease agreement requires essential documents such as the lease contract itself, proof of property ownership, and tenant identification. Detailed documents like insurance policies, business licenses, and financial statements are often necessary to verify the tenant's legitimacy and ability to meet lease obligations. Accurate record-keeping of these documents ensures legal compliance and protects both landlord and tenant rights.

What Documents are Needed for a Commercial Lease Agreement?

| Number | Name | Description |

|---|---|---|

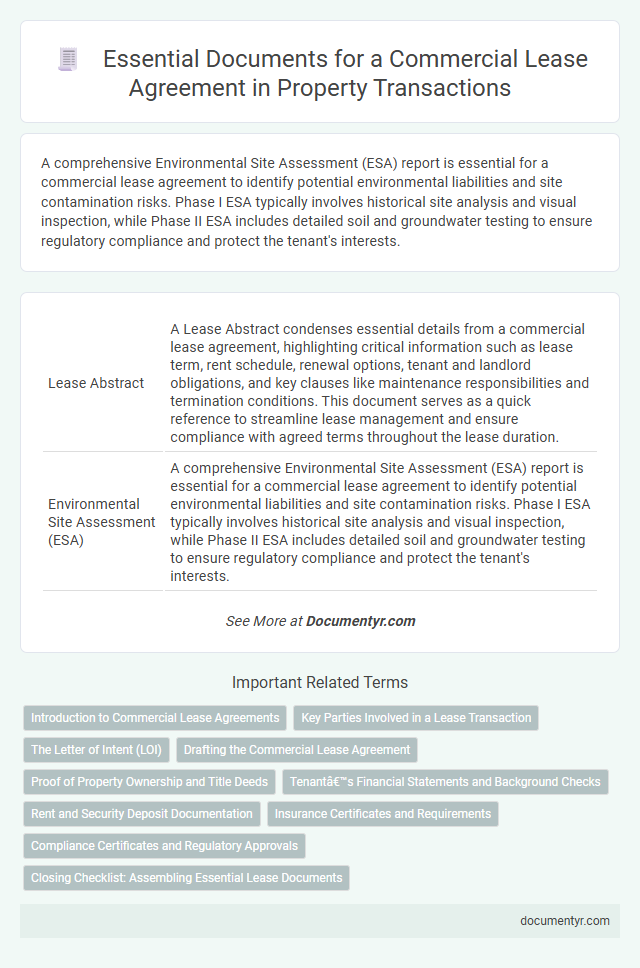

| 1 | Lease Abstract | A Lease Abstract condenses essential details from a commercial lease agreement, highlighting critical information such as lease term, rent schedule, renewal options, tenant and landlord obligations, and key clauses like maintenance responsibilities and termination conditions. This document serves as a quick reference to streamline lease management and ensure compliance with agreed terms throughout the lease duration. |

| 2 | Environmental Site Assessment (ESA) | A comprehensive Environmental Site Assessment (ESA) report is essential for a commercial lease agreement to identify potential environmental liabilities and site contamination risks. Phase I ESA typically involves historical site analysis and visual inspection, while Phase II ESA includes detailed soil and groundwater testing to ensure regulatory compliance and protect the tenant's interests. |

| 3 | Tenant Estoppel Certificate | A Tenant Estoppel Certificate is a critical document in a commercial lease agreement, confirming the tenant's lease terms, rent payments, and any disputes or claims against the landlord. This certificate protects both parties by providing an accurate snapshot of the lease status, ensuring transparency and legal clarity during property transactions or refinancing. |

| 4 | Subordination, Non-Disturbance, and Attornment Agreement (SNDA) | A Subordination, Non-Disturbance, and Attornment Agreement (SNDA) is essential in a commercial lease, clarifying the tenant's rights relative to the landlord's lender by subordinating the lease to the mortgage, ensuring non-disturbance of tenancy if foreclosure occurs, and confirming tenant attornment to a new owner. This document protects tenants from eviction during ownership changes and is often required by lenders to secure their interests while preserving tenant occupancy rights. |

| 5 | Certificate of Insurance (COI) | A Certificate of Insurance (COI) is essential for a commercial lease agreement as it provides proof of liability coverage, protecting both landlord and tenant from potential financial losses due to property damage or personal injury. This document typically includes policy limits, coverage types, and the insurer's details, ensuring compliance with lease requirements and risk management. |

| 6 | Tenant Representation Letter | A Tenant Representation Letter is a crucial document in a commercial lease agreement, outlining the tenant's authorization for a broker or agent to act on their behalf during lease negotiations. This letter ensures clear communication of tenant requirements and streamlines the leasing process, protecting tenant interests and facilitating efficient property lease transactions. |

| 7 | Letter of Intent (LOI) | A Letter of Intent (LOI) for a commercial lease agreement outlines key terms such as rent, lease duration, and property details, serving as a non-binding preliminary agreement between landlord and tenant. This document streamlines negotiations and provides a clear framework before drafting the final lease contract, ensuring both parties agree on essential conditions. |

| 8 | Good Standing Certificate | A Good Standing Certificate is essential for a commercial lease agreement as it verifies the tenant's legal status and compliance with state regulations, ensuring the entity is authorized to conduct business. This document helps landlords assess the credibility and stability of the tenant, reducing risks associated with leasing commercial property. |

| 9 | Operating Expense Reconciliation Statement | A detailed Operating Expense Reconciliation Statement is essential for a commercial lease agreement, outlining the tenant's share of common area maintenance, property taxes, insurance, and utilities based on actual expenses incurred. This document ensures transparency and accuracy in billing, helping both landlord and tenant verify and reconcile operating costs at the end of each fiscal year. |

| 10 | Fit-Out Rider | A Fit-Out Rider is a crucial document in a commercial lease agreement that outlines the specific improvements and modifications a tenant is permitted to make to the leased property. It details the scope of work, responsibilities for costs, approval processes, and standards for construction to ensure compliance with the landlord's requirements and local regulations. |

Introduction to Commercial Lease Agreements

A commercial lease agreement is a legal contract between a landlord and a business tenant outlining the terms of renting commercial property. It specifies details such as rent amount, lease duration, and permitted use of the space. Understanding the essential documents needed can help you navigate the leasing process smoothly.

Key Parties Involved in a Lease Transaction

Understanding the essential documents for a commercial lease agreement is crucial for a smooth transaction. These documents protect the interests of all parties and define the terms of the lease clearly.

The key parties involved in a lease transaction include the landlord, the tenant, and often a property manager or leasing agent. Your lease agreement will typically include identification documents, proof of business registration, and financial statements. These documents ensure both parties are verified and capable of fulfilling the lease obligations.

The Letter of Intent (LOI)

The Letter of Intent (LOI) is a preliminary document outlining the key terms and conditions of a commercial lease agreement. It serves as a roadmap for both the landlord and tenant, highlighting essential details such as rental rates, lease duration, and property use. The LOI helps streamline negotiations and ensures both parties have a clear understanding before drafting the final lease contract.

Drafting the Commercial Lease Agreement

Drafting a commercial lease agreement requires gathering essential documents to ensure legal clarity and enforceability. Proper documentation protects both landlord and tenant rights while outlining lease terms.

- Title Deed - Confirms the landlord's legal ownership of the commercial property.

- Property Survey Report - Details the exact boundaries and condition of the property involved in the lease.

- Tenant Identification - Includes business licenses and identification to verify the tenant's legal status.

Thorough preparation of these documents facilitates a clear, binding commercial lease agreement that minimizes disputes.

Proof of Property Ownership and Title Deeds

Proof of property ownership is a critical document required for a commercial lease agreement. It verifies the landlord's legal right to lease the property to tenants.

Title deeds serve as the official record of ownership and must be presented to confirm clear ownership of the commercial premises. These deeds ensure there are no disputes regarding the property's legal status during the leasing process.

Tenant’s Financial Statements and Background Checks

| Document | Description | Importance |

|---|---|---|

| Tenant's Financial Statements | Includes balance sheets, income statements, and cash flow statements. These documents provide a clear picture of the tenant's financial health, stability, and ability to meet lease obligations. | Essential for assessing creditworthiness, minimizing risk, and ensuring consistent rent payments throughout the lease term. |

| Background Checks | Encompasses credit reports, business history, legal records, and references from previous landlords or partners. This information helps verify the tenant's reliability and track record. | Crucial for confirming integrity, preventing fraud, and maintaining a secure commercial leasing environment. |

Rent and Security Deposit Documentation

Rent and security deposit documentation are crucial components in a commercial lease agreement to ensure clear financial terms and protect both landlord and tenant rights. Proper documentation helps prevent disputes and supports legal enforcement if necessary.

- Rent Payment Documentation - A detailed rent schedule specifying amount, due dates, and acceptable payment methods is essential to establish clear payment expectations.

- Security Deposit Agreement - Documentation outlining the deposit amount, conditions for withholding or refunding, and the process for damage claims secures tenant and landlord interests.

- Receipts and Proof of Payment - Maintaining records of all rent and security deposit payments provides evidence of compliance and supports dispute resolution if disagreements arise.

Insurance Certificates and Requirements

What insurance certificates are required for a commercial lease agreement? Commercial lease agreements typically demand proof of liability insurance and property insurance to protect both parties. Insurance certificates verify that tenants maintain coverage against risks such as property damage and bodily injury.

Why are insurance requirements important in a commercial lease? These requirements minimize financial risks and potential legal disputes by ensuring tenants carry adequate insurance coverage. They also safeguard the landlord's property and business interests throughout the lease term.

How should tenants provide proof of insurance for a commercial lease? Tenants must submit official insurance certificates from their providers that list the landlord as an additional insured party. The certificates should specify coverage limits, policy periods, and types of insurance as stipulated in the lease agreement.

What types of insurance coverage are usually mandated in commercial leases? Commonly required coverages include general liability insurance, property insurance, and sometimes business interruption insurance. The specific insurance requirements depend on the property type, business operations, and landlord policies.

Can insurance requirements vary between commercial leases? Yes, insurance certificates and coverage details can differ based on property location, risk factors, and lease terms. Tenants should carefully review the lease agreement to understand and fulfill all insurance obligations.

Compliance Certificates and Regulatory Approvals

Commercial lease agreements require specific documents to ensure legal compliance and operational safety. Compliance certificates and regulatory approvals validate that the leased property meets all mandated codes and standards.

- Compliance Certificates - These documents confirm the property adheres to local building, fire safety, and health regulations, ensuring tenant and occupant safety.

- Zoning Approvals - Zoning approvals verify that the commercial property is legally permitted for the intended business use within the designated area.

- Environmental Clearances - Environmental clearances certify that the property complies with environmental laws and poses no ecological risks to the surrounding area.

What Documents are Needed for a Commercial Lease Agreement? Infographic