Heirs must provide a legal will or succession certificate to establish rightful ownership of inherited property. Essential documents include the death certificate of the deceased, identity proofs of the heir, and the property's title deed. Registration of inheritance transfer with the local property registrar is required to complete the ownership change process.

What Documents Does an Heir Need for Inherited Property Transfer?

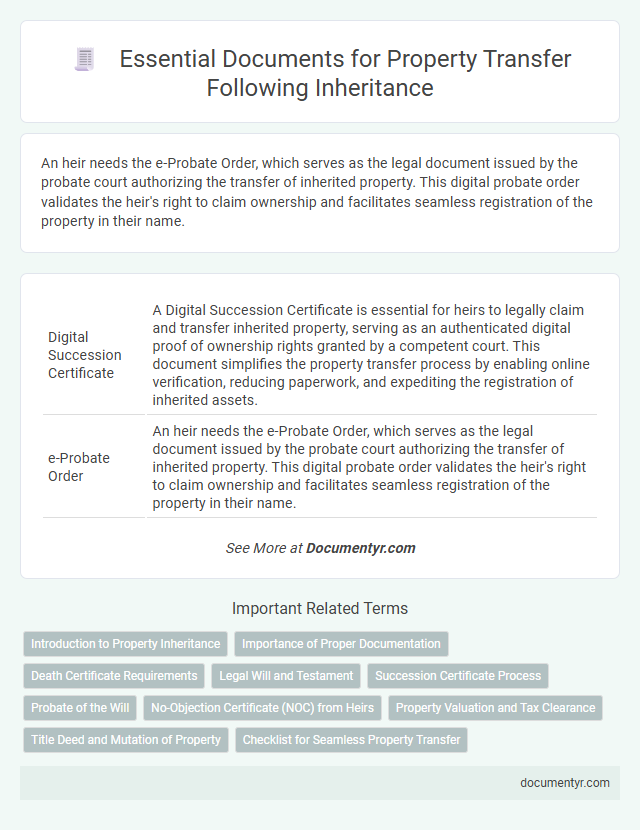

| Number | Name | Description |

|---|---|---|

| 1 | Digital Succession Certificate | A Digital Succession Certificate is essential for heirs to legally claim and transfer inherited property, serving as an authenticated digital proof of ownership rights granted by a competent court. This document simplifies the property transfer process by enabling online verification, reducing paperwork, and expediting the registration of inherited assets. |

| 2 | e-Probate Order | An heir needs the e-Probate Order, which serves as the legal document issued by the probate court authorizing the transfer of inherited property. This digital probate order validates the heir's right to claim ownership and facilitates seamless registration of the property in their name. |

| 3 | Blockchain Property Ledger | Heirs must provide a certified copy of the death certificate, a legally recognized will or probate documents, and valid identification when transferring inherited property, with records securely validated on the blockchain property ledger to ensure transparency and prevent fraud. The blockchain ledger records immutable ownership transfers, enhancing the trustworthiness and efficiency of the inherited property transfer process. |

| 4 | Biometric Heir Verification | Heirs must provide biometric identification documents such as fingerprint scans or facial recognition data to verify their identity securely during the inherited property transfer process. This biometric heir verification ensures authenticity, prevents fraud, and complies with legal requirements for property ownership succession. |

| 5 | Testamentary e-Will Extract | An heir must provide the Testamentary e-Will Extract as a crucial document for transferring inherited property, verifying the decedent's final wishes and validating the will electronically. This certified digital record ensures seamless probate procedures and legal recognition in property ownership transfer. |

| 6 | Unified Property Title Deed | An heir must obtain the Unified Property Title Deed to legally transfer inherited property ownership, which requires submitting the original will, death certificate of the deceased, and proof of heirship such as a succession certificate or legal heirship certificate. This deed consolidates ownership records in a single document, streamlining the transfer process and ensuring clear legal recognition of the heir's rights. |

| 7 | E-Intestate Heirship Affidavit | An heir must submit the E-Intestate Heirship Affidavit to legally establish their right to inherited property when no will exists, providing vital details about the decedent and surviving heirs. This affidavit, often required by county recorder offices, includes personal information, family relationships, and a statement asserting the transfer of property ownership under intestate succession laws. |

| 8 | NFT-based Asset Ownership Proof | Heirs transferring inherited property with NFT-based asset ownership must provide the original NFT certificate, digital wallet access credentials, and a verified smart contract linking the NFT to the property title. Legal documents such as the death certificate, will probate, and digital asset transfer authorization are essential to validate ownership and facilitate a seamless transfer on blockchain platforms. |

| 9 | Aadhaar-linked Inheritance Record | Heirs must provide a succession certificate, the decedent's death certificate, and Aadhaar-linked inheritance records to establish identity and claim ownership during property transfer. The Aadhaar-linked inheritance record ensures accurate verification of legal heirs, streamlining the title transfer process in compliance with Indian property laws. |

| 10 | Cloud Vault Legal Document Repository | Heirs need essential documents such as the original will, death certificate, and probate court order to transfer inherited property via the Cloud Vault Legal Document Repository securely. Utilizing Cloud Vault ensures encrypted storage, easy access, and verified authentication of all legal documents needed to complete the property transfer process efficiently. |

Introduction to Property Inheritance

What documents are required for an heir to transfer inherited property?

Property inheritance involves legally transferring ownership from a deceased individual to their heirs. Essential documents streamline this process, ensuring rightful ownership and preventing disputes.

Importance of Proper Documentation

Proper documentation is essential for the smooth transfer of inherited property. These documents establish legal ownership and prevent future disputes.

Essential papers include the death certificate, the will or probate documents, and the property title deed. You must also secure tax clearance certificates and any relevant succession certificates for a valid transfer.

Death Certificate Requirements

For transferring inherited property, the death certificate of the deceased is a crucial document. It serves as official proof of death and is required by legal and governmental authorities to initiate the transfer process. Ensure your death certificate is an original or certified copy to avoid delays in property ownership transfer.

Legal Will and Testament

When transferring inherited property, the primary legal document required is the Legal Will and Testament. This document outlines the deceased person's wishes regarding property distribution.

Your copy of the Legal Will and Testament must be submitted to the probate court to initiate the transfer process. The will helps establish your legal right as an heir to the inherited property. Other supporting documents may be requested, but the will is the key to a smooth property transfer.

Succession Certificate Process

| Document | Description |

|---|---|

| Succession Certificate | Essential legal document issued by a court to heirs, authorizing them to inherit the deceased's property, including financial assets and debts. |

| Death Certificate of Deceased | Official certificate proving the death of the owner of the property, required to initiate the succession certificate application. |

| Application Form | A formal petition submitted to the civil court requesting the issuance of a succession certificate for the inherited property. |

| Affidavit of Heirs | Sworn statement listing all legal heirs and their relationship with the deceased, which must be submitted during the process. |

| Heir's Identification Proof | Copies of government-issued ID documents such as Aadhar card, passport, or voter ID to verify the heir's identity. |

| Property Documents | Title deeds, sale deeds, or registration papers of the inherited property to confirm ownership and transfer details. |

| Legal Heir Certificate | Certificate issued by the Revenue Department or a competent authority establishing the heirs' rightful claim to the deceased's property. |

| Notice to Creditors | Public notice or court order notifying creditors about the issuance of the succession certificate, providing them an opportunity to express claims. |

Probate of the Will

Probate of the will is a crucial legal process in transferring inherited property to heirs. This process verifies the authenticity of the will and authorizes the distribution of assets according to the deceased's wishes.

- Original Will - The signed and notarized will is necessary to begin the probate process and confirm the decedent's intentions.

- Death Certificate - An official death certificate is required to legally acknowledge the passing of the property owner.

- Probate Petition - You must file a probate petition with the court to initiate the legal transfer of the inherited property.

These documents collectively establish your legal right to inherit and transfer the property through probate.

No-Objection Certificate (NOC) from Heirs

When transferring inherited property, obtaining a No-Objection Certificate (NOC) from all legal heirs is crucial. This document confirms that the heirs have no objections to the property transfer, ensuring a smooth legal process.

The NOC must be signed by each heir and notarized to validate their consent. Without a proper NOC, property registration authorities may reject the transfer application, causing delays or legal disputes.

Property Valuation and Tax Clearance

Transferring inherited property requires specific documents to validate ownership and comply with legal obligations. Understanding the importance of property valuation and tax clearance ensures a smooth inheritance process.

- Property Valuation Report - A certified property valuation report determines the current market value needed for tax calculations and legal records.

- Tax Clearance Certificate - This certificate confirms that all outstanding property taxes and inheritance taxes have been paid before the transfer.

- Inheritance Transfer Deed - Legal documentation that reflects the property's transfer from the deceased to the heir, supported by valuation and tax clearance papers.

Title Deed and Mutation of Property

To transfer inherited property, the heir must obtain the original Title Deed, which serves as proof of ownership. Mutation of Property is a crucial legal process that updates the ownership records in the government revenue department. This documentation ensures the heir's name is officially recorded, allowing for clear rights over the inherited asset.

What Documents Does an Heir Need for Inherited Property Transfer? Infographic