Property tax assessment requires essential documents such as the property deed, recent tax bills, and proof of ownership to verify legal possession. You must also provide a property tax receipt, a detailed property description, and any improvement or renovation records to ensure an accurate valuation. Accurate documentation supports fair property tax calculations and helps avoid discrepancies during the assessment process.

What Documents are Needed for Property Tax Assessment?

| Number | Name | Description |

|---|---|---|

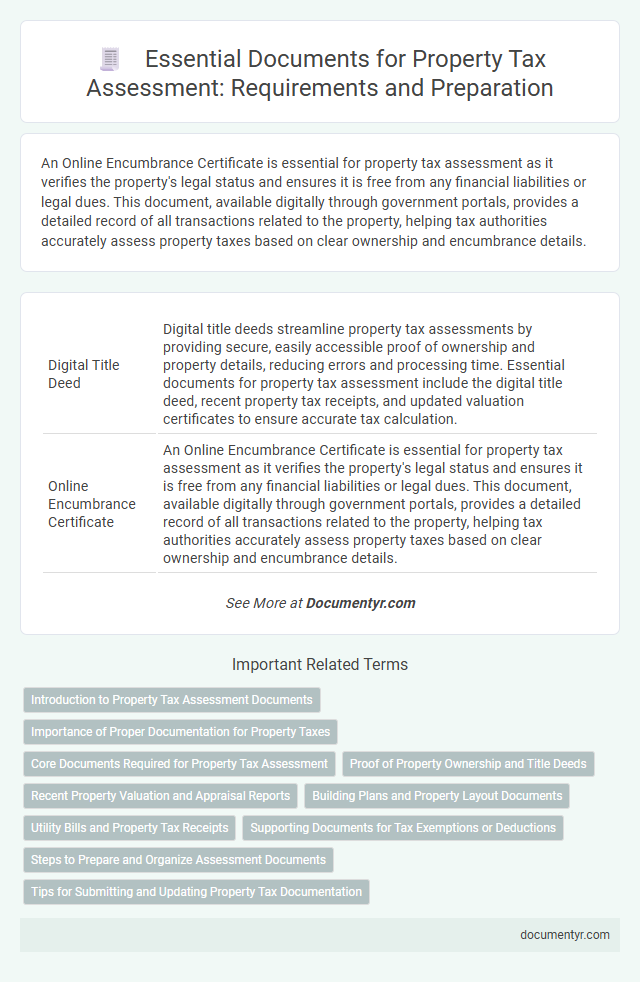

| 1 | Digital Title Deed | Digital title deeds streamline property tax assessments by providing secure, easily accessible proof of ownership and property details, reducing errors and processing time. Essential documents for property tax assessment include the digital title deed, recent property tax receipts, and updated valuation certificates to ensure accurate tax calculation. |

| 2 | Online Encumbrance Certificate | An Online Encumbrance Certificate is essential for property tax assessment as it verifies the property's legal status and ensures it is free from any financial liabilities or legal dues. This document, available digitally through government portals, provides a detailed record of all transactions related to the property, helping tax authorities accurately assess property taxes based on clear ownership and encumbrance details. |

| 3 | GIS-Linked Property Map | GIS-linked property maps are essential for accurate property tax assessment, providing precise parcel boundaries and spatial data that support property identification and valuation. Required documents typically include the GIS property map, proof of ownership, previous tax statements, and any legal descriptions or survey reports verifying the property's location and dimensions. |

| 4 | eMutation Certificate | The eMutation Certificate is a crucial document for property tax assessment, as it provides legal proof of ownership transfer and updates land records with the local revenue department. This certificate ensures accurate property details, preventing discrepancies in tax calculation and facilitating smooth verification during the assessment process. |

| 5 | Aadhaar-Linked Property ID | Aadhaar-linked Property ID is crucial for property tax assessment as it ensures accurate identification and helps streamline verification processes. Essential documents include the Aadhaar card, property deed, latest tax receipts, and valuation reports linked to the unique Property ID for seamless assessment and record updating. |

| 6 | RERA-Registered Sale Agreement | A RERA-registered sale agreement is crucial for property tax assessment, as it provides legally verified details about ownership, property dimensions, and transaction value. This document ensures transparency and accuracy, helping municipal authorities determine the correct tax liability based on official records. |

| 7 | Blockchain-Based Land Record | Blockchain-based land record systems require property owners to submit digital title deeds, verified transaction histories, and authenticated identity proofs for accurate property tax assessment, ensuring transparency and security. Immutable blockchain data reduces the risk of fraud and expedites the verification process by providing a reliable, tamper-proof record of ownership and property details. |

| 8 | Smart Property Tax Receipt | A Smart Property Tax Receipt requires property owners to submit documents such as the latest tax declaration, proof of ownership like a land title or deed, and valid identification for verification. These documents enable accurate digital assessment, streamlined tax payment, and enhanced record-keeping within the smart tax system. |

| 9 | Virtual Address Proof | Virtual address proof for property tax assessment typically includes government-issued digital documents such as e-ration cards, Aadhaar linked with current address, or utility bills submitted through official online portals. These documents must be verifiable through secure databases to validate ownership or tenancy for accurate tax computation. |

| 10 | Remote e-KYC Document | Remote e-KYC document requirements for property tax assessment typically include a government-issued photo ID such as Aadhaar card or passport, proof of ownership like the sale deed or title document, and valid address proof to verify the property's location. Digital verification processes leverage these documents to streamline assessment, reduce fraud, and enable secure online submission for faster property tax processing. |

Introduction to Property Tax Assessment Documents

Property tax assessment requires specific documents to verify ownership and determine the property's value accurately. These documents ensure that the tax authority correctly identifies your property and calculates the appropriate tax amount. Understanding which papers are necessary helps streamline the assessment process and avoid potential disputes.

Importance of Proper Documentation for Property Taxes

What documents are needed for property tax assessment? Proper documentation ensures accurate valuation and prevents disputes during the tax assessment process. Essential documents include the property deed, previous tax receipts, and a recent property valuation report.

Why is proper documentation important for property taxes? Accurate records help maintain transparency and support claims during appeals. Without correct documents, you risk overpayment or legal complications related to your property tax obligations.

Core Documents Required for Property Tax Assessment

Property tax assessment requires specific core documents to verify ownership and property details accurately. These documents ensure proper calculation and avoid discrepancies in your tax obligations.

The essential documents include the title deed or sale deed, which proves ownership. A property tax receipt or previous assessment record helps confirm prior payments and assessment history. Additionally, an approved building plan and occupancy certificate certify the property's legal construction status and usage.

Proof of Property Ownership and Title Deeds

Proof of property ownership is essential for property tax assessment and typically requires submission of valid title deeds. These documents establish legal ownership and must be clear, current, and free of liens to accurately determine tax liability. Ensuring your title deeds are complete and officially registered speeds up the assessment process and prevents potential disputes.

Recent Property Valuation and Appraisal Reports

Recent property valuation and appraisal reports are essential documents for property tax assessment. These reports provide a detailed analysis of the current market value of the property.

Accurate property valuation ensures proper tax calculation based on up-to-date information. Appraisal reports must be prepared by certified professionals to be accepted by tax authorities.

Building Plans and Property Layout Documents

Accurate property tax assessment relies heavily on detailed documentation. Building plans and property layout documents are essential components for verifying structural and land information.

- Building Plans - These detailed architectural drawings provide information about the size, design, and structural elements of the property.

- Property Layout Documents - These documents outline the boundaries, dimensions, and positioning of the property on the land parcel.

- Verification and Accuracy - Providing these documents ensures that your property is assessed based on precise and verified details, preventing errors and disputes.

You must submit these documents to facilitate an accurate and fair property tax assessment process.

Utility Bills and Property Tax Receipts

| Document Type | Description | Purpose in Property Tax Assessment |

|---|---|---|

| Utility Bills | Recent utility bills such as electricity, water, or gas showing the property address and account holder details. | Utility bills serve as proof of occupancy and confirm the physical existence and usage of the property, supporting accurate tax valuation. |

| Property Tax Receipts | Receipts of previous property tax payments issued by the local municipal authority or tax department. | Property tax receipts validate the payment history, help identify the assessed property value, and ensure accurate calculation of current assessments. |

Supporting Documents for Tax Exemptions or Deductions

Supporting documents for tax exemptions or deductions are crucial in property tax assessment. These documents verify eligibility and help reduce your taxable property value.

- Proof of Residency - Documents like a utility bill or driver's license demonstrate that the property is your primary residence.

- Income Statements - Pay stubs or tax returns confirm income levels to qualify for income-based exemptions or deductions.

- Disability Certification - Medical or government-issued proof establishes eligibility for disability-related tax relief.

Steps to Prepare and Organize Assessment Documents

Preparing for property tax assessment requires gathering specific documents to ensure an accurate valuation. Key documents include the property deed, recent tax bills, and proof of any improvements made.

Organize your documents by categorizing them into ownership papers, tax statements, and renovation records. Creating a checklist helps track all necessary paperwork and prevents last-minute missing items.

What Documents are Needed for Property Tax Assessment? Infographic