To file a property tax appeal application, essential documents include the property tax assessment notice, proof of ownership such as a deed or title, and evidence supporting your claim like recent property appraisals, comparable sales data, or repair estimates. Detailed photographs of the property's condition can also strengthen the appeal by providing visual proof of defects or discrepancies. Ensuring all relevant paperwork is accurate and complete enhances the likelihood of a successful property tax reassessment.

What Documents are Required for a Property Tax Appeal Application?

| Number | Name | Description |

|---|---|---|

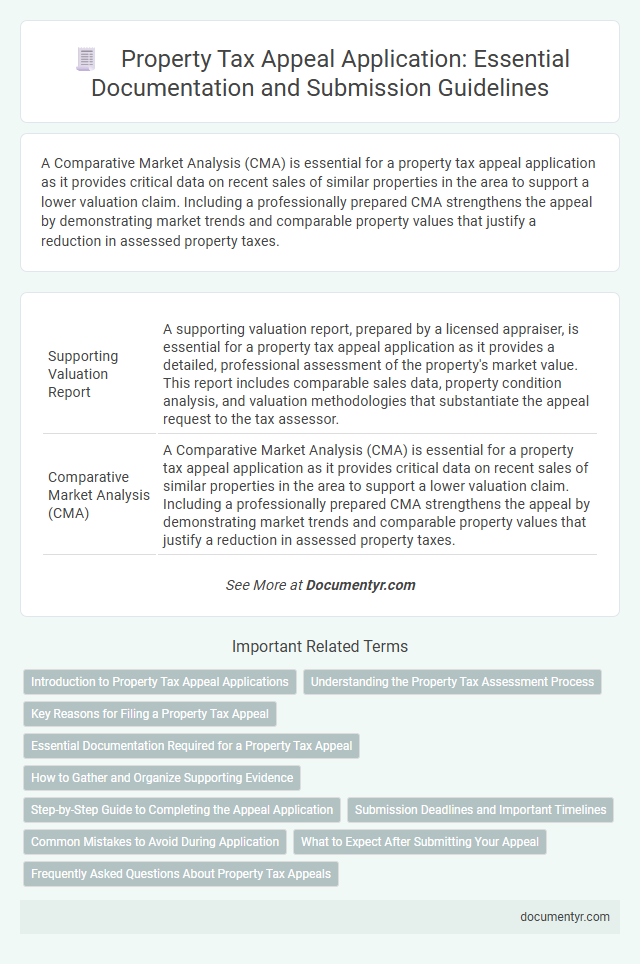

| 1 | Supporting Valuation Report | A supporting valuation report, prepared by a licensed appraiser, is essential for a property tax appeal application as it provides a detailed, professional assessment of the property's market value. This report includes comparable sales data, property condition analysis, and valuation methodologies that substantiate the appeal request to the tax assessor. |

| 2 | Comparative Market Analysis (CMA) | A Comparative Market Analysis (CMA) is essential for a property tax appeal application as it provides critical data on recent sales of similar properties in the area to support a lower valuation claim. Including a professionally prepared CMA strengthens the appeal by demonstrating market trends and comparable property values that justify a reduction in assessed property taxes. |

| 3 | Recent Property Tax Bill | A recent property tax bill is a critical document for a property tax appeal application, as it provides current assessment details and tax amount owed. Including this bill helps verify accuracy and supports claims for reassessment. |

| 4 | Error Correction Affidavit | The Error Correction Affidavit is a crucial document in a property tax appeal application, used to identify and rectify clerical or factual errors in property assessment records. Including this affidavit, along with the original tax assessment notice and proof of property ownership, ensures a comprehensive submission to support the appeal process effectively. |

| 5 | Digital Ownership Certificate | A Digital Ownership Certificate is essential for a property tax appeal application as it verifies legal ownership and serves as a primary document for reassessing property tax records. Including this certificate helps establish authenticity and supports claims of discrepancies in property valuation or taxation records. |

| 6 | Remote Notarized Statement | A Remote Notarized Statement is essential for a property tax appeal application as it verifies the authenticity of submitted documents without requiring in-person notarization. This statement must comply with state-specific remote notarization laws and include a digital signature, timestamp, and video recording to ensure legal validity. |

| 7 | GIS Property Boundary Map | A GIS Property Boundary Map is essential for a property tax appeal application as it provides precise, geospatial data delineating the exact borders and dimensions of the property, which supports accurate valuation disputes. This map, often sourced from local government GIS databases, helps demonstrate discrepancies in property boundaries or land use that may affect assessed values. |

| 8 | Smart Appraisal Addendum | The Smart Appraisal Addendum must be submitted alongside the property tax appeal application to provide a comprehensive analysis of the property's value, including recent comparable sales, property condition, and market trends. Supporting documents such as the original property tax assessment notice, proof of ownership, and photographic evidence of property condition enhance the appeal's accuracy and effectiveness. |

| 9 | Photographic Condition Evidence | Photographic condition evidence is crucial for a property tax appeal application as it visually documents the current state of the property, highlighting any damages, disrepair, or discrepancies that may affect its assessed value. High-quality, date-stamped photos of both the interior and exterior support claims of depreciation or condition-related value reduction, strengthening the appeal case. |

| 10 | Automated Valuation Model (AVM) Printout | The Automated Valuation Model (AVM) printout serves as a critical document in a property tax appeal application by providing an algorithm-based estimate of the property's market value using recent sales data and comparable property metrics. Including this printout supports the appeal by offering an objective valuation metric that may contrast with the taxing authority's assessment, enhancing the credibility of the taxpayer's argument for a reassessment. |

Introduction to Property Tax Appeal Applications

What documents are required for a property tax appeal application? A property tax appeal application demands specific paperwork to support your claim effectively. Proper documentation helps ensure a smoother review process and increases the likelihood of a successful appeal.

Understanding the Property Tax Assessment Process

Understanding the property tax assessment process is essential before filing a property tax appeal application. Gathering the correct documents supports a strong case for reassessment and potential tax reduction.

- Notice of Assessment - Official document showing the property's assessed value and tax amount.

- Comparable Property Sales - Evidence of similar property values in the area for market value comparison.

- Property Tax Bill - Current tax statement indicating the amount being challenged in the appeal.

Submitting accurate and comprehensive documents increases the likelihood of a successful property tax appeal.

Key Reasons for Filing a Property Tax Appeal

Filing a property tax appeal requires specific documentation to support your case. Key reasons include assessment errors, inaccurate property descriptions, or comparable properties being valued lower.

Essential documents include the original property tax assessment, recent appraisal reports, and evidence of comparable property values. You should also provide photos and repair estimates that highlight discrepancies in valuation.

Essential Documentation Required for a Property Tax Appeal

| Document | Description | Purpose |

|---|---|---|

| Property Tax Assessment Notice | Official notice showing the assessed value of the property | Serves as the basis for the appeal and identifies the current assessed value |

| Proof of Ownership | Deed or title document confirming ownership of the property | Validates the right to file the appeal |

| Recent Property Appraisal Report | Professional appraisal report indicating the market value of the property | Provides evidence to dispute the assessed value |

| Comparable Property Assessments | Assessment records of similar properties in the same area | Demonstrates discrepancies in assessed values compared to similar properties |

| Photographs of the Property | Current images showing property condition and features | Supports claims related to property condition affecting value |

| Tax Payment Receipts | Proof of past tax payments for the property | Confirms compliance and helps establish timelines for appeal |

| Completed Appeal Form | Official document required by the tax authority to initiate the appeal | Formalizes the appeal request |

How to Gather and Organize Supporting Evidence

Gathering and organizing supporting evidence is crucial for a successful property tax appeal application. Proper documentation strengthens your case and ensures a smoother appeal process.

- Collect the Property Tax Assessment Notice - Obtain the latest official assessment notice from your local tax assessor's office to verify the assessed value.

- Compile Comparable Property Sales Data - Gather recent sales prices of similar properties in your area to demonstrate discrepancies in valuation.

- Organize Photographs and Inspection Reports - Include clear images and inspection documents that highlight property condition issues affecting market value.

Step-by-Step Guide to Completing the Appeal Application

Gather essential documents before starting your property tax appeal application. These typically include the property tax assessment notice, recent property appraisal reports, and comparative market analysis.

Next, obtain proof of any recent home improvements and relevant photographs to support your case. Complete the appeal form by accurately entering property details and attach all required documents.

Submission Deadlines and Important Timelines

Submitting the correct documents on time is crucial for a successful property tax appeal application. Understanding submission deadlines and important timelines ensures your appeal is considered without delay.

- Appeal Form - You must submit a completed property tax appeal form by the designated deadline to initiate the process.

- Proof of Ownership - Provide documents such as the property deed or title to verify ownership before the submission cutoff date.

- Supporting Evidence - Include recent property appraisals, tax assessments, or comparable sales data within the required timeline to strengthen your appeal.

Common Mistakes to Avoid During Application

Submitting a property tax appeal requires specific documents to support your case. Common documents include the original property tax assessment, recent property tax bills, and evidence of property value such as appraisals or sales comparisons.

Errors often occur when applicants submit incomplete or outdated documents, which can lead to denial of the appeal. Avoid missing deadlines by verifying submission dates and ensure all paperwork is clearly legible. You should also avoid relying solely on verbal explanations without documented proof to strengthen your appeal.

What to Expect After Submitting Your Appeal

After submitting your property tax appeal application, expect a review process where assessors analyze your provided documents and property details. You may receive a request for additional information or a hearing date to present your case in person. A final decision will be communicated, detailing any adjustments to your property tax assessment.

What Documents are Required for a Property Tax Appeal Application? Infographic