Foreigners buying property in the US need several key documents, including a valid passport, proof of funds or financing, and a Tax Identification Number (TIN) for tax reporting purposes. A signed purchase agreement and title insurance are essential to ensure the legitimacy and protection of the transaction. Lenders may also require a credit report and additional financial documentation depending on the loan type and buyer's country of origin.

What Documents are Needed for Foreigners Buying Property in the US?

| Number | Name | Description |

|---|---|---|

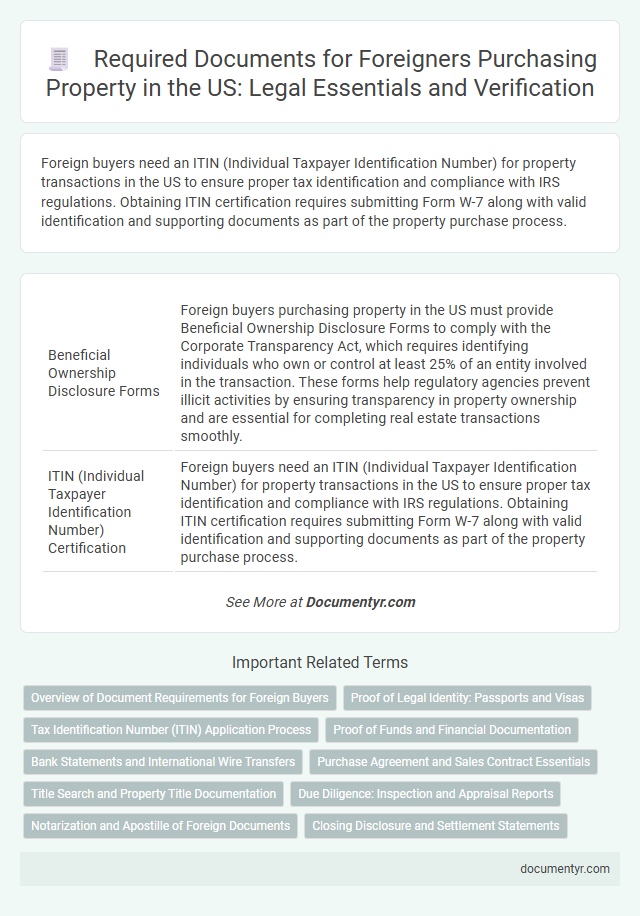

| 1 | Beneficial Ownership Disclosure Forms | Foreign buyers purchasing property in the US must provide Beneficial Ownership Disclosure Forms to comply with the Corporate Transparency Act, which requires identifying individuals who own or control at least 25% of an entity involved in the transaction. These forms help regulatory agencies prevent illicit activities by ensuring transparency in property ownership and are essential for completing real estate transactions smoothly. |

| 2 | ITIN (Individual Taxpayer Identification Number) Certification | Foreign buyers need an ITIN (Individual Taxpayer Identification Number) for property transactions in the US to ensure proper tax identification and compliance with IRS regulations. Obtaining ITIN certification requires submitting Form W-7 along with valid identification and supporting documents as part of the property purchase process. |

| 3 | FIRPTA Withholding Statement | Foreign buyers purchasing property in the US must provide a FIRPTA Withholding Statement, which certifies the transaction complies with the Foreign Investment in Real Property Tax Act requirements to avoid mandatory withholding tax. This document is essential for ensuring proper tax reporting and withholding on the sale of US real estate by non-resident aliens. |

| 4 | FinCEN Geographic Targeting Orders (GTO) Compliance | Foreign buyers of property in the US must comply with FinCEN Geographic Targeting Orders (GTO), which require reporting of transactions over $300,000 in specified metropolitan areas to enhance transparency and combat money laundering. Key documents include government-issued identification, proof of property address, and detailed ownership information to satisfy FinCEN's due diligence and anti-money laundering regulations. |

| 5 | Source of Funds Declaration | Foreign buyers purchasing property in the US must provide a Source of Funds Declaration, detailing the origin of the funds used for the transaction to comply with anti-money laundering regulations. This document typically requires bank statements, income proof, or investment records to verify legitimate financing sources. |

| 6 | EB-5 Visa Investment Documentation | Foreigners buying property in the US with an EB-5 visa must provide comprehensive investment documentation, including proof of the $1.8 million minimum capital investment (or $900,000 in targeted employment areas), a detailed business plan demonstrating job creation for at least 10 full-time American workers, and official source-of-funds evidence to ensure the investment is lawful. Additional documents include a valid passport, USCIS Form I-526 (Immigrant Petition by Alien Investor), and supporting financial statements to comply with both real estate and immigration regulations. |

| 7 | OFAC Clearance Statement | Foreign buyers purchasing property in the US must provide an OFAC Clearance Statement to comply with the Office of Foreign Assets Control regulations, ensuring the transaction does not involve sanctioned individuals or entities. This document verifies that the buyer is not on the Specially Designated Nationals (SDN) list, a critical step for legal and secure property acquisition. |

| 8 | Foreign Banking Reference Letter | A Foreign Banking Reference Letter is essential for foreigners buying property in the US, as it verifies financial stability and banking history to US lenders and sellers. This document typically includes details about the buyer's account standing, transaction history, and overall financial reliability. |

| 9 | Enhanced Due Diligence (EDD) Report | Foreign buyers in the US must provide an Enhanced Due Diligence (EDD) report verifying their identity, source of funds, and compliance with anti-money laundering regulations to ensure transaction transparency. This report complements standard documents such as passports, visa copies, and proof of address, facilitating smoother property acquisition and regulatory adherence. |

| 10 | Anti-Money Laundering (AML) Compliance Affidavit | Foreign buyers must provide an Anti-Money Laundering (AML) Compliance Affidavit to verify the legality of their funds and comply with U.S. federal regulations. This affidavit is essential for real estate transactions to prevent money laundering and ensure transparent property ownership. |

Overview of Document Requirements for Foreign Buyers

Foreigners buying property in the US must prepare several key documents to complete the transaction smoothly. These documents ensure compliance with legal and financial regulations throughout the purchase process.

An overview of document requirements includes a valid passport, proof of funds or financing, and a completed IRS Form W-8BEN for tax purposes. You will also need a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to facilitate tax reporting. Additional documents such as the purchase agreement and title paperwork are essential to finalize ownership transfer.

Proof of Legal Identity: Passports and Visas

| Document Type | Description | Purpose |

|---|---|---|

| Passport | Official government-issued identification card for foreign nationals | Verifies the buyer's legal identity and nationality |

| Visa | Authorization granting entry and stay in the United States | Confirms legal permission for foreign buyers to be present in the US during the property transaction |

| Entry Stamp or I-94 Form | Document showing arrival date and authorized length of stay | Supports visa validity and legal presence in the country |

| Additional Identification | Driver's license or government-issued ID from home country (optional) | Supplementary proof of identity during property purchase |

Tax Identification Number (ITIN) Application Process

Foreigners buying property in the US must obtain a Tax Identification Number (ITIN) to comply with tax regulations. The ITIN allows non-residents to report income and fulfill federal tax obligations related to property ownership.

The ITIN application requires submitting Form W-7 along with valid identification documents such as a passport. The process involves mailing these documents to the IRS or applying through an IRS-approved certifying acceptance agent for faster verification.

Proof of Funds and Financial Documentation

Foreigners buying property in the US must provide specific proof of funds and financial documentation to complete their transactions successfully. These documents verify the buyer's financial capability and comply with US regulations.

- Proof of Funds - Bank statements or financial institution letters showing sufficient funds for the purchase.

- Source of Funds Documentation - Documentation confirming the origin of money, such as salary slips, tax returns, or sale agreements.

- Tax Identification Number (TIN) - A US Individual Taxpayer Identification Number (ITIN) may be required for tax reporting purposes.

Proper financial documentation ensures transparency and smooth processing of property transactions for foreign buyers in the United States.

Bank Statements and International Wire Transfers

What bank statements are required for foreigners buying property in the US? Foreign buyers must provide recent bank statements to verify funds used for the property purchase. These statements help demonstrate the source and legitimacy of the money.

How do international wire transfers affect property transactions for foreign buyers? International wire transfers are commonly used to transfer purchase funds from overseas accounts to US sellers or escrow. It is crucial to maintain clear records of these transactions for legal and tax compliance.

Purchase Agreement and Sales Contract Essentials

When foreigners buy property in the US, certain documents are essential to secure the transaction. The purchase agreement and sales contract are the primary legal documents outlining the terms and conditions of the sale.

The purchase agreement details the price, property description, and contingencies, ensuring clarity between buyer and seller. The sales contract solidifies the agreement, including payment schedules and closing dates, protecting your investment.

Title Search and Property Title Documentation

Foreigners purchasing property in the US must provide specific documents to ensure clear ownership and legal compliance. Title search and property title documentation are crucial to verify the property's legal status and prevent future disputes.

- Title Search Report - This document verifies the legal ownership history and identifies any liens, encumbrances, or claims on the property.

- Property Title Certificate - A certified document that proves the seller's legal ownership of the property being sold.

- Identification Documents - Valid passports and sometimes secondary identification are required to confirm the buyer's identity during the property transaction.

Due Diligence: Inspection and Appraisal Reports

Foreign buyers must obtain thorough inspection and appraisal reports to ensure the property's condition and value meet expectations. Inspection reports identify structural issues, safety hazards, and necessary repairs, protecting buyers from unforeseen expenses. Appraisal reports provide an objective market value assessment, crucial for financing and investment decisions during the purchase process.

Notarization and Apostille of Foreign Documents

Foreigners buying property in the US must provide specific documents, including passports, visas, and proof of funds. Notarization of foreign documents is essential to verify authenticity, ensuring the documents are legally recognized. An apostille certifies the notarization, allowing your documents to be accepted by US authorities without further legalization.

What Documents are Needed for Foreigners Buying Property in the US? Infographic