Buyers need several important documents for a real estate closing in Florida, including a valid government-issued ID, the purchase agreement, and proof of homeowner's insurance. Lenders require loan documents such as the mortgage commitment letter and Closing Disclosure, while the title company provides the title insurance policy and settlement statement. Ensuring all paperwork is accurate and complete helps facilitate a smooth and timely closing process.

What Documents Does a Buyer Need for Real Estate Closing in Florida?

| Number | Name | Description |

|---|---|---|

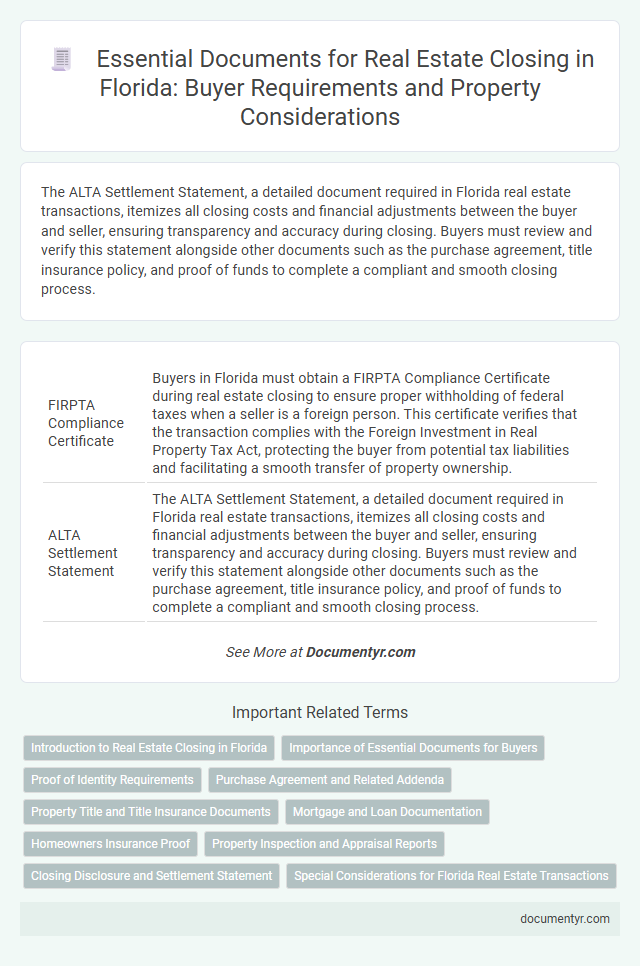

| 1 | FIRPTA Compliance Certificate | Buyers in Florida must obtain a FIRPTA Compliance Certificate during real estate closing to ensure proper withholding of federal taxes when a seller is a foreign person. This certificate verifies that the transaction complies with the Foreign Investment in Real Property Tax Act, protecting the buyer from potential tax liabilities and facilitating a smooth transfer of property ownership. |

| 2 | ALTA Settlement Statement | The ALTA Settlement Statement, a detailed document required in Florida real estate transactions, itemizes all closing costs and financial adjustments between the buyer and seller, ensuring transparency and accuracy during closing. Buyers must review and verify this statement alongside other documents such as the purchase agreement, title insurance policy, and proof of funds to complete a compliant and smooth closing process. |

| 3 | Loan Payoff Authorization | Buyers in Florida need a Loan Payoff Authorization during real estate closing to instruct the lender to pay off the seller's existing mortgage from the sale proceeds. This document ensures clear title transfer by confirming that all outstanding liens are settled prior to ownership handover. |

| 4 | Remote Online Notarization (RON) Consent | Buyers in Florida require Remote Online Notarization (RON) consent forms for real estate closings using digital platforms to verify identity and authorize documents electronically. This consent ensures compliance with Florida's electronic notarization laws, facilitating secure and efficient remote real estate transactions. |

| 5 | TRID Closing Disclosure | Buyers in Florida need the TRID Closing Disclosure, a critical document that outlines the final loan terms, closing costs, and transaction details required by federal law to ensure transparency in real estate closings. This form must be reviewed carefully prior to closing to confirm all financial figures align with the Loan Estimate and to avoid last-minute surprises. |

| 6 | Earnest Money Wire Confirmation | Buyers in Florida must provide an Earnest Money Wire Confirmation to verify the transfer of funds securing the property purchase during real estate closing. This document ensures the deposit is received and properly credited, protecting both parties in the transaction. |

| 7 | eClosing Acknowledgment | Buyers in Florida must provide an eClosing Acknowledgment when finalizing a real estate transaction, which electronically confirms their understanding and acceptance of the digital closing process. This document ensures compliance with Florida law governing electronic records and signatures in property transfers, streamlining the closing while maintaining legal integrity. |

| 8 | Title Commitment Schedule B-II Exceptions | Buyers in Florida must review the Title Commitment Schedule B-II Exceptions carefully during real estate closing, as it lists exceptions such as liens, easements, and restrictions that are not covered by title insurance. Understanding these exceptions is crucial to avoid unexpected encumbrances affecting property ownership and to ensure a clear title transfer. |

| 9 | Homestead Affidavit | Buyers in Florida must provide a completed Homestead Affidavit during real estate closing to claim property tax exemptions and protect their primary residence from certain creditors under Florida law. This document, along with the deed, proof of identity, and mortgage documents, ensures eligibility for homestead benefits and legal recording of ownership. |

| 10 | Florida Electronic Signature Affidavit | For real estate closings in Florida, buyers must submit a Florida Electronic Signature Affidavit to validate the use of electronic signatures on closing documents, ensuring compliance with state laws. This affidavit streamlines the signing process, enhances security, and confirms buyer consent to electronically execute contracts, deeds, and other necessary paperwork. |

Introduction to Real Estate Closing in Florida

Understanding the documents required for a real estate closing in Florida is essential for a smooth transaction. This process marks the final step in transferring property ownership, involving several critical papers.

- Purchase Agreement - This contract outlines the terms and conditions agreed upon by the buyer and seller for the property sale.

- Title Insurance Policy - Protects the buyer against any future claims or disputes over property ownership.

- Settlement Statement (HUD-1 or Closing Disclosure) - Details all financial transactions, including costs, fees, and credits related to the closing process.

Importance of Essential Documents for Buyers

| Document | Importance for Buyers in Florida |

|---|---|

| Purchase Agreement | Outlines the terms and conditions of the property sale. This legally binding contract protects your interests and ensures both parties agree on key details such as price, contingencies, and closing date. |

| Title Search and Title Insurance | Confirms the property's ownership history and identifies any liens or encumbrances. Title insurance safeguards you from future claims against the property, providing peace of mind during and after closing. |

| Mortgage Documents | Includes the loan application, approval letters, and closing disclosure. These documents detail the terms of your financing, interest rates, and payment schedules, critical for securing your home purchase. |

| Property Survey | Defines the property boundaries and identifies any easements or encroachments. Accurate surveys help avoid future disputes and confirm what you are purchasing. |

| Home Inspection Report | Provides an assessment of the property's condition, revealing potential issues that may require repairs or affect property value. |

| Closing Disclosure | Details all final costs and fees associated with the transaction. Reviewing this document ensures transparency and prepares you for the financial aspects of closing. |

| Identification | Valid government-issued ID is required to verify your identity and complete the closing process securely. |

Proof of Identity Requirements

What proof of identity do you need for a real estate closing in Florida? Buyers must present a valid government-issued photo ID, such as a driver's license or passport. This requirement ensures the buyer's identity is confirmed before finalizing the transaction.

Purchase Agreement and Related Addenda

For a real estate closing in Florida, the Purchase Agreement is a critical document that outlines the terms and conditions agreed upon by the buyer and seller. This contract serves as the foundation for the transaction and must be thoroughly reviewed before closing.

Related Addenda, such as inspection reports, financing contingencies, and disclosure statements, provide additional details that support the Purchase Agreement. These documents ensure that all parties are informed of any specific agreements or conditions that affect the property sale. You should gather and organize all these documents to facilitate a smooth closing process.

Property Title and Title Insurance Documents

Understanding the essential documents needed for a real estate closing in Florida is crucial for a smooth transaction. Property title and title insurance documents secure your ownership rights and protect against potential title disputes.

- Property Title - This document proves legal ownership of the property and must be clear of liens or encumbrances before closing.

- Title Insurance Policy - This insurance protects the buyer from financial loss due to defects in the property's title not found during the title search.

- Title Commitment - A preliminary report issued before closing that outlines the terms under which the title insurance will be issued.

Mortgage and Loan Documentation

Buyers in Florida must prepare specific mortgage and loan documents for a smooth real estate closing. These documents verify the buyer's financial qualifications and secure the transaction's legality.

- Loan Estimate - A detailed breakdown of estimated loan terms and closing costs provided by the lender.

- Mortgage Note - The buyer's written promise to repay the loan under specified terms.

- Closing Disclosure - A final statement of loan costs and payments that must be reviewed before closing.

Properly organizing these documents ensures compliance with Florida property laws and expedites the closing process.

Homeowners Insurance Proof

Proof of homeowners insurance is a critical document required for real estate closing in Florida. This insurance demonstrates that the property is protected against potential damages or losses before the transaction completes. Lenders typically request this proof to ensure the investment is secure and that the buyer meets the closing requirements.

Property Inspection and Appraisal Reports

Buyers in Florida must prepare several key documents for a successful real estate closing. Among these, property inspection and appraisal reports are essential to ensure the property's condition and market value are thoroughly evaluated.

The property inspection report details the structural and mechanical status of the home, identifying any necessary repairs or maintenance issues. The appraisal report provides a professional assessment of the property's market value, which is crucial for mortgage approval and final sale price.

Closing Disclosure and Settlement Statement

Buyers in Florida need several key documents for real estate closing, including the Closing Disclosure and the Settlement Statement. The Closing Disclosure provides a detailed summary of loan terms, closing costs, and the final amount to be paid, ensuring transparency. The Settlement Statement outlines the financial transactions between buyer and seller, confirming the distribution of funds and fees during the closing process.

What Documents Does a Buyer Need for Real Estate Closing in Florida? Infographic