To refinance a mortgage, essential documents include your current mortgage statement, proof of income such as pay stubs or tax returns, and credit reports. Lenders also require bank statements to verify assets and statements of debts to assess your financial obligations. These documents ensure a comprehensive review of your financial stability and eligibility for refinancing.

What Documents Are Necessary for Refinancing a Mortgage?

| Number | Name | Description |

|---|---|---|

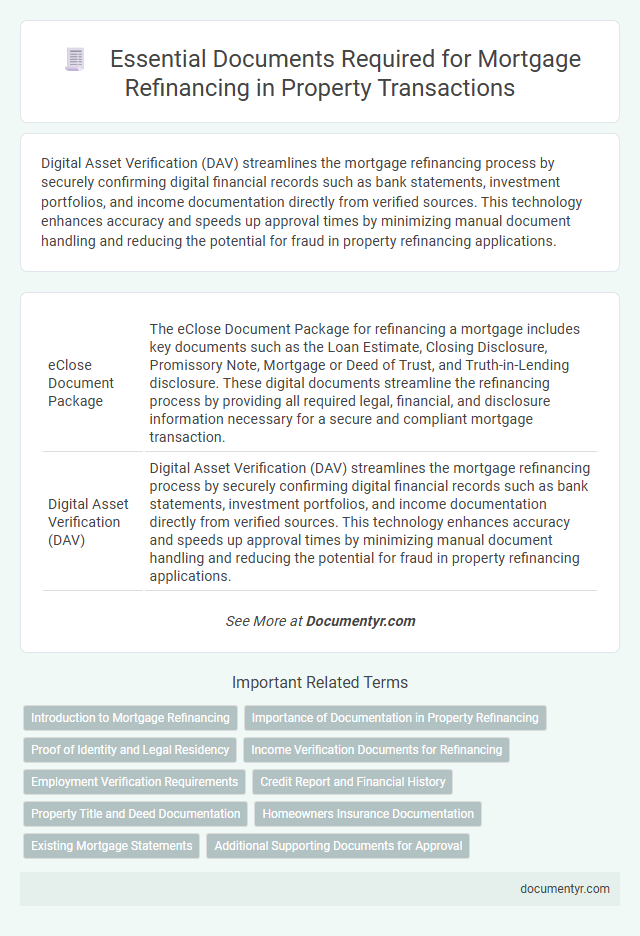

| 1 | eClose Document Package | The eClose Document Package for refinancing a mortgage includes key documents such as the Loan Estimate, Closing Disclosure, Promissory Note, Mortgage or Deed of Trust, and Truth-in-Lending disclosure. These digital documents streamline the refinancing process by providing all required legal, financial, and disclosure information necessary for a secure and compliant mortgage transaction. |

| 2 | Digital Asset Verification (DAV) | Digital Asset Verification (DAV) streamlines the mortgage refinancing process by securely confirming digital financial records such as bank statements, investment portfolios, and income documentation directly from verified sources. This technology enhances accuracy and speeds up approval times by minimizing manual document handling and reducing the potential for fraud in property refinancing applications. |

| 3 | Automated Income Verification Report | An Automated Income Verification Report is essential for refinancing a mortgage as it provides lenders with a reliable, real-time summary of the borrower's income from various sources, streamlining the approval process. This report typically includes earnings from wages, self-employment, and other income streams, reducing the need for traditional paper documentation such as pay stubs and tax returns. |

| 4 | Closing Disclosure (CD) e-signature | The Closing Disclosure (CD) e-signature is essential for refinancing a mortgage as it confirms the borrower's understanding and acceptance of loan terms, including closing costs and monthly payments. Lenders require the electronically signed CD to comply with federal regulations and ensure the refinancing process proceeds without delays. |

| 5 | Remote Online Notarization (RON) Consent | Refinancing a mortgage requires essential documents including the loan application, credit report, income verification, and property appraisal, with Remote Online Notarization (RON) Consent becoming increasingly crucial as it enables borrowers to notarize documents electronically from remote locations, expediting the approval process. Lenders typically require the signed RON Consent form to ensure compliance with state laws and secure legal validity during the mortgage refinancing transaction. |

| 6 | Day-1 Certainty Documentation | Day-1 Certainty documentation for mortgage refinancing includes automated verification reports such as the IRS Form 4506-C for tax transcripts and the Lender Verification Reports that confirm borrower income, assets, and employment. These documents streamline underwriting by providing rapid, accurate data to ensure compliance with investor guidelines and reduce the risk of loan defects. |

| 7 | Title eAbstract | Refinancing a mortgage requires obtaining a clear title report and an updated title eAbstract to verify ownership and identify any liens or encumbrances on the property. The title eAbstract provides a digital summary of public records, ensuring accuracy and transparency throughout the refinancing process. |

| 8 | Lender Credit Letter | A lender credit letter is a critical document in mortgage refinancing that outlines the credits or concessions a lender offers to cover closing costs, helping to reduce upfront expenses for the borrower. This letter must clearly state the amount of credit, associated terms, and be included in the closing disclosure to ensure transparency and compliance during the refinancing process. |

| 9 | Smart Document Tagging Compliance | Essential documents for refinancing a mortgage include the original loan agreement, recent pay stubs, tax returns, credit reports, and proof of homeowners insurance, all of which must be accurately tagged with smart document tagging for compliance and efficient processing. Smart document tagging enhances the organization, categorization, and retrieval of these documents, ensuring adherence to regulatory standards such as RESPA and TILA while streamlining lender verification processes. |

| 10 | Blockchain Title Deed | Blockchain title deeds provide a secure and transparent record essential for refinancing a mortgage, ensuring quick verification of property ownership and history. Lenders require these immutable documents alongside traditional paperwork such as income proof, credit reports, and the original mortgage agreement to streamline the refinancing process. |

Introduction to Mortgage Refinancing

Mortgage refinancing involves replacing your current loan with a new one, typically to secure better interest rates or adjust loan terms. Understanding the necessary documents is crucial for a smooth refinancing process.

Lenders require specific paperwork to verify your financial status, creditworthiness, and property details. Preparing these documents ahead of time helps expedite loan approval and closing.

Importance of Documentation in Property Refinancing

Proper documentation plays a crucial role in the mortgage refinancing process, ensuring accuracy and smooth approval. Gathering the necessary paperwork helps lenders assess your financial stability and property value effectively.

- Proof of Income - Documents like pay stubs, tax returns, and W-2 forms validate your earning capacity to repay the loan.

- Credit Report - Lenders review your credit history to evaluate risk and determine suitable refinancing terms.

- Property Appraisal and Title - Accurate valuation and clear ownership help establish the current market worth and secure the transaction.

Proof of Identity and Legal Residency

Refinancing a mortgage requires specific documents to verify your identity and legal residency status. Providing these documents ensures a smooth approval process and compliance with lending regulations.

- Government-Issued Photo ID - A valid driver's license or passport confirms your identity and is essential for refinancing verification.

- Social Security Number - Your Social Security card or tax returns verify your official identification and assist in credit checks.

- Proof of Legal Residency - Documents such as a green card, visa, or permanent resident card establish your lawful presence in the country.

Lenders use these documents to confirm eligibility and protect against fraud during the mortgage refinance process.

Income Verification Documents for Refinancing

| Document Type | Description | Purpose |

|---|---|---|

| Recent Pay Stubs | Last 2-3 months of pay stubs from the borrower's employer | Verify current income and employment status |

| W-2 Forms | W-2 tax forms from the past 2 years | Confirm annual income and job consistency |

| Tax Returns | Complete federal tax returns from the last 2 years, including all schedules | Provide a comprehensive income history especially for self-employed borrowers |

| Profit and Loss Statement | Year-to-date profit and loss statement for self-employed individuals | Show current business income trends for income verification |

| Bank Statements | Recent 2-3 months of bank statements | Verify deposits consistent with reported income |

| Social Security Income Documentation | Award letter or documentation verifying social security payments | Validate sources of income from social security |

| Alimony or Child Support Documentation | Legal agreements or proof of regular payments | Confirm additional income subject to consideration |

Employment Verification Requirements

Employment verification is a crucial part of the mortgage refinancing process. Lenders require proof of stable income to assess the borrower's ability to repay the loan.

Documents typically include recent pay stubs, W-2 forms, and sometimes tax returns if self-employed. Lenders may also contact employers directly to confirm job status and income details. This verification ensures financial stability and reduces the risk of loan default during refinancing.

Credit Report and Financial History

What documents are required to verify your credit report during mortgage refinancing? Lenders need detailed credit reports to assess your financial reliability. These reports include your credit score, outstanding debts, and payment history.

Why is your financial history important for refinancing a mortgage? It helps lenders evaluate your ability to repay the loan. Documentation such as tax returns, bank statements, and employment verification demonstrate consistent income and financial stability.

Property Title and Deed Documentation

When refinancing a mortgage, presenting clear property title and deed documentation is essential to verify ownership. These documents confirm that your name is legally recorded as the owner, ensuring there are no disputes or liens affecting the property. Lenders require accurate title and deed records to process the refinancing smoothly and protect their investment.

Homeowners Insurance Documentation

Homeowners insurance documentation is a critical part of the mortgage refinancing process. Lenders require proof of insurance to protect the property against potential damages or losses.

- Proof of Current Homeowners Insurance - A valid insurance policy showing active coverage on the property is necessary to meet lender requirements.

- Declaration Page - This document outlines the insured property, coverage limits, and policy period, providing detailed insurance information to the lender.

- Premium Payment Receipts - Evidence of recent premium payments confirms that the insurance policy is current and financially active.

Existing Mortgage Statements

Existing mortgage statements are essential documents for refinancing a mortgage. They provide detailed information about your current loan balance, payment history, and interest rates. Lenders use these statements to assess your financial standing and determine eligibility for refinancing options.

What Documents Are Necessary for Refinancing a Mortgage? Infographic