To refinance a mortgage, essential documents include your current mortgage statement, proof of income such as pay stubs or tax returns, and recent bank statements to verify assets. Lenders also require credit reports and identification documents like a driver's license. Providing complete and accurate paperwork can expedite the refinancing approval process.

What Documents are Needed for Mortgage Refinancing?

| Number | Name | Description |

|---|---|---|

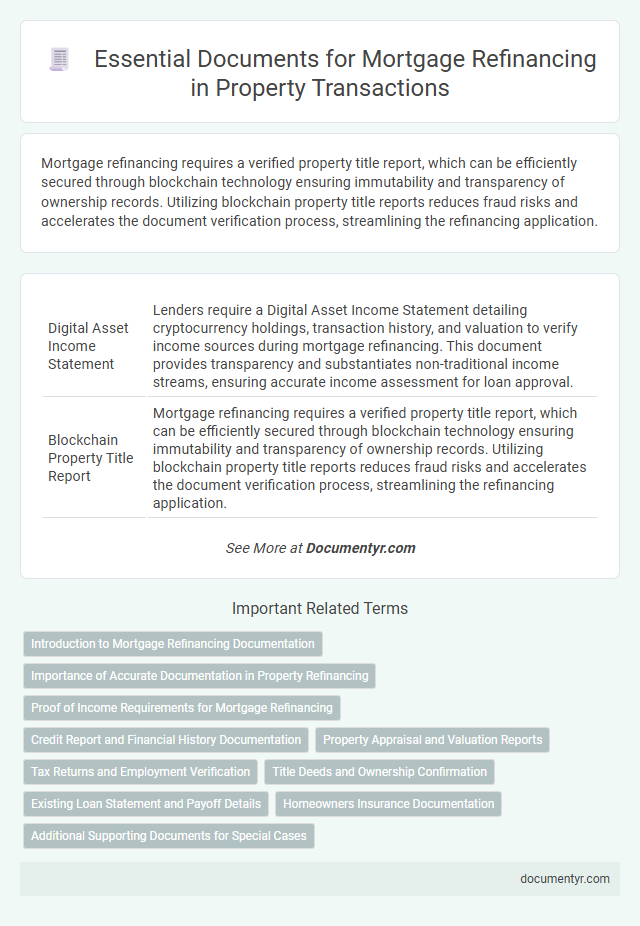

| 1 | Digital Asset Income Statement | Lenders require a Digital Asset Income Statement detailing cryptocurrency holdings, transaction history, and valuation to verify income sources during mortgage refinancing. This document provides transparency and substantiates non-traditional income streams, ensuring accurate income assessment for loan approval. |

| 2 | Blockchain Property Title Report | Mortgage refinancing requires a verified property title report, which can be efficiently secured through blockchain technology ensuring immutability and transparency of ownership records. Utilizing blockchain property title reports reduces fraud risks and accelerates the document verification process, streamlining the refinancing application. |

| 3 | Automated Valuation Model (AVM) Disclosure | Mortgage refinancing requires key documents including income verification, credit reports, and property appraisal details. The Automated Valuation Model (AVM) Disclosure informs borrowers that a computer-generated property value estimate is used in the refinancing process, enhancing transparency and accuracy. |

| 4 | Remote Online Notarization (RON) Receipt | A Remote Online Notarization (RON) receipt is essential for mortgage refinancing as it verifies the digital notarization of documents, ensuring compliance with state laws and lender requirements. This receipt serves as proof that the borrower's signatures were authenticated securely online, facilitating a streamlined and legally valid refinancing process. |

| 5 | E-Closing Disclosure Consent | Mortgage refinancing requires submitting an E-Closing Disclosure Consent, which authorizes the lender to provide the Closing Disclosure electronically, expediting the review process. This document ensures borrowers receive key loan terms and closing costs at least three business days before closing, complying with TRID regulations. |

| 6 | Gig Economy Income Verification | Mortgage refinancing with gig economy income requires comprehensive documentation including 12 to 24 months of tax returns, profit and loss statements, bank statements, and invoices to verify inconsistent earnings. Lenders may also request a history of 1099 forms and detailed records of all income sources to accurately assess financial stability. |

| 7 | Smart Contract Mortgage Addendum | The Smart Contract Mortgage Addendum requires detailed property title deeds, current mortgage statements, and identification proof for secure automated processing. This digital document enables transparent contract enforcement, reducing paperwork and expediting refinancing approvals through blockchain technology. |

| 8 | Environmental, Social, and Governance (ESG) Property Report | A comprehensive Environmental, Social, and Governance (ESG) Property Report is essential for mortgage refinancing as it assesses the property's compliance with sustainability standards, risk factors, and social impact metrics. This report includes environmental assessments, energy efficiency ratings, and governance disclosures that lenders use to evaluate long-term asset value and regulatory adherence. |

| 9 | AI-Powered Credit Profile Summary | Mortgage refinancing requires essential documents such as income verification, tax returns, property appraisal, and a comprehensive credit report generated through AI-powered credit profile summary tools. These AI tools analyze credit history, payment patterns, and financial behavior to provide lenders with accurate, data-driven insights that expedite approval and optimize loan terms. |

| 10 | Cryptocurrency Holdings Declaration | Lenders require a comprehensive Cryptocurrency Holdings Declaration to verify digital asset ownership and ensure accurate income assessment during mortgage refinancing. This document must detail wallet addresses, transaction history, and current valuations to comply with financial regulations and support creditworthiness evaluation. |

Introduction to Mortgage Refinancing Documentation

Mortgage refinancing requires submitting specific documents to verify your financial status and property details. These documents help lenders assess your eligibility and offer suitable loan terms.

Commonly required papers include income statements, credit reports, and property appraisals. Understanding the necessary documentation streamlines the refinancing process and reduces delays.

Importance of Accurate Documentation in Property Refinancing

Accurate documentation is crucial for mortgage refinancing to ensure a smooth and efficient approval process. Essential documents include income verification, credit reports, and property appraisal certificates, which validate the borrower's financial stability and property value. Precise and complete paperwork helps avoid delays, reduces the risk of loan denial, and secures favorable refinancing terms.

Proof of Income Requirements for Mortgage Refinancing

What proof of income documents are required for mortgage refinancing? Lenders typically require recent pay stubs, W-2 forms, and tax returns to verify your income. Self-employed applicants may need to provide profit and loss statements or 1099 forms.

Credit Report and Financial History Documentation

Mortgage refinancing requires a thorough review of your credit report to assess creditworthiness and risk levels. Lenders use this report to verify payment history, outstanding debts, and credit score, which directly impact loan approval and interest rates.

Financial history documentation includes proof of income such as pay stubs, tax returns, and bank statements. These documents help lenders evaluate debt-to-income ratio and overall financial stability. Accurate financial records ensure smoother refinancing processing and better loan terms.

Property Appraisal and Valuation Reports

Property appraisal and valuation reports play a crucial role in mortgage refinancing. These documents provide an accurate assessment of the property's current market value.

Lenders rely on these reports to determine the loan amount and interest rates for refinancing. Your property appraisal ensures transparency and fairness throughout the refinancing process.

Tax Returns and Employment Verification

Mortgage refinancing requires several key documents to verify your financial stability. Two of the most critical documents are tax returns and employment verification.

- Tax Returns - Lenders typically ask for the last two years of tax returns to assess income consistency and financial health.

- Employment Verification - Proof of current employment is needed to confirm job status and income reliability.

- Additional Supporting Documents - Pay stubs and W-2 forms often complement tax returns and employment verification to provide a complete financial profile.

Title Deeds and Ownership Confirmation

| Document | Description | Importance in Mortgage Refinancing |

|---|---|---|

| Title Deeds | The official document that proves ownership of the property. It contains legal descriptions and evidence of title transfer. | Essential for verifying property ownership. Lenders require clear title deeds to confirm there are no disputes or liens affecting the property before approving refinancing. |

| Ownership Confirmation | Additional documents such as certificates of title, previous sale agreements, or property tax receipts that reinforce ownership claims. | Supports the validity of the title deeds. These documents provide lenders with assurance that you have rightful control over the property, reducing lending risks. |

Existing Loan Statement and Payoff Details

When applying for mortgage refinancing, providing an existing loan statement is essential to verify current loan details, including outstanding balance and payment history. Payoff details are required to determine the exact amount needed to fully settle the original mortgage, ensuring accurate refinancing calculations. These documents streamline the refinancing process by offering lenders clear financial information and facilitating timely loan approval.

Homeowners Insurance Documentation

Homeowners insurance documentation is a crucial part of the mortgage refinancing process. Lenders require proof that your property is insured to protect their investment.

- Current Insurance Policy - Provides details of coverage, insurer name, and policy number.

- Declarations Page - Summarizes the coverage amounts and terms of the insurance policy.

- Proof of Payment - Confirms that premiums are up to date and the policy is active.

Submitting accurate homeowners insurance documents ensures smooth approval of your mortgage refinance.

What Documents are Needed for Mortgage Refinancing? Infographic