An LLC must have its Articles of Organization, Operating Agreement, and EIN ready to purchase commercial real estate. The purchase process also requires a resolution authorizing the transaction, along with any necessary member consents. Title insurance, the purchase agreement, and financing documents are essential to complete the property acquisition smoothly.

What Documents Does an LLC Need to Purchase Commercial Real Estate?

| Number | Name | Description |

|---|---|---|

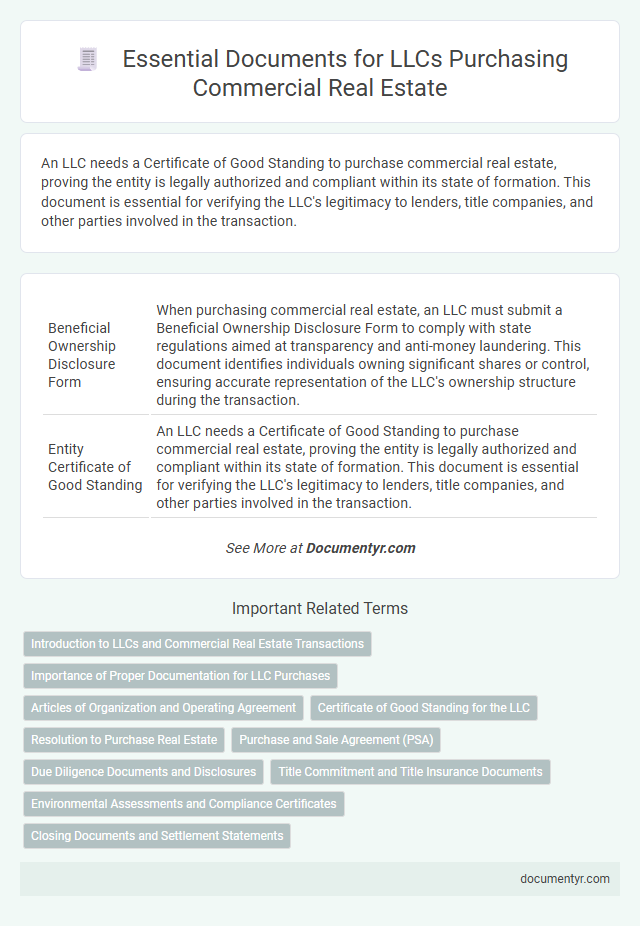

| 1 | Beneficial Ownership Disclosure Form | When purchasing commercial real estate, an LLC must submit a Beneficial Ownership Disclosure Form to comply with state regulations aimed at transparency and anti-money laundering. This document identifies individuals owning significant shares or control, ensuring accurate representation of the LLC's ownership structure during the transaction. |

| 2 | Entity Certificate of Good Standing | An LLC needs a Certificate of Good Standing to purchase commercial real estate, proving the entity is legally authorized and compliant within its state of formation. This document is essential for verifying the LLC's legitimacy to lenders, title companies, and other parties involved in the transaction. |

| 3 | Operating Agreement Real Estate Clause | An LLC purchasing commercial real estate must include an Operating Agreement with a Real Estate Clause that outlines property acquisition procedures, member responsibilities, and management authority specific to real estate transactions. This clause ensures clear governance on property ownership, transaction approvals, and dispute resolution within the LLC framework. |

| 4 | EIN (Employer Identification Number) Confirmation Letter | An LLC must provide its EIN (Employer Identification Number) Confirmation Letter, also known as the CP 575, when purchasing commercial real estate to verify its tax identification with the IRS. This document is crucial for opening escrow accounts, completing loan applications, and ensuring compliance with federal regulations during the property transaction. |

| 5 | LLC Member Resolution to Purchase Property | An LLC must prepare an LLC Member Resolution to Purchase Property, a formal document that authorizes the company to acquire commercial real estate, detailing the terms and approving the transaction. This resolution is essential for demonstrating internal consent and is often required by title companies, lenders, and escrow agents during the commercial real estate purchase process. |

| 6 | Title Opinion Letter for LLCs | A Title Opinion Letter for LLCs is essential in commercial real estate transactions, providing a legal assessment of property ownership, liens, and encumbrances to ensure clear title transfer. This document, prepared by a qualified attorney, protects the LLC from future title disputes and verifies the seller's authority to convey the property. |

| 7 | Commercial Real Estate Due Diligence Checklist | An LLC purchasing commercial real estate must provide key documents including the operating agreement, articles of organization, EIN confirmation, and bank resolution authorizing the purchase, alongside a comprehensive due diligence checklist featuring title reports, environmental assessments, zoning compliance certificates, and financial statements to ensure clear ownership and legal compliance. Securing recent appraisal reports, lease agreements, insurance policies, and survey plats are essential components that protect the LLC from potential risks and validate the property's value and condition. |

| 8 | UCC (Uniform Commercial Code) Search Report | An LLC needs a UCC (Uniform Commercial Code) Search Report to verify any existing liens or security interests on the commercial property before purchase, ensuring clear title and avoiding potential legal disputes. This report is crucial for confirming that the property is free from encumbrances and that the seller has unencumbered ownership rights. |

| 9 | Environmental Site Assessment (ESA) Waiver | An LLC purchasing commercial real estate typically needs to conduct an Environmental Site Assessment (ESA) to identify potential contamination liabilities, but may request an ESA waiver if prior assessments demonstrate minimal environmental risk. This waiver can expedite the transaction by reducing due diligence requirements, though lenders and regulatory agencies often require thorough documentation proving the site's environmental safety. |

| 10 | LLC Buy-Sell Agreement Amendment | An LLC must secure a Buy-Sell Agreement Amendment when purchasing commercial real estate to clearly define member rights, transfer restrictions, and dispute resolution specific to the property transaction. This amendment ensures all members agree on terms related to ownership changes, protecting the LLC's interests and maintaining smooth future sales or transfers. |

Introduction to LLCs and Commercial Real Estate Transactions

Limited Liability Companies (LLCs) are popular business structures for purchasing commercial real estate due to their liability protection and tax benefits. Understanding the necessary documents is crucial for a smooth transaction process.

Commercial real estate transactions involve unique legal and financial requirements compared to residential purchases. Proper documentation ensures compliance and safeguards the interests of the LLC and its members.

Importance of Proper Documentation for LLC Purchases

Proper documentation is crucial when an LLC purchases commercial real estate to ensure clear ownership and protect against legal disputes. Key documents include the LLC operating agreement, purchase agreement, title insurance, and due diligence reports. Securing these papers safeguards your investment and streamlines the transaction process.

Articles of Organization and Operating Agreement

Purchasing commercial real estate through an LLC requires specific foundational documents. The Articles of Organization and Operating Agreement are essential for establishing and operating the LLC in the transaction.

- Articles of Organization - This document officially registers the LLC with the state, providing legal recognition needed to enter property contracts.

- Operating Agreement - It outlines the management structure and ownership details of the LLC, ensuring clarity among members during the purchase process.

- Proof of Authorization - These documents demonstrate the LLC's authority to buy real estate, which sellers and lenders often require for verification.

Certificate of Good Standing for the LLC

When purchasing commercial real estate, an LLC must provide certain key documents to complete the transaction legally. One crucial document is the Certificate of Good Standing, which verifies the LLC's active and compliant status with the state.

- Certificate of Good Standing - Confirms that the LLC is properly registered and authorized to conduct business in the state.

- Operating Agreement - Outlines the LLC's internal management and ownership structure relevant to property decisions.

- Resolution to Purchase - Authorizes the LLC to buy the commercial property, ensuring proper approval from members or managers.

You must obtain the Certificate of Good Standing from the state before finalizing your commercial real estate purchase to demonstrate the LLC's legitimacy.

Resolution to Purchase Real Estate

What documents does an LLC need to purchase commercial real estate? An LLC must prepare a Resolution to Purchase Real Estate to authorize the transaction officially. This document provides legal approval from the members or managers, ensuring the purchase aligns with the LLC's operating agreement and state laws.

Purchase and Sale Agreement (PSA)

| Document | Description | Purpose | Key Elements |

|---|---|---|---|

| Purchase and Sale Agreement (PSA) | Legal contract outlining the terms and conditions of the commercial real estate transaction. | Establishes the binding agreement between the LLC buyer and the seller for the property purchase. |

|

| Operating Agreement of the LLC | Internal document defining how the LLC operates and authorizes real estate transactions. | Confirms the LLC's authority to enter into a Purchase and Sale Agreement. | Member roles, voting procedures, and authorization powers |

| Certificate of Formation (or Articles of Organization) | Official filed document establishing the LLC with the state. | Verifies the LLC's legal existence. | LLC name, state of formation, and filing date |

| Tax Identification Number (EIN) | IRS-issued number identifying the LLC for tax purposes. | Required for financial transactions and tax reporting related to the property purchase. | Employer Identification Number assigned by the IRS |

| Resolution Authorizing Purchase | Formal written approval from LLC members or managers authorizing the property acquisition. | Confirms internal consent for entering into the PSA and related obligations. | Date of resolution, authorized signatories, and scope of approval |

Due Diligence Documents and Disclosures

When an LLC purchases commercial real estate, securing the correct due diligence documents is essential. These documents validate the property's legal, financial, and physical status before finalizing the transaction.

Due diligence documents include the title report, environmental assessments, zoning compliance certificates, and financial statements related to the property. Your LLC must also obtain disclosures from the seller, such as existing leases, liens, or hazardous material reports, to ensure transparency and mitigate risks.

Title Commitment and Title Insurance Documents

When purchasing commercial real estate, an LLC must obtain a Title Commitment to ensure the property's title is clear and free of liens or encumbrances. This document outlines the terms and conditions under which the title insurance policy will be issued.

Your LLC needs Title Insurance Documents to protect against future claims or disputes regarding property ownership. Title insurance safeguards your investment by covering legal fees and losses arising from title defects. Securing these documents is essential for a smooth commercial real estate transaction.

Environmental Assessments and Compliance Certificates

When an LLC purchases commercial real estate, it must obtain environmental assessments to identify potential contamination or hazards on the property. These assessments typically include Phase I and Phase II Environmental Site Assessments to evaluate soil, groundwater, and overall site condition. Compliance certificates demonstrating adherence to local, state, and federal environmental regulations are also essential for closing the transaction and ensuring legal protection.

What Documents Does an LLC Need to Purchase Commercial Real Estate? Infographic