Purchasing a foreclosed home requires several key documents, including the purchase agreement, proof of funds or mortgage pre-approval, and the title report ensuring clear ownership. Buyers also need the seller's foreclosure notice and property inspection reports to assess potential risks. It is essential to review the deed, any liens or encumbrances, and escrow instructions to complete the transaction smoothly.

What Documents are Necessary for Buying a Foreclosed Home?

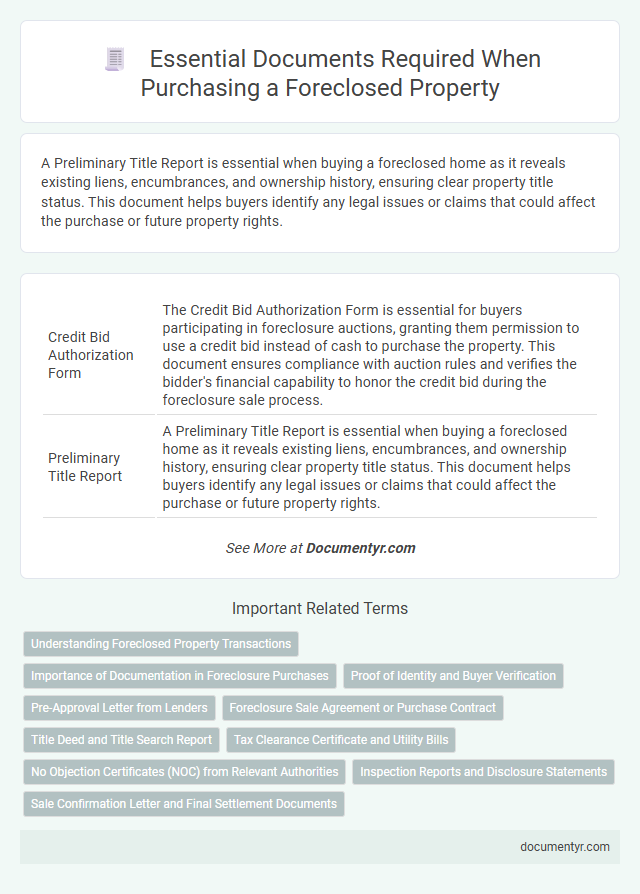

| Number | Name | Description |

|---|---|---|

| 1 | Credit Bid Authorization Form | The Credit Bid Authorization Form is essential for buyers participating in foreclosure auctions, granting them permission to use a credit bid instead of cash to purchase the property. This document ensures compliance with auction rules and verifies the bidder's financial capability to honor the credit bid during the foreclosure sale process. |

| 2 | Preliminary Title Report | A Preliminary Title Report is essential when buying a foreclosed home as it reveals existing liens, encumbrances, and ownership history, ensuring clear property title status. This document helps buyers identify any legal issues or claims that could affect the purchase or future property rights. |

| 3 | Trustee’s Deed Upon Sale | The Trustee's Deed Upon Sale is a critical document in the purchase of a foreclosed home, transferring ownership from the lender to the buyer once the foreclosure auction concludes. Buyers should also prepare to review the Notice of Default, the Notice of Trustee's Sale, and the preliminary title report to ensure clear title and understand any liens or encumbrances. |

| 4 | Redemption Rights Waiver | A Redemption Rights Waiver is a critical document in buying a foreclosed home, as it relinquishes the previous owner's right to reclaim the property after the foreclosure sale. Ensuring this waiver is included in the purchase paperwork confirms the buyer's clear title and eliminates potential legal disputes over ownership restoration. |

| 5 | Estoppel Certificate | An Estoppel Certificate is a critical document when buying a foreclosed home, as it verifies the outstanding debts and obligations tied to the property, such as unpaid HOA fees or mortgages. Lenders and buyers rely on this certificate to confirm accurate financial claims and prevent future disputes regarding the property's liabilities. |

| 6 | IRS Lien Release Documentation | Obtaining IRS lien release documentation is crucial when buying a foreclosed home to ensure the property is free from federal tax liens that could complicate ownership. Buyers should secure form 433-A or 433-F from the IRS, which verifies that any tax liens have been satisfied or released, preventing future legal claims against the property. |

| 7 | Assignment of Bid Confirmation | The Assignment of Bid Confirmation is a critical document in purchasing a foreclosed home, as it formalizes the transfer of winning bid rights from the original bidder to the buyer. This document serves as proof of ownership interest and is essential for completing the title search and finalizing the sale process. |

| 8 | Foreclosure Affidavit Package | The Foreclosure Affidavit Package is essential for buying a foreclosed home, containing critical documents such as the affidavit of foreclosure, title report, and deed of trust to verify the property's legal status. These documents ensure clear ownership transfer and reveal any liens or encumbrances that could impact the sale. |

| 9 | Third-Party Sale Disclosure | A Third-Party Sale Disclosure is essential when buying a foreclosed home, providing critical information about the property's condition and any known defects from parties other than the foreclosing lender. This document ensures transparency, helping buyers make informed decisions by revealing repairs, liens, or previous damage that may affect the home's value or safety. |

| 10 | Occupancy Status Certification | Occupancy Status Certification is a critical document required when buying a foreclosed home, verifying whether the property is currently occupied or vacant, which directly affects the purchasing process and legal responsibilities. This certification helps buyers assess the risk of eviction proceedings and ensures compliance with local foreclosure laws and regulations. |

Understanding Foreclosed Property Transactions

Buying a foreclosed home requires specific documents to ensure a smooth transaction and clear ownership transfer. Understanding these necessary documents helps buyers avoid legal complications and hidden costs associated with foreclosed properties.

- Purchase Agreement - A legally binding contract that outlines the terms and conditions of the sale between buyer and seller.

- Title Report - A detailed document showing the property's ownership history and any existing liens or claims against it.

- Foreclosure Notice - Official documentation indicating the property's foreclosure status and the process leading to the sale.

Importance of Documentation in Foreclosure Purchases

When buying a foreclosed home, having the correct documents ensures a smooth transaction and protects your investment. Essential paperwork includes the foreclosure notice, the title deed, and any lien or encumbrance reports. Proper documentation verifies ownership status and helps avoid legal complications during and after the purchase.

Proof of Identity and Buyer Verification

When buying a foreclosed home, proof of identity is essential to complete the transaction securely. Valid government-issued identification such as a driver's license or passport is required to verify the buyer's identity.

Buyer verification ensures the legitimacy of the purchaser and protects against fraud during the foreclosure process. Documentation like pre-approval letters and financial statements helps confirm your ability to complete the purchase.

Pre-Approval Letter from Lenders

When purchasing a foreclosed home, having a pre-approval letter from lenders is essential. This document proves your financial ability to complete the transaction and strengthens your offer.

Your pre-approval letter outlines the loan amount you qualify for based on your credit score, income, and debts. Lenders issue this letter after reviewing your financial documents, providing confidence to sellers and auction agents. Without it, your bid on a foreclosed property may not be considered seriously.

Foreclosure Sale Agreement or Purchase Contract

What is a Foreclosure Sale Agreement or Purchase Contract in the context of buying a foreclosed home? This document outlines the terms and conditions of your purchase, including the sale price, deposit requirements, and closing date. It legally binds you to the purchase once signed, ensuring both buyer and lender adhere to agreed-upon terms.

Title Deed and Title Search Report

When buying a foreclosed home, the Title Deed is essential as it proves legal ownership of the property. The Title Search Report reveals any liens, encumbrances, or claims that may affect the title's validity. Securing these documents ensures Your purchase is legitimate and free of legal complications.

Tax Clearance Certificate and Utility Bills

| Document | Importance | Details |

|---|---|---|

| Tax Clearance Certificate | Verifies no outstanding property taxes | This certificate confirms the foreclosed property has no unpaid property taxes. It is vital to obtain it to avoid inheriting tax debts when buying a foreclosed home. |

| Utility Bills | Proves payment status of utilities | Recent utility bills for water, electricity, and gas show that utility payments are up-to-date. This helps assess any hidden costs or pending dues before completing your purchase. |

No Objection Certificates (NOC) from Relevant Authorities

Buying a foreclosed home requires specific documentation to ensure a smooth transaction. No Objection Certificates (NOC) from relevant authorities are crucial for validating the legality of the property.

- No Objection Certificate from the Municipal Authority - Confirms that the property complies with local zoning and land use regulations.

- No Objection Certificate from the Housing Society - Verifies there are no outstanding dues or disputes related to the property within the society.

- No Objection Certificate from the Bank or Financial Institution - Ensures the foreclosed property is free of any financial liabilities or encumbrances.

Inspection Reports and Disclosure Statements

Inspection reports are essential when buying a foreclosed home, providing a detailed assessment of the property's condition. These reports highlight structural issues, repairs needed, and potential safety hazards that affect the home's value.

Disclosure statements reveal any known defects or legal issues related to the foreclosed property, ensuring transparency in the transaction. Buyers must review these documents carefully to avoid unexpected problems after purchase.

What Documents are Necessary for Buying a Foreclosed Home? Infographic