Key documents required for a short sale process include a hardship letter explaining the financial difficulties, recent pay stubs or proof of income, and a completed short sale package from the lender. The seller must also provide a detailed listing agreement, tax returns for the past two years, and documentation of all monthly expenses. Having these documents organized and ready helps streamline the lender's review and approval of the short sale.

What Documents are Necessary for a Short Sale Process?

| Number | Name | Description |

|---|---|---|

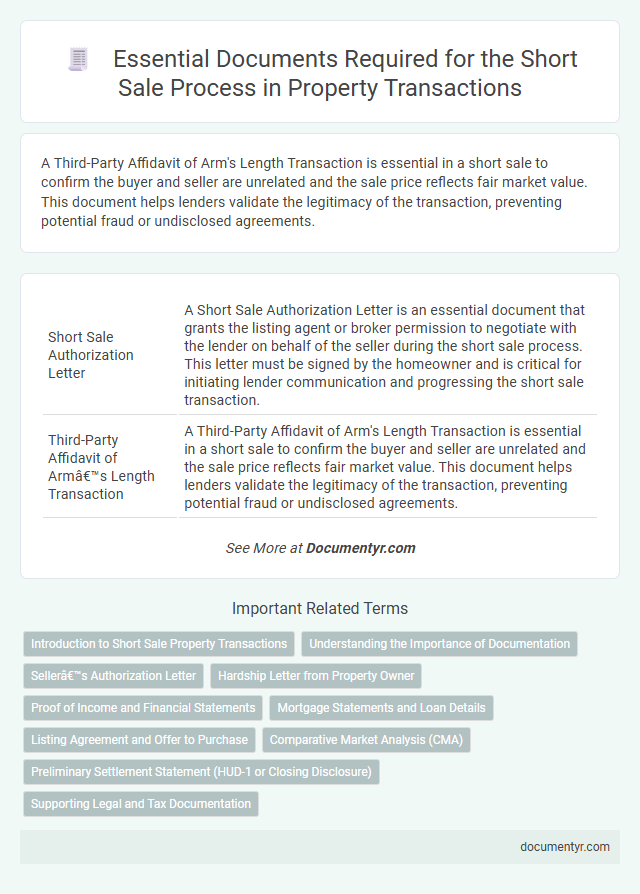

| 1 | Short Sale Authorization Letter | A Short Sale Authorization Letter is an essential document that grants the listing agent or broker permission to negotiate with the lender on behalf of the seller during the short sale process. This letter must be signed by the homeowner and is critical for initiating lender communication and progressing the short sale transaction. |

| 2 | Third-Party Affidavit of Arm’s Length Transaction | A Third-Party Affidavit of Arm's Length Transaction is essential in a short sale to confirm the buyer and seller are unrelated and the sale price reflects fair market value. This document helps lenders validate the legitimacy of the transaction, preventing potential fraud or undisclosed agreements. |

| 3 | Hardship Letter | A hardship letter is a crucial document in the short sale process, detailing the seller's financial difficulties and the reasons for seeking a short sale. Lenders require this letter to assess the borrower's situation and approve the sale below the mortgage balance. |

| 4 | Preliminary HUD-1 Settlement Statement | The Preliminary HUD-1 Settlement Statement is essential for a short sale as it itemizes all charges and credits between buyer and seller, helping both parties understand the financial details before closing. This document ensures transparency in the transaction by listing fees, taxes, and other costs, aiding lenders, agents, and sellers to negotiate and approve the short sale terms effectively. |

| 5 | Seller’s Financial Worksheet | The Seller's Financial Worksheet is a critical document that outlines the seller's income, expenses, assets, and liabilities, providing a comprehensive financial snapshot essential for short sale approval. Mortgage lenders rely on this worksheet to assess the seller's financial hardship and determine eligibility, making accurate completion vital for expediting the short sale process. |

| 6 | Broker Price Opinion (BPO) | A Broker Price Opinion (BPO) is essential in the short sale process as it provides an estimated market value of the property from a licensed real estate broker, helping lenders assess potential loss recovery. This document, alongside the seller's financial statements and hardship letter, supports lender approval by demonstrating the property's competitive market price. |

| 7 | Subordination Agreement | A Subordination Agreement is essential in the short sale process as it establishes the priority of liens, allowing the primary mortgage lender to be repaid first while subordinate lenders agree to defer their claims. This document ensures clear lien hierarchy, facilitating lender approval and expediting the short sale transaction. |

| 8 | Deficiency Waiver Request | A Deficiency Waiver Request in a short sale process requires precise documentation, including the lender's approval letter, the buyer's purchase agreement, and a detailed hardship letter from the seller explaining financial inability to cover the remaining mortgage balance. Supporting financial statements, recent tax returns, and bank statements are critical to validate the seller's claim and facilitate lender consent to waive the deficiency. |

| 9 | Relocation Assistance Agreement | A Relocation Assistance Agreement is essential in a short sale process as it outlines the terms and conditions under which the seller receives financial aid for moving expenses. This document must be submitted along with the short sale package to ensure compliance with lender requirements and facilitate transaction approval. |

| 10 | Short Sale Approval Contingency Addendum | The Short Sale Approval Contingency Addendum requires specific documents such as the buyer's purchase agreement, lender's approval letter, and financial hardship letter to proceed with the short sale process. These essential documents ensure all parties formally acknowledge and agree to the terms under which the short sale will be approved by the lender. |

Introduction to Short Sale Property Transactions

| Introduction to Short Sale Property Transactions | |

|---|---|

| Short Sale Definition | A short sale occurs when a property is sold for less than the outstanding mortgage balance, typically requiring lender approval. |

| Purpose of a Short Sale | Designed to help homeowners avoid foreclosure by negotiating a sale that satisfies the lender. |

| Essential Documents for a Short Sale | |

| Listing Agreement | Contract authorizing the sale of your property through a real estate agent. |

| Hardship Letter | A personal letter explaining your financial difficulties and reasons for requesting a short sale. |

| Financial Statements | Documents such as recent pay stubs, tax returns, bank statements, and profit & loss statements demonstrating your current financial status. |

| Mortgage Statement | Most recent mortgage statement reflecting the outstanding loan balance and payment history. |

| Purchase Agreement | Offer from a buyer detailing the terms and sale price, required for lender evaluation. |

| Comparative Market Analysis (CMA) | Report prepared by a real estate professional showing property value and market trends. |

| Authorization to Release Information | Signed document permitting the lender to discuss the short sale with agents or attorneys involved. |

| Title Report | A preliminary title search to identify any liens, encumbrances, or ownership issues. |

| Additional Lender Specific Forms | Forms required by the lender for short sale processing, varying by institution. |

| Importance of Documentation | Providing comprehensive and accurate paperwork speeds up lender approval and smooths the short sale process. |

Understanding the Importance of Documentation

Understanding the importance of documentation in a short sale process is crucial for a successful transaction. Essential documents include the financial hardship letter, recent tax returns, bank statements, and a listing agreement. These papers provide the lender with a comprehensive view of the seller's financial situation, ensuring transparency and facilitating approval.

Seller’s Authorization Letter

The Seller's Authorization Letter is a critical document in the short sale process, granting the lender permission to negotiate the sale on behalf of the homeowner. This letter confirms that the seller consents to the lender communicating with real estate agents, buyers, and third parties.

The authorization letter must be signed and dated by the property owner to validate the negotiation process. Without this document, lenders typically will not proceed with reviewing or approving the short sale offer.

Hardship Letter from Property Owner

The hardship letter from the property owner is a critical document in the short sale process. It explains the financial difficulties leading to the request for a short sale, providing context for the lender's decision.

This letter must clearly outline specific reasons such as job loss, medical expenses, or other unexpected hardships. Lenders use this document to assess the legitimacy of the short sale request and evaluate the owner's situation accurately.

Proof of Income and Financial Statements

Proof of income and financial statements are critical documents in the short sale process, demonstrating the seller's financial hardship. Lenders require these documents to evaluate eligibility and negotiate approval.

- Proof of Income - Includes recent pay stubs, tax returns, and bank statements to verify the seller's current earnings and employment status.

- Financial Statements - Comprehensive reports such as profit and loss statements or personal financial statements that outline assets, liabilities, and overall financial health.

- Documentation Consistency - All income and financial records must be accurate, complete, and up to date to ensure lender trust and a smoother short sale approval.

Mortgage Statements and Loan Details

What mortgage statements are required for a short sale process? Mortgage statements must provide a detailed account of the outstanding loan balance and payment history. These documents help verify the current debt and support negotiations with the lender.

Why are detailed loan documents essential during a short sale? Loan documents clarify the terms, interest rates, and any arrears associated with the mortgage. Accurate loan details enable all parties to understand the financial obligation and facilitate approval of the short sale.

Listing Agreement and Offer to Purchase

Successful completion of a short sale requires specific documentation to ensure legal and financial accuracy. Two critical documents in this process are the Listing Agreement and the Offer to Purchase.

- Listing Agreement - This contract authorizes the real estate agent to represent the seller in marketing and negotiating the property sale.

- Offer to Purchase - A formal proposal submitted by the buyer outlining the purchase price and terms, essential for lender approval in a short sale.

- Document Verification - Both documents must be accurate and complete to facilitate lender review and prevent delays in the short sale process.

Comparative Market Analysis (CMA)

In a short sale process, a Comparative Market Analysis (CMA) is a crucial document that helps establish the fair market value of the property. The CMA compiles recent sales data of similar properties in the area to provide an accurate valuation.

The short sale package typically requires the CMA to support the seller's asking price to the lender. This analysis assists lenders in understanding the property's current market conditions and justifies the proposed sale price below the outstanding mortgage balance. Including a well-prepared CMA can expedite lender approval by demonstrating thorough market research.

Preliminary Settlement Statement (HUD-1 or Closing Disclosure)

The Preliminary Settlement Statement, either the HUD-1 or the Closing Disclosure, is a critical document in the short sale process. It outlines all the financial details involved in the transaction before final settlement.

- HUD-1 Form - Provides a detailed itemization of fees, charges, and credits during the closing of the sale.

- Closing Disclosure - Summarizes loan terms, projected monthly payments, and closing costs for the buyer and seller.

- Financial Transparency - Ensures you understand the full financial obligations and proceeds related to the short sale.

Accurate review of the Preliminary Settlement Statement helps facilitate a smooth and informed short sale closing.

What Documents are Necessary for a Short Sale Process? Infographic