First-time home buyers need key documents such as proof of income, including pay stubs, tax returns, and employment verification, to demonstrate their ability to repay the mortgage. Lenders also require credit reports, bank statements, and identification documents to assess financial stability and verify identity. Having these essential documents organized ensures a smoother and faster mortgage approval process.

What Documents Does a First-Time Home Buyer Need for Mortgage Approval?

| Number | Name | Description |

|---|---|---|

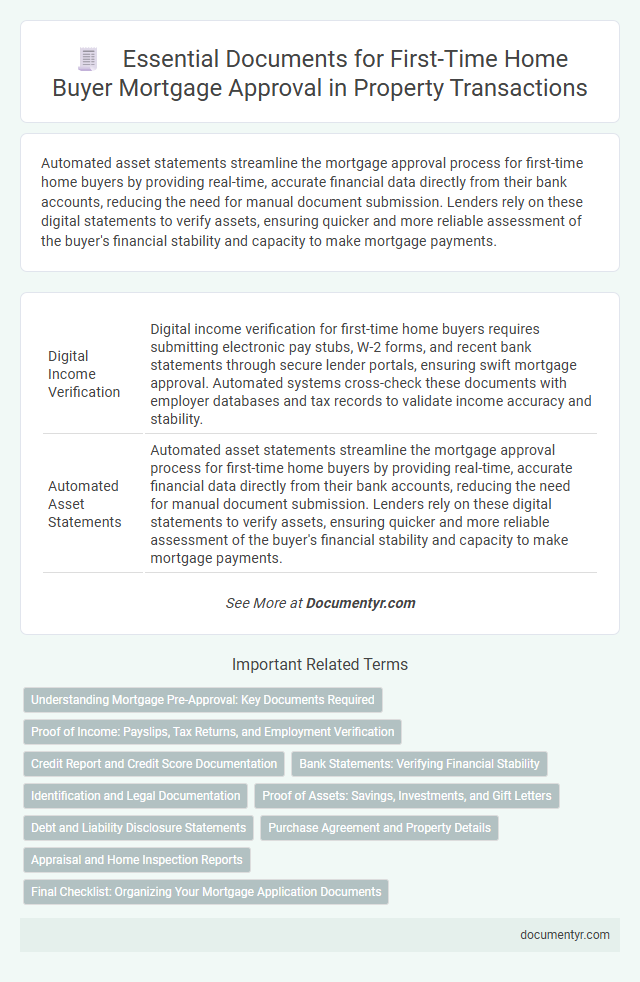

| 1 | Digital Income Verification | Digital income verification for first-time home buyers requires submitting electronic pay stubs, W-2 forms, and recent bank statements through secure lender portals, ensuring swift mortgage approval. Automated systems cross-check these documents with employer databases and tax records to validate income accuracy and stability. |

| 2 | Automated Asset Statements | Automated asset statements streamline the mortgage approval process for first-time home buyers by providing real-time, accurate financial data directly from their bank accounts, reducing the need for manual document submission. Lenders rely on these digital statements to verify assets, ensuring quicker and more reliable assessment of the buyer's financial stability and capacity to make mortgage payments. |

| 3 | E-signature Authorization Form | The E-signature Authorization Form is essential for first-time home buyers as it allows lenders to securely collect and verify digital signatures on mortgage documents, expediting the approval process. This form ensures compliance with electronic transaction laws, reducing paperwork and facilitating a faster, more efficient mortgage application experience. |

| 4 | Remote Identity Verification | First-time home buyers must provide government-issued photo identification and proof of Social Security number to complete remote identity verification for mortgage approval. Lenders often require digital submission of these documents alongside income statements and credit reports to securely authenticate the buyer's identity without in-person interaction. |

| 5 | Borrower Consent for Data Pull | Borrower consent for data pull is essential for first-time home buyers to allow lenders access to credit reports, employment history, and financial accounts, ensuring accurate risk assessment. This consent typically involves signing authorization forms that comply with privacy laws and enable seamless verification of borrower information during mortgage approval. |

| 6 | Bank API Access Document | First-time home buyers must provide a Bank API Access Document to authorize lenders to securely retrieve financial data directly from their bank accounts, streamlining the mortgage approval process. This digital authorization enhances accuracy in income verification and asset evaluation, reducing manual paperwork and expediting loan decisions. |

| 7 | Crypto Asset Disclosure | First-time home buyers seeking mortgage approval must provide standard documents such as proof of income, credit history, and identification, along with a detailed disclosure of any crypto assets to verify financial stability and source of funds. Lenders require transparent reporting of cryptocurrency holdings to assess risk and ensure compliance with anti-money laundering regulations. |

| 8 | Gigtax Form (for gig workers) | First-time home buyers who are gig workers must provide a Gigtax Form, a document that verifies their income from freelance or contract work, as part of mortgage approval requirements. This form substantiates earnings where traditional pay stubs are unavailable, helping lenders assess financial stability accurately. |

| 9 | Open Banking Permission Letter | A first-time home buyer needs to provide an Open Banking Permission Letter to allow lenders secure access to their financial data, enabling a detailed assessment of income and spending habits for mortgage approval. This document is crucial for streamlining the verification process and ensuring accurate creditworthiness evaluation based on real-time bank transaction information. |

| 10 | Rent Payment History Report | A Rent Payment History Report provides lenders with verifiable records of timely monthly rent payments, enhancing a first-time home buyer's credibility when traditional credit history is limited. Including this document in the mortgage application strengthens the buyer's financial profile and improves chances of mortgage approval. |

Understanding Mortgage Pre-Approval: Key Documents Required

First-time home buyers must gather specific documents to secure mortgage pre-approval, a crucial step in the home buying process. Pre-approval helps determine the loan amount a buyer qualifies for, streamlining property searches.

Key documents include proof of income such as pay stubs, tax returns, and W-2 forms to verify financial stability. Lenders also require credit history reports to assess creditworthiness. Additionally, identification documents like a valid passport or driver's license and proof of assets such as bank statements ensure a comprehensive evaluation for mortgage approval.

Proof of Income: Payslips, Tax Returns, and Employment Verification

Proof of income is a crucial component in the mortgage approval process for first-time home buyers. Key documents include recent payslips, which demonstrate consistent earnings over time.

Tax returns provide lenders with a comprehensive view of yearly income and financial stability. Employment verification confirms current job status and reliability to repay the mortgage loan.

Credit Report and Credit Score Documentation

First-time home buyers must provide a detailed credit report as part of the mortgage approval process. This report highlights the borrower's credit history, including past loans, payment consistency, and outstanding debts.

Lenders analyze the credit score to assess financial reliability and risk level. A strong credit score increases the chances of mortgage approval and may result in lower interest rates for the buyer.

Bank Statements: Verifying Financial Stability

Bank statements are crucial for first-time home buyers to demonstrate consistent income and financial responsibility during the mortgage approval process. Lenders use these documents to verify that buyers have stable finances and can manage monthly mortgage payments.

- Recent statements - Typically, lenders require bank statements from the past 2-3 months to assess current financial health.

- Proof of income deposits - Statements show regular salary deposits or other income sources essential for loan qualification.

- Monitoring expenses - Lenders review spending patterns to ensure buyers are not overextended financially before approving the mortgage.

Identification and Legal Documentation

First-time home buyers must provide specific identification and legal documents to secure mortgage approval. These documents verify identity and establish legal standing to move forward with the home loan process.

- Government-issued Photo ID - A valid driver's license or passport confirms the buyer's identity.

- Social Security Number (SSN) - Essential for credit checks and verifying financial history during mortgage approval.

- Proof of Legal Residency - Documents such as a green card or visa demonstrate the borrower's legal status in the country.

Proof of Assets: Savings, Investments, and Gift Letters

What proof of assets is required for mortgage approval as a first-time home buyer? Lenders need documentation of your savings, investments, and any gift letters to verify your financial stability. These documents demonstrate your ability to cover down payments and closing costs effectively.

Debt and Liability Disclosure Statements

Debt and liability disclosure statements are critical for first-time home buyers seeking mortgage approval. These documents provide lenders with a clear overview of your financial obligations and help assess your borrowing capacity.

- Credit Card Debt Statements - Show outstanding balances and monthly payment amounts for credit cards.

- Loan Agreements - Detail terms and remaining balances on personal, auto, or student loans.

- Liability Disclosure Form - Summarizes all current debts, including unpaid taxes or legal judgments.

Accurate disclosure of all debts and liabilities ensures a smoother mortgage approval process and accurate risk evaluation by lenders.

Purchase Agreement and Property Details

The purchase agreement is a critical document for mortgage approval, outlining the terms and conditions of the home sale, including price, contingencies, and closing date. Detailed property information, such as the address, tax identification, and appraisal report, provides lenders with verification of the asset securing the loan. These documents ensure your mortgage application is complete and enable the lender to assess the home's value and legality accurately.

Appraisal and Home Inspection Reports

| Document | Description | Importance for Mortgage Approval |

|---|---|---|

| Appraisal Report | A professional assessment of the home's market value conducted by a licensed appraiser. | Ensures the property's value meets or exceeds the loan amount, protecting lenders from lending more than the home's worth. |

| Home Inspection Report | An evaluation performed by a certified home inspector detailing the property's condition, including structure, systems, and potential issues. | Identifies defects or repairs needed, helping buyers and lenders understand risks and negotiate before final approval. |

What Documents Does a First-Time Home Buyer Need for Mortgage Approval? Infographic