Essential documents for signing a commercial lease agreement include the tenant's identification, proof of business registration, and financial statements to verify creditworthiness. The lease agreement itself must outline terms, rent amount, duration, and maintenance responsibilities. Landlords often require a security deposit receipt and prior lease references to complete the documentation process.

What Documents are Necessary for Commercial Lease Agreement Signing?

| Number | Name | Description |

|---|---|---|

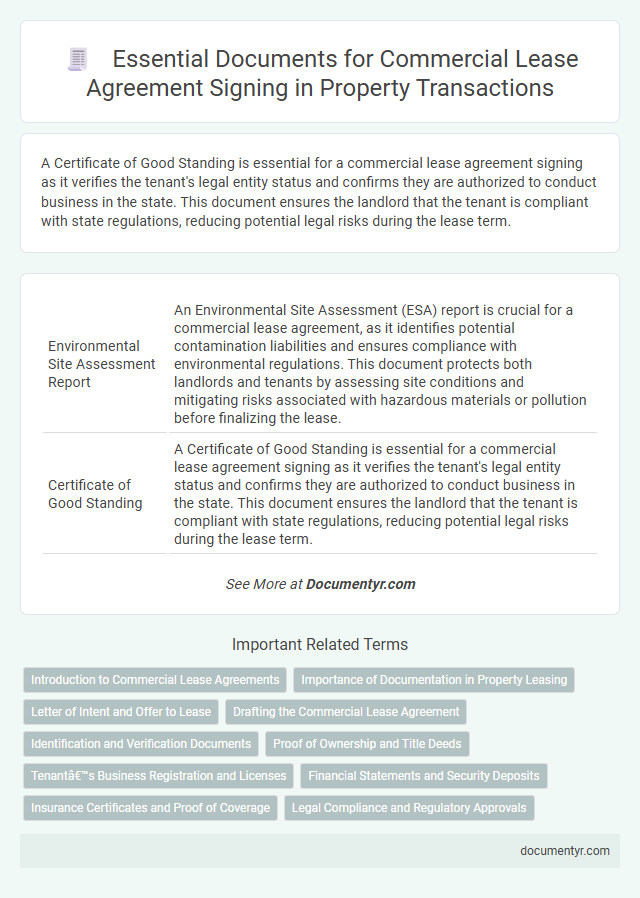

| 1 | Environmental Site Assessment Report | An Environmental Site Assessment (ESA) report is crucial for a commercial lease agreement, as it identifies potential contamination liabilities and ensures compliance with environmental regulations. This document protects both landlords and tenants by assessing site conditions and mitigating risks associated with hazardous materials or pollution before finalizing the lease. |

| 2 | Certificate of Good Standing | A Certificate of Good Standing is essential for a commercial lease agreement signing as it verifies the tenant's legal entity status and confirms they are authorized to conduct business in the state. This document ensures the landlord that the tenant is compliant with state regulations, reducing potential legal risks during the lease term. |

| 3 | Estoppel Certificate | An estoppel certificate is crucial in a commercial lease agreement as it confirms the accuracy of lease terms and the tenant's current status, protecting landlords and potential buyers from undisclosed disputes or defaults. This document verifies rent payments, lease duration, and any outstanding obligations, ensuring transparency and legal clarity for all parties involved. |

| 4 | Subordination, Non-Disturbance, and Attornment Agreement (SNDA) | A Subordination, Non-Disturbance, and Attornment Agreement (SNDA) is a critical document in commercial lease agreements that outlines the relationship between tenants and lenders or property owners, ensuring tenant rights are protected if the property changes hands. This agreement guarantees tenant's lease remains in effect (non-disturbance), acknowledges the priority of the lender's mortgage (subordination), and obligates the tenant to recognize a new owner as the landlord (attornment). |

| 5 | Letter of Intent (LOI) | A Letter of Intent (LOI) outlines the preliminary terms and conditions agreed upon by the landlord and tenant before finalizing a commercial lease agreement, serving as a foundational document to ensure mutual understanding. This document typically includes rent details, lease duration, property specifications, and contingencies, streamlining negotiations and reducing potential disputes during lease signing. |

| 6 | Fire Safety Compliance Certificate | A Fire Safety Compliance Certificate is a crucial document required for signing a commercial lease agreement, ensuring the property meets local fire safety regulations and standards. This certificate verifies that the landlord has implemented proper fire prevention measures, which protects tenant safety and minimizes legal liability risks. |

| 7 | Title Encumbrance Disclosure | A clear Title Encumbrance Disclosure is essential for commercial lease agreement signing to verify property ownership and reveal any liens or claims that could affect the lease. This document ensures both parties understand legal limitations, preventing future disputes related to encumbrances on the leased property. |

| 8 | Digital Identity Verification Record | Digital identity verification records, including government-issued ID scans and biometric data, are essential for authenticating the lessee's identity in a commercial lease agreement. These records ensure compliance with legal standards, prevent fraud, and facilitate a secure, efficient signing process. |

| 9 | Electronic Execution Consent | Electronic execution consent for commercial lease agreements requires parties to provide a signed electronic consent form or clause within the lease, confirming their agreement to use electronic signatures. This document ensures the lease's enforceability and compliance with electronic transaction laws such as the ESIGN Act or UETA. |

| 10 | Beneficial Ownership Declaration | A Beneficial Ownership Declaration is a crucial document for commercial lease agreement signing, ensuring transparency by identifying individuals who ultimately own or control the leasing entity. This declaration helps prevent fraud and complies with legal requirements, safeguarding both landlords and tenants in commercial property transactions. |

Introduction to Commercial Lease Agreements

Introduction to Commercial Lease Agreements |

|

|---|---|

| Definition | A commercial lease agreement is a legal contract between a landlord and a business tenant that outlines the terms and conditions for renting commercial property such as office spaces, retail stores, or industrial units. |

| Purpose | To establish clear responsibilities, rental terms, duration, and rights of both parties to ensure smooth tenancy and avoid disputes. |

| Importance of Documentation | Proper documentation verifies the identities, financial stability, and legal compliance of both landlord and tenant, facilitating a transparent and enforceable agreement. |

Essential Documents for Signing a Commercial Lease Agreement |

|

| Identification Proof | Government-issued IDs for both landlord and tenant, such as passports or driver's licenses, to validate identity. |

| Business License | Current and valid business registration or license documents confirming the tenant's legal operation status. |

| Financial Statements | Recent bank statements, credit reports, or financial records that demonstrate the tenant's ability to meet lease payment obligations. |

| Proof of Address | Documents such as utility bills or official correspondence confirming the business or tenant's address. |

| Property Documents | Title deed or ownership documents of the landlord to prove legal ownership of the commercial property. |

| Insurance Certificates | Relevant insurance documents like property insurance or tenant liability coverage to meet lease requirements. |

| Lease Agreement Draft | A written and signed copy of the lease agreement outlining all agreed terms, conditions, and obligations. |

Importance of Documentation in Property Leasing

Proper documentation is essential for securing a commercial lease agreement, ensuring clarity and legal protection for both landlord and tenant. Critical documents verify identities, property details, and agreed terms, reducing the risk of disputes.

Key documents include the lease agreement, identification proofs, property ownership papers, and financial statements like credit reports and bank statements. These records establish trust and outline responsibilities, fostering a smooth leasing process in commercial property transactions.

Letter of Intent and Offer to Lease

What documents are necessary for commercial lease agreement signing? A Letter of Intent (LOI) outlines the preliminary terms between landlord and tenant, serving as a foundation for the lease negotiations. An Offer to Lease formalizes the tenant's proposal, detailing key lease terms before the final agreement is drafted.

Drafting the Commercial Lease Agreement

Drafting a commercial lease agreement requires essential documents to ensure legal clarity and mutual understanding. These documents include the property's title deed, proof of ownership, and identity verification for both landlord and tenant. You must also prepare detailed lease terms, including rent amount, duration, maintenance responsibilities, and any special clauses relevant to your commercial property.

Identification and Verification Documents

Signing a commercial lease agreement requires proper identification and verification documents to ensure legality and authenticity. Your identity and business credentials must be thoroughly validated before finalizing the lease.

- Government-issued ID - A valid passport or driver's license confirms the identity of the individual signing the lease.

- Business Registration Certificate - This document verifies the legal existence of your company.

- Tax Identification Number (TIN) - Provides proof of tax compliance and business legitimacy for leasing purposes.

Submitting accurate identification and verification documents streamlines the commercial lease signing process and protects all parties involved.

Proof of Ownership and Title Deeds

Proof of Ownership is a crucial document required for signing a commercial lease agreement, confirming the landlord's legal right to lease the property. Title Deeds serve as primary evidence that the property is free from disputes and liens, ensuring transparent ownership. You must present these documents to validate ownership and facilitate a smooth lease agreement process.

Tenant’s Business Registration and Licenses

Tenant's business registration and licenses are essential documents for signing a commercial lease agreement. These verify the legal status and operational authority of the tenant's business.

Business registration ensures the tenant is formally recognized by government authorities, providing landlords confidence in the tenant's legitimacy. Required licenses confirm that the tenant complies with industry-specific regulations and local laws. Providing accurate and up-to-date documentation helps avoid legal complications and facilitates a smooth leasing process.

Financial Statements and Security Deposits

Securing a commercial lease agreement requires submitting key financial documents and understanding security deposit terms precisely. These components ensure both parties assess financial responsibility and protect lease interests effectively.

- Financial Statements - Provide detailed reports including balance sheets, income statements, and cash flow statements to verify the tenant's financial stability.

- Security Deposit Documentation - Outline the amount, terms for holding, and conditions for returning the security deposit to safeguard the landlord's property and mitigate risks.

- Proof of Payment Capability - Bank statements or credit references demonstrate the tenant's ability to meet ongoing rental obligations, supporting trust between parties.

Insurance Certificates and Proof of Coverage

Insurance certificates and proof of coverage are essential documents when signing a commercial lease agreement. These documents demonstrate that the tenant has secured adequate insurance to protect the leased property and surrounding premises.

You must provide updated insurance certificates showing liability, property damage, and any other required coverages. Verifying proof of coverage ensures compliance with lease terms and helps mitigate potential risks for both parties involved.

What Documents are Necessary for Commercial Lease Agreement Signing? Infographic